gilaxia

Introduction

In Ignore Market Forecasts and Adopt an All-Weather Portfolio I discussed the challenge of using economic and market forecasts to guide investing. With the recent market turmoil, persistent inflation, tight Fed policy and trouble in Europe, the expert forecasts have become even more intense and variable.

My Contrarian All-Weather Retirement Portfolio won’t be very exciting for those seeking outsized returns. It’s not designed for younger or more aggressive investors. And given its passive, index-based construction, you won’t find any hot stocks here. Rather, it’s geared towards investors who have achieved financial security and who want capital preservation with modest real returns.

One of my favorite investors, William Bernstein, said,

“If you’ve won the investing game, stop playing. For a younger investor, stocks aren’t as risky as they seem. For the middle-aged, they’re pretty risky. For a retired person, they can be nuclear-level toxic.”

In other words, there is no need to bear higher risk if a lower risk portfolio will satisfy your financial goals.

Why do I call it Contrarian? Those who follow me know I have written several articles on mean reversion and have a value orientation. I utilize asset class tilts that are somewhat unconventional compared to what most financial advisors would recommend.

I followed a three-step process to arrive at our all-weather portfolio:

- Set financial goals and create an Investment Policy Statement (IPS)

- Choose the asset classes and allocations to meet the financial goals

- Identify specific investment vehicles for each asset class

This article focuses on item 2. In a sequel I will cover item 3, some of which I’ve already shared on SA.

My Investment Principles

Before delving into portfolio construction, I think it’s important to present the framework that governs my all-weather portfolio. My principles have evolved, but the core concepts have been in place during my 40+ years of investing:

1. Utilize a passive, asset-allocation investment methodology with low cost, index-based investments over a long holding period.

2. Utilize diverse asset classes in the investment allocation:

Equities

- Small cap and large cap, value and growth index funds, with an emphasis on value

- Foreign developed and emerging markets index funds

- Commodity producer (natural resources) equities

- Farmland

- MLPs

Bonds

- US Bonds

- US TIPS

- US high quality bonds

- ETFs, bond mutual funds and individual Treasury bonds

Precious metals – ETFs, and physical gold and silver

Cash – Money markets, bank savings accounts and CDs

3. Do not invest in:

- Commodities futures, hedge funds, or private equity

- Speculative investments that appear as “one-time” special opportunities

4. Establish and maintain a long-term target asset allocation. We allow a small degree of flexibility with allocations and rebalance periodically, but do not engage in dynamic tactical asset allocation or market timing. Asset classes will move in and out of favor over many years and it is impossible to predict when turns will occur. A key to success is staying the course and making only small adjustments over time.

5. Adjust target asset allocations when our objectives or risk/return preferences change.

The Contrarian All-Weather Retirement Portfolio Goals

There is no one-size-fits-all portfolio. Each investor has a unique willingness, ability and need to take risk. In our case, using retirement planning modeling tools, we arrived at a real return goal of 2% per year. We’d like annual drawdowns of no more than 5-7%.

Contrarian All-Weather Retirement Portfolio Design

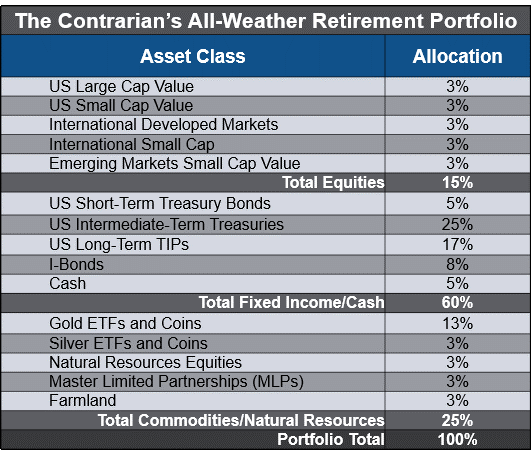

Portfolio Mix: 15% Equities, 55% Bonds, 5% Cash and 25% Commodities

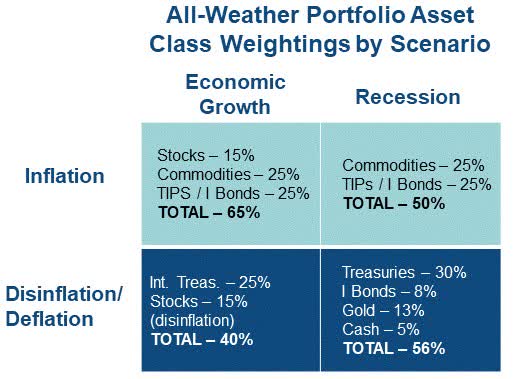

The first decision is the weighting of major asset classes. In my previous article, I discussed the reasons to hold assets that perform well in a variety of economic conditions. The two primary dimensions are inflation versus disinflation/deflation and economic growth versus recession/depression. The chart below depicts the resulting four scenarios and which assets have performed well during those regimes.

The other consideration is asset class volatility. The most volatile, risk assets are stocks and commodities; cash and bonds are least volatile. The more volatile assets should have a lower weighting to equalize the return impact on the overall portfolio.

Author

Economic Growth and Inflation

This scenario is a slam dunk for investors, with most asset classes historically performing well. It was the prevalent regime throughout the past 60 years. The Contrarian portfolio carries a 65% weighting of stocks, commodities and inflation indexed bonds.

Note that in periods of rising inflation with economic growth, equity performance is still positive, but subpar. According to AAII’s “Building a Balanced Portfolio: An Unconventional Allocation,” excess annual returns over cash in those periods were 2% compared to 5.7% from 1927-2014.

Another 25% is allocated to long-term TIPS (17%) and I Bonds (8%). According to AAII, TIPS returned an excess over cash of 1.2% per year during periods of rising growth and 4.7% per year over all periods. But they’ve done best during periods of rising inflation and slower growth.

Stagflation a la the 1970’s and 1940’s

Many believe we are heading into a prolonged period of stagflation – the upper right quadrant. During those times commodities have provided effective portfolio protection. My approach is a mix of gold (13%), silver (3%) and natural resources equities (9%), for a total allocation of 25%. During 1973-1981, natural resources equities rose 13% per year. They have also risen during periods of a weakening dollar. For example, during 2001-2008, they went up 90% while U.S. stocks languished. I discussed this in Natural Resources Equities: Preparing for Reflation and a Dollar Decline. There I also explain why I prefer natural resources equities to commodity futures.

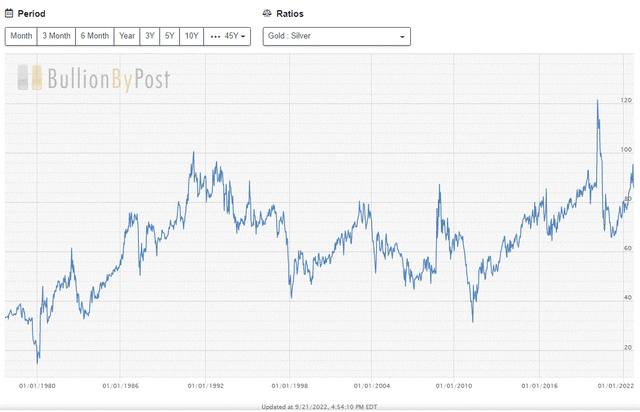

I am long-term bullish on gold, although I see it primarily as a store of value. Silver is attractive as an inflation hedge and use as an industrial metal. And it is trading at the lower end of its historic relative valuation versus gold.

Gold to Silver Ratio (BullionByPost.com)

TIPS have also done well during stagflation. AAII reported long-term TIPS returned an excess over cash of 10.8% per year during periods of rising inflation and 7.8% per year during periods of falling growth from 1927-2014.

Ray Dalio, among others, makes a good argument that the 2020’s will mirror the 1940’s. The parallel is the gigantic deficit spending to finance World War II (recently the Covid stimulus), with the Fed implementing yield curve control. The jury is out on the latter, but I believe there is a good possibility they will accommodate and accept higher inflation to reduce enormous real debt and prevent the economy from cratering.

During the 1940’s inflation averaged 5.5% but was volatile, ranging from -2% to +18%. The Fed kept long rates well below inflation during most of the period – no more than 2.5%. As a result, bond investors suffered negative real returns for ten years.

Indeed, the Fed’s rate hikes may leave the real yield in negative territory for some time. The most recent Fed “dot plot” shows a peak Fed Funds rate of 4.6% in 2023. Even a moderating 5% inflation rate next year would result in a negative real short rate. And this example assumes the Fed would not cave in should the economy worsen further.

Equities have suffered during stagflation, with annual excess returns of only 2% and 1.7% during rising inflation and falling growth periods, respectively.

Whether we see the 1970’s, the 1940’s or we return to more “normal” 2-3% inflation, I believe the risks of prolonged, elevated inflation with slower growth warrant a healthy dose of stagflation protection assets.

Economic Growth with Disinflation

The lower left quadrant depicts economic growth with disinflation (deflation applies only to the lower right). Stocks and bonds have done very well during these periods. This regime has been common since the early 1980’s. The most prominent example of economic growth with disinflation was during the roaring bull market of the 1980’s-90’s, with stocks generating high double-digit annual returns. At the same time bonds had a roaring bull market with yields falling from the high teens to low single-digits. The Contrarian’s portfolio carries a 25% allocation to intermediate-term Treasury bonds and 15% stocks for this scenario.

Recession/Depression and Disinflation/Deflation

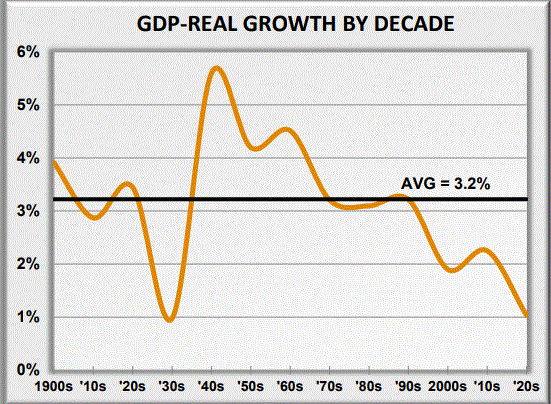

U.S. GDP growth has slowed over the course of the past several decades. And we are now unofficially in the second recession since 2020.

Crestmont Research

It has taken increasing amounts of extraordinary monetary and fiscal stimulus to generate economic growth over the past two decades. Fortunately, we haven’t (yet) had a prolonged Great Depression-style period. However, in my opinion the probability is increasing and is higher now than at any time in my 40+ years of investing.

Combining this with our capital preservation goal leads us to a healthy dose of protection for this scenario. Treasury bonds have been the primary defense. For example, during the 2007-09 Great Recession CPI dropped from 5.6% to -2.1%. In 2008 we saw a 57% drop in the S&P 500, when short, intermediate, and long-term Treasuries returned 6.7%, 13.5%, and 22.5% respectively.

With all the angst now about inflation and rising rates, it is hard to consider the possibility of deflation and declining rates. But I would suggest you check out Gundlach’s recent presentation, Rehab, as well as Stephanie Pomboy, for two prescient and contrarian viewpoints.

The Contrarian All-Weather portfolio carries 25% of assets in intermediate-term Treasuries, 5% in short-term Treasuries, and 5% in cash. Another 8% in I Bonds provides additional protection since their redemption value doesn’t decline during deflation, even though the composite interest rate can go to zero.

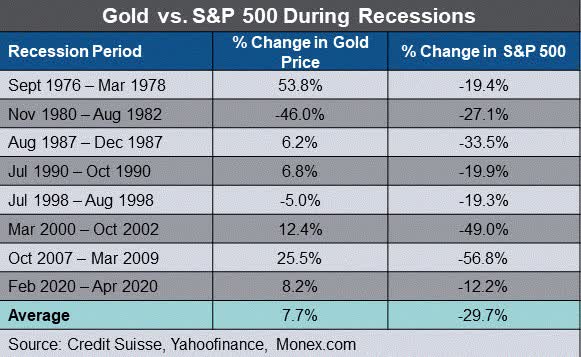

Gold Can Protect a Portfolio in Recession and Depression

What about gold in a recession or deflationary depression? The table below shows that gold returned an average of 7.7% over the past eight recessions since the U.S. left the gold standard, while the S&P declined an average of 29.7%. So far this year’s debacle hasn’t spared gold, although as of this writing it is down 10%, compared to 23% for the S&P 500. But we may still be in the early innings of this cycle.

Author, Credit Suisse, Yahoo Finance, Monex

Rather than take much space here, I refer you to this review of what happened to gold in the 1930’s. After confiscating gold from the public, the U.S. government reset the price from $20.67 per ounce to $35 per ounce, an increase of 69%. It’s impossible to predict what would happen in a similar scenario, but I believe gold should at least maintain itself as a store of value.

After we add gold at 13% to the lower right quadrant, 30% in Treasuries, 8% I Bonds and 5% cash, a total of 56% of the portfolio provides protection for this scenario.

Portfolio Holdings

The table below shows sub-asset class holdings. I primarily utilize ETFs or index funds. Exceptions are I Bonds, individual Treasury bonds and TIPS, physical gold and silver, and farmland equities. Our equity allocation is weighted towards foreign, value and small cap. I discuss why in my mean reversion articles and will provide more insight in a sequel.

Author

Portfolio Performance

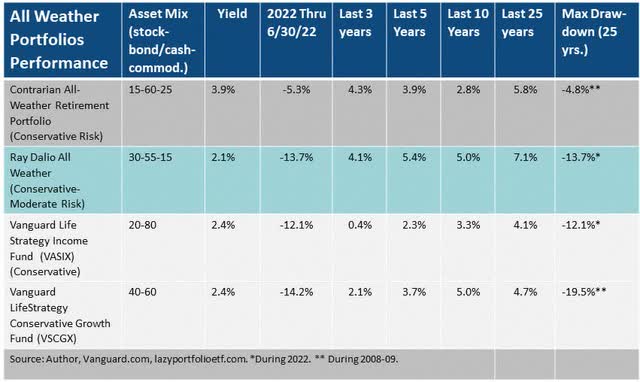

The Contrarian portfolio has performed well versus comparable portfolios. It delivered an annual return of 5.8% over the past 25 years and the maximum drawdown was only 4.8% in the worst year (2008).

Author, Lazy Portfolio ETF, Vanguard

Among the comparables, only the Dalio portfolio outperformed on a total return basis over the past five, 10 and 25 years. But it also carried more risk, with 45% in stocks and commodities. The better performance during those periods was largely due to weightings in U.S. large cap equities (30%) and long-term Treasuries (40%). Large caps gained 8.1%/yr. while long-term Treasuries had an historic bull run, gaining 5.8%/yr. over 25 years.

However, one should exercise caution investing through the rear-view mirror. The first half of 2022, the U.S. market’s worst in 50 years, was telling. During that time and over the past three years, the Contrarian portfolio outperformed The Dalio portfolio by 840 and 20 basis points, respectively. This was due to the Contrarian allocations to foreign and value equities, commodities, and the use of short and intermediate bonds, versus higher risk long-term Treasuries. The iShares 20+ Year Treasury Bond ETF (TLT) demonstrated that peril, down 31% YTD. Indeed, last year, before the surge in yields, Dalio expressed his concerns about bonds.

Yet recent yields of ~4% on short and intermediate Treasuries, modest interest rate risk, and the growing case for portfolio insurance makes them a viable component to an all-weather portfolio in my opinion.

The Vanguard LifeStrategy Conservative Growth portfolio has a comparable risk asset exposure of 40%. It does not own commodities and carries what I would consider plain vanilla assets. The Contrarian portfolio fared better over every period, except for the recent ten-year period. Once again, that was due to the asset class tilts noted above.

The Contrarian portfolio also had much lower risk. This year’s first half decline was 4.8%. In contrast, the Dalio portfolio declined 13.7%, Vanguard LifeStrategy Conservative Growth portfolio declined 19.5% and the more conservative Vanguard LifeStrategy Income Fund declined 12.1%.

The Contrarian portfolio yields 3.9%, well above that of the other portfolios. This is supportive of retirement investors’ withdrawal needs and helps them maintain allocations during severe market downturns. And the Contrarian portfolio generated an annual real return of 3.4% over the past 25 years, above my 2% goal.

Best Guess Future Returns

Using my proprietary modeling tool, I arrived at an estimated ten-year return for the Contrarian portfolio of 5.76% per year, almost identical to its actual return over the past 25 years. However, there is undoubtedly a significant margin of error in this estimate. Past performance is no guarantee of future results!

Yet if the portfolio can generate such a return and we return to inflation near the 60-year average of 3.8% over the coming decade, I would achieve my bogey of a 2% annual real return. I would be very pleased with that, especially given a much riskier 100% U.S. equity portfolio could earn only 3-6% per year, with much greater volatility and uncertainty.

Risks

This approach advocates riding an all-weather portfolio through all storms. Yet, future returns usually vary widely from past and especially forecasted returns. These are extraordinary times, with ongoing effects of the pandemic, enormous private and public debt, geopolitical turmoil, an aging population, rapid technological advancement, and innovation. And even the most patient investors may not be able to stand pat during market extremes.

What worked well in the investing world over the past 25 years may not work the same way going forward. If The Fourth Turning is correct, we are experiencing an historic transition that will profoundly affect us. If Elliott Wave Theory is correct, within 12-18 months we may enter a decades-long bear market rivaling that of the Great Depression.

Conclusion

The Contrarian All-Weather Retirement Portfolio has generated solid returns with low risk over the past 25 years. It may be suitable for older and/or more risk averse investors who can follow a long-term, patient approach. I believe this is superior to market timing, dynamic tactical asset allocation, and traditional target-date portfolios. While it carries risk, it has the potential to protect and modestly grow real capital for steadfast investors.

In a future article I will describe the third step in crafting the Contrarian portfolio – choosing specific assets. Please consider following if you’d like to be notified when that is published.

Be the first to comment