Falcor

It’s been a rollercoaster ride of a year for investors in the gold sector, but the ride, fortunately, reached bottom in September and has been climbing steadily since the Q3 Earnings Season. This can be partially attributed to the improvement in sentiment with a rising gold price combined with the fact that unit costs looked to have peaked in Q3 with the negative impact of supply chain headwinds and inflationary pressures in nearly all areas exacerbated by weaker production, with Q4 output typically being the strongest. Given the further decline we’ve seen in energy prices since September, combined with a stronger gold price, this has set up a much better quarter ahead.

One name that’s benefited immensely from this shift in sentiment is Eldorado Gold (NYSE:EGO), which briefly found itself down more than 10% on earnings but has rallied 60% from its lows since its report. The impressive rally in the stock is not surprising given that it was very attractively valued heading into Q3 Earnings Report, sitting at just ~3.3x forward cash flow and one of the lowest P/NAV multiples sector-wide. In this update, we’ll look at the most recent results and the year ahead to see what the best course of action looks to be following the stock’s recent advance.

Lamaque Operations (Company Website)

Q3 Results

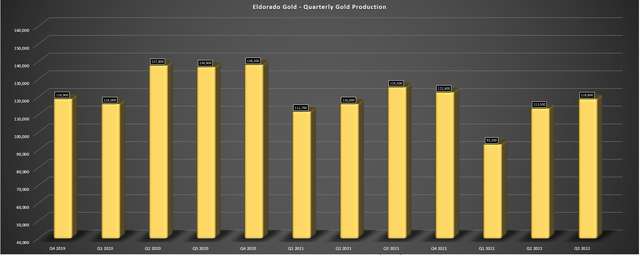

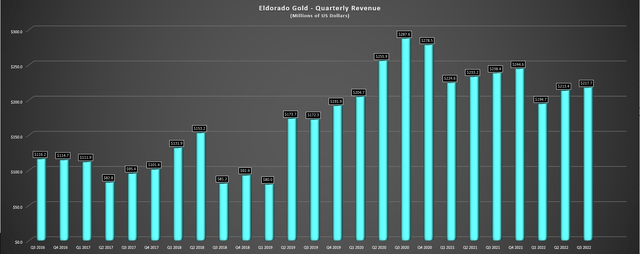

Eldorado Gold (“Eldorado”) released its Q3 results in late October, reporting quarterly production of ~118,800 ounces and sales of ~118,400 ounces. This translated to a 5% decline year-over-year, with ounces sold down just over 5% as well. Combined with a much weaker average realized gold price, revenue fell 9% in the period, with Eldorado reporting an average realized price of $1,688/oz. Unfortunately, this has left the company in need of a very strong finish to the year to meet the low end of its production guidance of 460,000 ounces, with ~134,500 ounces needed at a bare minimum. The good news is that Kisladag should have a much stronger quarter with more tonnes placed in Q3, which will benefit its Q4 results (~3.05 million tonnes).

Eldorado Gold – Quarterly Production (Company Filings, Author’s Chart) Eldorado Gold – Quarterly Revenue (Company Filings, Author’s Chart)

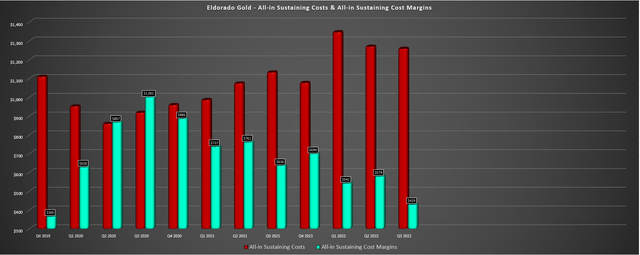

From a cost standpoint, it was a challenging quarter for Eldorado Gold, with elevated electricity costs in Greece and Turkiye and higher fuel and reagent costs at Kisladag. These increased costs offset the benefit of weaker currencies in the period (Euro, Turkish Lira, Canadian Dollar), resulting in a sharp increase in cash costs at all of its operations. The one operation that saw limited cost creep was Lamaque due to much higher production (improved grades), though this was partially offset by some COVID-19-related absenteeism that led to lower throughput. Based on the higher cash costs and another quarter of elevated sustaining capital partly due to underground development and a tailings expansion at Lamaque, all-in-sustaining costs [AISC] rose to $1,259/oz in the period.

Eldorado Gold – AISC & AISC Margins (Company Filings, Author’s Chart)

While the 12% increase in AISC year-over-year (1,259/oz vs. $1,133/oz) may not seem that significant compared to other producers, it’s worth noting that Eldorado was up against relatively easy comps on a year-over-year basis due to elevated sustaining capital in the same period last year at Kisladag, Efemcukuru, and Olympias. Besides, on a full-year basis, all-in-sustaining costs are more than 20% higher year-to-date ($1,289/oz vs. $1,066/oz) and will likely come in above $1,200/oz for the year even with a strong Q4 on deck. The rising costs and lower production combined with increased growth capital (Skouries, Kisladag) resulted in a cash outflow of $25.9 million in the quarter.

Crude Oil Futures Price (StockCharts.com)

While these headline results are certainly disappointing, and margins are sitting at their weakest levels since Q4 2019 (Q3 2022: $429/oz), the market is forward-looking and the upcoming year looks much better. This is because Eldorado should see a significant increase in production at Kisladag and Lamaque and is also expected to see a slight lift in production at Olympias. Meanwhile, we should see improved productivity with less COVID-19-related absenteeism and the benefit of lower energy prices. Plus, we could also see slightly lower sustaining capital year-over-year after a heavy year of spending at Lamaque in 2022 that weighed on AISC at this asset. The result is a much better year on deck. Let’s take a closer look below:

Recent Developments & 2023 Outlook

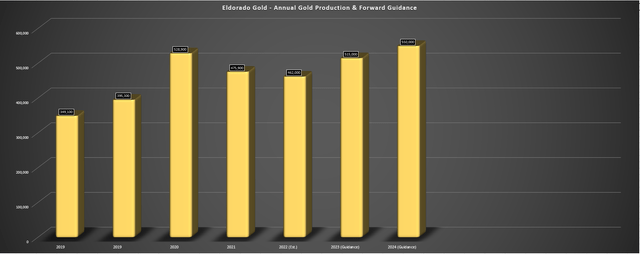

Looking at the chart below, we can see that FY2022 production is expected to decline for the second consecutive year, trending lower following a massive year in 2020 for Kisladag (226,500 ounces), with the operation benefiting from much higher grades than it is currently. However, despite working with much lower grades at its flagship operation, production at Lamaque and Kisladag is expected to improve next year to a combined 355,000 ounces. Looking ahead to FY2024, production is expected to improve to ~550,000 ounces, nearly 20% above FY2022 levels.

Notably, Eldorado continues to work on improvements at Kisladag, and the new HPGR circuit is performing to plan. These investments include investments in higher-capacity mobile conveyors to enhance material handling capability in the belt agglomeration circuit to boost throughput, plus the installation of an agglomeration drum. Meanwhile, at Lamaque, Eldorado should see higher grades next year and increased tonnes mined, translating to a significant increase in production year-over-year. Finally, the company has struggled to keep costs down at Olympias with an added VAT import charge on gold concentrate into China, with planned shipments to Russia impacted by the Russia/Ukraine war.

Eldorado Gold – Annual Production & Forward Outlook (Company Filings, Author’s Chart & Estimates + Guidance)

Fortunately, Eldorado is working to send shipments to alternative markets to reduce this VAT import charge headwind, and it’s continuing to work towards turning around Olympias which has been a major drag on costs. So, with what could be a better year for Olympias ahead, plus much higher production and lower costs from its two largest assets, I would expect Eldorado’s consolidated all-in-sustaining costs to dip below $1,120/oz next year when combined with higher assuming energy prices cooperate. This would result in a significant margin improvement, assuming gold can average at least $1,800/oz for the year.

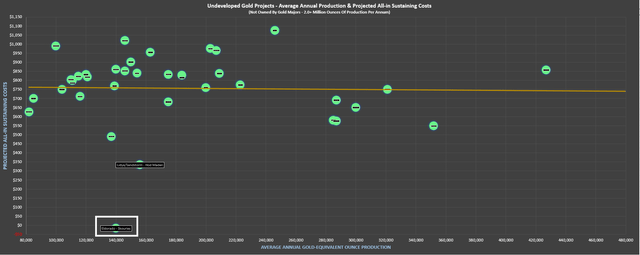

However, from a bigger-picture standpoint, Eldorado is quite unique in terms of its margin profile. This is because the company continues to work towards completing financing and making a construction decision on Skouries (hoping for this to be complete by year-end) and is also evaluating a potential throughput expansion at Olympias. The latter would drive costs lower for this polymetallic asset, while Skouries would be a complete game-changer, with it expected to produce ~140,000 ounces of gold at negative all-in-sustaining costs. The result would be that Eldorado’s AISC would dip below $925/oz, transforming it from an average-cost producer to a producer with industry-leading costs post-2025.

Skouries – Average Production & Costs vs. Other Undeveloped Projects (Company Filings, Author’s Chart)

Given this proverbial (albeit not very hidden) ace in the hole that Eldorado has in Skouries, assuming it’s green-lighted, I don’t see any reason to get hung up on the margin compression we’ve seen recently. In fact, I would expect any pullbacks below US$6.50 going forward to provide a buying opportunity, given that this is an entirely different company with Skouries in production and a higher production profile from Lamaque. The most recent development was that Eldorado had signed a Mandate Letter with Greek banks for a credit committee-approved ~$700 million project finance facility, representing the bulk of Skouries estimated capex ($845 million). Let’s take a look at the stock’s valuation:

Valuation

Based on ~190 million fully-diluted shares and a share price of US$8.50, Eldorado trades at a market cap of ~$1.62 billion and an enterprise value of ~$1.87 billion. This figure compares very favorably to an estimated net asset value of $2.94 billion, with Eldorado trading at just 0.55x P/NAV and is well below its peer group. The significant discount is partially related to the fact that nearly half of its NPV (5%) is tied to Skouries, a project yet to receive the green light, but this is still a significant undervaluation, especially given that Skouries is a transformative asset. In fact, even adjusting for inflationary pressures, Skouries could be one of the lowest-cost mines globally, behind Evolution’s (OTCPK:CAHPF) Ernest Henry and just behind Newcrest’s Cadia (OTCPK:NCMGF), with these two mines also benefiting from copper credits.

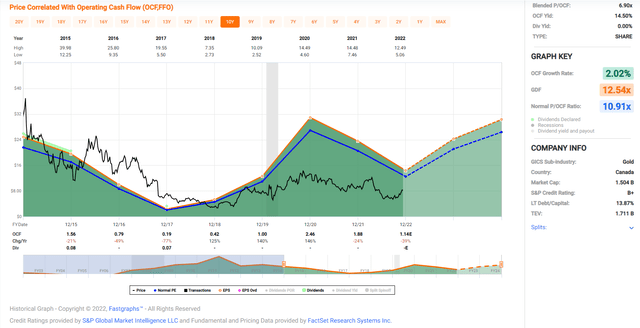

Eldorado – Historical Cash Flow Multiple (FASTGraphs.com)

Looking at Eldorado from a cash flow standpoint, the stock has historically traded at ~10.9x cash flow (10-year average), with its 5-year multiple average closer to 6.1. Based on FY2022 cash flow per share estimates of $1.14, Eldorado would appear to be fully valued based on the more recent multiple, trading at more than 7x estimates. However, it’s important to note that we should see a sharp increase in cash flow per share due to higher production. With 2022 already winding to a close with just a few weeks left, I believe it makes more sense to use FY2023 estimates ($1.75).

Eldorado is trading at ~4.9x cash flow estimates using these estimates, and I would argue that 6.5x cash flow is a conservative multiple. Based on these estimates, Eldorado’s fair value would come in at US$11.40 per share, pointing to a 34% upside from current levels.

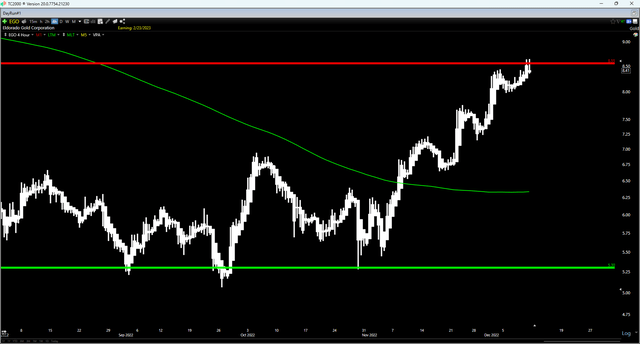

Technical Picture

Although Eldorado remains very reasonably valued despite its recent advance, the key is to buy cyclical businesses when sentiment is in the gutter, and they’re trading at a deep discount to fair value. In Eldorado’s case, the stock may be cheap, but it’s hard to argue that sentiment is in the gutter, with the stock sporting a 60% gain over the past 30 trading days. In fact, the stock is sitting just shy of short-term resistance at US$8.55, which could be a tricky spot for the stock short term. Meanwhile, the stock’s next major support level doesn’t come in until US$5.30. So, while the stock may be cheap, it’s nowhere near a low-risk buy zone. In fact, it’s potentially become prone to some profit-taking.

Based on this less attractive reward/risk outlook ($0.15 in upside to potential resistance, $3.25 in downside to support), I believe it makes sense to take some profits above US$8.30, and I don’t see any reason to add exposure to the stock here. Obviously, a rising gold price will lift all boats, and I could be wrong. Still, no one ever went broke taking a profit as long as they manage their losers carefully, and with EGO up 60% in 30 days, some profit-taking looks prudent even if the company should have a much better year on deck.

Summary

Eldorado Gold has a much stronger Q4 ahead and a much better year, and with financing for Skouries imminent, the company continues to have a bright future with a path to significant margin expansion due to first decile costs. That said, I prefer buying on sharp drawdowns, not chasing rallies, and purchasing Eldorado here after a violent rally would be the definition of chasing a rally. Hence, I would be selling a portion of my position into strength to book some profits. In terms of putting new capital to work in the sector, I see a much deeper valuation disconnect in Argonaut Gold (OTCPK:ARNGF), where I have recently started a new position at C$0.355.

Be the first to comment