bjdlzx

(This article was in the newsletter on September 20, 2022, and has been updated as needed.)

Enerplus Corporation (NYSE:ERF) is a Canadian company that has essentially moved its operations to the United States. The strategy is similar to Ovintiv Inc. (OVV). Enerplus appears to have a decent operations side of the company. But the sales side probably needs some work.

When it comes to the commodity business, every penny matters because the whole industry really does not have a competitive moat when “everyone” is essentially selling the same product. Therefore, protecting above-average profitability often comes from better geology, superior operations in some form, or the ability to find profits where much of the industry does not. This management does well on some of this.

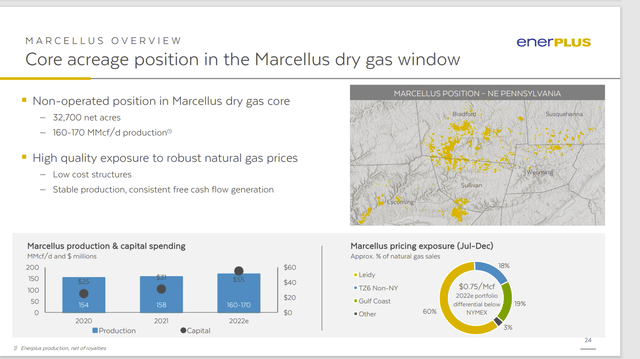

Enerplus Summary Of Marcellus Operations And Results (Enerplus Corporate Presentation September 2022)

Probably the presence in some very good Marcellus acreage in the dry gas part of the play is a very good operational strategy. The cost structure is good enough for the company to report profits. But the marketing strategy to sell that gas needs some work. The Marcellus area has become oversupplied as the basin production rose. This has led to a “mile-wide” discount from the benchmark as shown above.

When a company operates in the commodity business, that discount is a tremendous amount of money to be losing. Even if operations allow for a decent return on the production due to low costs, management needs to “go the extra mile” for shareholders by finding ways to get better pricing for that natural gas.

Comparison To Antero Resources

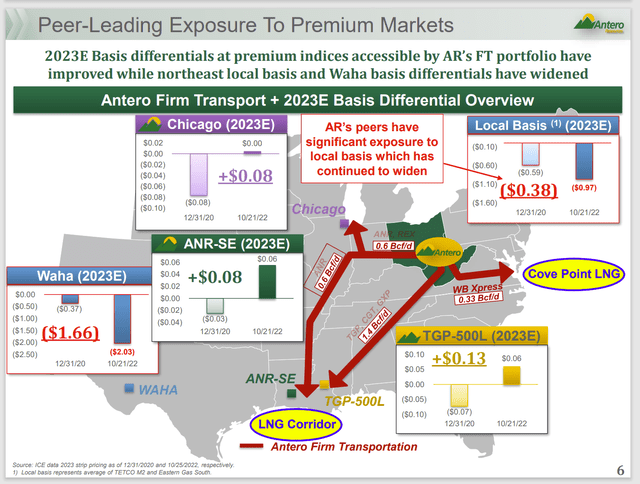

One of the things that shareholders do is pay management to think ahead. Antero Resources (AR) management has done that to provide shareholders with a considerable pricing boost compared to Enerplus pricing. Such thinking ahead helps considerably with cash flow generation because only a small amount of revenues actually make it to the income and cash flow portions of the balance sheet. Therefore, small differences in prices received make a big difference in profitability.

Antero Resources Pricing Results Compared To Benchmark (Antero Resources October 2022, Earnings Conference Call Presentation)

Some general guidelines to relate profits to revenue would be that typically net income is roughly 5% of revenue over the business cycle. For cyclical companies, that number can be considerably larger during the good times and then averaged out by deficits during cyclical downturns. That 5% can vary somewhat depending upon where you look and who you talk to, but it has been around a long time.

That makes the premium that Antero Resources typically reports compared to NYMEX pricing a huge advantage when compared to the pricing that Enerplus reports. It is also one of the reasons that Antero Resources typically has robust cash flow compared to many in the industry despite higher costs associated with the production of rich natural gas.

But midstream contracts are long term and management needs to take into account the location of midstream and possible connections before it begins development of the leases. Not many managements do that. Typically, they view themselves as “price-takers” and take whatever price is in the area as long as suitable profits can be reported.

The Enerplus Marcellus location is known for its low costs. Therefore, profitability is probably assured under a wide range of pricing assumptions. But getting the production to either export markets or better pricing markets than the typical Appalachian production is something that shareholders pay management to do.

The way that Antero Resources has done this is to obviously plan ahead when accepting long-term midstream contracts. Long-term followers of my articles know that this company has long been criticized for excess midstream capacity (supposedly that is costly). But then again, that extra capacity allowed management to redirect natural gas to places with soaring prices, as was the case with winter storm URI back in 2021 to the benefit of shareholders.

Shown above is the current plan. But this management has long been far more flexible about selling natural gas than is the case for many managements in the industry.

Even though Enerplus has larger-margined oil operations in the Bakken, the differential shown by the two companies for natural gas is large enough to prove to be a material income item in the future.

Enerplus Oil Pricing

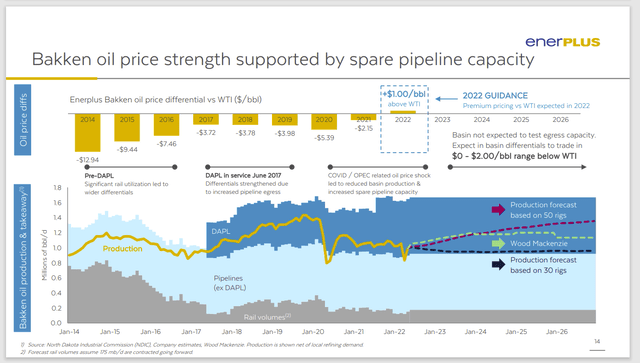

The picture for the all-important Bakken oil pricing has improved considerably over the years.

Enerplus Oil Price Bakken Improvement History (Enerplus Corporate Presentation September 2020)

The Bakken situation has improved considerably over the booming years of rapid development in the past. The result has enabled a small premium to the benchmark for the first time in as long as I can remember.

This is the majority of the company production and is also the product with the largest margin. Pricing of this production is therefore of utmost importance. The other key here is to get the product produced in the Bakken to refineries in nearby areas to avoid the costs of shipping the product to the Gulf where most of the refining capacity is located. Doing this can again add a small amount to the reported margin from time to time.

Outlook

The current industry situation can make a lot of penny-pinching irrelevant. But many money saving strategies take time to become effective. Therefore, the time to implement profit improving measures is often the time when the market cares less about that than the robust commodity price outlook.

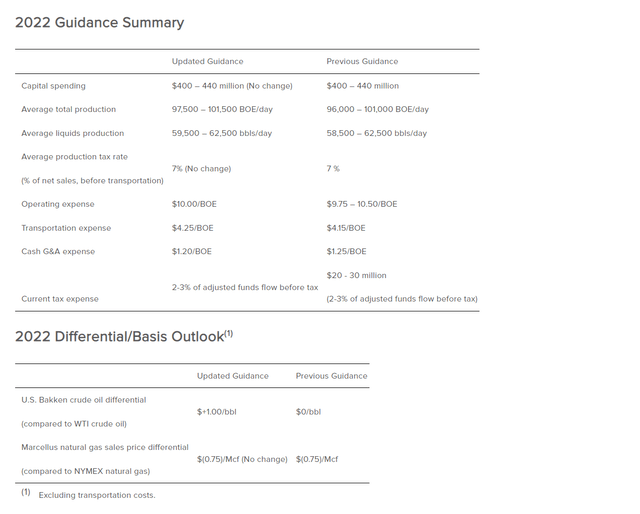

Enerplus Fiscal Year 2022 Guidance (Enerplus Second Quarter 2022, Earnings Press Release)

Clearly the transportation expense can use some work. That is near the top cost of all the companies that I follow. At the current time, oil prices are so good that the transportation expense may not matter as much. But that can change rapidly in this industry.

Cenovus Energy (CVE) is bringing on the Superior Refinery early next year. Other refineries are adding capacity that may provide this company with a chance to lower those transportation costs somewhat.

Now received pricing (NET) is the key. So high transportation costs can be offset by superior prices. But management needs to report that to shareholders as Antero Resources does.

The operating costs appear to be at least reasonable. The cost leader in the Bakken is usually Continental Resources (CLR). But a lot of other acreage, even with higher costs often provides more than reasonable profitability.

Probably the most significant area of improvement has to be the Marcellus natural gas pricing. Admittedly, natural gas does not have the margins (and usually not the profitability) of oil. But the differences between the prices received by fellow basin producer Antero Resources from what Enerplus is generating is large enough to demand the attention of management.

Long-term transportation agreements often mean that received pricing changes are a slow (and long-term) process. That means that the time to get started is now. This is an industry where every penny counts, and it appears that management is leaving more than a few pennies on the table.

Be the first to comment