jetcityimage/iStock Editorial via Getty Images

Over the past year, many high-flying growth stocks have fallen back to reality. The Nasdaq 100 (QQQ) has lost around a third of its value this year, while more speculative growth funds, such as the ARK Innovation ETF (ARKK), have lost a staggering 61% (71% since its peak). The stock prices of top growth names, such as Uber Technologies (NYSE:NYSE:UBER), have declined dramatically as investors question their ability to grow earnings. UBER is down 40% this year and 57% from its peak as the company struggles to increase profits amid a driver shortage and a stagflationary environment.

I was among a small handful of analysts signaling risk in Uber last year, as detailed in “Uber Is Unlikely To Ever Generate Consistent Cash-Flow.” Since then, the stock has lost ~48% of its value despite a moderate cash flow increase. The stock is currently trading at ~$26.7 per share, up ~20% from its June lows of ~$22 after reporting a surprisingly significant increase in cash flows. Of course, the company continues to lose money and has a forward EPS of -$4.50, or a negative earnings yield of ~17%.

Its market capitalization is far lower than when I covered it last while there has been a slight improvement in its business fundamentals. However, the U.S. and global economy are slowing while most people suffer declines in real wages. Interestingly, that prospect may not necessarily harm Uber, as a rise in unemployment would likely assist its driver shortage. Fundamentally, Uber faces immense price competition from Lyft (LYFT), and unless the company can build a strong niche, I have doubts regarding its ability to maintain positive operating cash flow. That said, given the stock’s substantial decline, I believe it deserves a closer look to better asses its “thrive or dive” potential.

A “Thrive Or Dive” Growth Stock Environment

Like many growth stocks, UBER appears to be at a critical “make or break” turning point where it will either prove itself as a profitable venture or lose its remaining market value as it risks insolvency. The 2010s economic regime, marked by low inflation and low-interest rates, allowed the growth of many new companies that would previously not be possible. This “goldilocks” period also included substantial technological advancement following the development of smartphone technology. Before 2020, low money costs (inflation and interest rates) encouraged waves of venture capital and excessively high valuations as it mattered little whether or not a company was profitable as long as it was growing.

Following 2020, the economic environment has shifted toward a more “normal” picture. As interest rates have risen, the value of cash and positive cash flows has become far more important than growth. Companies like Uber can no longer rely excessively on cheap capital to fuel research and development. Further, rising inflation pressure has caused most people and companies to reduce or mitigate unnecessary expenses, potentially decreasing demand for non-essential services. Furthermore, high inflation is causing a growing “wage-price spiral” wherein workers demand higher wages amid rising living costs, often at the expense of corporate profit margins. There are minimal signs indicating the economic environment will shift any time soon, demanding Uber and most younger “growth stocks” prove themselves as profitable ventures (that are not dependent on “easy money“) or risk losing their remaining capitalization.

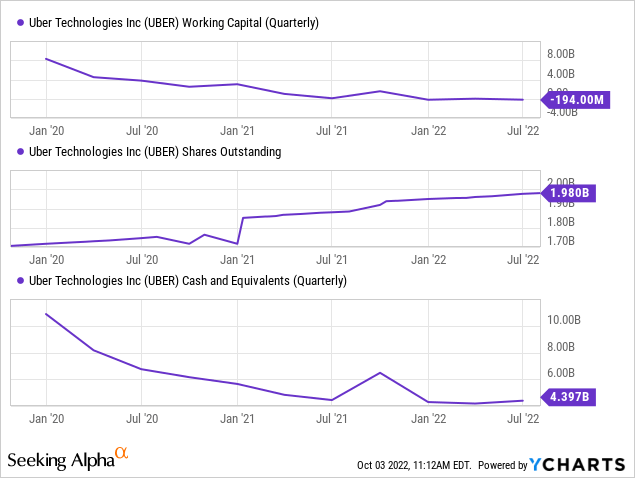

Despite strong Q2 operating cash flows, Uber Technology’s working capital dipped back into negative territory last quarter. The company’s cash assets remain around three-year lows following heavy bleeding in 2020. Uber has offset cash losses by issuing new shares, thus diluting existing shareholders. See below:

Uber’s market capitalization is far lower today than in 2020, so additional equity sales would dilute existing shareholders more than in the past (to raise cash by an equal measure). At the same time, the company needs money given its low reserves, particularly considering its negative working capital. Of course, Uber can look to debt markets for cash but is likely to pay around 10% or more in interest, given its low credit rating and the sharp rise in junk bond rates.

Overall, I believe it is abundantly clear that Uber’s survival depends on generating consistent positive cash flow, ideally enough to reduce its apparent liquidity risk. I think Uber will need to achieve this over the coming quarters or risk financial restructuring or business closure. If Uber can accomplish this, it will prove itself as a genuinely profitable enterprise and may see earnings grow to the point where its valuation today could seem low. In my opinion, there is no middle ground with Uber today, given its financial and operational situation and the broader economic environment; it is either headed to zero or may double or triple in value.

Uber And Lyft Compete For Monopoly Power

The chief barrier to Uber’s profitability is competition from Lyft, which is arguably in a worse financial situation than Uber. When I covered Uber last, my core argument was that the ultra-competitive nature of the internet made it extremely difficult for either Uber, Lyft, or DoorDash (DASH) to generate consistent profits. Drivers will fluctuate toward platforms with the highest pay, while customers will gravitate toward those with the lowest prices, driving profit margins to zero. Physical businesses can mitigate this through location value or high physical barriers to entry (development of factories, supply chains, etc.), but Uber and Lyft do not have this “moat” ability and will compete toward zero profits unless one company can build a monopoly.

Fundamentally, the delivery and driving market are in a “death competition” where only one can survive, at least in any geographic region. If Uber can compete with Lyft, DoorDash, and others out of business, it may become extremely profitable by setting labor costs, customer prices, and restaurant fees. Of course, even if all of Uber’s competitors go bankrupt, new contenders may emerge to threaten Uber’s market share. In the past, when excessive venture capital money flowed to nearly anything, this risk was significant; however, now that money is becoming scarce, the market faces much more significant barriers to entry. Uber has some added protection from new competitors due to the considerable development of its intellectual property; however, as seen in its recent data breach, this moat is not necessarily secure.

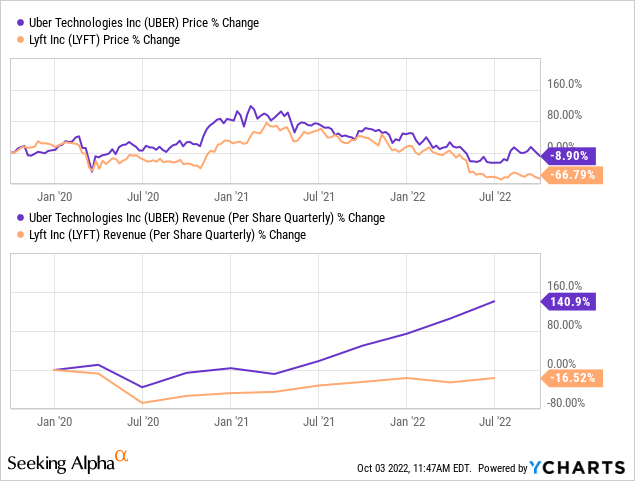

Uber has grown revenue per share much faster than Lyft over the past three years while suffering far lower stock price declines. See below:

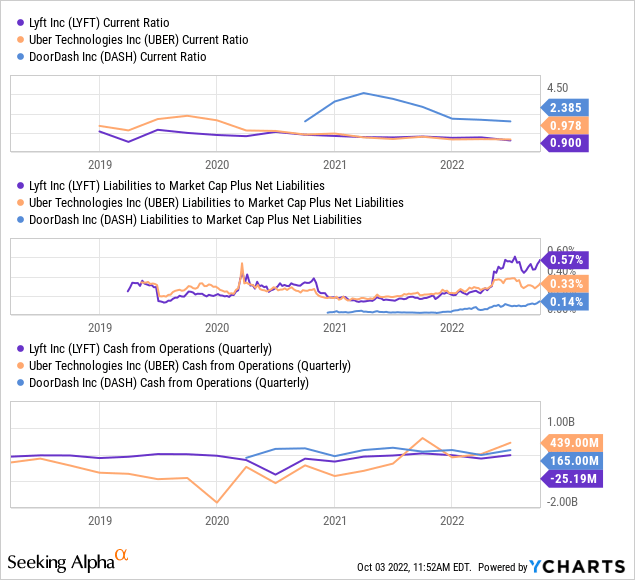

DoorDash has expanded its sales per share faster than Uber since it went public but has suffered substantial price declines of over 75% since inception. DoorDash’s market capitalization of $19B is well below Uber’s at $52B but far above Lyft’s at only $4.6B. In my view, this shift indicates Lyft may be on the verge of bankruptcy, but Uber’s bottom line remains threatened by DoorDash’s growth. This situation is also reflected in DoorDash’s more substantial current ratio and solvency, as well as its decent operating cash flow compared to Lyft. See below:

Uber is rapidly absorbing most of Lyft’s market share while DoorDash has stamped out a significant foothold over Grubhub and Postmates. Uber Eats is in a weak position compared to DoorDash in the food delivery market but is on the verge of obtaining a near monopoly in the driving market. Surveys suggest Lyft has superior driver pay but slightly higher average ride costs than Uber. At this point, Uber’s market share may be large enough that it need not worry about greater competition in driver pay.

DoorDash is undoubtedly a growing threat to Uber’s food delivery service. Still, as trends continue, Uber may garner an economic monopoly (that is, capacity for monopolistic pricing power) in driving while DoorDash secures an economic monopoly in food delivery. In my view, Lyft may be far closer to bankruptcy than many assume and, at its current valuation, may be acquired by Uber and essentially destroyed (as Uber did with Postmates). Hypothetically, if Uber were to sell its food delivery segment to DoorDash, it would undoubtedly have sufficient capital to outcompete Lyft via prices or acquire and integrate it. Uber’s weak capitalization remains a significant risk, but there is some hope for the firm, given its considerable edge over Lyft.

The Bottom Line

Uber and its competitors are at a critical crossroads. I suspect that, by year-end, it will become apparent who will be the market champion as competition may soon drive Lyft to zero. On the surface, this potential may make the company an attractive opportunity today; however, I am bearish on UBER for a few key reasons. First, its position in food delivery may cause more significant losses as it seeks to compete with DoorDash, which generally has greater capitalization. Second, if a larger company or activist investor acquires Lyft, it may quickly secure sufficient capitalization to out-price Uber and reverse its losing streak. Third, even if Uber ensures monopolistic pricing power, its regulatory risk remains large as governments may pursue more aggressive price and wage controls.

One critical related risk is that the ride-hailing industry loses its luster. A recent driver-led study showed that Uber and Lyft drivers net less than $7 per hour (after “wear and tear,” etc.) in California after a recent law was passed that altered “employee” vs. “contractor” status. With gasoline, maintenance, and other costs rising while real wages fall, Uber drivers may demand higher pay while Uber customers seek lower prices. Even if Uber gains total pricing power over Lyft, it may not be enough to offset these critical economic and social trends.

It is unclear how the declining GDP will impact the company as booking levels have remained strong despite the economic strain. Still, I suspect booking demand will inevitably slow as people struggle to pay bills amid rising prices; however, this factor may be more significant for food delivery than for ride-sharing, as food delivery and restaurant food are economic luxuries. An associated rise in unemployment could offset demand declines through lower driver pay, but the labor market’s resiliency signals that may be unlikely.

UBER is more attractive than I covered last year due to its market-share expansion and Lyft’s financial turbulence. Given this and the decline in value, a bullish argument could be made for the stock as its profits could soar if competition declines. That said, I remain bearish on UBER since its financial position is weak enough that it could suffer insolvency not long after Lyft, particularly if the competitive or economic landscape shifts. Many analysts believe Uber will pull an EPS of $4-$5 by 2030, giving it a low valuation today. However, in my view, Uber faces many significant uncertainties and barriers that threaten its solvency to be a solid rebound opportunity.

Be the first to comment