mi-viri/iStock via Getty Images

Investment summary

Following extensive review of the investment case file the neutral stance on Outset Medical, Inc (NASDAQ:OM) remains firmly intact. Following its Q2 earnings there remains little flesh to put on the skeleton for OM and instead operational headwinds actually dovetailed in Q2 FY22 to weaken the forward-looking outlook for the company, by estimate. Whilst we’ve projected CAGR 30% top-line growth in to FY24 for the company, I’d also note that profitability remains an issue, especially as the cost of capital continues increasing and liquidity is swept up across the board.

Alas, forward-looking growth isn’t enough to mitigate the current issues OM must tackle in order to justify its inclusion into equity portfolios. I’ve made note of this and also referred back to the previous analysis on OM highlighting many of the pertinent risks at hand in far greater detail. Net-net, I’ve retained the hold rating on OM, retaining the previously outlined $13 price target in doing so.

Exhibit 1. OM 6-month price distribution

OM Q2 numbers again unsupportive of bullish asymmetry

The company came in with another set of mixed numbers last quarter, with downsides versus consensus at the top-line. Revenue of $25.1 million (“mm”) came in-line with guidance. Segmentally, product turnover narrowed by ~490bps YoY to $19.6mm and was underlined by a pullback in console revenue, itself decreasing 21% YoY to just $13.2mm. Meanwhile, service and ‘other’ revenue came into $5.4mm, an 18.5% YoY gain, whereas consumables turnover grew 69% vs. the previous year. Both segments were driven by growth in the installed base.

Perhaps the key takeout from the period was OM’s decision to implement a shipment hold on the distribution and marketing of its Tablo system for in home use. The decision was made in lieu of a 510(k) application the company had filed back in May in view of changes made to the devices original 2020 clearance. The 510(k) clearance was completed in July for Tablo’s use at home. Subsequently the company resumed marketing and shipping expenditure for Tablo for home use. As per the 10-Q:

The shipment hold on Tablo for home use had a significant negative impact on our bookings and revenue for the second quarter of 2022, as well as on our pipeline of potential new deals.

The disruption extended to OM’s acute customer base, and also squashed what management “anticipated would be a record June”. Investors were originally satisfied with the news however the upside was short-lived with the OM share price quickly receding back to range.

Moreover, OM announced 2 weeks later that it had tendered a national contract with the Department of Veterans Affairs (“VA”) to supply the Tablo system to 106 VA hospitals around the nation. Again the stock barely budged, in fact clipped another few points to the downside in the sessions following.

This tells me the market has already priced in these kind of ‘surprises’ in the Tablo segment for OM, meaning that future updates – unless completely out of synch with expectations – are likely to yield similarly muted responses from the market, by estimate.

Guidance reinstated – but still not enough

OM came into the year with around 1,250 consoles in backlog with a good chunk of these comprised of home console units. It was going to begin delivery of consoles out of this backlog, however, as a result of the ship hold, haven’t been able to do so. Consequently, patients trained on the device whom were ready to begin using Tablo went ahead and found other forms of therapy instead of waiting [it would be unreasonable for them to wait for OM anyway]. Therefore, the company still has this backlog to sort through.

As such, management now forecasts revenue of $105-$110mm, signifying a 2-7% growth schedule at the top. Previously, it had forecasted a stellar year in FY20 before the ship hold [from Tablo placements], however, this has since been put to the back-burner following the decision. As a result, the company reckons it will take “a couple of quarters to rebuild the patient pipeline and regain the lost momentum”.

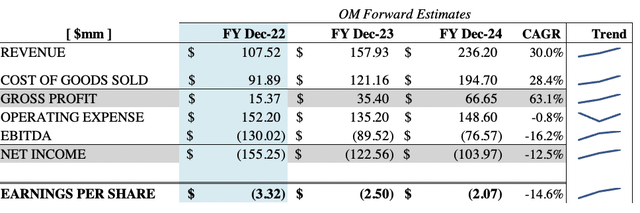

As seen in Exhibit 2, our internal team has laid out the forecasts for OM’s top-bottom line until FY24. Whilst we see top-line growth at CAGR ~30%, I’d also point out there’s a similar pace of COGS growth anticipated, and for the company to remain unprofitable until this time. As I’ve pointed out at lengths in previous analyses on OM, this is a key risk to the company, as such little profitability means there’s little change of quality earnings reaching the bottom line or to free cash flow (“FCF”).

Exhibit 2. OM consolidated forward estimates FY22-FY24

Technical factors for consideration

On the chart, price action looks bearish and is supported by long-term trend indicators suggesting the same. Retracing the down-leg from April FY22 to late June has seen the stock test the 23% tab on the fibs x3 before rejecting and turning back to the downside. It currently trades sideways whilst momentum has levelled off back to range. Meanwhile, on balance volume (“OBV”) has pushed lower in continuation with the long-term downtrend since April.

Exhibit 3. OM 9-month price action continues to present as bearish with long-term trend indicators suggesting the same

- OBV in particular suggests there is a lack of long-term buying support and that sellers are still active

- The stock needs to break through $24 to reverse trend at which point the next technical target would be c.$30

Data: HB Insights, Refinitiv Eikon

On a 12-month daily cloud chart, shares are currently testing the cloud having traded sideways for the good part of a month now. The lag line is positioned beneath the cloud and thus nullifies any bullish up-tilt in my estimation. With price distribution equally as narrow it suggests the bid-ask spread is wide and that liquidity is not abundant in this trade, placing risk on entry/exit points and therefore adding an element of position and sizing risk to the equation. Nevertheless, the price action seen above and below remains bearish and there’s no meaningful technical anomalies that would suggest investor psychology is any different.

Exhibit 4. Testing the cloud with minimal upside support, lag line also beneath cloud implying bearish sentiment

Data: HB Insights, Refinitiv Eikon

Conclusion

OM continues to remain a high-risk, low percentage play at this point in time by my estimation. There are risks to earnings growth that haven’t been completely factored in by market participants, not to mention, any positive news on the Tablo segment looks to already have been priced in and appropriately discounted by investors. Hence why we’ve yet to see a resurgence in the OM share price after the latest 2 updates on the segment. Point is, not much has changed fundamentally for OM from this period to last, and the neutral view on the stock remains well intact. Net-net, I rate OM a hold and keep the $13 price target from previous analyses in situ.

Be the first to comment