onurdongel

(Note: This article appeared in the newsletter on June 26, 2022, and has been updated as needed.)

Magellan Midstream Partners (NYSE:MMP) is a very sound partnership with one of the higher financial strength ratings in the industry. Like Enterprise Products Partners (EPD), this company is also rated investment grade. But unlike Enterprise Products Partners, this company transports refined products and does a lot of oil related business. The market does not make the connection with the green revolution here that is made with natural gas products. Yet oil-based products find their way into our lives in so many ways that the future remains bright even if fuel demand disappeared tomorrow.

Some of the more unexpected products made from oil include Aspirin, yarn, crayons, lotion and Vaseline. In fact, one would be surprised at all the beauty products (like lipstick) that have a basis in oil, coal, and coal tar. In addition, oil has the easier carbon-hydrogen chemical bonds that are easier to break than the oxygen-hydrogen bonds in water. If the day ever comes when natural gas becomes too expensive to serve as a raw material for the fast-growing hydrogen market, then oil would be another possible place to look to make hydrogen (though it is not the only one by far).

In the meantime, oil, like natural gas is slowly finding its way into the green revolution. This part of the industry has done far less to trumpet the progress made in helping the market find those green end products. Nonetheless, the dependency on nonrenewable resources will have to first change before we ever lose that dependency. That implies some ingrained habit changing that is not likely to be a fast process. Because of that, many still show the need for oil growing in the future as well as natural gas.

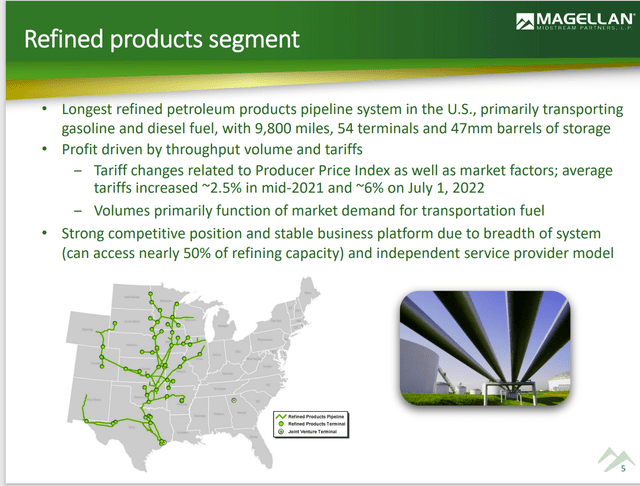

Magellan Midstream is largely involved in the “first step”. That first step largely involves getting product to and from refineries

Magellan Midstream Refined Product Distribution And Storage Map (Magellan Midstream August 2022, Corporate Presentation)

The company aims to be a “one-stop-shop” for its main customers. The whole business is largely fee based. The convenience of dealing with a large transporter of these types of goods is obvious. The partnership does have competition “all over the place” but has a competitive advantage simply because its large size allows its customers many convenient alternatives.

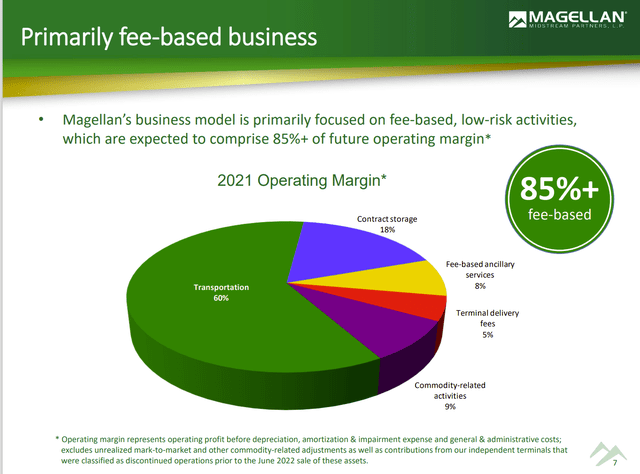

Magellan Midstream Breakdown Of Fee Based Business (Magellan Midstream August 2022, Corporate Presentation)

The business is largely fee-based business and is further insulated from industry cycles by long term take-or-pay contracts. This company will show something of a cyclical nature. But it will not be anything close to the upstream cyclical swings that investors constantly see.

Nonetheless, Mr. Market does not like the negative earnings comparisons that come with any cyclical nature. Despite the steadiness of this business and the good financial strength, these units will often follow the upstream companies down whenever upstream has a cyclical downturn. As often as not, the cushion provided by the financial strength usually makes this company a bargain whenever the upstream industry suffers from weak commodity prices.

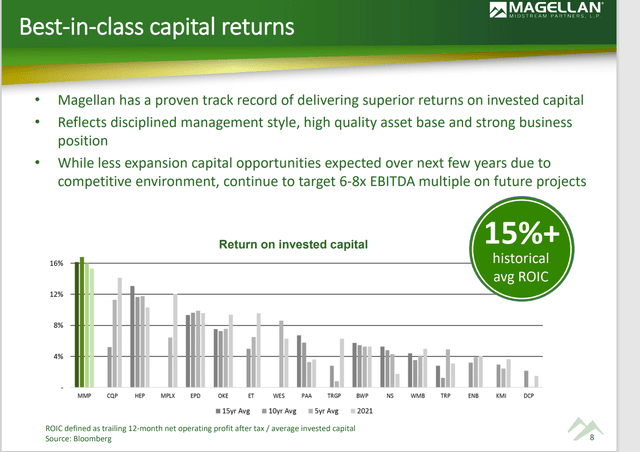

Magellan Midstream Long-Term Profitability Comparison (Magellan Midstream August 2022, Corporate Presentation)

Despite some cyclical tendencies in the business, management has kept the partnership profitability well within an excellent range. Good profitability also provides some investment downside protection because the market does have respect for decent profits and the cash flow that comes with those profits.

One of the side issues with a lot of “story stocks” and “pioneers of new industries” is the tendency to report profits without cash flow. That happens when the depreciation and other cost allocation methods are insufficient to actually record the amount of expense necessary to cover the revenues.

Investors need to remember that public accountants gain new customers through a competitive process. This competitive process puts pressure on them to “mitigate” their normal conservative tendencies. Public accountants are well known for adjusting cost allocation guidelines after a problem has made public headlines. This is due to that competitive pressure that limits the amount of income and so the time spent to find outright fraud as well as aggressive accounting that is likely to not be allowed in the future.

Investors can counteract this public accounting tendency by looking at the cash received from the profits reported. At some point, even growing companies will have cash flow from operating activities. Investors need to hold “managements feet to the fire” to make sure that cash gets to the bottom line and that deadlines do not get pushed back.

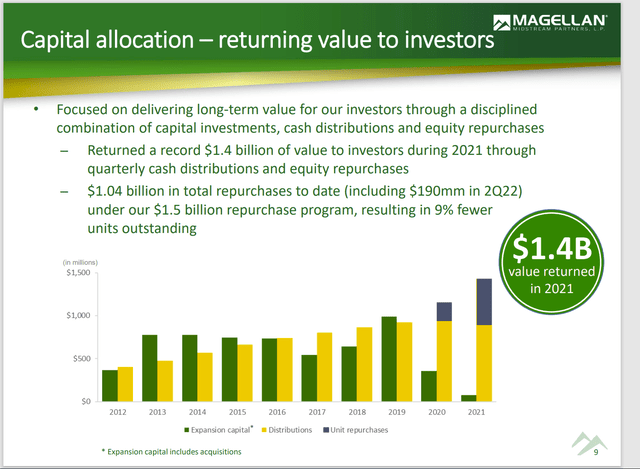

Magellan Midstream Record Of Returning Cash To Investors (Magellan Midstream August 2022, Investor Presentation)

Magellan Midstream has a long record of returning excess cash to shareholders. The profitability shown above enables this record to be maintained while keeping leverage low. Note that in the early stages of an industry recovery, the midstream capacity is still filling-up from the previous downturn. So, the need for a lot of expansion is just not there.

Free cash flow will change as the industry recovery picks up and more midstream capacity is needed. The use of share repurchases has enabled this partnership to have an attractive long-term distribution growth record. Management has wisely not increased the distribution quickly during this time of record free cash flow. Some of that free cash flow will be needed as demand for more capacity increases cyclically as it has in the past.

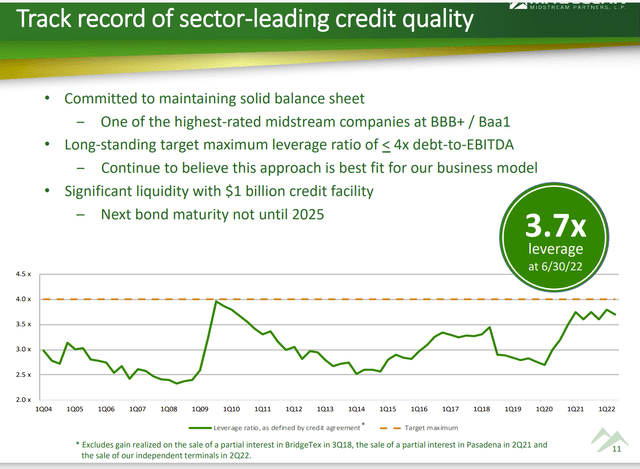

Magellan Midstream Debt Ratio History And Financial Strength Rating (Magellan Midstream August 2022, Investor Presentation)

Magellan Midstream has kept debt ratios at industry leading low levels for a large independent midstream company. The result is that rare investment grade rating for a midstream company. Management has the debt level at a place to be able to totally finance future expansions with debt if that proposal is profitable enough or if management chooses to increase the debt ratio.

Any investment-grade company has more than adequate access to debt markets at reasonable rates. In addition, the company has long self-financed so there was no adjustment needed when the market clamped down on competitors who raised equity to help finance future expansion projects. The resulting periodic equity dilution was largely absent here.

A well run midstream like this one will provide some appreciation combined with a generous distribution. The total return should be in the teens. The units can be held by investors until the story changes or until the stock price becomes so outrageously high that it would take years of growth to justify the price. That is just so unlikely in an industry that is not considered part of the green revolution that it is not worth worrying about. As a result, most investors can purchase this on any pullback and probably hold “forever” as long as there are no unfavorable management changes or changes to the “steady-as-you-go” story. This stock will appeal to a wide range of investors.

(Note: this company issues a K-1. Investors need to be thoroughly familiar with all aspects of a K-1 before they invest).

Be the first to comment