grinvalds

Etsy, Inc. (NASDAQ:ETSY) will report second-quarter earnings after the market closing bell today. Although many investors are likely to focus on gross merchandise sales and the number of active buyers and sellers on the platform, I believe investors should focus on a few other not-so-straightforward financial performance metrics to determine how the company will perform in the coming quarters with macroeconomic challenges continuing to impact businesses of every scale and size.

Another Earnings Beat From Etsy May Not Move The Needle

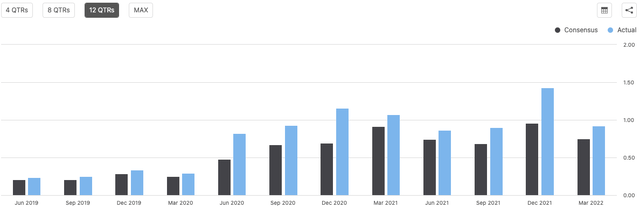

Etsy, as illustrated below, has topped Wall Street estimates for earnings in each of the last 12 quarters. At Leads From Gurus, we focus on companies that can beat earnings estimates consistently, and Etsy fits the bill perfectly.

Exhibit 1: Earnings surprise history

Source: Seeking Alpha

Mr. Market has not always responded to these positive earnings surprises positively. For this reason, it makes sense to understand what moved the needle in the last few quarters. Here’s a summary of what happened when Etsy reported quarterly earnings.

| Reporting period | Market reaction following the earnings release | Comments |

| Q1 2022 | Etsy stock declined 17% on May 5. | Although the company topped estimates, expenses grew sharply, leading to a 40% YoY decline in net income. To make matters worse, the company guided for lower-than-expected revenue for Q2 amid macroeconomic pressures. |

| Q4 2021 | Etsy stock rose 10% in regular trading and another 10% in after-hours trading on February 24. | The company guided for lower-than-expected revenue for Q1 2022 but the investor sentiment improved based on the strong growth seen in GMS, GMS per active buyer, and the acquisition of more than 10 million new buyers in the holiday quarter. |

| Q3 2021 | Etsy stock rose 13% on November 04 following the earnings release. | The company again guided for slightly lower-than-expected revenue for Q4 2021 but the market reacted positively to the double-digit growth in GMS and the acquisition of more than 7 million buyers. |

| Q2 2021 | Etsy stock declined around 10% on August 5 following the earnings release. | The soft revenue beat spooked investors although GMS grew in double-digits and the company added more than 8 million new buyers. |

| Q1 2021 | Etsy stock declined around 15% on May 6 following the earnings release. | Consolidated GMS jumped 132% and Etsy added more than 16 million new and reactivated buyers as well. The company guided for lower-than-expected guidance for EBITDA for Q2 2021. This guidance for a deceleration of growth was the main reason that spooked investors. |

Source: Company filings and Yahoo Finance

What we can infer from this data is that beating earnings estimates today will not lead to a strong positive reaction from investors. The market reaction is likely to be determined by the number of new buyers acquired by Etsy in the quarter, the company’s guidance for the next quarter, and the trends seen in gross merchandise sales.

With inflation continuing to remain at multi-decade highs, I do not believe Etsy will report healthy GMS growth for the second quarter. Many work from home companies have come under massive pressure in the last few months, and I believe Etsy, at best, will report mid-single-digit growth in GMS to go with earnings in-line with analyst estimates or slightly better in the best-case scenario. The guidance for the next quarter is unlikely to suggest better-than-expected growth either amid macroeconomic challenges, geopolitical tensions, and continued supply-chain issues.

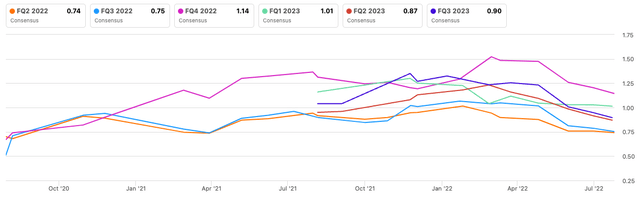

In the worst-case scenario, Etsy might fail to beat earnings estimates and issue lackluster revenue guidance for the next quarter. As illustrated below, analysts have revised their EPS estimates for the second quarter multiple times in the last few months, but the company is still at risk of missing this lowered guidance because of weakening discretionary spending.

Exhibit 2: Consensus EPS revision trend

Source: Seeking Alpha

If I were an Etsy shareholder, I would have preferred to take a back seat as Q2 earnings approach, if possible, as earnings are unlikely to move ETSY stock higher unless the company paints a rosy picture for the remainder of this year.

Q2 Cost Trends Will Shed Light on Etsy’s Future

In the first quarter of this year, Etsy’s net profit declined by a staggering 40% YoY, and this had a lot to do with rising costs across the board. Some of these cost increases were brought on by high inflation while certain costs – R&D expenses for example – remained higher due to the company management not slowing down on investments amid challenging times. The below table summarizes how costs increased dramatically in Q1.

| Financial statement item | As a percentage of revenue in Q1 2021 | As a percentage of revenue in Q1 2022 |

| Cost of revenue | 25.95% | 29.86% |

| Selling, general, and administrative expenses | 36.94% | 39.98% |

| R&D expenses | 9.75% | 15.45% |

| Total operating expenses | 46.89% | 55.42% |

Source: Seeking Alpha

The massive increase in costs in Q1 made it clear that Etsy needs to invest aggressively to retain active users – both buyers and sellers – and to attract new users. If Q2 earnings reveal a continuation of this trend, it would be a clear indication that the company’s earnings are likely to deteriorate in the second half of this year as inflationary concerns nor supply-chain challenges are showing signs of improvement. On the other hand, continued growth in R&D spending in Q2 will indicate the management’s decision to invest in the business to push Etsy into a good position to thwart the threat of competition in the long run, which I would view as a positive development.

Etsy will need to keep on investing back in the business to ensure its online marketplaces are catering to the changing demands of buyers and sellers. Investing in technological improvements should be viewed as a necessity to attain and retain competitive advantages in this highly competitive business sector. As we discussed in our previous article on Etsy, the company has a lot to offer investors in the long run with its unique business proposition that caters to a unique cohort of buyers and sellers. For Etsy to build on this position, new investments are essential. The problem with these investments is that the company will have to wait patiently to make the most of these investments as short-term investment returns are likely to be dismal because of the challenges faced by the consumer today that limit their spending power.

Etsy’s subsidiaries – Reverb, Depop, and Elo7 – proved to be a drag on EBITDA margins in Q1, and as the company continues with consolidation efforts, chances are that Etsy’s profit margins will come under further pressure in the coming quarters before showing any improvements.

Overall, I believe investors should look out for cost trends in Q2 to identify whether the company is sticking to its original strategy of aggressively investing in the business to secure long-term competitive advantages. If this is the case, I would certainly view this trend as a positive one for long-term shareholders. On the other hand, an increase in the cost of revenue and other non-discretionary costs should be considered as a warning sign of troubles the company will face in the second half of this year.

The Business Model is What Makes Etsy Attractive

In our previous article, we discussed in detail how Etsy is well-positioned to become a long-term winner in the e-commerce segment because of its unique business model that focuses on handmade products that are not freely available on any other online marketplace. I am not planning to dig deep into the company’s business model in this article, but to add some clarity, the company does not compete with other e-commerce giants in product categories that are primarily driven by price and the speed of delivery. Etsy’s focus is on unique, non-traditional items for which the demand stems from consumers who are passionate about these products. With Etsy’s international expansion gaining traction in regions such as India that have a lot to offer when it comes to handmade items, I believe the company is well-positioned to benefit from long-term competitive advantages resulting from the network effect.

Takeaway

I like what I see from Etsy, given that the company is not just another e-commerce company competing for market share with the likes of Amazon.com, Inc. (AMZN). The company, so far, has made commendable strategic decisions to secure the sustainability of its earnings in the long run, and I am waiting for this to be confirmed in Q2 earnings as well. In the short term, Etsy will undeniably come under pressure, and it makes sense to use dollar cost averaging as a strategy to invest in Etsy stock in set intervals over the next few quarters.

Be the first to comment