Miro Nenchev

As I have written many times in my previous articles, the shipping sector represents a very nice investment opportunity for investors located in the moderately aggressive side of the risk spectrum, with some emphasis on income returns. One of the lesser known companies in the dry bulk sector is Grindrod Shipping Holdings Ltd. (NASDAQ:GRIN), which I think people tend to overlook. In this article, I will explain why I think that this company represents a bang for the investor’s buck at its current price, by looking into its fleet and financial characteristics.

Smaller vessels provide for less volatility of returns

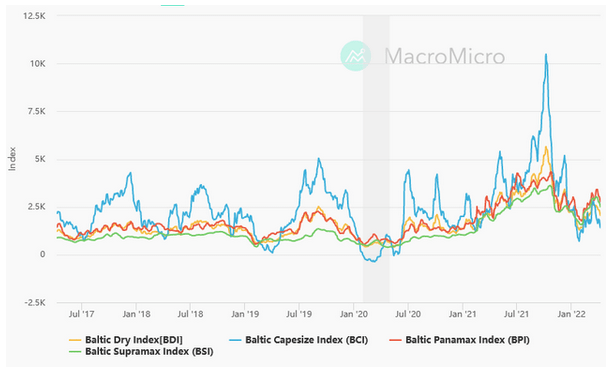

Grindrod Shipping currently owns a total of 31 dry bulk vessels which fall into the Supramax / Ultramax and Handysize categories. Historically, freight rates for smaller vessels have been less volatile than those of larger ones, as it is shown in the graph listed below.

Baltic ndex returns for different vessel types (MacroMicro)

This phenomenon happens for various reasons, ranging from the economic uncertainty bound to the larger commitment represented by larger commodity amounts, to infrastructure related factors, such as docking and loading or unloading restrictions.

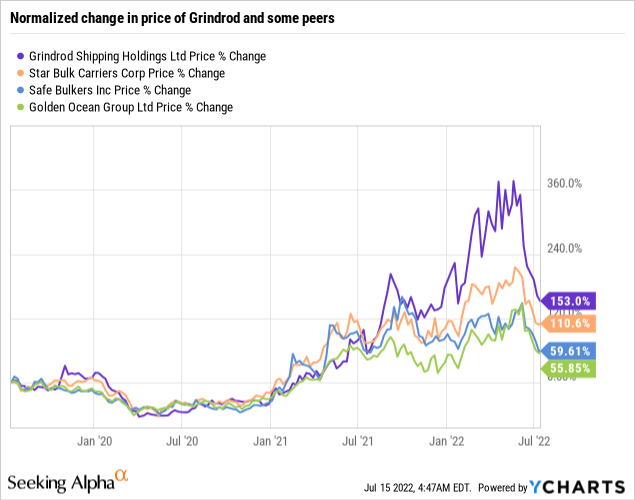

This is also reflected in the chart listed above, which depicts the normalized percentage change of the price of Grindrod Shipping and some of its peers, operating in larger dry bulk vessels. We can see two things in this graph. First of all, the company has provided the highest returns among its larger vessel peers, while until the middle of 2021 its price fluctuations were smoother. From this point and onward, we can see the differentiation between the rates of smaller vessels and those of larger ones, as they were reflected in the share price of the respective companies. Smaller vessel rates proved to be more resilient to the geopolitical uncertainties, partially due to the reasons mentioned earlier. This could allow a less risky investor to get access to the beautiful world of shipping, and this is one of the reasons they should.

Nicely managed and shareholder friendly

Grindrod shipping is one of the best-managed shipping companies out there, and this is due to various reasons. First of all, the company is doing a great job in extending some existing time charter contracts at very lucrative rates while also maintaining most of its fleet in the spot market. Moreover, last May, the company extended the contract of its Supramax IVS Crimson Creek for another 11 to 13 months, at a daily rate of $26.3k. According to data from Hellenic Shipping News, one year time charters for Supramaxes at the time were at $27.5k per day, while today they stand at $21.5k to $25.5k per day. Assuming a rough $3k daily rate differential, we get a residual cost increase of $1.1 million for the company, which may be translated to higher anticipated rates during Q3 and Q4 2022, or an intention to buy the vessel after the time charter contract ends.

Actions like this, together with a strong first quarter of 2022, resulted in quarterly earnings per share of $1.52, of which, $0.47 were distributed to common shareholders. Not at all bad, assuming the seasonality of the business. For the second quarter, the company anticipates some pullback on earnings due to the Russia – Ukraine war and the China steel output reduction. What is important to remember, however, is the straightforward dividend policy which states that the company shall pay out 30% of its adjusted net income to shareholders.

However, at $15.33 per share, the company is now trading at 2.3 times its forward earnings. Comparing this figure to the peer group mentioned above, we can see that Grindrod is the cheapest of all 4 companies. This, however, confirms the “less volatile” hypothesis that I wrote about earlier. By comparing the earnings multiple to that of a similar company, Eagle Bulk Shipping (EGLE), we can see that they are almost identical.

Shareholder friendliness, however, does not extend to dividend distributions. The company has used its earnings in a meaningful way, by buying back shares and driving down some debt. Right now, the company has a net debt of $126 million while there are no significant debt maturities until 2025.

Risks

As always, there are some risks that can affect the company and / or the dry bulk shipping in general. First of all, from a global economy standpoint, there’s a lot of uncertainty regarding economic growth, as monetary tightening will take its toll on demand. Surely, the supply side (slow steaming, low order book, shipyard congestion etc.) will dampen the effect of any demand slowdown, but still, with inflation hitting record highs, none can predict how hard the economy is going to be hit. In this inflationary environment, the company has also the difficult task to lower its daily cost of $12.5k, which is one of the highest among its peers.

Bottom Line

At just 2.3 times its forward earnings and with a fleet of smaller vessels, I would consider Grindrod a bargain at this price. Any mispricing at this point could easily be hedged by the nice and safe dividend yield, but honestly, I do believe that seasonality will take place from now on, driving rates – and prices – higher. The company has announced its plans to reduce its operating expenses as it has some pricey charters in place. The management has proved historically that they act in the best favor of shareholders so I believe that they will continue to distribute dividends, lower debt and daily costs and support the share price with buybacks when necessary. All of these lead me to be “long” in the company.

Be the first to comment