Luca Piccini Basile

Investment Thesis: While sales across the Trucks segment have continued to perform well, I take the view that investors will want to see more evidence of growth before the stock sees further upside.

In a previous article back in March, I made the argument that AB Volvo (OTCPK:VLVLY) could see lower demand in the short to medium-term as a result of high fuel prices.

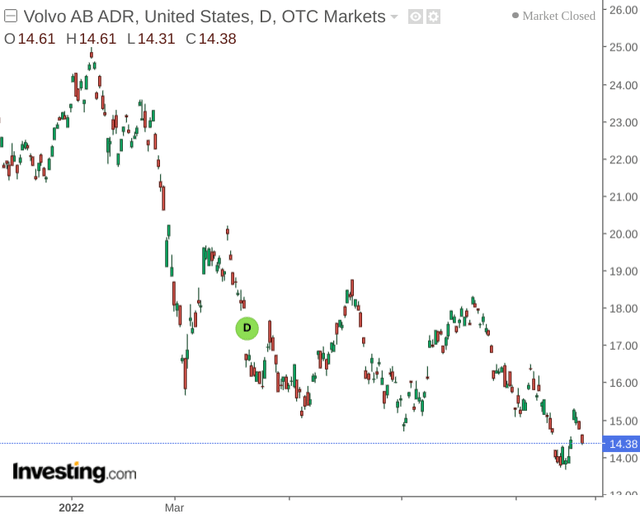

The stock has undergone a decline of just over 20% since my last article:

The purpose of this article is to assess whether AB Volvo could be in a position for a significant rebound from here.

Performance

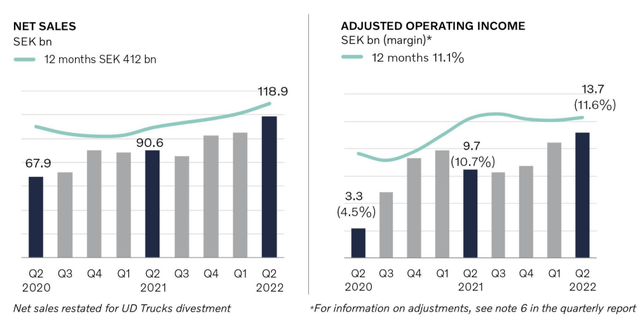

When looking at performance for Q2 2022, Volvo Group has seen continued growth in net sales and operating income.

Volvo Group Second Quarter 2022

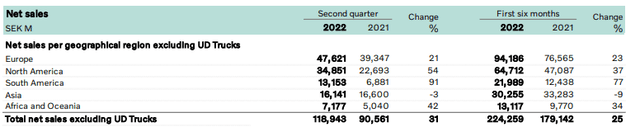

Particularly, driving the growth has been strong growth in net sales across North America – which has been closing in on that of Europe. Overall net sales were up by 31% for Q2 2022 as compared to the same quarter in the last year, with net sales for the first six months up by 25% on that of last year.

Volvo Group: Report on the Second Quarter 2022

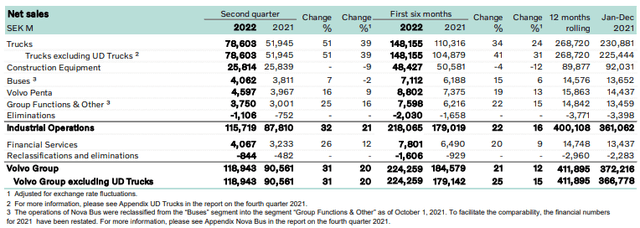

In addition, truck sales continued to lead all other segments – up by 39% when adjusted for exchange rate fluctuations:

Volvo Group: Report on the Second Quarter 2022

From this standpoint – my previous assertion that higher fuel prices could reduce demand across the Trucks segment has so far not held up – although the picture will likely become clearer heading into 2023 as inflation persists and fears regarding a potential recession linger.

Given this, investors will still want to ensure that Volvo Group can maintain sufficient liquidity to be able to fund its current liabilities if the need arises.

When looking at the company’s quick ratio (calculated as cash and cash equivalents plus accounts receivable plus other receivables and marketable securities all over current liabilities) – we can see that the quick ratio has fallen slightly from 0.63 to 0.56 from December 2021 to June 2022.

| December 2021 | June 2022 | |

| Cash and cash equivalents | 62126 | 54268 |

| Accounts receivable | 40776 | 47015 |

| Other receivables | 16742 | 17578 |

| Marketable securities | 167 | 92 |

| Current liabilities | 190457 | 213694 |

| Quick ratio | 0.63 | 0.56 |

Source: Figures sourced from Volvo Group: Report on the Second Quarter 2022. Figures provided in millions of SEK (Swedish Krona), except the quick ratio. Quick ratio calculated by author.

While investors may be willing to tolerate a slight fall in the quick ratio for as long as sales growth continues – a fall in the ratio below 0.5 might be of concern to some investors as it could indicate that Volvo Group would have less ability to meet its current liabilities if sales growth starts to slow.

Looking Forward

Going forward, I take the view that investors will pay particular attention to Q3 2022 results to assess whether Volvo Group will continue to see the strong demand it has seen to date across the Trucks segment – while also looking at the balance sheet to ensure that the company’s cash position can remain solid in the event of lower projected sales through to 2023.

In addition, while demand itself might remain strong – the ongoing semiconductor shortage – which is anticipated to last through to 2024 – may continue to place downward pressure on production and limit the degree to which Volvo Group can fulfill demand.

Moreover, while the automotive sector as a whole started to see a significant recovery as the emergency phase of COVID-19 began to recede – rising interest rates (particularly in the United States) could dampen the growth in demand that we have been seeing for automobiles due to higher borrowing costs. This could be particularly amplified for Volvo Group should truck demand see a particular fall – the Trucks segment account for 66% of overall sales for the group in the most recent quarter.

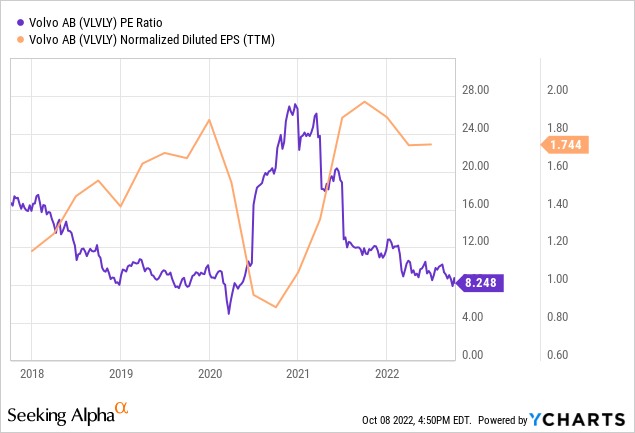

YCharts

On an earnings basis, we can see that the P/E ratio is down near levels last seen in 2020, with earnings per share near a five-year high. From this standpoint, there might be scope for upside if earnings growth continues to remain resilient and Volvo Group does not see a particularly big hit to sales in the current macroeconomic environment.

Conclusion

To conclude, AB Volvo has seen significant growth across its Trucks segment and looks to be attractively valued on an earnings basis. With that being said, Q3 2022 will likely give a good indication as to whether sales growth can be sustained, and as such I take the view that investors will want to see more evidence of growth before the stock sees further upside.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment