EXTREME-PHOTOGRAPHER

The past few years have been extraordinary when you really think about it. A global pandemic followed up by a robust economy that was so strong we are now having to see interest rates rise significantly in order to offset inflationary pressures. Naturally, this has disturbed the fundamental condition of a countless number of companies spread across most industries. An example of this can be seen by looking at Big 5 Sporting Goods Corporation (NASDAQ:BGFV), a sporting goods retailer that has exhibited tremendous bottom line improvement over the past three years. Although the company does look cheap right now, and overall risk is low, the fundamental condition of the company has worsened this year. With management due to report earnings for the third quarter of the 2022 fiscal year in the coming days, it remains to be seen whether management can turn this tide around. In the event that they can, upside for shareholders could be material. But considering what we know today, I think a more cautious approach might make sense.

A complicated picture

For those not aware of Big 5 Sporting Goods, it’s important to note that the enterprise operates as a sporting goods retailer with stores located throughout the western portion of the eras. Through these locations, numbering 431 in all as of this writing, the company provides a full line product offering including athletic shoes, apparel, accessories, fitness products, camping gear, and so much more. More specifically, using data from the 2021 fiscal year, 55% of revenue came from what management calls hard goods. Examples of these include durable items like exercise equipment and baseball gloves. 55% of sales came from this category in 2021. Athletic and sport footwear is the next largest category, accounting for 24.1% of revenue. Next, we had athletic and sport apparel products, accounting for 20.9% of sales. Specific offerings largely consist of name-brand products like those produced by Nike (NKE), Skechers U.S.A. (SKX), Under Armour (UAA), and others.

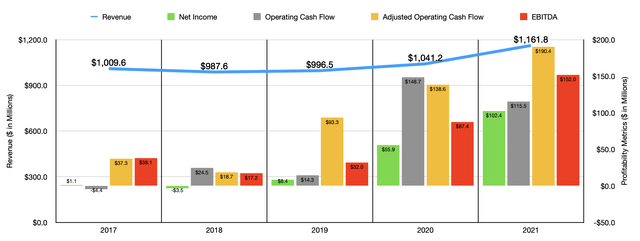

Author – SEC EDGAR Data

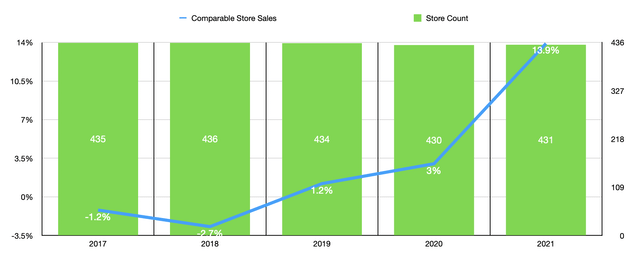

Over the past five years, the financial picture seen by Big 5 Sporting Goods has been rather interesting. From 2017 to 2018, revenue dropped modestly from $1.01 billion to $987.6 million. Then, in 2019, sales popped back up to $996.5 million. Although the pandemic negatively affected consumer budgets, sales at Big 5 Sporting Goods benefited. With fewer people working and more people at home, the need for sporting goods was undeniably strong. So in 2020, sales popped up to $1.04 billion before shooting up to $1.16 billion in 2021. Interestingly, this all occurred at a time when the company’s store count actually fell. The company went from having 434 locations in 2019 to 430 in 2020. In 2021, this number increased only modestly to 431. The real driver behind this increase then was a rise in comparable store sales. This number shot up by 13.9% in 2021. By comparison, the number between 2019 and 2020 ranged between 1.2% and 3%, while the number in the years prior to that was negative.

Author – SEC EDGAR Data

On the bottom line, the picture has been volatile as well. Between 2017 and 2019, the company’s bottom line ranged from a low point of negative $3.5 million to a high point of $8.4 million. Then, in 2020, the company generated a profit of $55.9 million, which ultimately increased to $102.4 million in 2021. This makes a lot of sense when you consider not only the impact that pricing could have played in the picture, but also when you consider that management is experiencing low margins already because the firm operates in a highly competitive space. So any sort of increase in sales driven by volume per store or price per product will have the benefit of expanding margins for the enterprise since it spreads each fixed dollar of cost over additional dollars of revenue. Other profitability metrics looked similar. For instance, operating cash flow followed no real trend between 2017 and 2019. In 2020, it jumped to $148.7 million compared to the $14.3 million that stood out one year earlier. And in 2021, it narrowed to $115.5 million. On an adjusted basis, the situation is a little different, with the metric rising consistently between 2018 and 2021, shooting up from $18.7 million to $190.4 million. And finally, we have EBITDA, which followed the same trajectory that adjusted operating cash flow did, ultimately peaking at $152 million compared to the $32 million it was at two years earlier.

Author – SEC EDGAR Data

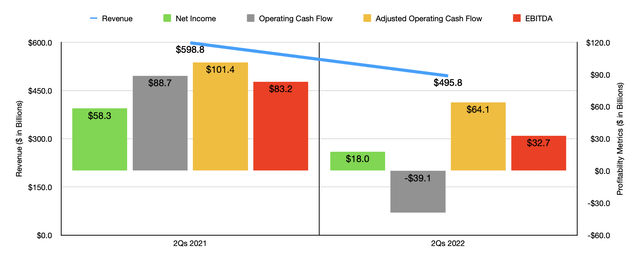

So far, the picture for 2022 has been not so great. Revenue with the company in the first two quarters of the year totaled $495.8 million. That’s down from the $538.8 million in revenue generated the same time last year. Interestingly, this was not driven by a change in store count. Instead, it can be attributed to a 17.3% plunge in comparable store sales. Management chalked this up to a combination of factors, including weaker economic issues, a pullback from irregularly robust demand during the pandemic era, and other factors. This drop in revenue brought with it a drop in profitability as well. The company went from generating net income of $58.3 million in the first half of 2021 to only $18 million the same time this year. Operating cash flow went from $88.7 million to negative $39.1 million. Even if we adjust for changes in working capital, it would have fallen from $101.4 million to $64.1 million. And finally, EBITDA for the company also dropped, falling from $83.24 million to $32.7 million.

After the market closes on Nov. 1, the management team at Big 5 Sporting Goods is expected to report financial results covering the third quarter of the company’s 2022 fiscal year. This will give us a fresh chance to see how the picture for the company is changing. Interestingly, management has already given us some guidance for the quarter. They didn’t give a concrete revenue number, but did instead say that same-store sales should decline by the high single-digit rate. Analysts, meanwhile, expect revenue to come in at around $258.4 million. That would represent a decline of 10.8% compared to the $289.6 million the company reported the same time last year. Earnings per share, meanwhile, are forecasted to be around $0.27. This compares to the $1.07 in profits reported in the third quarter of 2021 but is only marginally lower than the $0.30 per share reported in 2019. Management, meanwhile, expects this figure to come in at between $0.27 per share and $0.32 per share. So this call may not be far off.

Author – SEC EDGAR Data

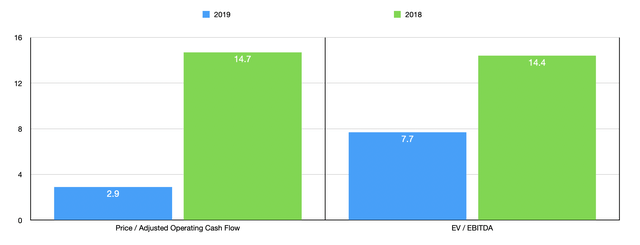

Given this deterioration on both its top and bottom lines and the expectation for it to continue, I do think investors should be more cautious moving forward. We definitely are not going to see another year like 2020 or 2021 anytime soon. But it’s not unthinkable that financial performance could eventually revert back to what we saw in 2019. If that’s the case, the company would be trading at a forward price to adjusted operating cash flow multiple of 2.9 and at a forward EV to EBITDA well table of 7.7. By all accounts, these numbers are solid. But if the company were to see its financial results revert back to what was seen in 2018, shares would look probably fairly valued with multiples of 14.7 and 14.4, respectively. As part of my analysis, I also compared the company, using data from 2019, from two similar firms. On a price to operating cash flow basis, these companies ranged from a low point of 3.3 to a high point of 13.3. In this case, Big 5 Sporting Goods was the cheapest of the group. And using the EV to EBITDA approach, the range was from 5.8 to 9, with one of the two being cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Big 5 Sporting Goods Corporation | 2.9 | 7.7 |

| Dick’s Sporting Goods (DKS) | 13.3 | 5.8 |

| Sportsman’s Warehouse Holdings (SPWH) | 3.3 | 9.0 |

Takeaway

Based on the data provided, we’re seeing some rather interesting times for sporting goods retailer Big 5 Sporting Goods. Fundamentally, shares of the enterprise are quite cheap right now. But given the rapid deterioration in business we are experiencing, it’s unclear what the end result will be. When coupled with uncertain economic conditions, I think investors would be wise to consider a wait-and-see approach to see just how the third quarter ends up. So because of that, I personally have decided to rate the company a “hold.”

Be the first to comment