Nordroden

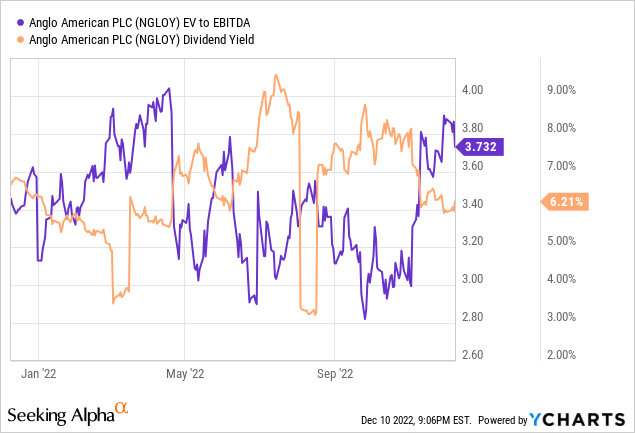

Diversified mining company Anglo American’s (OTCQX:NGLOY) latest downward revision to its mid-term production guidance was disappointing but not unexpected, given similar moves across major global mining peers like Glencore (OTCPK:GLCNF) and Vale S.A. (VALE). In tandem, unit costs also suffered directly from the lower volumes, with the company now guiding for ~9% cost inflation on an underlying basis for FY23, in addition to the ~16% inflation for this fiscal year. Still, there are silver linings for long-term investors. For one, Anglo continues to offer valuable exposure to a diversified basket of commodities, including copper, iron ore, and platinum group metals, among others. It also has one of the more compelling growth pipelines within the EU/UK diversified miner universe, particularly with regard to new copper and platinum group metals capacity. At current valuations, Anglo stock trades at a discounted ~4x EBITDA valuation and pays out a well-covered ~6% dividend yield.

Ongoing Operational Challenges Weigh On The Production Outlook

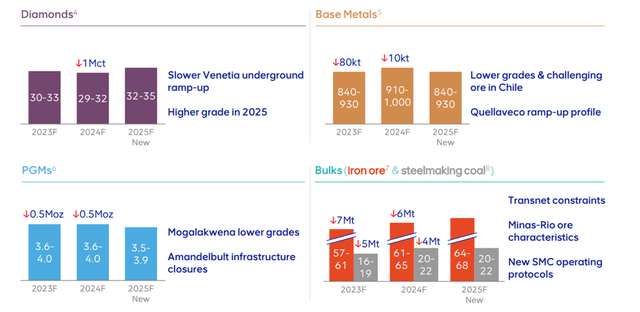

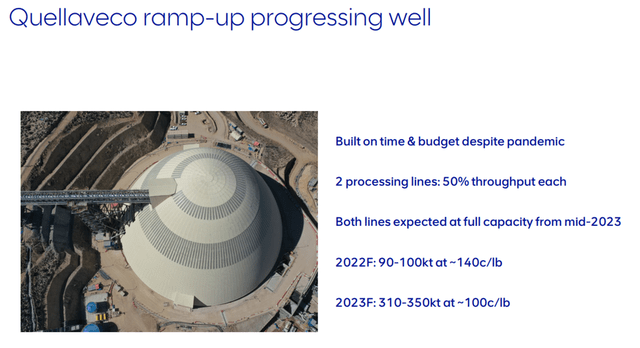

At its latest capital markets day event, Anglo moderated its production guidance across the board, rebasing expectations amid a tough operating environment. The updated guidance for FY23/FY24 now calls for ~5% growth, with FY25 also expected to be in line. For context, the projected 5% increase in overall volume for FY23 is well below the prior double-digit growth guidance, implying an extension of the planned volume ramp-up into the following year. Much of the 5% growth projection in FY23 will be driven by the Peruvian Quellaveco copper mine, while for FY24, growth is set to be broad-based across copper, iron ore, and steelmaking coal. Offsetting the tailwinds are ore hardening at the iron ore mining project Minas Rio in Brazil, which was behind the iron ore production cuts, as well as logistical disruptions from Transnet in South Africa (due to on-and-off strikes and maintenance programs).

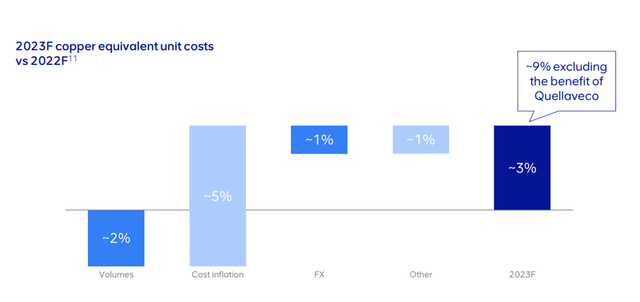

The lower production means lower scale benefits, and thus, unit costs are also expected to be higher by +3% and +5% in FY23 and FY24, respectively. While this is a negative development, the quantum is still lower than many of its peers, helped by Quellaveco-driven volume growth tailwinds. Quellaveco benefits will also help the Q4 production guidance, which stands at an implied ~8% uplift (based on FY22 guidance at down low-single-digits %). That said, Anglo’s reduced long-term production growth target at +25% (down from +30% previously) is concerning and, depending on how its peers respond, could impact profitability down the line.

More Capex Cuts Ahead As Supply Tightens

In line with the lower production guide, Anglo’s selective approach toward project execution has begun to permeate across the rest of the mining universe. With mine depletions also rising, supply conditions look set to tighten significantly. This contrasts with demand tailwinds from the accelerating energy transition globally, potentially driving a skewed supply/demand balance down the line. Anglo’s robust pipeline should allow it to capitalize – the ramp-up of the Quellaveco mine, for instance, is set to increase Anglo’s global production base by ~10% in a base case scenario and up to 25% over time.

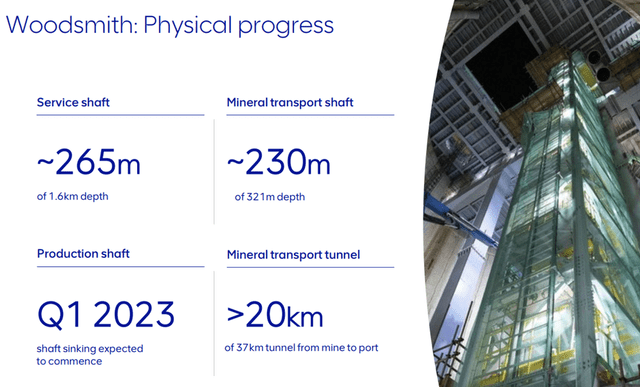

Beyond Quellaveco, Anglo also has major greenfield options such as Woodsmith at hand. For now, though, Woodsmith is facing a potential impairment at year-end, as the project cost overruns and delays (vs. initial projections when Anglo acquired Sirius Metals in 2020). Yet, Woodsmith’s potential to become a high-margin contributor to the Anglo portfolio is intact over the long run, given plans for effective low-carbon fertilizer production remain on track throughout the project.

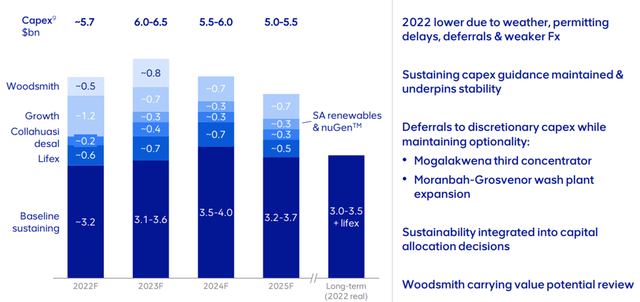

Net, Anglo’s decision to moderate its capex guidance seems prudent, in my view. For FY23, the headline guidance has been maintained at $6-6.5bn, but given this range now includes another $0.8bn for Woodsmith, I view this as a capex cut. Similarly, FY25 capex was moderated to $5-5.5bn (down from $5.5-6bn for FY24). As for FY22, capex was also revised lower to $5.7bn (down from $6.1-6.6bn previously), though this was largely due to external factors such as supply chain disruptions, employee availability, and FX fluctuations.

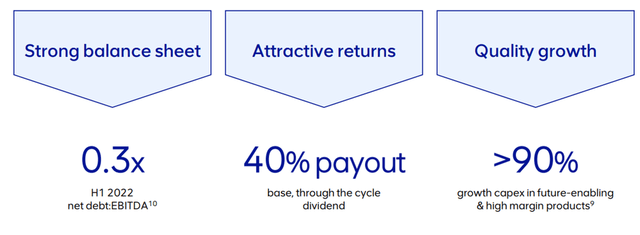

While lower capex should help cash generation and debt, Anglo’s updated guide for $2-2.5bn of working capital build in FY22 from Peru copper, platinum grade metals, and diamonds, means net debt could still end the year higher than forecast. That said, the working capital impact should even out over time; alongside the lack of capex inflation, this bodes well for Anglo’s balance sheet capacity and capital return potential.

Compelling Valuation Case Despite The Latest Guidance Reset

The key focus post capital markets day will likely be on the production downgrades across the board, but this was widely anticipated given the ongoing supply-side challenges (weather and supply chains), as well as ESG pressure. Plus, Anglo’s cuts were broadly in line with the other major miners, so on a relative basis, its fundamentals remain strong. Investors willing to take the long view will find a lot to like here – the industry’s operational challenges are near-term bullish for commodity prices, with the resulting capex restraint likely to tighten supply over the mid to long-term as well. Given its growth pipeline and diversified commodities exposure, Anglo’s discounted EBITDA valuation and elevated (but well-covered) dividend yield make the valuation case compelling.

Be the first to comment