gremlin

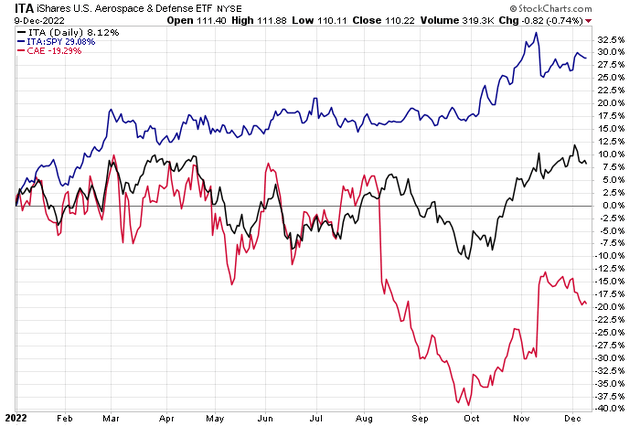

Aerospace & Defense stocks continue to lift. The group is up nearly 30 percentage points on the S&P 500 in 2022 and appears to be rocketing higher to cap off the year. One international name, though, is struggling despite being up big for the quarter. Can you find future alpha north of the border in CAE (NYSE:CAE)? Let’s dive in.

Aerospace & Defense: Moving Higher In Q4

According to Bank of America Global Research, CAE provides simulation and modeling technologies and integrated training services to the civil aviation and military industries. In FY2020, about 42% of revenues were from simulation products and about 58% of revenue came from training and services. Although headquartered in Montreal, Canada, CAE has an unmatched global training footprint with 160 sites and training locations in over 35 countries, 135,000 pilots trained per year, and about 10,000 employees.

The Canada-based $6.5 billion market cap Aerospace & Defense industry company within the Industrials sector trades at a high 65.6 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

CAE has gained market share in a strong industry over recent years and a recent global pickup in commercial air traffic post-Covid is a tailwind. As the pilot shortage eases, that, too, will be a positive for the firm. A source of uncertainty is how the LHX integration is executed (a recent acquisition). A broader challenge is if a global recession indeed strikes in 2023. Investors must pay close attention to margins, but with defense spending increases generally expected, CAE should be decently positioned.

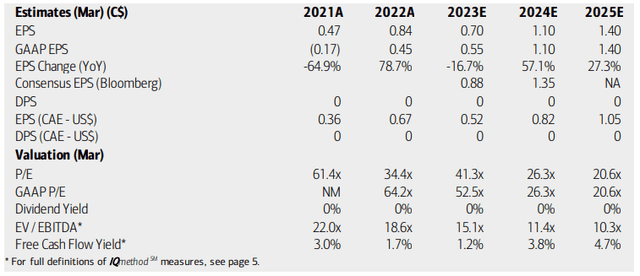

On valuation, analysts at BofA see earnings having climbed strongly this year, but there are headwinds for 2023 (which the company is currently in). A general EPS uptrend is then expected through 2024. The Bloomberg consensus forecast is more upbeat than BofA’s outlook.

Unfortunately for the bulls, the valuation is quite rich. Seeking Alpha rates it with a D, but I see the forward PEG ratio as reasonable at 1.46. After a quarter that barely beat street estimates, the company did reaffirm its outlook, so forward estimates should be a good gauge right now. As a result, the EV/EBITDA multiple should retreat while the free cash flow improves. Overall, it is a mixed valuation picture ahead of an uncertain year.

CAE: Earnings, Valuation, Free Cash Flow Forecasts

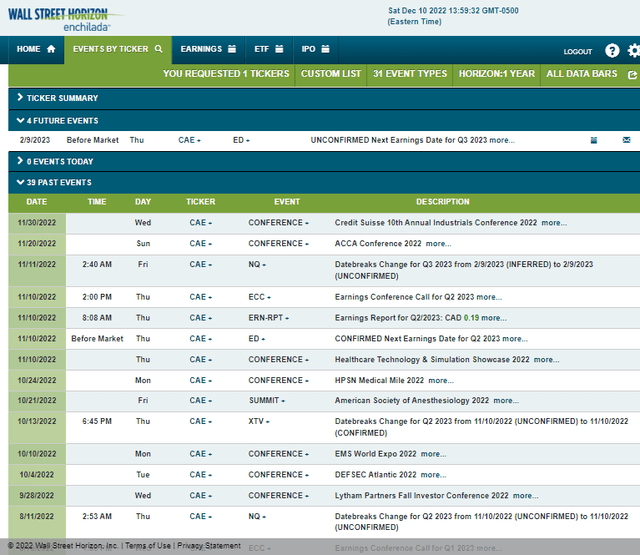

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3 2023 earnings date of Thursday, February 9 BMO. The calendar is light aside from that event.

Corporate Event Calendar

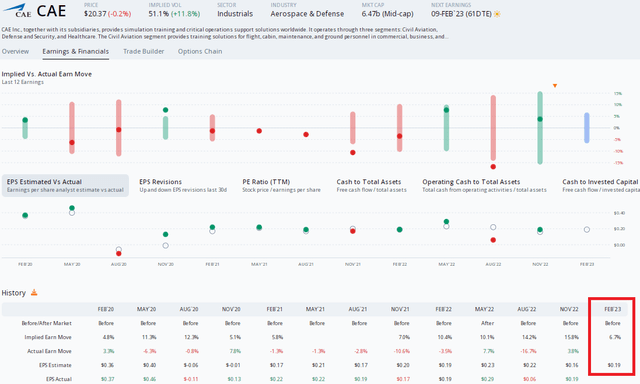

Digging into the upcoming earnings report expectations, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $0.19 which would be unchanged from the same quarter last year. Meanwhile, options traders have priced in less volatility before the February report compared to other quarters as the implied volatility is just 51%. I see the options as priced fairly when analyzing historical actual stock price swings.

CAE: Earnings Seen As Unchanged YoY

The Technical Take

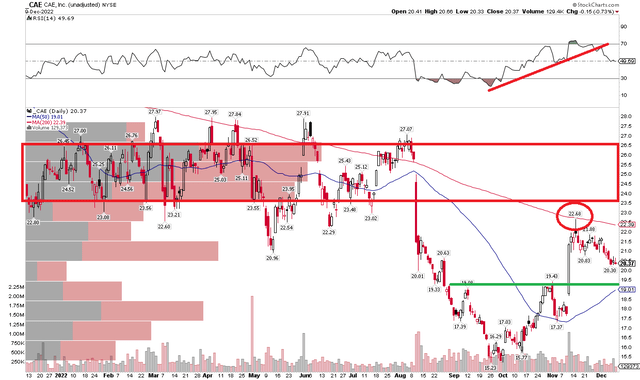

With a ho-hum valuation and some, but not excessive, volatility, can the chart offer clues on where shares may be destined? I am encouraged by a bull flag pattern right now but notice how the stock paused at the falling 200-day moving average while breaking its RSI uptrend. After a volume spike on a big up day around its earnings report, I like the current consolidation. But there is bearish overhead supply in the $24 to $28 range that might be tough to work through. Buying on a dip to $19 to $19.50 could be a short-term opportunity.

CAE: Shares Remain In A Downtrend After A Big Rally

The Bottom Line

I’m a hold on CAE Inc. as the valuation is somewhat high here given some macro uncertainty ahead. I’d like to see how profits verify in the coming two to three quarters before feeling good about its currently high P/E and downtrending share price.

Be the first to comment