zorazhuang

Chinese tech firms, like Baidu (NASDAQ:BIDU), got good news to close the week. The SEC and the Public Company Accounting Oversight Board (PCAOB) signed a preliminary deal with Chinese regulators in a positive sign the Chinese stocks won’t be delisted. My investment thesis remains ultra Bullish on Baidu loaded with cash and tech inventions in promising new areas.

Delisting Fears Reduced

The biggest fear of owning Chinese tech stocks Baidu and Alibaba (BABA) was the SEC forcing these firms to delist from U.S. stock exchanges. The Holding Foreign Companies Accountable Act (HFCAA) became a law on December 18, 2020 requiring foreign listed equities to have reliable accounting firms perform an audit based on the determination of the PCAOB.

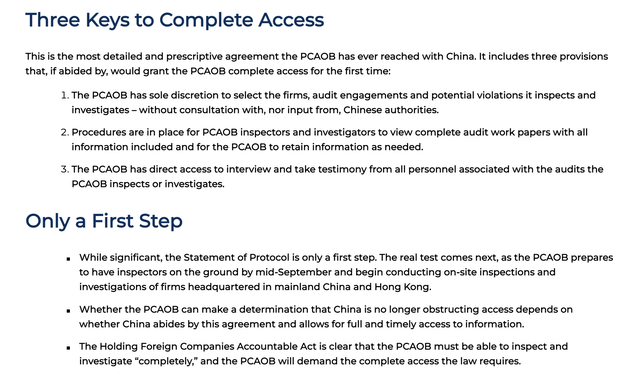

The SEC, PCAOB and Chinese regulators reached a deal to where the U.S. authorities will have the sole discretion of the audit review. The preliminary deal is only a first step with a crucial moment coming in mid-September with the PCAOB planning to have inspectors on the ground in mainland China and Hong Kong.

The proof will definitely be in the pudding on whether the Chinese authorities actually follow through on allowing inspectors to review Chinese company financial documents and audit reports plus interview personnel associated with the audits. The market shouldn’t be surprised if the agreement runs into issues after the Chinese regulators agree in theory, but not in actual practice.

The risk to Baidu and other Chinese stocks is that after a three-year period of failed audits, the stocks can be delisted. Baidu has already hit the one-year milestone, but the company still has plenty of time to work with the regulators to find a solution for U.S. shareholders.

AI Boost

Due to covid lockdowns in China, the stock is hard to value right now. The full aspects of the business aren’t known with results reduced in Q1’22 and the upcoming Q2’22 report to be released before the market open on August 30.

Baidu recently reported Q1 results that soared past analyst expectations, but the Chinese tech giant only pulled off 1% revenue growth. The company continued to generate massive growth in non-ad revenues with the non-marketing business growing by 35% and AI Cloud jumping 45% YoY.

Apollo Go continues to get additional regulatory approvals for expanded services including the start of driverless ride hailing services in a region of Beijing at the end of April. The company followed this approval with the recent permits to offer fully driverless robotaxi services in both Wuhan and Chongqing.

Between AI Cloud and robotaxis, Baidu remains in a massive growth mode while the online marketing business (internet search) remains a growth opportunity, albeit at slower growth rates. As the AI business develops in the years ahead, Baidu becomes an exceptionally cheap stock.

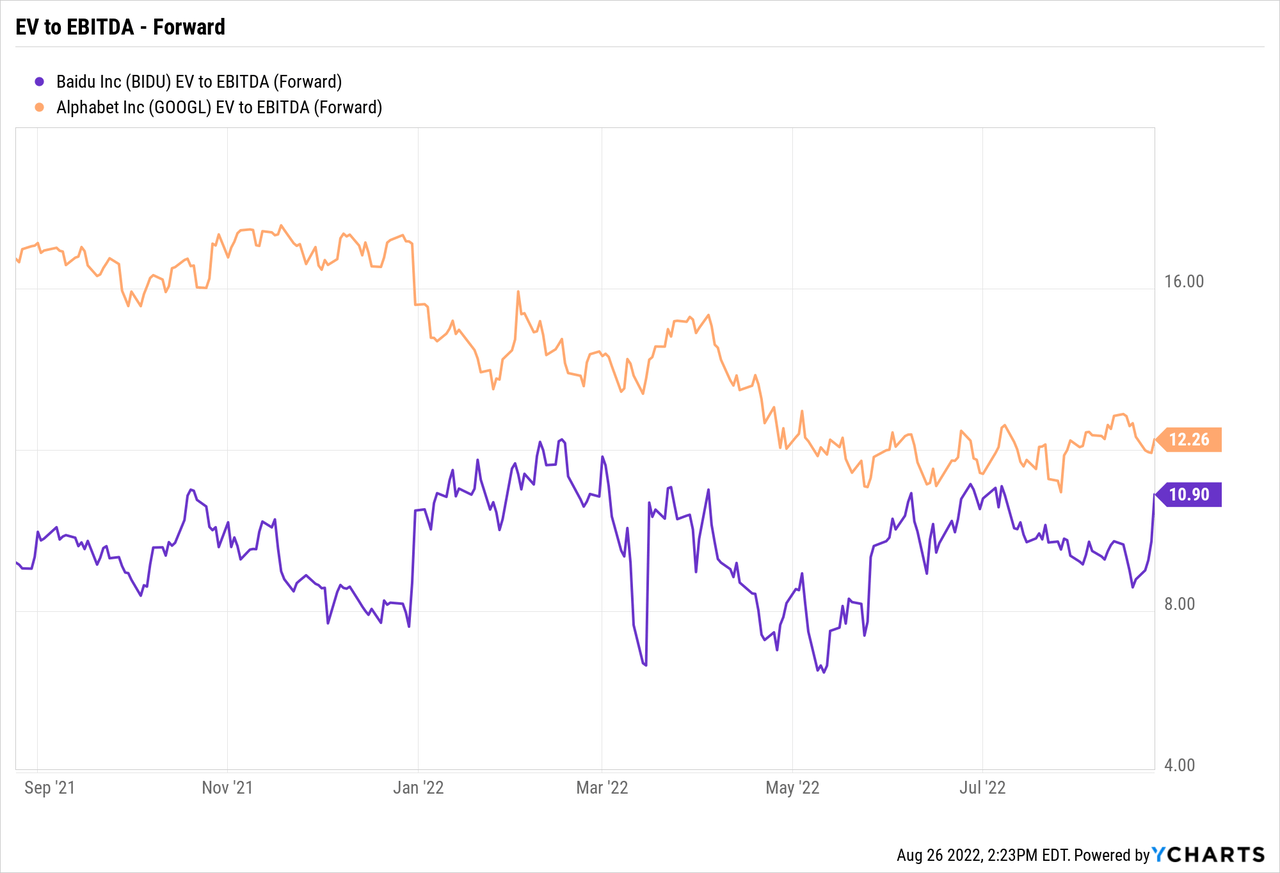

The stock trades at only 15x 2023 earnings estimates and naturally the EV is far lower with the nearly $18 billion net cash balance. In comparison to Alphabet (GOOG, GOOGL), the Chinese company trades at a slightly lower forward EV/EBITDA multiple at just 11x.

Baidu isn’t as cheap now with some cuts to recent earnings expectations due to Chinese lockdowns. Either way, both Alphabet and Baidu are exceptionally cheap stocks with revenue growth alone looking to exceed the current valuation multiples. Both companies should be able to exceed those growth rates on the bottom line. In addition, Baidu has the $18 billion net cash position to continue repurchasing ultra cheap shares despite the strong growth prospects when China fully ends covid restrictions and gets back to focusing on growing the economy.

The company reports before the open on August 30 with analysts forecasting a big hit to Q2’22 revenues with a target for a 12.5% dip to $4.24 billion. Analysts forecast another 5.3% dip during Q3’22 to $4.74 billion while China continues to work in and out of covid restrictions this quarter.

Takeaway

The key investor takeaway is that Baidu only trades at 11x EV/EBITDA targets from what is currently a difficult economic period due the CCP still fighting a virus the U.S. has mostly moved beyond. The stock gets a lot cheaper when China fully reopens and earnings expectations rise while the recent agreement between financial regulators in the US and China help reduce the risk of an ultimate delisting of the stock.

Investors should continue to load up on the leading Chinese tech company while the stock is still cheap below $150.

Be the first to comment