Natali_Mis/iStock via Getty Images

Introduction

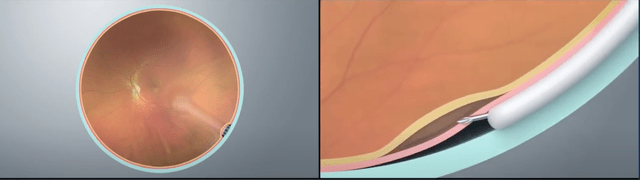

Clearside Biomedical announced in 2021 that XIPERE (triamcinolone acetonide injectable suspension) was approved for the treatment of macular edema associated with uveitis. This approval was the first for Clearside using their SCS microinjector platform that administers therapeutics to the suprachoroidal space (SCS) via a microneedle. XIPERE will now be marketed and sold by Bausch + Lomb (BLCO), the eye care business of Bausch Health Companies, with the official launch taking place in March, 2022. The company will now focus on advancing internal pipeline candidate CLS-AX for the treatment of Wet age-related macular degeneration (AMD), as well as advancing its partnered programs. Partner Regenxbio has seen early success with administering gene therapy candidate RGX-314 into the SCS using Clearside’s microinjector, and as such the company is seeking to establish additional partnerships for ocular gene therapy programs. This article will review Clearside’s pipeline candidates, partnered programs, and speculate on further business development.

XIPERE

Clearside initially received a complete response letter (CRL) from the FDA in response to the XIPERE new drug application (NDA) that sent the stock plummeting over 40% in 2019. The company additionally had multiple delays resubmitting the NDA for XIPERE citing issues with their contract manufacturing organization (CMO). Given that, there was a lot at stake for the company to achieve approval for XIPERE this time around, including milestone payments from partners Bausch + Lomb and Arctic Vision. Thankfully for investors, the company gained approval on Oct 25, 2021 and the company received $20 million in non-dilutive funding from their partners.

Clearside is now entitled to receive tiered royalties at increasing percentages from the high-teens to twenty percent on sales of XIPERE. Unfortunately, given the delay in NDA resubmission, Bausch amended the licensing agreement and Clearside will not receive any royalties on the first $45 million of cumulative net sales of XIPERE. Bausch has stated that they believe XIPERE is a $600 million dollar opportunity.

CLS-AX

The company’s lead pipeline candidate is CLS-AX, a suspension of the tyrosine kinase inhibitor (TKI) axitinib, and is currently in a Phase 1/2a dose escalation trial for the treatment of patients with wet AMD. CLS-AX is an inhibitor of vascular endothelial growth factor receptor (VEGF)-1, -2 and -3 giving it broader VEGF inhibition than the current standard of care drugs aflibercept and ranibizumab. The company believes administration to the SCS will allow for enhanced efficacy and compartmentalization to reduce side effects such as ocular inflammation. The aim of the OASIS Phase 1/2a study is to establish a floor of safety, while assessing some secondary end points such as changes in best correct visual acuity (BCVA) and central subfield thickness (CST).

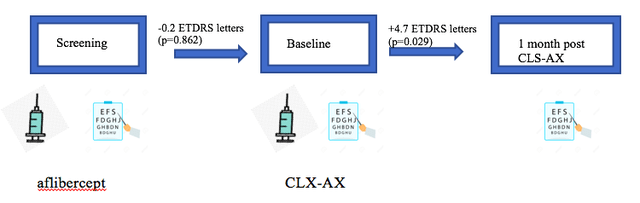

In August 2021, the company announced data from cohort 1 of the OASIS trial for 6 patients announcing there had been no serious adverse events (SAEs) or any signs of inflammation, increased ocular pressure or vasculitis. However, what got investors excited was the statistically significant improvement in BCVA 1-month post treatment of CLX-AX vs BCVA after 1 month (between screening and baseline) for aflibercept.

Data Obtained from Clearside Biomedical

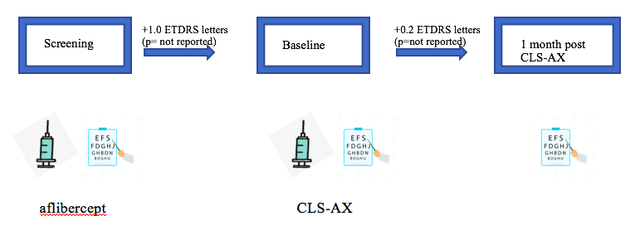

Mean CST, however, appeared to be stable at 1 month treatment with CLS-AX. Reporting this improvement was a double-edged sword for the company. The stock soared and some analysts were quick to call it a potential game-changer, however, there was now pressure on the company to show a similar improvement in BCVA at 1 month post CLS-AX at the higher dose in cohort 2. This was not the case when the company reported data for cohort 2 in Dec 2021. Unlike cohort 1 where there had been a +4.7 letter improvement, there was only a +0.2 letter improvement one month post CLS-AX. In fact, aflibercept performed better with a 1.0 letter improvement from screening to baseline.

Data Obtained from Clearside Biomedical

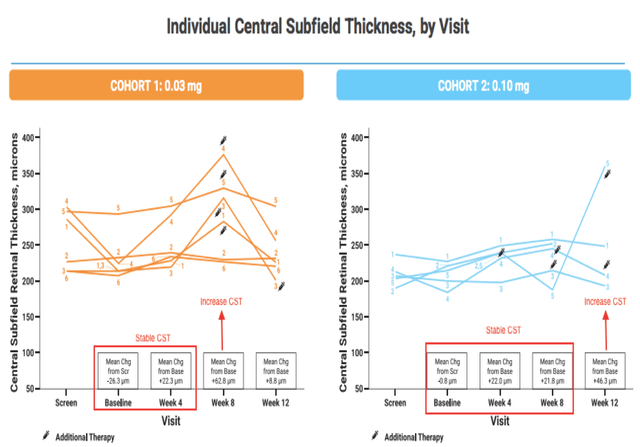

The company instead chose to focus on CST showing that it had been stable out to week 8 in cohort 2 vs only out to week 4 in cohort one, possibly showing a dose response.

Clearside Biomedical Corporate Presentation

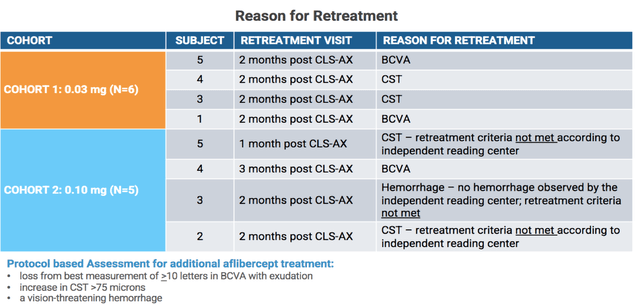

BCVA and CST aside, investors had been hoping to also see a decrease in patients requiring retreatment between cohorts 1 and 2. However, 4 out of the 5 patients in cohort 2 required retreatment with one patient being treated at 1 month post CLS-AX and two patients being treated at 2 months post CLS-AX. When presenting this data, the company stated that the retreatment criteria had actually not been met in three out of the four patients retreated after being reviewed by an independent reading center. This suggests that the clinicians running the trial had retreated patients that might not have required it. The company will need to review this data with the trial clinicians to ensure the correct protocol is being used moving forward.

Clearside Biomedical Corporate Presentation

The company has now enrolled Cohort 3, in which each patient will receive a dose of 0.5 mg of CLS-AX. The company also recently disclosed that they will review safety data for Cohort 3 and if there are no dose limiting toxicities they will proceed with a 4th cohort at an even higher undisclosed dose that will run concurrently with Cohort 4. Cohort 3 will read out in June 2022 and Cohort 4 by the end of 2022. Clearside is hopeful that they will be able to select a dose by the end of the year to move into a Phase 2b trial.

Partnership Programs:

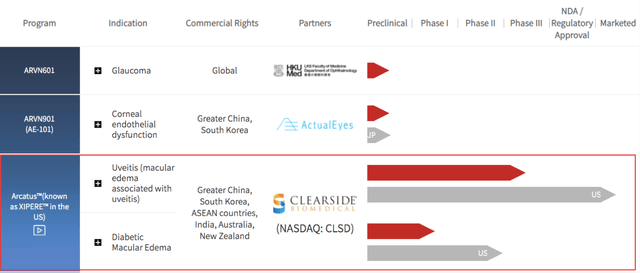

Arctic Vision

In March, 2020, Clearside entered into a license agreement with Arctic Vision that granted Arctic Vision to develop XIPERE in China, Hong Kong, Macau, Taiwan and South Korea. This deal was later amended to include ASEAN Countries (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam). Arctic vision is running a phase 3 trial of XIPERE for patients with macular edema associated with uveitis and a Phase I trial in patients with diabetic macular edema.

Arctic Vision Website Pipeline

In December 2021, Clearside received a milestone payment of $4.0 million following receipt of FDA approval of XIPERE in the U.S. Furthermore, Arctic Vision has agreed to pay a total of $22.5 million in development and sales milestone payments as well as tiered royalties of 10% to 12% of net sales of XIPERE in the Arctic Territory.

Regenxbio

Partner Regenxbio is developing gene therapy candidate RGX-314, a potential one-time gene therapy for the treatment of Wet AMD and diabetic retinopathy. Regenxbio has already shown impressive results with subretinal delivery of RGX-314 with stable to improved vision in some patients with Wet AMD out to 3 years with a meaningful reduction in anti-VEGF injection burden. The company is now running two Phase III trials in a bid to win approval for RGX-314 via subretinal administration. However, the company is aware that this surgical route of administration will limit availability of RGX-314 to patients willing and able to undergo surgery at a highly specialized retina treatment center. For this reason, Regenxbio has partnered with Clearside to administer gene therapy into the SCS space via microinjector to bring gene therapy in-office and greatly increase the pool of potential patients to undergo this therapy. Regenxbio announced in 2021 a collaboration with AbbVie for RGX-314 receiving $370 million upfront with up to $1.4 billion in additional development, regulatory and commercial milestones. Regenxbio and AbbVie will share profits equally in the U.S. and Regenxbio will receive royalties outside the U.S.

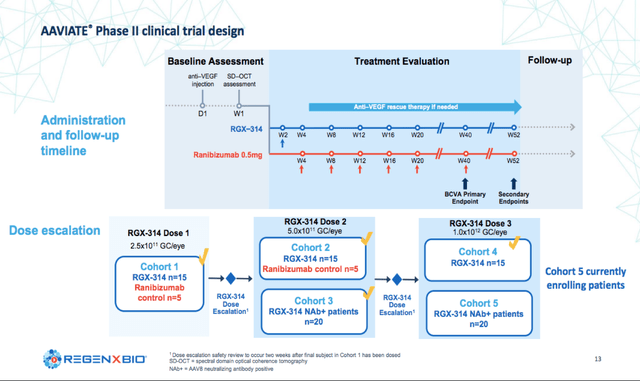

AAVIATE

The first Phase II partnered clinical trial named AAVIATE is a randomized, dose-escalation study designed to evaluate the efficacy, safety and tolerability of RGX-314 for patients with Wet AMD. The trial so far has enrolled 4 cohorts with the 5th cohort currently enrolling expected to be complete in the first half 2022. The primary outcome for the trial is mean change in BCVA for RGX-314 compared with ranibizumab monthly. Other key endpoints include the effect of RGX-314 on central retinal thickness (CRT) and the need for supplemental anti-VEGF therapy for patients that received RGX-314.

Regenxbio Corporate Presentation

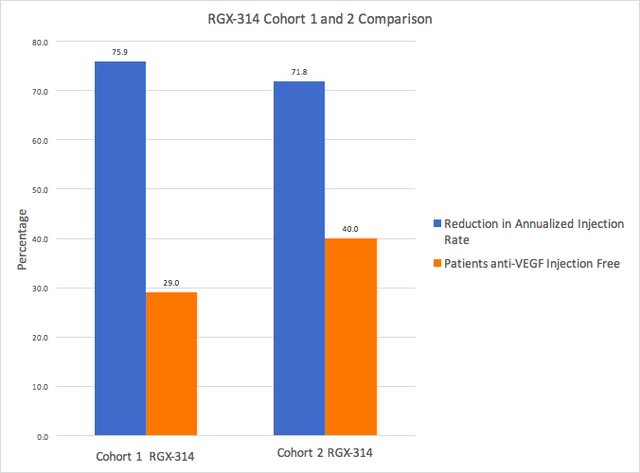

So far, the company has reported 6-month data for cohort 1 and 2 summarized below:

|

Cohort 1 RGX-314 |

Cohort 2 RGX-314 |

Mean Cohort 1+ 2 Ranibizumab |

|

|

Mean Change in BCVA from Screening (Letters) |

-2.8 |

-0.1 |

+4.0 |

|

Mean Change in BCVA from Week 1 (Letters) |

-0.6 |

+0.2 |

+1.3 |

|

Mean Change in CRT (µm) |

-2.5 |

-33.0 |

-12.0 |

|

Change in Annualized Injection Rate (%) |

75.9 |

71.8 |

– |

|

% Patients anti-VEGF Injection Free |

29.0 |

40.0 |

– |

The data so far shows a dose response from cohort 1 to 2 with improved BCVA and mean change in CRT. Cohort 2 showed an improvement in mean CRT when compared with Ranibizumab. Ranibizumab, however, did outperform both cohorts of RGX-314 for change in BCVA.

Data Obtained from Regenxbio.com

Cohort 1 and Cohort 2 had similar rates of reduction in annualized injection rate, however the percentage of patients injection free was higher in cohort 2. Longer term data out to one year should be available in 2022. Furthermore, cohort 3 data is highly anticipated since it will include patients that have neutralizing antibodies (NAb) to the AAV8 capsid. Patients with pre-existing antibodies to the AAV8 may be expected to have reduced efficacy and perhaps a predisposition to have intraocular inflammation. Anti-AAV8-NAb prevalence rates vary with reports across different studies anywhere from 20-80% of the population.

Regenxbio Corporate Presentation

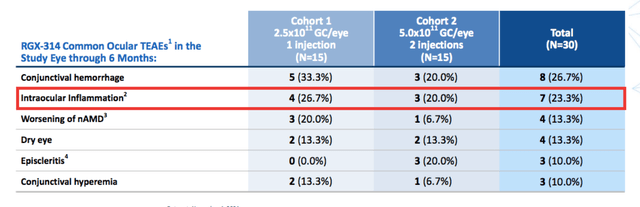

Overall RGX-314 had a good safety profile. About a quarter of patients suffered from intraocular inflammation all that resolved with steroid eye drops. So far none of the cohorts have utilized prophylactic steroids, however this remains an option should cases of inflammation increase, which could be the case in NAb patients.

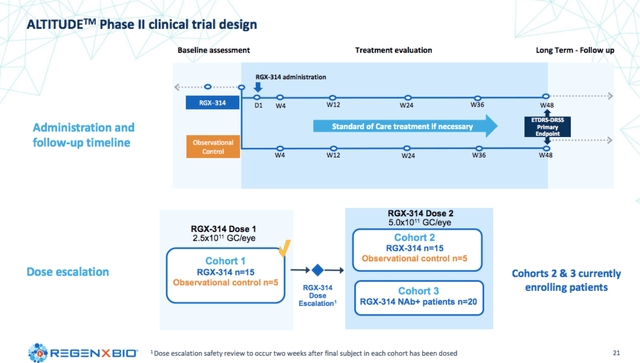

ALTITUDE

The second partnered trial with Regenxbio, ALTITUDE, is evaluating RGX-314 in patients with diabetic retinopathy, a chronic and progressive complication of diabetes mellitus.

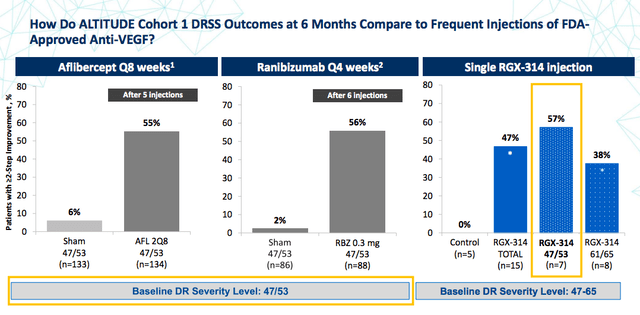

Regenxbio Corporate Presentation

So far cohort 1 treated patients have shown similar improvements in the Diabetic Retinopathy Severity Scale (DRSS) after a one time administration of RGX-314 compared to currently approved therapies that require dosing every 4-8 weeks. Cohorts 2 and 3 are currently enrolling.

Regenxbio Corporate Presentation

Aura Biosciences

Aura Biosciences has a platform developing Virus-Like Particles (VLPs) to target solid tumors. Lead drug candidate is AU-011 for the treatment of primary choroidal melanoma, the most common intraocular cancer in adults. The company estimates the incidence of choroidal melanoma in the U.S. and Europe to be 11,000 patients/year. There are currently no drugs approved with radiotherapy being the only treatment option that leaves patients with a relatively poor prognosis and irreversible vision loss in around 70% of patients. Aura has shown in a Phase II trial of intravitreal administration of AU-011 high levels of local tumor control with vision preservation at 12 months in patients that had prior active tumor growth. Rather than immediately moving into a pivotal trial using intravitreal administration of AU-011, the company decided to partner with Clearside to run a phase II trial administering AU-011 to the SCS. Data so far has shown an improved safety profile versus intravitreal administration, however efficacy data will be presented at the American Academy of Ophthalmology’s annual meeting in Chicago September 30 – Oct 3 2022. The company has a licensing agreement with Clearside, where it is eligible to receive up to $21.1 million in payments related to pre-specified development and regulatory milestones, as well as low to mid-single digit royalties on net sales that utilize the SCS Microinjector. However, this is dependent on the efficacy data yet to be presented. If the efficacy and safety data outperform intravitreal administration then Aura will likely move forward with the licensing agreement. However, if intravitreal data is superior then it is possible that Aura could terminate the agreement with Clearside. Both Aura and Clearside are optimistic that given Clearside’s SCS microinjectors ability to target the choroid directly, and not rely on diffusion across the vitreous humor, SCS administration should be superior to intravitreal administration.

Future Partnerships:

On the company’s most recent conference call the CEO, George Lasezkay, stated:

“..we have decided to consider additional development and commercialization partners for gene therapy. Outside of the specific indications licensed to REGENXBIO, we are in a position to partner with other companies working on gene therapy, using non-viral vectors for any retinal disorder or viral vectors targeting inherited retinal disorders or retinal diseases that are not primarily treated with current anti-VEGF standard of care therapies such as geographic atrophy.”

In response to an analyst question Dr. Lazekay elaborated saying:

“all I can tell you is, we do have discussions from time-to-time, and we’re exploring possible relationships, but it’s just a matter of ongoing business like any company in our position would do. We’re not — I can’t make any more comments than that, except that we to people and we are talking to multiple people about potential collaborations.”

Business Development Possibilities:

1. Bausch + Lomb:

Bausch + Lomb may be considering an outright acquisition of Clearside. Bausch + Lomb are already training physicians on suprachoroidal administration.

Since Bausch has invested in training physicians on suprachoroidal delivery, they could benefit from acquiring Clearside and adopting the SCS microinjector platform for their own. They would also no longer have to pay milestones or royalties to Clearside on the sales of XIPERE. Bausch Health Company has been open that they don’t currently have the financial flexibility given the company’s outstanding debt payments. However, Bausch + Lomb has recently filed for an IPO that will give the company more flexibility for business development. CEO of Bausch Health Company, Joe Papa, recently stated at a Cowen healthcare conference:

“..with the B&L IPO, the balance sheet’s going to be a lot more flexible with that flexibility, we think we’ll have an opportunity to invest both in the organic growth through the company but also through inorganic, both on opportunities for the business. I think that’s going to also fuel the long-term opportunity in front of us. Now I don’t want anyone to think I’m going to try to do $3 billion transaction as soon as we do an IPO. I’m really referring more to bolt on opportunities as we think about the future.”

2. Novartis:

Novartis has increased business development activity in the ophthalmology space in the last couple of years. They acquired Vedere Bio, a company with focusing on intravitreally-injected AAV gene therapy programs, in 2020 and more recently acquired Gyroscope Therapeutics. With the Gyroscope acquisition, Novartis has agreed to pay up to $1.5 billion to gain access to GT005, an AAV2-based, one time gene therapy candidate to treat geographic atrophy (GA). GA is an advanced form of dry age-related macular degeneration (AMD) that leads to progressive and irreversible vision loss. GT005 produces CFI protein that is believed to regulate the activity of the complement system. By increasing CFI production, Novartis hopes to reduce inflammation, with the goal of preserving a person’s eyesight. GT005 for the treatment of GA is currently being evaluated in a Phase 1/2 clinical trial and two Phase 2 clinical trials. GT005 is currently being administered subretinally with a device known as the Orbit SDS that cannulates the SCS that allows for access to the back of the eye for subretinal injection.

While this approach avoids the need for vitrectomy or retinotomy, it is still a surgical procedure that requires patients to go to the operating room. In the same way Regenxbio is attempting to bring RGX-314 in-office by partnering with Clearside, Novartis might do the same for GT005. Interesting during the company’s earnings call CEO George Lasezkay discussed partnering with gene therapy candidates and specifically cited geographic atrophy as an example.

3. Atsena Therapeutics

Clearside Biomedical recently announced adding Dr. Ben Yerxa to the board of directors. Dr. Yerxa is the CEO for the Foundation Fighting Blindness, a private funder of research on potential treatments and cures for inherited retinal degenerative diseases. He is on the clinical advisor board of Atsena Therapeutics, a clinical-stage gene therapy company, that has ongoing Phase I/II evaluating gene therapy for patients with GUCYD-associated Leber congenital amaurosis, a genetic eye disease that affects the retina. The company at this time is only delivering their gene therapy via subretinal and intravitreal approaches. Of note, the board of directors has representation from Hatteras Venture Partners who have a large representation on Clearside’s board.

4. Vedere Bio II

As mentioned, Dr. Ben Yerxa was nominated to the board of directors for Clearside. He is also on the board of Vedere Bio II, a company developing next-generation ocular gene therapies for vision restoration and preservation in patients with vision loss due to photoreceptor death. After Vedere was acquired by Novartis, Vedere Bio II was created as a new entity by Vedere founders to develop earlier stage assets not acquired by Novartis.

5. Hemera Biosciences/Janssen Pharmaceuticals

Hemera Biosciences, LLC, a clinical stage ocular gene therapy company announced in Dec 2021 that Janssen Pharmaceuticals acquired rights to Hemera’s investigational gene therapy, HMR59. HMR59 is an intravitreal AAV gene therapy being evaluated for the treatment of dry AMD. HMR59 is a potential one-time treatment administered in an office setting that increases the ability of retina cells to produce a soluble form of CD59, called sCD59, that blocks the formation of the membrane attack complex in the complement cascade. A Phase 1 trial testing HMR59 has evaluated 17 subjects with advanced dry AMD and geographic atrophy who received a single intravitreal dose of HMR59. Although data has not yet been published, the company may wish to explore suprachoroidal administration of HMR59.

Financials

The company made a net income of $376,000 for the year ending December 31, 2021. Clearside, as of December 31, 2021, announced cash and cash equivalents totaled $30.4 million. However, that amount does not include $10 million in cash collected Q1 2022 related to the XIPERE pre-launch milestones. The company believes this will fund operations into the second quarter of 2023.

As mentioned, the company will not receive royalties on XIPERE until sales reach over $45 Million. The company will receive milestone payments from other partnered programs but has not guided to the amount. The company has at active at-the-market (ATM) agreement with Cowen and Company LLC selling 2.9 million shares of common stock for net proceeds of $12.2 million in 2021. As of December 31, 2021, there was $14.4 million available for future sales under the ATM agreement. If the company is looking to start a phase IIb trial for CLS-AX at the end of 2022 they will have to raise significantly more capital. This likely means continuing to utilizing the ATM or seeking other forms of financing.

Risks

There are a multitude of risks investing in Clearside Biomedical summarized below:

- Competition from companies producing sustained-release formulation anti-VEGF therapies such as Ocular Therapeutix (OCUL) and EyePoint Pharmaceuticals (EYPT).

- Competition from companies creating devices to access the SCS such as Oxular Limited.

- Any negative safety signals in CLS-AX cohort 3 preventing progression to cohort 4.

- No signs of a dose response for CLS-AX in cohort 3.

- Increase in intraocular inflammation or other adverse events in partnered programs with Regenxbio.

- Poor efficacy with suprachoroidal delivery of AU-011 leading to Aura selecting intravitreal administration over suprachoroidal for the pivotal trial.

Conclusion

Clearside Biomedical faces a pivotal year in 2022. The company will hope to show a dose response in cohort 3 and cohort 4 for CLS-AX and to advance the therapy into a phase IIb trial by the end of the year. The company will hope data from partnered programs continue to be promising and that Aura Biosciences will select suprachoroidal administration for AU-011. In addition, the company is searching for a partner to advance gene therapy candidates via the SCS. Given the success of partner Regenxbio using the SCS microinjector for suprachoroidal gene therapy administration, Clearside should be able to form at least one new partnership. Investors may wish to look out for the Bausch + Lomb IPO, and see how the company uses the funds. Clearside Biomedical could well be a “bolt on opportunity” for Bausch + Lomb.

Be the first to comment