roman023/iStock via Getty Images

Right now, the market seems scared. Anything that might be subjected to the fallout of a recession is being slammed, including companies that are already cheap and that are generating strong fundamental performance. The latest example of this can be seen by looking at Terex Corporation (NYSE:TEX). This company, which produces aerial work platform equipment, utility equipment, and telehandlers, as well as materials processing and specialty equipment, has been hit especially hard. This comes even as management has delivered some strong financial performance figures. While it can be easy to get caught up in the noise, investors really would be wise to focus on the fundamental picture of the business. So long as management can deliver on its guidance for the year, shares should represent a great prospect for long-term, value-oriented investors. And so, despite the pain that has been experienced recently, I have decided to retain my ‘buy’ rating on the business.

Ignore the pain

Back in October of 2021, I wrote a bullish article about Terex. In that article, I acknowledged the company’s volatile history. However, I also said that recent performance had been robust and that the overall trend for the company was positive in recent years. I said that the near-term outlook for the company was looking positive as well and that it was attractively priced, making it a solid prospect for investors moving forward. All of these factors, combined, caused me to rate the enterprise a ‘buy’, reflecting my belief that it would likely outperform the broader market for the foreseeable future. So far, this claim has not played out well. While the S&P 500 is down by 12.1%, investors who purchased into Terex would have been down by 34.2%.

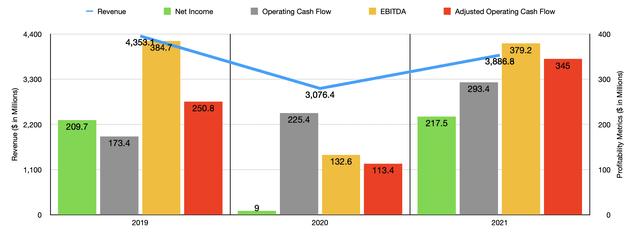

Given this massive return disparity, one would be forgiven for thinking that the fundamental performance of the company has been awful. But that couldn’t be further from the truth. Consider how the company finished its 2021 fiscal year. For that year as a whole, revenue came in at $3.89 billion. That’s 26.4% higher than the $3.08 billion reported just one year earlier. This increase in revenue was driven largely by higher demand for the aerial work platforms, materials processing equipment, material handlers, concrete mixer trucks, cranes, and utility equipment that the company produces. Unfortunately, management did not really provide much else in the way of detail, such as how much of the increase in revenue came from price increases and how much was driven by greater volume. We also know that revenue will likely be strong moving forward, because backlog for the company also exploded higher. At the end of 2020, backlog came in at $1.35 billion. That number spiked to $2.99 billion in 2021.

Regardless of the cause, we also have the fact that profitability for the company came in much stronger than it was one year before. Net income of $217.5 million marked a stark improvement over the negative $10.6 million generated in the 2020 fiscal year. It was also the highest level of profitability the company had seen in at least five years. Other profitability metrics followed suit. Operating cash flow, for instance, rose from $225.4 million in 2020 to $293.4 million last year. If we adjust for changes in working capital, the picture was even more robust, with the metric climbing from $113.4 million to $345 million. Meanwhile, EBITDA for the business also expanded, jumping from $162.5 million to $379.2 million. The company’s profitability, as defined by cash flow, is still largely lower than what it was in the years prior to 2020. But that just goes to show how difficult the 2020 fiscal year was.

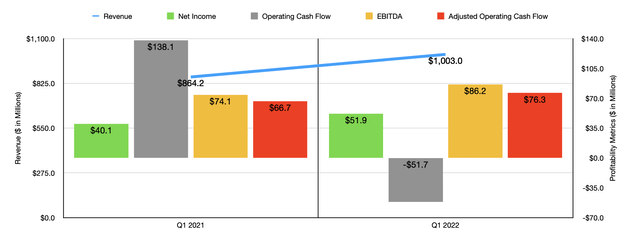

Heading into the 2022 fiscal year, we have seen no weakness as of yet. Revenue of $1 billion translates to a year-over-year growth rate of 16.1% compared to the $864.2 million generated in the same quarter of the company’s 2021 fiscal year. Once again, this trend looks set to continue, with backlog spiking further to $3.5 billion in just a single quarter. Net income of $51.9 million came in slightly higher than the $40.1 million achieved one year earlier. Admittedly, operating cash flow did worsen year over year, dropping from $138.1 million to negative $51.7 million. But if we adjust for changes in working capital, it actually would have risen from $66.7 million to $76.3 million. Meanwhile, EBITDA rose from $74.1 million to $86.2 million.

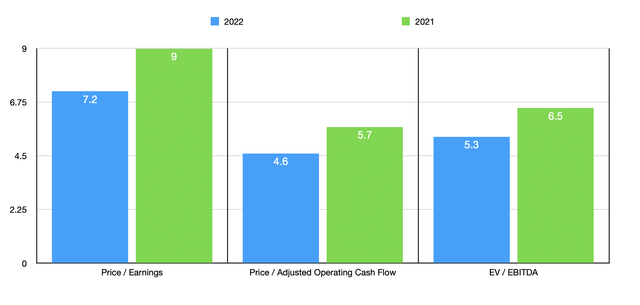

When it comes to the 2022 fiscal year as a whole, management has not provided any detailed guidance when it comes to revenue. But they do think that earnings per share will be between $3.55 and $4.05. At the midpoint, this will translate to net income of $269.4 million. If we assume that other profitability metrics will follow suit, then we should anticipate adjusted operating cash flow of roughly $427.4 million and EBITDA of $469.7 million. These details give us enough to value the company at this time. Using the 2022 estimates, we can see that the company is trading at a price-to-earnings multiple of 7.2. That’s down from the 9 that we get if we use 2021 results. The price to adjusted operating cash flow multiple should decline from 5.7 in 2021 to 4.6 this year. And the EV to EBITDA multiple should drop from 6.5 to 5.3. To put the pricing of the firm into perspective, I also compared it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 11.8 to a high of 22.4. And using the EV to EBITDA approach, the range was from 8.8 to 14. In both cases, Terex was the cheapest of the group if we compare those figures to the calculations that rely on the 2021 results. Meanwhile, the price to operating cash flow multiple of these firms was from 3.8 to 420.1. And in this scenario, only one of the companies was cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Terex Corporation | 9.0 | 5.7 | 6.5 |

| Trinity Industries (TRN) | 12.3 | 3.8 | 14.0 |

| Federal Signal Corp (FSS) | 22.4 | 26.7 | 14.0 |

| Meritor (MTOR) | 11.8 | 50.1 | 8.8 |

| Alamo Group (ALG) | 17.0 | 420.1 | 10.0 |

| The Greenbrier Companies (GBX) | 13.2 | 24.8 | 10.3 |

Takeaway

Although the past few months have been rather painful, management seems to remain bullish about Terex and shares of the company are trading at incredibly cheap levels even if this year disappoints. I stand by my original statement that the company is subject to volatility. And because of that, we could see additional pain from a fundamental perspective if the economy weakens. But overall, the firm seems to be in a robust position and I fully suspect that the picture for shareholders will ultimately improve. All of these reasons have led me to retain my ‘buy’ rating on the company for now.

Be the first to comment