Scott Olson

Retail stocks don’t often come to mind when it comes to high dividend growers. That’s because this segment is fraught with competition with little differentiation between companies. Even the most successful retailers are constantly under pressure to keep prices low and fend off new competition.

But there are a few companies that have been able to consistently grow their dividends while navigating the challenges in the retail sector. These companies have proven that they resonate with consumers and are able to generate healthy profits. This brings me to Best Buy (NYSE:BBY), which has been a top dividend growth stock in the retail sector. This article highlights why BBY is currently a buy while it’s relatively cheap, so let’s get started.

Why BBY?

Best Buy is America’s largest pure-play retailer of consumer electronics. It’s also considered by many to be a “last man standing”, after other pure play electronics stores closed up shop, including Circuit City and more recently, regional players such as Fry’s Electronics.

Perhaps counterintuitively, I find it far better to invest in dominant players in a slow growth industry than to buy into fast growing industries. That’s because slow growth industries attract far less competition and thus don’t need to hire MBA level strategists to try constantly outsmart the competition. This is reminiscent of Peter Lynch, who remarked that he preferred industries that don’t attract a lot of MBAs.

Suffice to say, physical retail is a slow-growth industry and it would be safe to assume that there is no one out there trying to open a nationwide chain of electronics retailers to try to put Best Buy out of business.

Nonetheless, BBY hasn’t been immune to macroeconomic weakness, coupled with a difficult comparable to last year, when many consumers were working and spending more time at home, thereby leading to a surge in consumer electronics sales. This is reflected by the 12% decline in comparable sales in Q2 FY23 (ended July 31st), compared to 19.6% growth in the prior year period.

While the business will likely be challenged in the near-term, I believe the long-term thesis is intact. This is reflected by the fact that BBY has successfully transitioned to an omnichannel model, which is proving to be valuable leading tech brands such as Apple (AAPL) rent valuable space in BBY’s stores to showcase their newest products. This type of experience is something that an online-only business model simply cannot touch.

Now, more than one-third of BBY’s sales come through digital channels, and next-day delivery now covers virtually all (99%) of US households. Plus, BBY’s “buy online pick up in-store” further drives foot traffic and sales at its retail locations, and is something online-only competitors cannot replicate.

BBY is also transitioning more towards services, as its Totaltech program now has over 4.5 million members who receive unlimited home tech support, members only pricing, and free extended warranties on purchases. If anything, the pandemic since 2020 has given this segment of BBY’s business a strong boost that it should be able to sustain and carry forward. Management highlighted the long-term strategic benefits of this program during the recent conference call:

As we have previously shared, from a financial perspective, Totaltech is a near-term investment to drive longer-term benefits. Over time, we expect the incremental spend we garner from members will lead to higher operating income dollars. As I’ve just covered, there are several things we are seeing with the program that give us confidence that customers value the membership and that our thesis in general is playing out.

At the same time, consumer electronics is a low-frequency category. And we are in a unique macro environment, meaning it will take time for us to truly assess the performance. As you would expect, we will continue to monitor the program and iterate on the offering as we learn more.

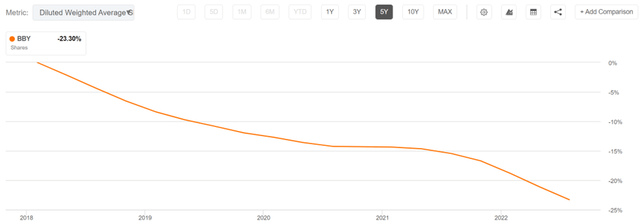

Meanwhile, BBY maintains a strong BBB+ rated balance sheet, and has been active in returning capital to shareholders. As shown below, BBY has repurchased 23% of its outstanding shares over the past 5 years alone.

BBY Outstanding Shares (Seeking Alpha)

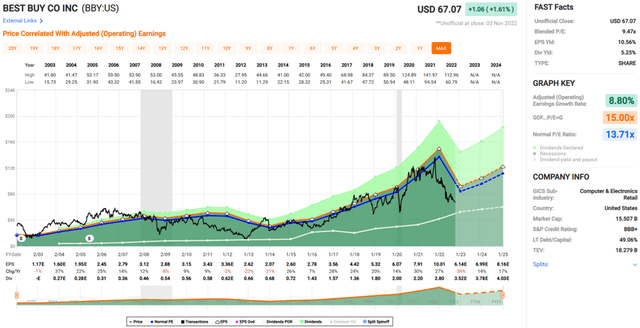

It addition, it currently yields a respectable 5.3%. The dividend is well-protected by a 42% payout ratio and comes with a high 5-year dividend CAGR of 21%, including a 26% raise this year. BBY is attractively priced at $67 with a forward PE of 10.7, sitting below its normal PE of 13.7.

Analysts expect the current fiscal year to be a trough for earnings, projecting 11 – 18% annual EPS growth over the next 2 years. S&P Capital IQ has an average price target of $81, implying potential double-digit annual total returns over the next couple of years.

Investor Takeaway

Best Buy is a dominant company in a slow-growth industry that is attractively priced after selloff. While BBY has been challenged by macroeconomic weakness and a difficult comparable, I believe the long-term thesis is intact. This is a company with a strong balance sheet, an omnichannel business model, and exposure to high-growth categories such as services and home office/learning. For these reasons, I believe Best Buy is a compelling value proposition at current levels before the market wakes up on this stock.

Be the first to comment