FG Trade

Dear readers/subscribers,

In this article, we’re going to take a look at the company RELX (NYSE:RELX). As of this article, I’m initiating coverage of the business. We’ll take a look at what the company does, how it’s been doing, some of the risks, and most important of all, what we’re paying for the company and what we’re getting for the price.

Let’s get going.

Presenting RELX PLC

RELX, as the company is called, is a global provider of information-based analytics and decision-making tools for B2B customers, enabling better decision-making, better results, and being more productive. This is a bit of a general description, but it is what the company does.

This company’s somewhat “odd” name is a relatively new thing – and came into being in 1993, with the name RELX coming in 2015. It was formerly known as Reed Elsevier and came into being as a result of a merger of Reed International and Elsevier. The first was a trade book and magazine publisher, the second was a scientific publisher. The roots of the company’s components go back to the early 1880s.

The company has been an extremely active M&A’er, which is how it achieved its current competencies within the areas of legal analytics, ID analytics, supply chain integration, and consulting insurance consulting, and many other consulting areas.

The company is investment-grade rated, has a relatively attractive yield in terms of dividends, and has a strong tradition of earnings performance over the past 20 years. It’s a “good” company, as such.

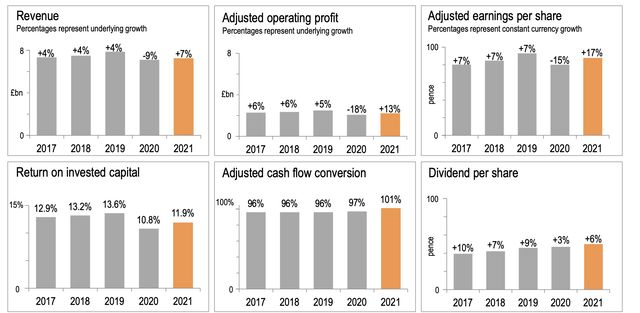

RELX manages revenues of over £7B on an annual basis, with an adjusted operating profit of around £2.2B, coming to a margin of just over 30% with cash flow conversions of over 100%.

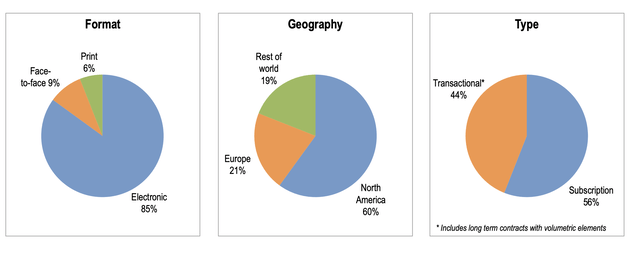

The company is conservatively indebted, coming in at no more than 2.4x net debt/EBITDA. The company’s revenue split is an appealing mix, with a heavy NA focus for most of its business.

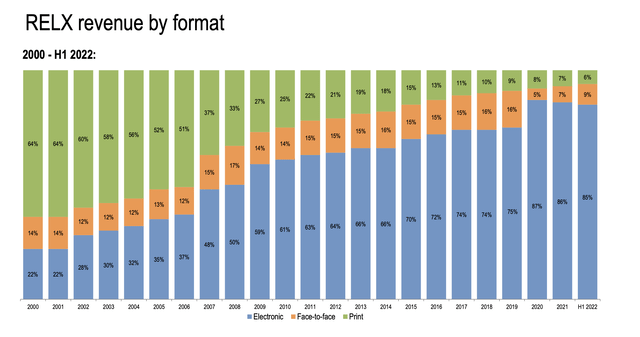

RELX as a business has evolved much in a very short period of time. Over the past 20 years, RELX business has gone from being nearly 65% print and 15% face-to-face to be more than 84% digital – a complete turnaround, that’s very much “in with the time”.

The company’s business is helping others to succeed. It focuses on developing information-based analytics and decision tools that deliver value and gets paid for these services. The targeted customer outcomes are better growth, better RoR, and a more positive impact on society.

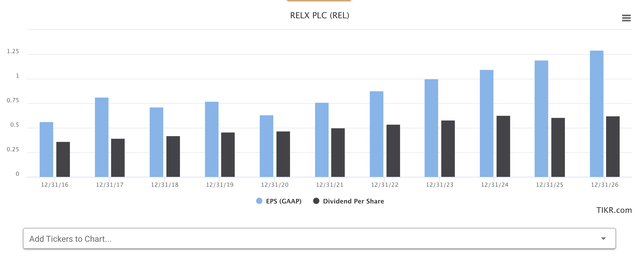

The company does its job well, because, for the last 5 years, the company has been consistently able to grow every single relevant metric compared to the year before.

The capital allocation priorities for the company for these earnings are as follows. RELX focuses on organic development, first of all, coming to around 5% of revenues allocated to this. About half a billion pounds are then allocated to M&A considerations to keep the inorganic growth thesis intact, while another significant portion with a dividend coverage of 1.8x is allocated to shareholder payouts, which is growing year-over-year.

All the while, the company seeks not to go over a 2.5x net debt/EBTIDA for any extended time, explaining its BBB+ credit rating. The company also knows “how” to buy back shares – buying back significantly as prices were cheap, but not touching that lever as the prices were elevated.

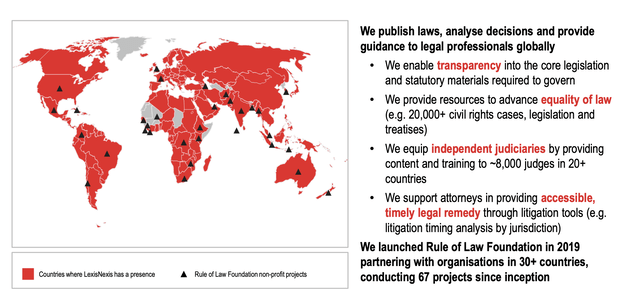

Here is where the company’s customers typically work.

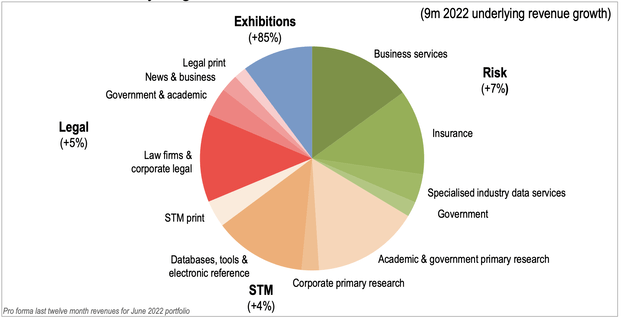

The company has an overall #1 or #2 market position in every single segment it operates in. It can be said that the company has 4 key market segments, with Exhibitions being the smallest of them and STM being the largest of them.

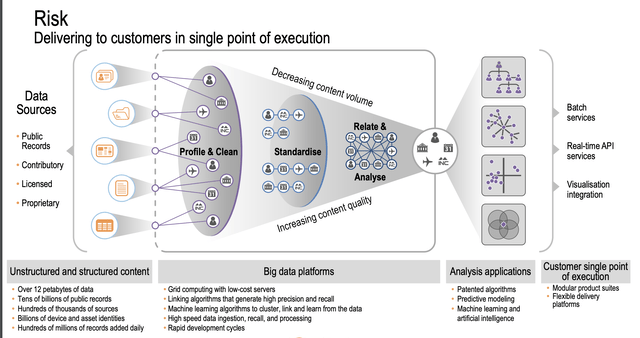

What the company actually does is tricky to put into layman’s terms. We’re talking about very complex processes.

However, if forced to boil it down to a few words, I would say the following things.

- Fraud/Identity protection/E-commerce fraud reduction

- Financial crime detection/compliance

- Article/Science Validation and improvements & providing peer review

- Help with Fund allocation decisions for Universities/funding organizations

- Accelerate & Improve research

- Support Drug research and recovery

- Support treatment selection and standardized care, while learning and improving on outcomes

- Litigation analytics

- Legal document drafting

- Predict legal outcomes

Those are some of the things that the company does – and they do these things extremely well.

The latest set of results we have from the company is interim results for the 2Q22/1H22. The company reported a half-year revenue growth of 13%, with profit growth above revenue growth at 16%, showcasing efficiency and good tailwinds. The company also bumped its interim dividend by 10%, again showcasing good trends.

The company’s revenue split has also improved, with legal taking more of a portion of the cake here.

We have strong revenue and strong profit trends both, with growth in every single segment, despite the ongoing worldwide pressures we’re currently under. EPS improved by 18%, 14% even if we work with constant currency rates.

The company also generated nearly £900M in FCF over the past few months, with uses of cash being M&As, dividends, and some debt reduction down to 2.2x, excluding pensions.

The company did offer a nine-month sales call back in October. Not a full earnings call, but still some data to take into consideration. Revenue growth for 3Q22, though here we go for 9M22, is continuing to see growth with 9% for the full year, compared to 6% YOY. The company has obviously entered into the final quarter of its fiscal, and momentum is reportedly strong, with expectations being good top-line growth for the full year, as well as constant currency growth in adjusted EPS.

Unlike other businesses, the company does not see any massively increased risk due to debt refinancing over the next few years.

On the debt refinancing, we have a couple of maturities in the next couple of years. We’ve got about $800 million of debt maturing next year, although some of that’s at quite high rates, over 4%, some are over 6%. So not particularly different to current rates. And then there’s $1 billion also in 2024, which is at lower rates, but we’ll see where rates have got to by then.

(Source: 9M Call, Nicholas Luff)

The typical trend for this company has been to take recessions and eventual downturns quite likely. A low-double digit EPS drop is typically all we see, with fairly quick recoveries for the business in the upswing. The same is expected of the trends this time around, only for the growth in coming years to be quite impressive even beyond 2023.

Let’s look at how this impacts valuation and what sort of valuation picture we have for RELX.

RELX – The valuation

Unfortunately, the valuation for RELX is only conditionally appealing. Back in 2012-2013, you could have picked up this company for below 15x P/E. But outside of financial crisis recovery, this company trades closer to a historical premium of around 18.5x P/E for the past 20 years.

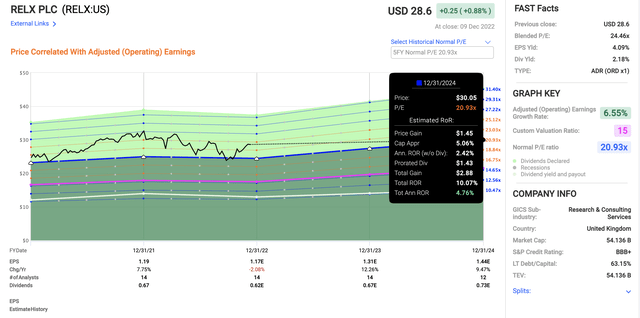

That means that at today’s ADR P/E of close to 25x, the company cannot truly be called “undervalued”, as things stand. We have dropped some percentages during the year, but things have recovered as well.

The analysts following the company expect an EPS pressure of 2% negative for the fiscal on an adjusted basis, followed by double-digit growth. Back in COVID-19, this company dropped to as low as 14.8x normalized, but that’s not where we are now.

I have difficulties reconciling paying a 22-24x P/E for a company that on a 5-year basis grows on average 3-5% and yields 2.2%. That’s not really where I want to put my capital.

The company’s fundamentals are rock-solid. At the right price, this becomes a “Must-buy” to me, and a company to hold pretty much until it hits 25x P/E or above, at which point, I would start rotating shares for a profit.

There is a premium upside in RELX if we want to take that side of the argument, just not a high one. If we assume a 20.5x P/E, which is the highest I can go, then we have an RoR of 4.7% on an annual basis here. Not exactly attractive, as far as valuations go.

I would give RELX a growth profile of between 3-6% per year on an EBITDA basis, which is in line with where the company has been for the past few years and where it is expected to go. Current estimates are for continued, high-single digit EPS growth for the coming few years, and a similar dividend growth along the same trajectory, similar to the growth we see above.

Growth or growth estimates are not the problem.

Valuation is. The closest peers that are publicly traded that do similar, if not exactly the same services are things like Thomson Reuters (TRI), Experian (EXPN), and Clarivate (CLVT). The problem is that RELX trades above most of these, except TRI in most relevant metrics, and also trades somewhat above its historical averages.

While analysts give this company a slight double-digit upside with price targets coming to nearly £26 on average for the natively-registered REL ticker in London, I would take a more conservative stance, as these analysts have tended to view the company somewhat more favorably than might be warranted, based on DCF estimates, peers, where the growth is going, and what alternatives are available on the market today. I’m not paying a 20x+ P/E for this sort of growth.

My own target for REL comes to around £20/share at the highest, translating to around $24/share for the ADR.

Because of that, I cannot in good conscience at this point view RELX as anything but a “HOLD” and wait for the company to drop back down to more attractive levels.

RELX is a company I want to own – but not at that price.

Thesis

- RELX is a class-leading company in research and consulting – and it’s a convincing investment at a good price. My ambition is to own RELX in my portfolio once the price drops down. I view the company as a relatively simple and stable play on attractive business segments.

- If bought at below 20x P/E, and trimmed at above 25-26x P/E, this company has the potential to give you excellent returns over time while paying you a relatively attractive and well-covered dividend of above 2%.

- I would consider RELX a “BUY” at around $24/share for the ADR. The ADR is relatively liquid, meaning you can either go native or buy the RELX US ticker here.

- I’m at a “HOLD” for RELX here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company is excellent but does not fulfill my valuation-based criteria, making it a “HOLD” here.

Be the first to comment