koto_feja logo from the company website

Relay Therapeutics (NASDAQ:RLAY) was founded in 2016 and is based in Cambridge, MA. Its Dynamo platform uses a computational approach to drug discovery.

The nearest catalyst for the company is the Phase 1 data release for RLY-2608 in treating PIKCA mutant tumors, including HR+/HER2- breast cancer in the first half of 2023. For the purpose of this article, I will focus on this part of the pipeline.

PIKCA is one of the most frequently genetically activated kinases in solid tumors. The prevalence of this mutation is 30% in breast cancer. Some estimates are as high as 40% prevalence. The estimated target market is approx. 58,000 newly diagnosed patients in the U.S. every year.

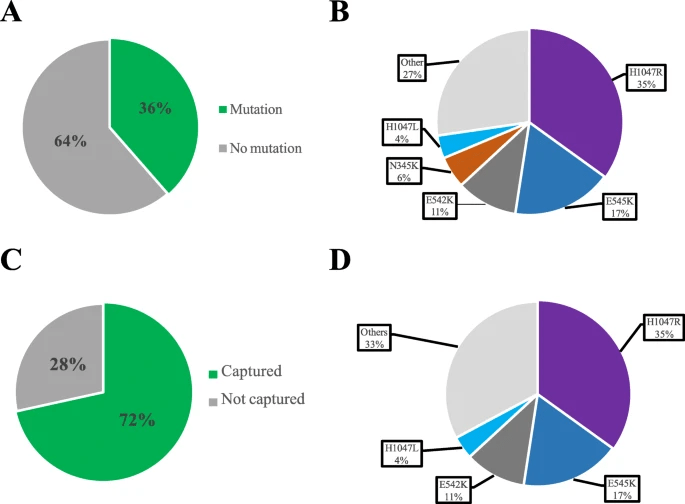

Source: Breast Cancer: 22: 45 (2020)

Legend: Proportion of PIKCA mutations in BC in relation to the mutations detected by therascreen. a Proportion of patients with PIKCA mutations in the combined dataset. b Distribution of the various types of PIKCA mutations in the combined dataset. c Proportion of PIKCA mutations detected by the therascreen assay. d Distribution of the various types of PIK3CA mutations detected by the therascreen assay in the combined dataset

In 2019, FDA approved Piqray, the first drug targeting PIKCA mutations in HR+, HER2- breast cancer. In pivotal studies, the drug showed an improvement in progression-free survival to 11 months vs. 5.7 months in the control group. The consensus peak sales estimate for the drug is $670M/year in 2028 (Evaluate Pharma). Some analysts’ estimates are as high as $1 billion/per year.

The drug, however, has side effects like severe hyperglycemia (even diabetic ketoacidosis has been reported which can be potentially fatal). Hyperglycemia is due to the blockade of the intracellular action of insulin, a class side effect of PIKCA class of drugs. Despite these side effects, Novartis reported $390M in 2021 sales for this drug.

Relay is developing RLY-2608, the first known allosteric, pan-mutant (targeting H1047X, E542X, and E545X) PIKCA inhibitor in clinical development. The target site for the drug was discovered using a computational approach by the Dynamo platform. The preclinical data showed that the drug binds preferentially to a novel allosteric site and causes tumor regression in mouse models of H1047R and E545K mutations. Notably, the drug showed significantly lower hyperglycemia compared to the competition (Piqray which is a non-mutant selective site inhibitor). The second arm of the dose escalation part of Phase 1 clinical trial is ongoing. In this trial, RLY-2608 is being tested in combination with fulvestrant in patients with HR+, HER2-, PIKCA mutated locally advanced or metastatic breast cancer. The data is expected in H1 2023.

The pan-allosteric action of RLY-2608 has the potential for occupying significant market share from Piqray in PIKCA-mutant HR+-HER2- breast cancer by showing not only higher efficacy but also better safety (lower hyperglycemia). If the data shown in the preclinical studies are replicated in the clinical trials, and the drug is eventually approved, I anticipate that oncologists would prescribe it as a preference over Piqray.

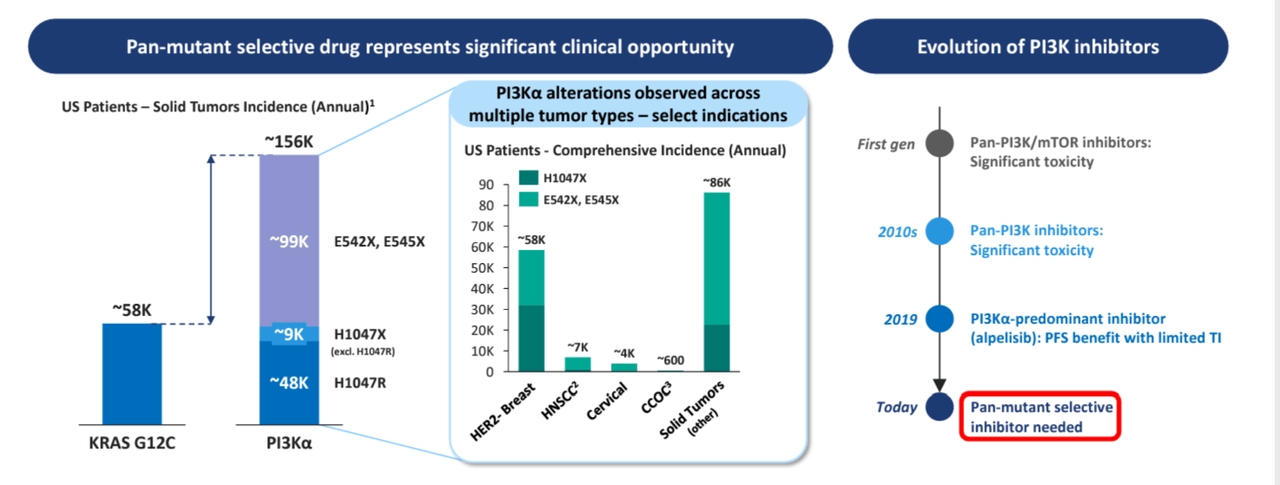

Beyond breast cancer, the drug also has the potential to be developed in other cancers with PIKCA mutation like head and neck cancer, cervical cancer, etc. (please see the figure below), thus expanding the target markets.

(PI3KA mutations across cancers; source 10-K)

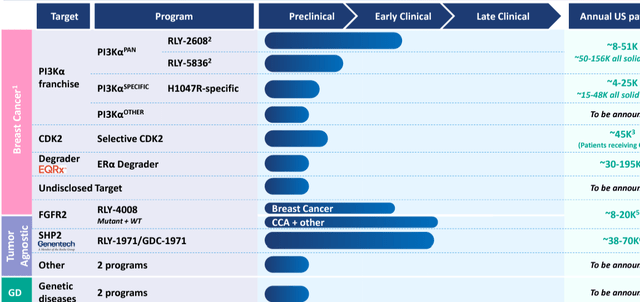

The company also has RLY-4008, the only FGFR2 inhibitor in development, in clinical trials. The stock has been under investor radar since presenting the spectacular data for this drug candidate at the ESMO conference this year, which showed an objective response rate, ORR of 88% in FGFRi treatment-naïve FGFR2-fusion CCA patients treated at the pivotal dose of 70 mg daily. The ORR showed by currently approved FGFR inhibitors is only 36%. The data added validation to the potential of the company’s Dynamo platform. Full dose escalation data will be reported in the first half of 2023, another price-moving catalyst. The target market for this cancer is 1000 patients in the U.S./year (estimated peak $150M/year of U.S. revenue) but could be expanded to 8000-20,000 cancers with FGFR2 alteration in the U.S./year (up to $3 billion/year of revenue opportunity across various cancers like breast cancer where it is being developed).

Company’s pipeline: from 10-K

The company’s CEO Patel served as Chief Strategy Officer at Allergan. President, R&D Bergstrom served as the Chief Medical Officer at Mersana Therapeutics and leadership roles at Sanofi and Merck. Chief Scientific Officer (CSO) (Early Research) Fortin served as the Head of molecular pharmacology and biological chemistry at Novartis. CSO, Late Research Watters served as the Head of Translational Medicine at Sanofi and Head of Molecular profiling at Merck. Chief Medical Officer Wolf served as the Senior Vice President, of clinical development at Blueprint Medicines (BPMC). Chairman of the Board and founder Borisy earlier served as the CEO of the company and also co-founded Foundation Medicine, serving as its first CEO.

The company is well-funded with an expected $1 billion in cash reserves (after the recent offering and adjusting for operating cash used in Q3) and no need for a capital raise before the RLY-2608 data release.

The consensus peak sales estimate for RLY-2608 is $700M/year. RLY-4008 could bring $1.2 billion/year in peak U.S. sales across various cancers (even considering the lower end of the range of the target market = 8000 patients). I have used an input price of $150K/year for both drugs in range with several approved oncology drugs, price/sales of 7 (average price/sales for biotech companies per NYU-Stern data from Damodaran is 7.6), a discount rate of 15%, and peak sales in 2032. Using these inputs, the discounted enterprise value, EV of these two parts of the pipeline could be $3.2 billion. The current EV of the company is $1.6 billion. The company also has other product candidates in the pipeline, like CDK2 target in breast cancer and SHP2 target (partnered with Genentech).

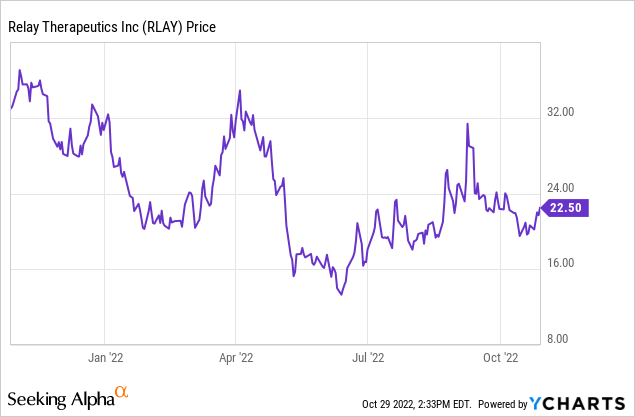

The mean Wall Street analyst price target (per Tipranks) is $40 (76% upside potential).

The stock pulled back recently after the pop due to ESMO data and is currently trending up into the Phase 1 data for RLAY-2608 in the first half of 2023. I bought the stock last week.

Conclusion

The bullish thesis of this article is based on the expectation of future positive data from RLY-2608 and RLY-4008. While I continue to be bullish that the data will be successful based on preclinical studies, the thesis may change to bearish if the data is not impressive.

Other risks in the investment include underwhelming data in the data releases from the product candidates, side effects, FDA hold on trials, unexpected capital raise, etc. There is no guarantee that the promise shown by RLY-2608 in preclinical studies will be replicated in clinical trials. Investing in early developmental stage biotech companies is very risky and it is possible to lose entire capital. Investing in these companies may not be suitable for all investors.

Be the first to comment