Bryan Bedder/Getty Images Entertainment

Although the shoe space may not be viewed as particularly interesting or attractive to some investors, there can be some good returns generated in this space if you know where to look. One great success story over the past couple of months has been Deckers Outdoor Corporation (NYSE:DECK). With strong revenue and mixed bottom line results, shares of the company have risen nicely. To be frank, the increase we have seen as of late is more likely attributed to the fact that shares were previously priced at a fairly low level. And, as a result, the market has reacted and pushed them higher. This is not to say, of course, that the fundamental condition of the enterprise is bad. In fact, the 2023 fiscal year as a whole should be quite positive for shareholders. Having said that, I would make the case that, after the rise in price, the stock of the business is much closer to being fairly valued at this time. Even so, the firm has a nice catalyst and I believe that it offers some (though not much) additional upside moving forward.

Stellar upside, decent results

Back in the middle of June of this year, I wrote an article about Deckers Outdoor that took a bullish stance on the company. I called the company an attractive one and said that it was posting strong growth at that time. This came following a period of significant share price decline because of concerns over the broader economy. Although those concerns were definitely legitimate, I did say that the low price that shares were trading for made the company an interesting prospect that investors should consider buying. Since then, the company has outperformed even my own expectations. While the S&P 500 has generated a gain of 10.8% since the time I published the aforementioned article, shares of Deckers Outdoor have seen upside in the amount of 35.7%.

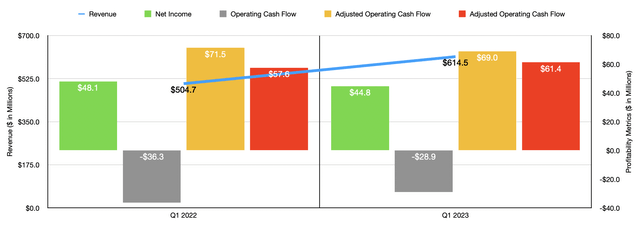

This monumental upside was not entirely unwarranted. Consider, for starters, how the company performed from a revenue perspective. In the first quarter of its 2023 fiscal year, which is the only quarter for which I now have data that I didn’t have data previously, revenue came in at $614.5 million. That’s 21.8% above the $504.7 million generated the same quarter last year. In the latest quarter, wholesale channel net sales for the company jumped by 24.7%, while direct-to-consumer channel sales rose a more modest but still impressive 15.4%. Domestic net sales for the company rose by 14.4%. But this paled in comparison to the 36.4% rise experienced on the international stage.

From a brand perspective, the greatest upside came from the company’s HOKA brand. Sales here skyrocketed by $116.9 million, or 54.9%. This strength was on both the wholesale and direct-to-consumer side. Total volume of pairs sold for the company jumped by 20.2%. Management chalked this up to strong demand for the HOKA brand that, in turn, was driven by market share gains with existing customer accounts, core franchise updates, the addition of new styles, and select door expansion with strategic accounts. Total revenue associated with the HOKA brand came out to $330 million during the quarter, which was up 55% compared to the same time last year. Management claims that demand has been fueled by continued innovation in this space and the investment in stores to push the brand further. On that front, the company is planning to open its first permanent US HOKA retail location during the spring of calendar year 2023. In the meantime, it’s opening a second pop up location in New York City and it continues to see strong traffic in its pop-up store in Chicago. Management’s ultimate goal is to eventually grow this brand on its own, with the company even stating that ‘much more growth’ for it lies ahead.

Although revenue growth has been impressive, the company has seen some pain on its bottom line. Net income in the latest quarter came in at $44.8 million. That’s down slightly from the $48.1 million generated the same time last year. Although this may seem small, it’s rather significant from a margin perspective. In short, the company’s net profit margin declined from 9.5% to 7.3%. That disparity, spread across this year’s projected revenue of between $3.45 billion and $3.50 billion, would translate to missed profitability of $76.5 million. It would be acceptable if this decline in profitability were driven by continued investment in growth. But according to management, the decrease in total income from operations compared to the prior year. Was mostly due to higher costs of goods sold on a percentage of revenue basis thanks in large part to higher freight costs. This should be a transitory issue, but exactly how short-lived is anybody’s guess. Higher costs for transportation and other related items have been more stubborn over the past year or so than I or many others anticipated. This decline in profitability had a negative impact EBITDA, with that metric dipping from $71.5 million to $69 million. On the other hand, operating cash flow improved, going from negative $36.3 million to negative $28.9 million. And if we adjust for changes in working capital, it would have risen from $57.6 million to $61.4 million.

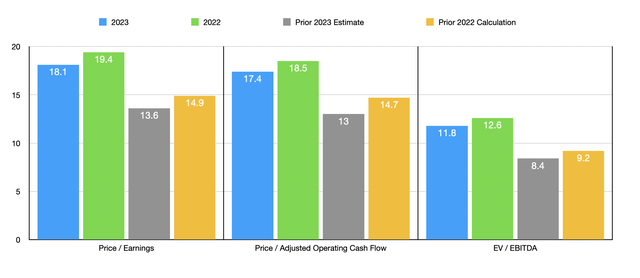

When it comes to the 2023 fiscal year as a whole, management expects earnings per share of between $17.50 and $18.35. Given the number of shares currently outstanding for the enterprise, this should translate to net income, at the midpoint, of $483 million. If we assume that profitability change relative to last year’s profitability is indicative of how other profitability metrics will perform, then we should anticipate adjusted operating cash flow of $503.9 million and EBITDA of $683.1 million. Given these estimates, we can see that the company is trading at a forward price-to-earnings multiple of 18.1. This is down from the 19.4 reading we get using 2022’s results. The price to adjusted operating cash flow multiple should drop from 18.5 to 17.4. And the EV to EBITDA multiple should decline from 12.6 to 11.8. The reason why this metric is so much lower is because the company has no debt on hand but has cash and cash equivalents of $695.2 million. That drastically reduces the company’s enterprise value.

As the chart above illustrates, the pricing for the company is definitely higher than it was when I last wrote about the business in mid-June of this year. Also, as part of my analysis, I compared Deckers Outdoor to five similar companies. On a price-to-earnings basis, these companies ranged from a low of 7.8 to a high of 29.9. And when it comes to the EV to EBITDA approach, the range was from 7.9 to 22.8. In both cases, four of the five companies were cheaper than our prospect. Meanwhile, the price to operating cash flow multiples of the firms ranged from between 9 and 34.2, resulting in three of the five companies being cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Deckers Outdoor Corporation | 18.1 | 17.4 | 11.8 |

| Skechers U.S.A. (SKX) | 14.9 | 12.8 | 9.1 |

| Crocs (CROX) | 9.8 | 9.0 | 8.2 |

| Steven Madden (SHOO) | 11.5 | 23.9 | 7.9 |

| Wolverine World Wide (WWW) | 7.8 | 15.7 | 10.0 |

| NIKE (NKE) | 29.9 | 34.2 | 22.8 |

Takeaway

All things considered, I do believe that Deckers Outdoor continues to demonstrate that it is a high-quality operator in this space. The company is experiencing some issues with profitability at present. But that will eventually come to pass. Long term, the company has a strong catalyst in HOKA and that could fuel growth further. Having said that, shares are no longer as cheap as they were. While I wouldn’t be surprised to see the company continue to grow nicely, I do think the stock is much closer to fairly valued. But with this catalyst and the transitory nature of its cost issues, I would still rate it a ‘buy’, but only marginally so.

Be the first to comment