D3signAllTheThings/iStock via Getty Images

Welcome to the July 2022 edition of the “junior” lithium miner news. We have categorized those lithium miners that won’t likely be in production before 2023 as the juniors. Investors are reminded that many of the lithium juniors will most likely be needed in the mid and late 2020’s to supply the booming electric vehicle [EV] and energy storage markets. This means investing in these companies requires a higher risk tolerance and a longer time frame.

July saw a superb month of news for the lithium sector and the lithium juniors. The news of car manufacturer Ford (F) supporting (A$300m loan) a lithium junior so as to secure lithium off-take was the big news this past month. It was also a huge wake up call to the rest of the EV OEMs and battery/cathode/anode manufacturers that do not yet have security of EV metals supply.

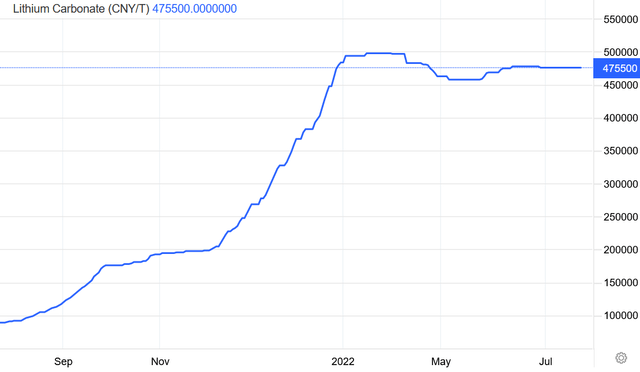

Lithium price news

Asian Metal reported during the past 30 days, 99.5% China lithium carbonate spot prices were up not updated (up 4.58% the past 60 days) and China lithium hydroxide prices were not updated. Lithium Iron Phosphate (Li 3.9% min) prices were up 1.32%. Spodumene (6% min) prices were up 2.91% over the past 30 days.

Benchmark Mineral Intelligence (“BMI”) as of late June reported China lithium carbonate prices of RMB 469,000 (US$69,875) (battery grade), and for lithium hydroxide RMB 472,500 (US$70,400).

Metal.com reported lithium spodumene concentrate (6%, CIF China) price of CNY 33,761 (~USD 4,996/mt), as of July 22, 2022.

China Lithium carbonate spot price – CNY 475,500 (~USD 70,373)

Source: Trading Economics

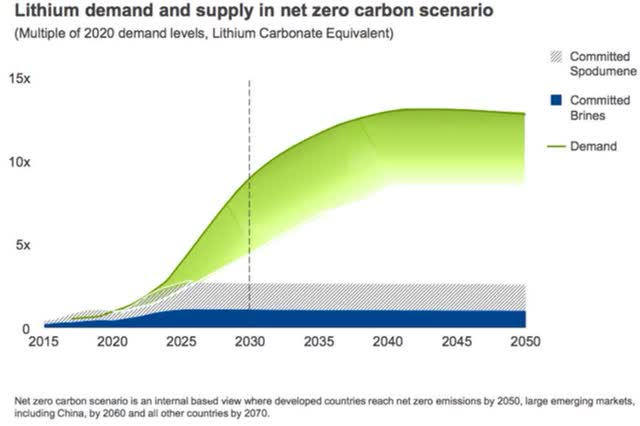

Rio Tinto’s lithium emerging supply gap chart (chart from 2021)

Source: Mining.com courtesy Rio Tinto

Lithium market news

For a summary of the latest lithium market news and the “major” lithium company’s news, investors can read: “Lithium Miners News For The Month Of July 2022” article. Highlights include:

- BMI: The energy storage revolution has arrived. Lithium-ion battery cell capacity to grow at a CAGR of 47% to 2032.

- Gotion High Tech signs lithium plant deal in Argentina with JEMSE.

- G7 launches $600 billion global infrastructure investment plan including battery spend.

- CATL’s new battery ‘Qilin 3.0’ is a leap forward but also a precursor of something radical to come. Qilin capable of a range of 1,000 km (620 mile).

- FREYR Battery sanctions construction of its inaugural Gigafactory.

- Morningstar: Lithium stocks a bright spot in basic materials. Morningstar forecasts lithium selling at $70,000 per metric ton in 2023 and averaging in the mid-$30,000 range over the decade.

- SQM says the market will need new supplies of 200-300,000 tpa of lithium pa, equal to roughly 8 to 10 new projects coming on stream every year.

- Volkswagen began construction of its first global battery plant at Salzgitter, Germany; launched a new battery business that will expand across Europe and into North America, as part of a plan to produce its own batteries.

- Panasonic picks Kansas for new $4B electric vehicle battery factory. Tesla lays down 2 TWh battery challenge to Panasonic.

- Trudeau announces deal with Umicore to build $1.5B cathode materials plant in Ontario, will be the first industrial-scale manufacturing plant of its kind in North America.

- US says it will back miners to stop China’s weaponization of battery metals.

- Ernst, Manchin Seek to End U.S. dependence on China for defense materials.

- Fastmarkets’ William Adams: Lithium prices have yet to peak, but expect surprises.

- Rio Tinto on the hunt for more lithium assets.

- Musk says lithium refining a ‘license to print money,’ stock investors jump in.

Junior lithium miners company news

Sayona Mining [ASX:SYA] (OTCQB:SYAXF)

On June 27, Sayona Mining announced: “New lithium discoveries strengthen Moblan potential.” Highlights include:

- “Multiple new spodumene pegmatites identified at Moblan South, South East Extension, Moleon and extensions to the Main Moblan lithium deposit at Sayona’s Moblan Lithium Project, Québec.

- These new discoveries provide the means to significantly increase the resource base of Sayona in North America.

- Exciting new and distinct Moblan South Discovery open in all directions located 200m south of the main Moblan deposit.

- Highlights include 23.4m @ 1.69% Li2O from 17.6m and 27.1m @ 1.5% Li2O from 53.1m (Moblan South) and 32.1m @ 2% Li2O from 94.1m (Main Moblan dyke) and 23m @ 1.79% Li2O from 34.7m (Moblan East).

- Drilling continuing, with 20,000m drilling campaign underway as Sayona continues to build on potential of the new Northern Lithium Hub, strengthening its leading lithium (spodumene) resource base in North America.“

On June 28, Sayona Mining announced: “Sayona and Piedmont formally approve NAL restart.” Highlights include:

- “Sayona Québec Inc. formally approve restart of North American Lithium (NAL) operation, with budget of approx. C$98 million.

- NAL on track for resumption of spodumene concentrate production in first quarter 2023, becoming the first North American local supplier of lithium concentrates.

- Sayona and Piedmont evaluating options for downstream processing in Québec, in order to capture further value in the fast‐growing EV and battery sector.“

Investors can read the Company presentation here, and a Trend Investing CEO interview here.

Note: North American Lithium [NAL] is owned 75% Sayona Mining: 25% Piedmont Lithium.

Upcoming catalysts include:

- 2022 – Authier permitting. Possible project financing and off-take.

- Q1 2023 – Restart of NAL (SYA 75%: PLL 25%) operations.

Piedmont Lithium [ASX:PLL] (PLL)

Piedmont Lithium 100% own the Carolina Lithium spodumene project in North Carolina, USA; as well as 25% of North American Lithium [NAL].

On June 28, Piedmont Lithium reported:

Piedmont Lithium and Sayona Mining formalize restart plans for North American Lithium in Quebec… The NAL restart project will be entirely funded from pro-rata cash contributions by Sayona and Piedmont, with each party having completed significant capital raises in the first half of 2022.

On July 6, Piedmont Lithium reported: “Piedmont Lithium added to Russell 2000® Index.”

Upcoming catalysts include:

- 2022 – Carolina Lithium – Possible further off-take, permitting or project funding announcements.

- Q1 2023 – NAL (25% Piedmont Lithium) production set to begin.

You can view the company’s latest presentation here.

Liontown Resources [ASX:LTR] (OTCPK:LINRF)

Liontown Resources 100% own the Kathleen Valley Lithium spodumene project in Western Australia. DFS completed in November 2021.

On June 29, Liontown Resources announced: “Liontown executes Binding Offtake Agreement with Ford.” Highlights include:

- “Liontown and Ford have executed a definitive binding full-form offtake agreement (Offtake Agreement), the third and final foundational offtake required to underpin development of Liontown’s Kathleen Valley Lithium Project (Kathleen Valley or the Project).

- The Offtake Agreement for the supply of up to 150,000 dry metric tonnes (DMT) per annum will have an initial term of 5 years from the commencement of commercial production (expected in 2024).

- Ford and Liontown have also executed a binding full-form funding facility agreement (Funding Facility) with respect to a A$300 million debt facility to be used for the Project’s development.

- This Funding Facility, together with the proceeds from Liontown’s A$463 million capital raise in December 2021, paves the way for a Final Investment Decision for the Project.“

On June 29, Liontown Resources announced: “Liontown Board approves development of Kathleen Valley Lithium Project.” Highlights include:

- “With high-calibre foundational offtake agreements now in place with Ford, Tesla and LG Energy Solution, and financing commitments secured that will allow the project to be funded through to first production, the Liontown Board has made the Final Investment Decision (FID) to proceed to develop Kathleen Valley.

- First production of spodumene concentrate is scheduled for Q2 2024.

- In preparation for project delivery, the Company intends to award a series of major contracts (including EPCM, Power Purchase Agreement, freight logistics, bulk earthworks and open cut mining services) to established and high-quality contractors.

- Accommodation village design, build and construction has been awarded to ADD Business Group, with manufacture and site preparation works already underway.

- Early grade control drilling is well advanced at the planned two open pits ahead of anticipated pre-production mining commencing in Q1 2023.

- The capital cost estimate for the Project has been revised as part of the FID process.“

On July 21, Liontown Resources announced:

Liontown awards EPCM contract to Lycopodium… The Project remains on-track for commissioning and production by Q2, 2024.

You can view the company’s latest presentation here.

Vulcan Energy Resources [ASX: VUL] (OTCPK:VULNF)

Vulcan Energy Resources state that they have “the largest lithium resource in Europe” with a total of 15.85mt LCE, at an average lithium grade of 181 mg/L. The Company is in the development stage developing a geothermal lithium brine operation (geothermal energy plus lithium extraction plants) in the Upper Rhine Valley of Germany.

On July 8, Vulcan Energy Resources announced: “Agreement between Vulcan Energy and Enel Green Power and Zero Carbon Lithium™ Project update.” Highlights include:

- “Binding agreement signed with Enel Green Power to explore and develop geothermal lithium in Italy.

- Preliminary EIA approval, growing community support across the region and Demo Plant progress update at the Zero Carbon Lithium™ Project in Germany.“

Upcoming catalysts include:

- H2 2022 – DFS, potential permitting and project funding.

- 2024 – Target to commence production.

POSCO [KRX:005490] (PKX)

On June 30 Reuters reported:

Britishvolt signs deal with Posco Chemical for battery materials. Electric vehicle (EV) battery startup Britishvolt has signed a deal with South Korean battery materials firm Posco Chemical (003670.KS) designed to secure the supply of cathode and anode materials, the two companies said on Thursday.

On July 22, Business Korea reported:

POSCO Holdings to invest KRW6tn in Lithium Business by 2030. POSCO Holdings will invest about 6 trillion won in the lithium business by 2030, said Lee Kyung-seop, head of the company’s rechargeable battery material business, in a second-quarter earnings conference call on July 21. “We will invest up to 1.5 trillion won each year,” Lee said. “We will be able to finance the investment with the earnings to be generated by our Argentine brine lithium plant and Gwangyang lithium plant from 2025.”

Upcoming catalysts include:

- 2024 – Target to commence production at Hombre Muerto and ramp to 25ktpa LiOH.

Wesfarmers [ASX:WES] (OTCPK:WFAFY)(took over Kidman Resources)

The Mt Holland Lithium Project is a 50/50 JV between Wesfarmers [ASX:WES] (OTCPK:WFAFF) and SQM (SQM), located in Western Australia. There is also a proposal for a refinery located in WA. Wesfarmers acquired 100% of the shares in Kidman for A$1.90 per share, for US$545 million in total.

No lithium news for the month.

You can view the latest company presentation here and news on the Mt Holland construction here.

Upcoming catalysts include:

- H2, 2024 – Mt Holland spodumene production and Kwinana LiOH refinery planned to begin and ramp to 45–50ktpa LiOH.

AVZ Minerals [ASX:AVZ] (OTC:AZZVF)

AVZ Minerals owns 51% of its Manono Lithium & Tin Project in the DRC, after selling 24% of it to Suzhou CATH Energy Technologies for US240m. DRC-owned firm Cominiere has a 25% share.

On July 15, AVZ Minerals announced: “Site operational update Manono Lithium and Tin Project.” Highlights include:

- “Diamond drilling recommences at Manono Project with stated objective of significantly increasing lithium resources and reserves at Roche Dure.

- Company commits to 15,000m drilling program at Roche Dure extension, targeting ore to a minimum of -200m depth…

- Equipment purchased as part of Early Works Program has started to arrive at site.”

Upcoming catalysts include:

- 2022 – Initial project work. FID on the Manono Project.

Note: July 2022 – AVZ Minerals ‘confident’ despite Manono dispute remaining unresolved

Standard Lithium [TSXV:SLI] (SLI)

On July 13, Standard Lithium announced: “Standard Lithium corporate update.” Highlights include:

- “Key management additions to drive project execution.

- Master Service Agreement with Telescope Innovations to perform CO2 sequestration R&D.

- DFS/FEED Study Award.

- Senior management increase shareholdings.”

Leo Lithium Limited [ASX:LLL] (Firefinch Limited spinout 50/50 JV with Ganfeng Lithium)

On July 5, Leo Lithium announced:

Sale of 28.6m Leo Lithium shares – FFX cash injection of $12.9 million. Firefinch Limited (ASX: FFX) (Firefinch or the Company) announces it has sold 28.6 million shares in Leo Lithium Limited (ASX: LLL) (Leo) through a block trade executed after market on Monday 4th July 2022 at a sale price of A$0.455 per Leo share (Trade).

On July 20, Leo Lithium announced:

Completion of US$40 million debt facility with Ganfeng. Leo Lithium has agreed terms with Joint Venture partner Ganfeng Lithium Co., on an expandable US$40 million debt facility for the Goulamina Lithium Project….

On July 21, Leo Lithium announced: “Quarterly report for the quarter ended 30 June 2022.” Highlights include:

Corporate

- “Leo Lithium commenced trading on the Australian Securities Exchange on 23 June 2022 following an oversubscribed initial public offering which raised A$100 million…

Project Development

- “All development work is progressing in line with schedule and budget. Momentum continues to build on design, engineering and procurement activities.

- Key site activities included the installation of the drillers and pioneer camp and the upgrade of the site access road.

- Detailed plant design is underway and will allow flexibility for Stage 2 production expansion.

- Procurement of long-lead items such as the ball mill, jaw crusher and cone crushers de-risked a significant part of the project procurement profile. The ball mill was the most critical item and was secured under budget and with an eight-week improvement on the baseline schedule, due to the assistance of Ganfeng.

- Work is underway on an accelerated production plan targeting compression of the schedule to ensure that first production is achieved as early as possible in Q1 2024.”

Global Lithium Resources [ASX:GL1]

On June 28, Global Lithium Resources announced: “Manna drilling delivers positive assays. First RC assays increases confidence and prospectivity at depth as diamond drilling commences at Manna.” Highlights include:

- “…..The program validates previous drilling and resource information, further extending the orebody at depth which remains open….

- Drilling intercepts across the same Pegmatite shows continuity with depth: MRC0028 returned 12m @ 0.75% Li2O from 41m, inc. 4m @ 1.41% Li2O from 41m. MRC0029 returned 11m @ 0.83% Li2O from 123m, inc. 4m @ 1.29% Li2O from 126m and 1m @ 1.12% Li2O from 133m. MRC0035 returned 15m @ 0.91% Li2O from 221m, inc. 3m @ 1.39% Li2O from 221m and 2m @ 1.16% Li2O from 229m and 1m @ 1.02% Li2O from 234m.

- Additional pegmatite intercepts showing continuity with depth: MRC0034 returned 13m @ 0.84% Li2O from 46m. MRC0035 returned 6m @ 1.09% Li2O from 172m.

- Manna East Pegmatite showing increasing width with depth: MRC0032 9m @ 1.29% Li2O from 110m.

- Ongoing drilling will further target lithium mineralised pegmatites both along strike and at depth…..“

On July 22, Global Lithium Resources announced: “Manna drilling intercepts significant lithium bearing pegmatites. Resource open along strike and down dip.” Highlights include:

- “Reverse circulation [RC] assay returns multiple +10m intercepts in a single drill hole: MRC0040 returned individual intercepts of: 10m @ 1.21% Li 2O from 50m. 12m @ 1.71% Li 2O from 75m. 11m @ 1.31% Li 2O from 225m. 6m @ 1.26% Li 2O from 251m.

- Additional Reverse circulation [RC] assay results: MRC0037 returned individual intercepts of: 5m @ 1.64% Li 2O from 31m. 6m @ 1.32% Li 2O from 101m. 3m @ 1.06% Li 2O from 133m.

- Diamond drilling [DD] confirms lithium bearing pegmatites extend up to 150m down dip past the current resource. RC assay results correlate well with deeper diamond Lithium bearing pegmatite intercepts…

- Results from Manna drilling campaign to be incorporated into updated Mineral Resource later this year.”

On July 22, Global Lithium Resources announced: “Drilling intercepts significant lithium pegmatites – Amended.”

Savannah Resources [LSE:SAV] [GR:SAV] (OTCPK:SAVNF)

On July 6, Savannah Resources announced:

Barroso Lithium Project Environmental Impact Assessment evaluation process update. Dale Ferguson, CEO of Savannah Resources said, “We are pleased to receive APA’s feedback and we have accepted its proposal to move the EIA review process into the Article 16 phase. We look forward to working closely with the regulator under Article 16 to further optimise elements of the Project, which will have extremely positive benefits both for Portugal and Europe. We, like APA, are committed to delivering an environmentally responsible and socially optimised Project. Equally, we remain dedicated to a life-of-project programme of ongoing improvements which has been illustrated with our fast-developing decarbonisation strategy.

Upcoming catalysts include:

2022 – EIA permit due.

2023 – DFS due.

Critical Elements Lithium Corp. [TSXV:CRE] [GR:F12] (OTCQX:CRECF)

On July 19, Critical Elements Lithium Corp. announced:

Critical Elements Lithium commences Summer Exploration Program. Jean-Sébastien Lavallée, CEO of Critical Elements commented: “We are very excited to resume exploration on our extensive land portfolio, and in particular drilling on the Rose and Lemare projects. In the past, we have been able to demonstrate how quickly and efficiently we can define resources. We are very enthused about the exploration potential of our portfolio and the ability to delineate more resources.”

Investors can view the company’s latest presentation here.

Upcoming catalysts include:

- 2022 – Rose Lithium-Tantalum Project provincial permitting. Possible off-take or financing announcements.

You can read the latest Trend Investing Critical Elements Lithium article here.

Lake Resources NL [ASX:LKE] [GR:LK1] (OTCQB:LLKKF)

Lake Resources own the Kachi Lithium Brine Project in Argentina. Lake has been working with Lilac Solutions Technology (private, and backed by Bill Gates) for direct lithium extraction and rapid lithium processing.

On July 14, Lake Resources announced:

Lake responds to online report. Lake Resources is advancing project delivery, extraction technology, and operations to serve critical North American and Asian supply chains. Its flagship Kachi project, located in Argentina’s Catamarca province, is a globally significant lithium resource.

ioneer Ltd [ASX:INR] [GR:4G1] (OTCPK:GSCCF) (IONR)

ioneer ltd. announced in September 2021 the sale of 50% of its flagship lithium boron project to Sibanye Stillwater for US$490m.

On July 1, ioneer Ltd announced: “Ioneer commences trading on NASDAQ.” Highlights include:

- “ioneer today announced the commencement of trading on the NASDAQ under an American Depositary Receipt (ADR) listing…

- Key work streams progressing well including additional lithium off-take, debt funding, detailed engineering and federal permitting.

- Final stages of documentation for two lithium offtake agreements that will ensure our Nevada produced lithium is committed to US EV supply chain.

- Debt funding due diligence continuing with US Department of Energy Loan Programs Office.“

On July 22, ioneer Ltd announced: “ioneer signs binding lithium offtake agreement with Ford.” Highlights include:

- “ioneer has signed a binding offtake agreement with Ford to supply lithium from Rhyolite Ridge in Nevada intended to supply BlueOval SK.

- In support of end-to-end U.S. EV supply chain and Ford’s plan, ioneer is supplying lithium from its Nevada operations for lithium-ion batteries planned for EVs built in America.

- The 5-year binding agreement is for a total of 7,000 tpa of lithium carbonate from ioneer’s Rhyolite Ridge Lithium-Boron operation in Nevada and represents approximately 34% of annual output in the first 5 years of production.“

Upcoming catalysts include:

- Any debt funding deals on top of the existing Sibanye-Stillwater US$490m to fund Rhyolite Ridge.

European Metals Holdings [ASX:EMH] [AIM:EMH] [GR:E861] (OTCPK:ERPNF) (OTCQX:EMHLF)(OTCQX:EMHXY)

No significant news for the month.

Upcoming catalysts include:

- 2022 – Any off-take or project funding deals.

Galan Lithium [ASX:GLN]

Galan is developing their flagship Hombre Muerto West (“HMW”) Lithium Project located on the west side edge of the high grade, low impurity Hombre Muerto salar in Argentina. In total Galan Lithium has 3.0m tonnes contained LCE @858mg/L.

On July 14, Galan Lithium announced: “Outstanding initial well test results at HMW Project. High lithium grades, porosity and brine flow rates recorded.” Highlights include:

- “72-hour constant rate testing successfully completed at first Pata Pila pumping well (PPB-01-21). Brine sampling confirms high grade resource (Li > 910 mg/L). Hydraulic testing saw aquifer response showing favourable conditions for high volume brine production (15 – 20L per second)…

- Testing of first well at Rana de Sal (PBRS-01-21) is imminent.“

Cypress Development Corp. (TSXV:CYP) (OTCQX:CYDVF)

Cypress Development owns tenements in the Clayton Valley, Nevada, USA.

No news for the month.

Frontier Lithium [TSXV:FL] (OTCQX:LITOF)

Frontier Lithium own the PAK Lithium (spodumene) Project comprising 26,774 hectares and located 175 kilometers north of Red Lake in northwestern Ontario. The PAK deposit is a lithium-cesium-tantalum [LCT] type pegmatite containing high-purity, technical-grade spodumene (below 0.1% iron oxide).

On June 29, Frontier Lithium announced: “Frontier Lithium files year-end March 31, 2022 financial results.” Highlights include:

- “At March 31, 2022 the Company had cash and cash equivalents of C$17.7 million, leaving it well positioned to execute on its plan to complete the PFS and planned 15,000 metre drill program which commenced in May 2022…”

On July 25 Frontier Lithium reported:

FRONTIER INTERSECTS 144 M OF HIGH GRADE LITHIUM AVERAGING 1.72% Li2O WITH SIGNIFICANT CESIUM AND TANTALUM ZONES AT SPARK.

Lithium Power International [ASX:LPI] (OTC:LTHHF)

On July 5, Lithium Power International announced: “LPI becomes largest tenement holder in Greenbushes region & buys holding in Eastern Goldfields.”

- “Lithium Power has bought CMC Lithium and its Greenbushes Project in Western Australia, adding an extra 365km2 of prospective ground around Talison Lithium’s Greenbushes Mine, the world’s largest hard-rock spodumene operation.

- Lithium Power has also acquired two tenements in the mineral rich Eastern Goldfields of WA, from private company Lysander Lithium.

- In the Eastern Goldfields, prolific gold and nickel endowment is often complimented by large lithium spodumene pegmatite deposits, such as Neometals’ Mt Marion mine.

- The properties were acquired for a combination of cash and LPI stock.

- Lithium Power now has tenements in each of the three major WA hard rock lithium areas – Greenbushes, the Pilbara Craton and the Eastern Goldfields.”

Upcoming catalysts:

- 2022 – Further developments with Mitsui re off-take partner and funding announcements for Maricunga Lithium Brine Project in Chile. Spin-out of Western Australian Greenbushes and Pilgangoora lithium assets.

American Lithium Corp. [TSXV: LI] (OTCQB:LIACF) (acquired Plateau Energy Metals Inc.)

On June 27, American Lithium Corp. announced: “American Lithium validates Sulfate of Potash as a strategic by-product of future lithium production at Falchani.”

On July 11, American Lithium Corp. announced: “American Lithium launches Pre-Feasibility work at Falchani, with initiation of EIA with SRK.”

On July 14, American Lithium Corp. announced: “American Lithium intersects up to 2,900 ppm Li in best results to date from thick lithium claystone averaging 1,550 ppm Li over 50.3 m in hole TLC-2206C.”

Wealth Minerals [TSXV:WML] [GR:EJZN] (OTCQB:WMLLF)

Wealth Minerals has a portfolio of lithium assets in Chile, such as 46,200 Has at Atacama, 8,700 Has at Laguna Verde, 6,000 Has at Trinity, 10,500 Has at Five Salars. Also the right to acquire a 100% interest in the Ignace REE Lithium Property in Ontario, Canada.

On June 30, Wealth Minerals announced: “Correction: Wealth closes strategic investment for a total of $3,037,000…”

Investors can view the company’s latest presentation here.

E3 Lithium Ltd. [TSXV:ETL] [FSE:OU7A] (OTCQX:EEMMF) (Formerly E3 Metals)

E3 Lithium Ltd. is a lithium development company focused on commercializing its extraction technology and advancing the world’s 7th largest lithium resource with operations in Alberta. E3 has an inferred mineral resource of 6.7 million LCE.

On June 24, E3 Lithium Ltd. announced:

E3 Lithium begins drilling first lithium evaluation well in Alberta… The well will be completed in E3’s Clearwater Project area, east of the Town of Olds, Alberta. Drilling operations are expected to be completed by mid-July. Following drilling, a service rig will be moved onsite to commence testing of the formation to verify brine chemistry and flow rates.

On June 29, E3 Lithium Ltd. announced: “E3’s lithium used to produce lithium metal battery.”

On July 4, E3 Lithium Ltd. announced:

E3 Metals Corp. changes name to E3 Lithium Ltd… The Company’s common shares will trade on the TSX Venture Exchange under the name and under the new trading symbol “ETL”. The Company’s common shares will trade on Frankfurt Stock Exchange under the same trading symbol “OU7A” and on the OTCQX under the same trading symbol “EEMMF”.

On July 8, E3 Lithium Ltd. announced: “E3 Lithium commences trading under new symbol “ETL”.”

On July 8, E3 Lithium Ltd. announced: “E3 Lithium receives TSXV approval and closes agreement with Imperial Oil. E3 LITHIUM LTD…”

On July 11, E3 Lithium Ltd. announced:

E3 Lithium outlines 23.4 Mt LCE Inferred Mineral Resource in consolidated Bashaw District… The Bashaw District combines and expands the Clearwater Resource and Exshaw Resource areas into a consolidated resource that contains an estimated total of 59 billion m3 (59 km3) of brine formation water at an average grade of 74.5 milligram/Litre (mg/L) lithium (Figure 1).

On July 20, E3 Lithium Ltd. announced: “E3 Lithium finishes drilling its first well; completion and sampling program to begin…”

You can read the company’s latest presentation here.

Iconic Minerals [TSXV:ICM] [FSE:YQGB] (OTCQB:BVTEF)/ Nevada Lithium Corp. [CSE: NVLH]

Joint Venture (Nevada Lithium Corp. earn in option to 50%) in the Bonnie Claire Project in Nevada, USA; with an Inferred Resource of 18.68 million tonnes LCE.

On July 21, Iconic Minerals announced:

Iconic completes first drill hole of 2022 at the Bonnie Claire Lithium Project… Iconic Minerals Ltd CEO, Richard Kern, comments: “Completion of our first core hole is a major milestone in the quest to move Bonnie Claire forward to a feasibility study and beyond. Core allows us to determine detailed geology as well as gather the geo-technical parameters to be used in designing borehole testing. I believe this program will further prove the enormous potential of the project.”

Arena Minerals [TSXV:AN] (OTCQX:AMRZF)

On June 24, Arena Minerals announced:

Arena Minerals applies for trading on the OTCQX, provides additional information on investor relations agreements…

On June 27, Arena Minerals announced: “Arena Minerals produces 35% lithium chloride in pilot testing at Sal de la Puna Project.”

Rio Tinto [ASX:RIO] [LN:RIO] (RIO)

On July 15, Rio Tinto announced: “Rio Tinto releases second quarter production results.” Highlights include:

- “At the Jadar lithium-borate project in Serbia, we are continuing to explore all options. We acknowledge the concerns from local communities and are engaging meaningfully to explore ways to address them.

- The acquisition of the Rincon lithium project in Argentina was completed at the end of March 2022, and integration is well underway. We are undertaking engagement with communities, the province of Salta and the Government of Argentina to ensure an open and transparent dialogue with stakeholders about the work planned, including possible pathways for a smaller start-up to accelerate market entry. Detailed studies are progressing.

On July 21, Rio Tinto announced:

Rio Tinto and Ford sign MOU for battery and low carbon materials supply to support net-zero future. Rio Tinto and Ford Motor Company have signed a non-binding global memorandum of understanding [MOU] to jointly develop more sustainable and secure supply chains for battery and low-carbon materials to be used in Ford vehicles. The multi-materials partnership will support the transition toward a net-zero future by supplying Ford, one of the world’s largest automakers, with materials including lithium, low-carbon aluminium and copper… Under the agreement, Ford will explore becoming the foundation customer for Rio Tinto’s Rincon lithium project in Argentina. Rio Tinto is currently progressing detailed planning to bring Rincon into production and will work with Ford toward a significant lithium off-take agreement to support its production of electric vehicles.

Lithium South Development Corp. [TSXV:LIS] (OTCQB:LISMF)

On July 7, Lithium South Development Corp. announced:

Evaporation test work underway at HMN Li Project… We are pleased to announce the results of the test work to date aiming to demonstrate the possibility of producing battery grade lithium carbonate. Accordingly, a representative Hombre Muerto North salar brine sample of 7,359 L (8.874 t) containing 874 mg/L Li+ was subjected to pre-concentration by evaporation at the site. About 92% of the lithium was recovered in 600 L (744 kg) preconcentrated brine assaying about 6.8 g/L Li+. Subsequent liming followed by concentration-evaporation yielded about 60 L of brine (80 kg) assaying 32.7 g/L Li+. The overall lithium recovery was 60% compared to 51% recovery predicted in the 2019 NI 43-101 Technical Report… The next step in the process test work will be to advance the concentration process aiming for 6% Li in the final brine, rendering it potentially suitable for the production of Lithium Chloride, a marketable commodity…

Alpha Lithium [TSXV:ALLI][GR:2P62] (OTCPK:APHLF)

On June 28, Alpha Lithium announced:

Alpha Lithium completes drilling in Tolillar and initiates exploration at Hombre Muerto… Alpha is commencing a Vertical Electrical Sounding (“VES”) survey on its 100% owned, 5,000-hectare property in Hombre Muerto with the intention to complement and direct the Company’s upcoming drilling program. At Tolillar, the Company is pleased to provide an update on VES, drilling and the scheduled completion of an inaugural NI 43-101 Resource Report. The Company currently has $44 million in cash; and accordingly, is extremely well-funded to continue its drilling and exploration activities.

On July 19, Alpha Lithium announced:

Alpha Lithium advances towards 40,000 tonne per year lithium carbonate plant in Argentina. Company initiates detailed engineering for pilot plant & opens PEA bids for large scale plant…

International Lithium Corp. [TSXV:ILC] (OTCPK:ILHMF)

No news for the month.

Lithium Energy Limited [ASX:LEL]

No news for the month.

Argentina Lithium & Energy Corp. [TSXV: LIT] (OTCQB: OTCQB:PNXLF)

On July 13, Argentina Lithium & Energy Corp. announced:

Argentina Lithium discovers positive lithium results in initial drilling at Rincon West… and reports positive lithium analyses from brine samples collected over a 70 metre thick permeable interval with lithium grades ranging from 225 to 380 mg/litre…

On July 21, Argentina Lithium & Energy Corp. announced:

Argentina Lithium expands salt flat holdings at Salar de Rincon. Argentina Lithium & Energy Corp… is pleased to announce that it has won the public tender to purchase 100% interest of the Rinconcita II mining concession area… located on the Salar de Rincon in Salta Province, Argentina… The Property consists of 460.5 ha of salt flat, located adjacent to and east of Argentina Lithium’s Rincon West property, and located adjacent to and west of Rincon Mining’s Rincon Project, which was purchased by Rio Tinto earlier this year.

Avalon Advanced Materials [TSX:AVL] [GR:OU5] (OTCQX:AVLNF)

Avalon has three projects in Ontario, Canada, and five in total throughout Canada. Avalon’s most advanced project is the Separation Rapids Lithium Project in Ontario with a M& I Resource estimate of the 8.2MT at 1.37% Li2O and 0.36% Rb2O plus Inferred 1.2MT at 1.33% Li2O and 0.361% Rb2O. Avalon is working on a plan for a JV to build a lithium-ion battery materials refinery in Thunder Bay, Ontario.

No news for the month.

Essential Metals [ASX:ESS] (OTCPK:PIONF)

Essential Metals has 9 projects (lithium, gold, gold JV, and nickel JV) all in Western Australia. Their flagship Pioneer Dome Lithium (spodumene) Project has a JORC Compliant Total Resource of 11.2Mt at 1.21% Li2O.

On July 14, Essential Metals announced: “Pioneer Dome Lithium Project–Resource extension drilling, metallurgical test work and Mining Lease Application underway. Current activities expected to pave the way for an updated Mineral Resource and Scoping Study in the December 2022 quarter.” Highlights include:

- “Cade Deeps drilling: Three holes completed ~120–130m below the Cade Mineral Resource, suggesting that a southerly plunge could be present instead of the previously interpreted northerly plunge. Thick pegmatite intersections up to 25m in true width were observed in two holes with a ~1m interval of visual spodumene observed in one hole. All pegmatite drill core will be submitted for lithium assays. The programme is expected to be completed by mid–August.

- Metallurgical test work: Three composite samples are currently being processed at Nagrom Laboratories…..

- An application for a Mining Lease to encompass the Dome North Mineral Resources is being prepared and is expected to be lodged by end–August. The regulatory process will likely take 6–9 months.”

Green Technology Metals [ASX: GT1]

Green Technology Metals [ASX:GT1] (“GT1”) has several very promising lithium projects near Thunder Bay in Ontario, Canada. The current JORC Total Mineral Resource is 4.8Mt @ 1.25% with a project’s (spodumene) wide target resource of 50-60 MT @ 0.8-1.5% Li2O.

On July 8, Green Technology Metals announced: “Further step-out success at Seymour.” Highlights include:

- “Diamond drilling recommenced at the North Aubry deposit (Seymour Lithium Project) in June.

- First completed hole (GTDD-22-0323) returned 17.9m spodumene bearing pegmatite from 218m; assays pending.

- Intersection considerably thicker than modelled and potentially significantly increases the mineralised volumes in this targeted strike extension of North Aubry.

- Second completed hole (GTDD-22-0128), down-dip of GTDD-22-0323; returned 18.6m spodumene bearing pegmatite from 312m, plus a further 6.41m pegmatite interval 60m above main zone.

- Additional step-out drilling at North Aubry set to target further northerly strike extension, along with accompanying down-dip extensional opportunities.

- Next planned drillhole at North Aubry sited approximately 100m north-west of GTDD-22-0323.

- Diamond drilling of key targets at Pye prospect (Seymour) is expected to recommence next week.“

On July 19, Green Technology Metals announced: “Baseline environmental studies continue at Seymour.”

Battery recycling, lithium processing and new cathode technologies

Rock Tech Lithium [CVE:RCK](OTCQX:RCKTF)

On June 28, Rock Tech Lithium announced:

Rock Tech Lithium and Transamine to cooperate on lithium supply… With their established expertise, Transamine would represent an ideal partner for Rock Tech in sourcing the raw material needed for our lithium hydroxide converters…

On July 7, Rock Tech Lithium announced:

Rock Tech wins thyssenkrupp Materials Trading as potential supplier of raw materials and customer for its lithium hydroxide…

On July 13, Rock Tech Lithium announced:

Rock Tech Lithium signs framework agreement with a globally operating car producer based in Germany. Markus Brügmann, CEO of Rock Tech Lithium stated, “We are very pleased to have found a renowned partner to advance the topic of e-mobility. We expect to commence production of lithium hydroxide in Guben, Brandenburg, where we are building Europe’s first lithium hydroxide converter. The start of production is planned for 2024.”

Neometals (OTC:RRSSF) (RDRUY) [ASX:NMT]

On July 13, Neometals announced: “Cooperation agreement with Mercedes-Benz now legally binding.”

On July 14, Neometals announced: “Lithium-ion battery recycling update.” Highlights include:

- “Primobius’ Engineering and Cost Study for a 50tpd lithium-ion battery shredding ‘Spoke’ expected end of July 2022 and refinery ‘Hub’ study in DecQ 2022.

- Cost study delays due to Primobius’ focus on ramp-up of its Hilchenbach Spoke operation and engineering obligations associated with the Mercedes/LICULAR and Stelco agreements.

- Completion of front-end engineering will precede the offer of equipment supply agreements for both 10tpd Mercedes/LICULAR and 50tpd Stelco Spokes in December 2022.“

Nano One Materials (TSX: NANO) (OTCPK:NNOMF)

No significant news for the month.

Other lithium juniors

Other juniors include: 5E Advanced Materials Inc. [ASX:5EA] (FEAM), American Lithium Minerals Inc. (OTCPK:AMLM), Anson Resources [ASX:ASN] [GR:9MY], Ardiden [ASX:ADV], Arizona Lithium [ASX:AZL] (OTCQB:AZLAF), Atlantic Lithium [LON:ALL] (OTCQX:ALLIF), Bradda Head Lithium Limited [LON:BHL] (OTCQB:BHLIF), Bryah Resources Ltd. [ASX:BYH], Carnaby Resources Ltd. [ASX:CNB], Critical Resources [ASX:CRR], Electric Royalties [TSXV:ELEC], Eramet [FR: ERA] (OTCPK:ERMAF) (OTCPK:ERMAY), European Lithium Ltd. [ASX:EUR] (OTCQB:EULIF), Foremost Lithium Resources & Technology [CSE:FAT] (OTCPK:FRRSF), Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF), HeliosX Lithium & Technologies Corp. [TSXV:HX] (formerly Dajin Lithium Corp. [TSXV:DJI]), Hannans Ltd [ASX:HNR], Infinity Lithium [ASX:INF], International Battery Metals [CSE: IBAT] (OTCPK:IBATF), Ion Energy [TSXV:ION], Jadar Resources Limited [ASX:JDR], Jourdan Resources [TSXV:JOR] (OTCQB:JORFF), Kodal Minerals (LSE-AIM: KOD), Larvotto Resources [ASX:LRV], Latin Resources Ltd [ASX:LRS] (OTC:LAXXF), Lepidico [ASX:LPD] (OTCPK:LPDNF), Liberty One Lithium Corp. [TSXV:LBY] (OTCPK:LRTTF), Lithium Australia [ASX:LIT] (OTC:LMMFF), Lithium Chile Inc. [TSXV:LITH][GR:KC3] (OTCPK:LTMCF), Lithium Corp. (OTCQB:LTUM), Lithium Energi Exploration Inc. [TSXV:LEXI](OTCPK:LXENF), Lithium Ionic Corp. [TSXV:LTH], Lithium Plus Minerals [ASX:LPM], Metals Australia [ASX:MLS], MetalsTech [ASX:MTC], MinRex Resources [ASX:MRR], MGX Minerals [CSE:XMG] (OTC:MGXMF), New Age Metals [TSXV:NAM] (OTCQB:NMTLF), Noram Lithium Corp. [TSXV:NRM] (OTCQB:NRVTF), One World Lithium [CSE:OWLI] (OTC:OWRDF), Patriot Battery Metals [TSXV:PMET] (OTCQB:PMETF), Portofino Resources Inc.[TSXV:POR] [GR:POT], Power Metals Corp. [TSXV:PWM] (OTCQB:PWRMF), Prospect Resources [ASX:PSC], Pure Energy Minerals [TSXV:PE] (OTCQB:PEMIF), QMC Quantum Minerals Corp. [TSXV:QMC] (OTCPK:QMCQF), Snow Lake Lithium (LITM), Spearmint Resources Inc. [CSE:SPMT] (OTCPK:SPMTF), Surge Battery Metals Inc. [TSXV:NILI] (OTCPK:NILIF), Tantalex Lithium Resources [CSE:TTX], [FSE:1T0], Ultra Lithium Inc. [TSXV:ULI] (OTCQB:ULTXF), United Lithium Corp. [CSE:ULTH] [FWB:0UL] (OTCPK:ULTHF), Vision Lithium Inc. [TSXV:VLI] (OTCQB:ABEPF), Winsome Resources Limited [ASX:WR1], Xantippe Resources [ASX:XTC], Zinnwald Lithium [LN:ZNWD].

Conclusion

July saw lithium chemicals prices flat and spodumene prices slightly higher.

Highlights for the month were:

- Sayona and Piedmont formally approve NAL restart, set for Q1, 2023.

- Liontown Resources executes Binding Offtake Agreement and A$300m debt facility with Ford. The Kathleen Valley Lithium Project is now fully-funded with first production of spodumene concentrate scheduled for Q2 2024.

- Britishvolt signs deal with POSCO Chemical for battery materials. POSCO Holdings will invest about 6 trillion won in the lithium business by 2030.

- Leo Lithium completes US$40 million debt facility with Ganfeng for the Goulamina Lithium Project.

- Global Lithium Resources: Manna drilling intercepts significant lithium bearing pegmatites.

- Savannah Resources receives feedback on its Environmental Impact Assessment for the Barroso Lithium Project.

- ioneer commences trading on NASDAQ, signs binding off-take agreement with Ford.

- FRONTIER INTERSECTS 144 M OF HIGH GRADE LITHIUM AVERAGING 1.72% Li2O.

- Lithium Power International becomes largest tenement holder in Greenbushes region & buys holding in Eastern Goldfields.

- E3 Lithium closes agreement with Imperial Oil. Outlines 23.4 Mt LCE (at 74.5mg/L) Inferred Mineral Resource in consolidated Bashaw District.

- Iconic Minerals completes first drill hole of 2022 at the Bonnie Claire Lithium Project.

- Arena Minerals produces 35% lithium chloride in pilot testing at Sal de la Puna Project.

- Rio Tinto and Ford sign MOU for battery and low carbon materials including lithium, low-carbon aluminium and copper.

- Lithium South achieves solid evaporation test results at HMN Li Project.

- Alpha Lithium initiates detailed engineering for pilot plant & opens PEA bids for large scale plant, in Argentina.

- Argentina Lithium expands salt flat holdings at Salar de Rincon.

- Green Technology Metals achieves further step-out success at Seymour.

As usual all comments are welcome.

Be the first to comment