vadishzainer/iStock via Getty Images

While volatility continues to reign in the markets, particularly for growth stocks, investors have a rare opportunity to buy into several very high-quality tech names at an incredibly strong bargain. In my view, there’s been a lot of “throwing the baby out with the bathwater” going on over the past few months – while it’s true that much of the tech sector needed a valuation reset, the market sold off virtually all growth stocks indiscriminately, leaving many high-quality names in fire sale territory.

Such is the case with Elastic (NYSE:ESTC), a relatively less-popular infrastructure software stock that specializes in search. Its eponymous Elasticsearch product powers the functionality of being able to search for text strings within applications. One of the only such tech vendors in its space, Elastic’s market is still quite greenfield, with the company managing to grow north of >40% y/y consistently over the past several quarters.

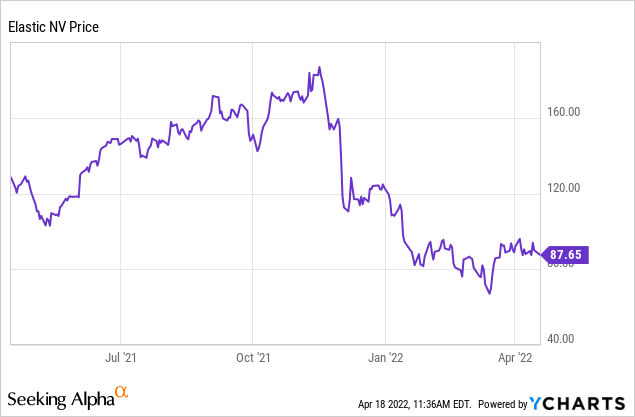

Year to date, however, shares of Elastic have lost more than 25% of their value; while relative to all-time highs above $180 notched last November before the tech correction began in earnest, Elastic has given up more than half its value. It’s a good time, in my view, for investors to re-assess the bullish thesis in this stock.

I remain heavily bullish on Elastic. I’m a huge fan of both the company’s technology profile (sticky revenue base, improving emphasis on cloud and integrations with public cloud vendors, backend infrastructure technology that continues to grow in importance with the rise of the app economy) as well as the company’s financial profile (strong revenue and billings growth, history of above-breakeven profitability, free cash flow and Rule of 40 success).

For investors who are newer to this stock, here’s a recap of what I believe to be the key bullish drivers for Elastic:

- Elastic has three powerful tools in its suite, powering enterprise search, security, and APM. Search is Elastic’s bread and butter, and the company is the best-in-breed leader at infrastructure that allows you to essentially perform a Google-like search within the confines of a certain application. Security is a natural extension of Elastic’s data-monitoring ability, with companies using Elastic to protect against fraud and cyber threats. The latter category (APM), meanwhile, is the same space that hotshot Datadog (DDOG) is in, and helps companies maintain their tech stack uptime and monitor performance. The basic point is this: Elastic’s core platform supports a variety of use cases and one that has been adopted by major corporations. It estimates its global TAM at $78 billion, suggesting only ~1% current penetration.

- Purely recurring, high-margin software product. 94% of Elastic’s revenue comes from subscriptions, meaning the company has very high revenue visibility. It has net revenue expansion rates of ~130%, meaning the majority of its customers upsell dramatically (versus ~110% net expansion rates for most other software companies). On top of that, Elastic’s revenue comes in at a high-70s gross margin. The math on this works out like a charm: as more and more Elastic customers renew and expand, Elastic can take advantage of its huge gross margin to scale profitably, given that renewal deals to existing customers cost far less in terms of sales dollars to achieve.

- Very sticky technology base. Elastic is in a category of software considered “infrastructure software,” which means that it sits at the heart of a company’s IT stack. This kind of software is very difficult to rip out (versus a top-end application, like a CRM system, that is relatively easier to stop using and migrate to another solution).

- Strong cloud growth. Elastic’s hosted cloud solutions are seeing much stronger (~80% y/y) growth rates relative to the rest of the company, which serves as an additional upside catalyst for investors to be excited about. It also gives Elastic an easy route to market for customers who are on services like Amazon AWS (AMZN), where Elastic now features very native integrations.

- Rule of 40. Elastic’s revenue growth is north of >40% y/y while its pro forma operating margin is just north of breakeven. This makes Elastic a “Rule of 40” software company, which is a target many of its peers try and fail to achieve.

The recent rout in Elastic’s stock, however, dramatically undervalues the company for its myriad of strengths. At current share prices near $88, Elastic trades at a market cap of $8.22 billion. After we net off the $864.4 million of cash and $566.3 million of debt on Elastic’s most recent balance sheet, the company’s resulting enterprise value is $7.92 billion.

Meanwhile, for the upcoming fiscal year FY23 (the year for Elastic ending in April 2023), Wall Street has projected revenue of $1.08 billion for the company, representing 26% y/y growth (data from Yahoo Finance).

This puts Elastic’s valuation at 7.3x EV/FY22 revenue – which is a solid bargain for a stock growing at >40% y/y which is also a member of the Rule of 40 club. In its heyday, Elastic traded at revenue multiples in the low-teens – which, once confidence in growth stocks returns, it should have no problem flexing back up to.

Stay long here – Elastic is a growth stock that has suddenly turned into a huge value opportunity. Take advantage of the dip here to lock in a position at very low cost.

Q3 download

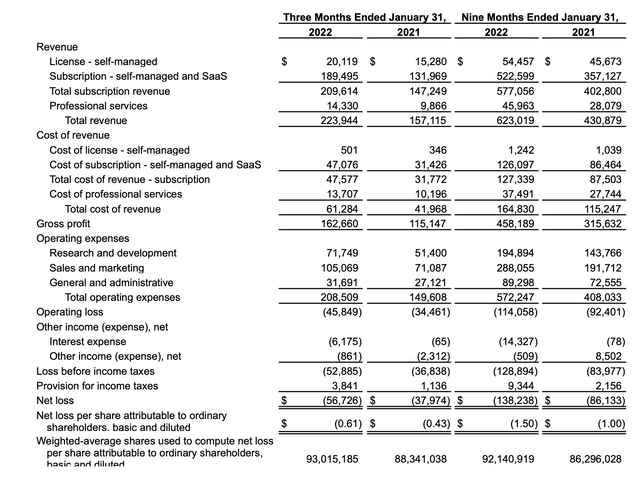

Let’s now go through Elastic’s latest results for its fiscal third quarter (ending in January) in further detail. The Q3 earnings summary is shown below:

Elastic Q3 results (Elastic Q3 earnings release)

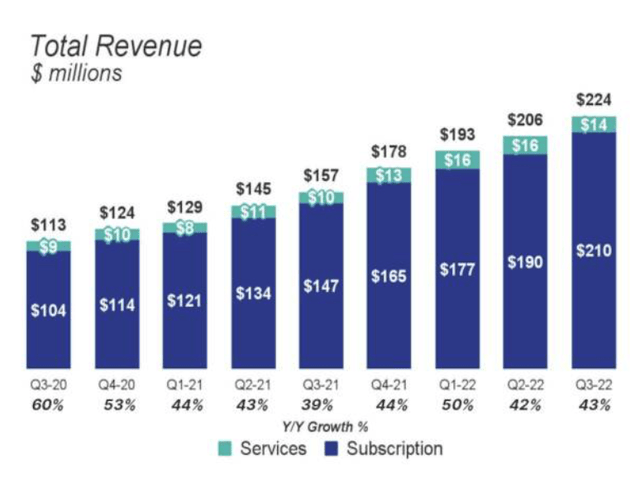

Elastic’s revenue grew at a 43% y/y pace to $223.9 million in the quarter, beating Wall Street’s expectations of $209.7 million (+33% y/y) by a huge ten-point margin. Note as well that Elastic’s revenue essentially kept pace with the 42% y/y growth it achieved last quarter.

In fact, when you look at the company’s overall revenue trend – we can see that growth has roughly clung to the low/mid-40s range for quite some time. Q3’s revenue growth pace is essentially the same growth rate at which Elastic was growing in the first half of FY21 – even though at that time, Elastic’s scale was about half of where it is today. The translation here: Elastic’s market is still greenfield and ripe for growth, and the company’s execution against that market opportunity has been commendable – hence why it’s difficult to reconcile this very strong fundamental performance versus the massive ~50%+ decline in share prices since the start of November.

Elastic revenue trends (Elastic Q3 earnings deck)

Elastic Cloud revenue, meanwhile, grew 80% y/y to $80.4 million, representing roughly a third of overall revenue. Making Elastic adoption easier for AWS customers and increasing the variety of AWS integrations has been a key piece driving cloud growth here. With the growth that Elastic is seeing in its hosted cloud products, it eventually expects cloud to represent over 50% of the company’s overall revenue within three years.

Here’s some more anecdotal commentary from CFO Janesh Moorjani’s prepared remarks on the Q3 earnings call, detailing the strength of cloud and the benefits it’s bringing to customers:

As a reminder, the vast majority of Elastic Cloud revenue is now derived from consumption-based arrangements in which a customer can bring unlimited data into our platform. They can consume resources flexibly as needed. And in terms of the commercial model, they can either go month-to-month and simply be invoiced for actual consumption at the end of a month or they can purchase credits upfront and consume those over time. These three factors, the scalability of the platform, the flexibility of consuming resources as needed, and the choice of the commercial model all reduce customer friction. We believe this makes the consumption business model superior to a traditional ratable model […]

Within Elastic Cloud, we saw continued strength in both the annual and monthly formats. Monthly cloud revenue was approximately 17% of total revenue in Q3 versus 16% in Q2, continuing a trend we have seen for some time now. The monthly cloud format continues to be a great way to acquire new customers. The vast majority of our new customers start on monthly cloud and as they scale up and ramp their spending, they can move to an annual subscription.

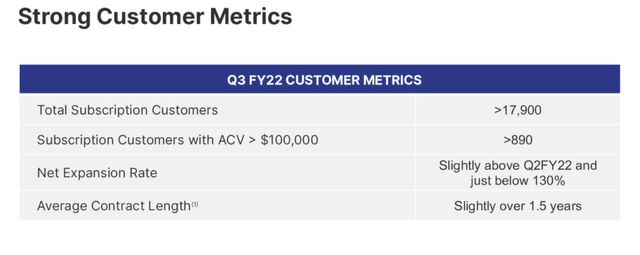

Elastic key customer metrics (Elastic Q3 earnings deck)

One other metric worth mentioning: as you can see in the chart above, Elastic has managed to cling to a net revenue expansion rate of approximately ~130%, “slightly above” where it was in Q2. This means that the typical customer is expanding their relationship and spend with Elastic by 30% in the following year, which is a marker of a really effective “land and expand” go-to-market strategy.

In spite of strong growth, Elastic also continued its bottom-line strength. Pro forma operating margins within the quarter were 0.1%, a slight 10bps higher than breakeven in the year-ago Q3; while YTD pro forma operating margins of 1.4% were 280bps higher than the prior year. The company’s pro forma EPS of -$0.12 also came in well ahead of Wall Street’s expectations of -$0.20.

Key takeaways

It’s not often you get strong revenue growth, clear tailwinds for continued expansion, profitability potential, and cheap value all rolled into one package. Take advantage of this rare buying opportunity.

Be the first to comment