gesrey/iStock via Getty Images

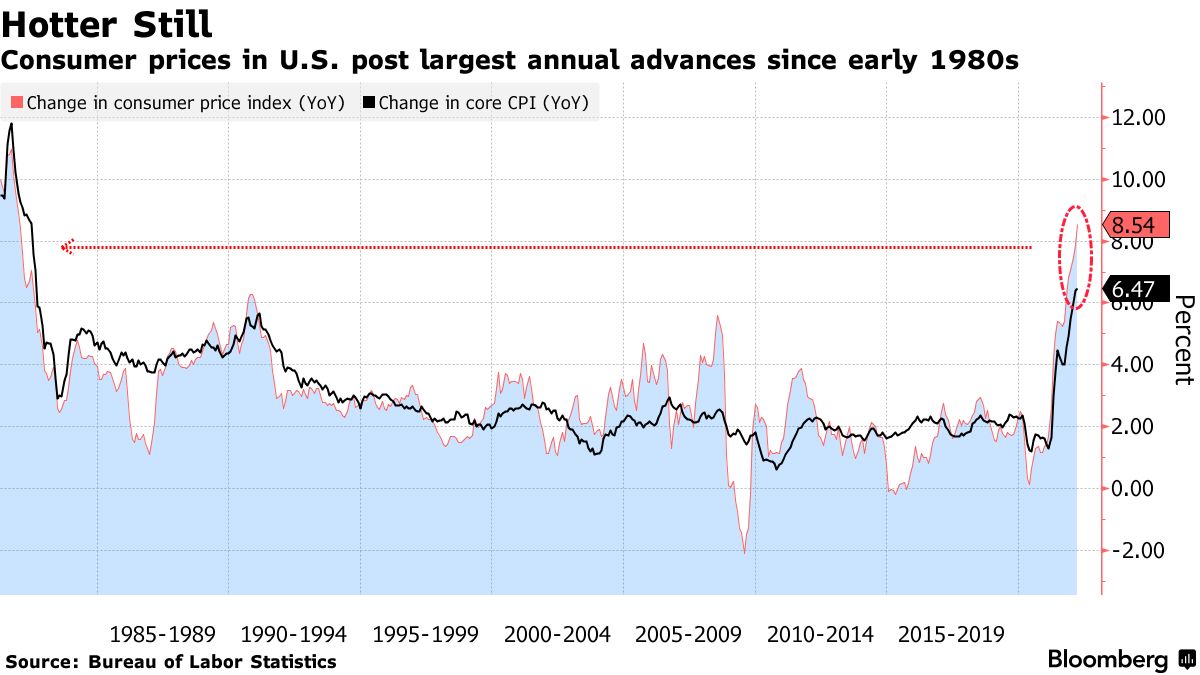

Stocks started with a strong opening yesterday after the core rate of inflation for March was reported to have increased just 0.3%, which was better than the 0.5% expected. The 10-year Treasury yield fell to 2.7% on the news, which fueled a rally in technology stocks. That rally didn’t last long when oil prices started to climb back above $100 a barrel on reports that China was easing some of its economic lockdowns in Shanghai. Investors refocused on the fact that the nominal inflation rate, which includes food and energy, rose to a new annualized high of 8.5%. Renewed inflation fears combined with the uncertainty about earnings reports from the major banks we will receive through the remainder of this week led stocks to close near their lows for the day.

finviz

Last month I surmised that we were near the peak rate of inflation when oil spiked to $130 per barrel in reaction to Russia’s invasion of Ukraine. After today’s Consumer Price Index report, I am certain of it. Granted, service inflation may yet to have peaked, and rent inflation will remain sticky, but the costs for goods is starting to come down as inventories have grown and stresses in the supply chain start to ease. More importantly, energy prices appear to have peaked, and as 2022 progresses the year-over-year comparisons should become more favorable.

Bloomberg

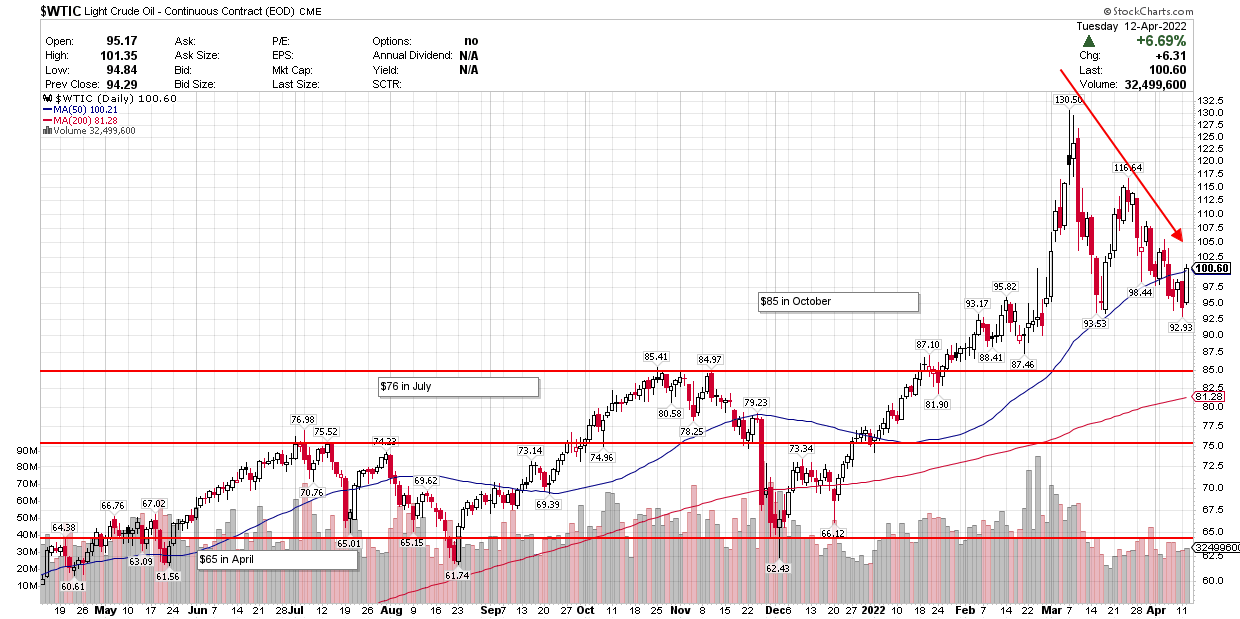

Gasoline prices accounted for nearly half of the monthly increase in the CPI for March on the tailcoats of the surge in the price of crude oil, as it rose 18 percent nationwide. That fed into higher costs for airline tickets and other transportation costs, as well as car and truck rentals. Yet oil prices have fallen more than $30 per barrel from the peak, and WTI crude broke below its 50-day moving average and the psychologically important $100 level last week. The year-over-year comparison for oil last April when the price was $65 will be compared to approximately $75 in July and then $85 in October. Provided the price settles near current levels, which I think is realistic, the rate of annualized increase should decline rapidly.

StockCharts

Bears will complain that oil is still close to $100 per barrel, but markets respond more to rates of change than absolute numbers. The rate of change should be moving in the right direction and bring down the annualized Consumer Price Index. More importantly, gasoline prices should follow, which is likely to lead to an improvement in consumer sentiment now at a decade low.

finviz

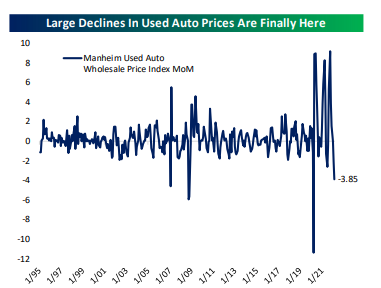

The price decreases are not confined to energy, as used car prices declined 3.8% last month, which was one of the most rapid drops on record. This should start to chip away at the core rate of inflation, as the 35% year-over-year increase in prices for this category moderates.

bespokepremium

Lumber prices have fallen 30% over the past month to a four-month low, as do-it-yourself renovators are holding off on new projects because of the high cost. In this example, the solution to higher prices has been higher prices, which slows demand. We are starting to see the same dynamic in the housing market, as high prices combined with higher mortgage rates slow price increases, which feeds into the largest component of the core inflation rate—rents.

finviz

Rent accounts for approximately one third of the core inflation rate. We may not have seen the peak in rent inflation, which is at a 31-year high of 5%, but a significantly slower pace of home price appreciation should start to help later this year. The rent component is calculated using the prior 12 months of leases signed, and the most recent months price increases are clearly unsustainable. As the rate of increase stops accelerating, which it appears to be doing now, the prices increase will moderate.

Bloomberg

If 8.5% was our peak rate of inflation for this cycle, it does not mean we will return to 2% anytime soon. Wages continue to grow at better than 5%, which is helping to stave off a more rapid decline in the rate of economic growth. I expect we will see the rate of inflation fall more rapidly than the consensus expects, which should be in line with or below the rate of wage growth, resulting in real wage gains by year end. These are all rates of change that should support risk assets.

Be the first to comment