JHVEPhoto

Royal Bank of Canada (NYSE:RY) delivered another strong set of results at the half year mark – earnings topped analyst estimates in Q2 as net interest income benefited from strong lending growth and a resilient economic outlook enabled the bank to release more of its COVID-19 loan loss provisions.

There were some unhelpful trends, though. Inflationary pressures and a competitive hiring environment are beginning to erode RBC’s cost-cutting efforts. At the same time, aggressive monetary policy tightening is starting to reduce client activity in capital markets and cool mortgage demand.

RBC has weathered challenging business environments before, and is well-placed to get through these headwinds as well. What makes this financial institution so special is its leading market position, healthy balance sheet, and diversified business model. This enables it to earn market-beating returns and gives it a wide economic moat which provides a degree of resilience in an otherwise volatile and cyclical sector.

Canada’s Housing Market

Looking ahead, the slowdown in the mortgage market is expected to continue as the Canadian housing market continues to cool. The number of home sales declined significantly in the second quarter of 2022, and home prices have been on a downward trajectory since April.

Price gains made over the last few years have not been sustainable and a correction in the housing market has long been overdue. Canada has one of the world’s least affordable housing markets, with the average residential property having more than tripled in value since 2005, according to data from The Canadian Real Estate Association. This included a 52% price appreciation between the start of 2020 and March 2022, as pandemic-era low interest rates, short supply and demand for bigger properties that are more suitable for home working pushed residential real estate prices to new records.

However, we should not draw too many comparisons with what is going on in Canada and the 2008 housing market crash in the U.S. Although household debt relative to disposable incomes in Canada is higher than in the U.S. during the run-up to the 2008 crash, the fundamentals are very different.

In Canada, the subprime market is much smaller, non-recourse mortgages are rare, interest on mortgage payments is not tax-deductible and the regulator imposes strict affordability tests. These characteristics should encourage greater financial stability. Additionally, macroeconomic conditions remain robust, with the unemployment rate at historic lows. GDP in Q2 also grew more than expected, at an annualized rate of 4.6%.

Falling Home Prices

Still, property prices could have further to fall as monetary policy is being tightened at a faster pace than previously expected. Analysts from Desjardins reckon that this could drive home prices to fall by between 20-25% from its peak to the end of 2023. That would represent the biggest decline in valuations for more than two decades. That being said, even at the high end of those estimates, home prices will nonetheless remain some way above pre-pandemic levels.

Yet, Canada’s housing market could defy these expectations, and prices could begin to stabilize earlier than expected. It certainly would not be the first time analysts were proven wrong on the timing of the housing market crash. What’s more, demand-supply conditions are still tight and immigration levels are rising.

We are also seeing the declines in sales getting smaller. National home sales fell by 5.6% on a month-over-month basis between May and June, while prices are down 3.3% from their peak on a seasonally adjusted basis. And almost paradoxically, rental rates continue to rise, with average rents up 2.6% between June and July.

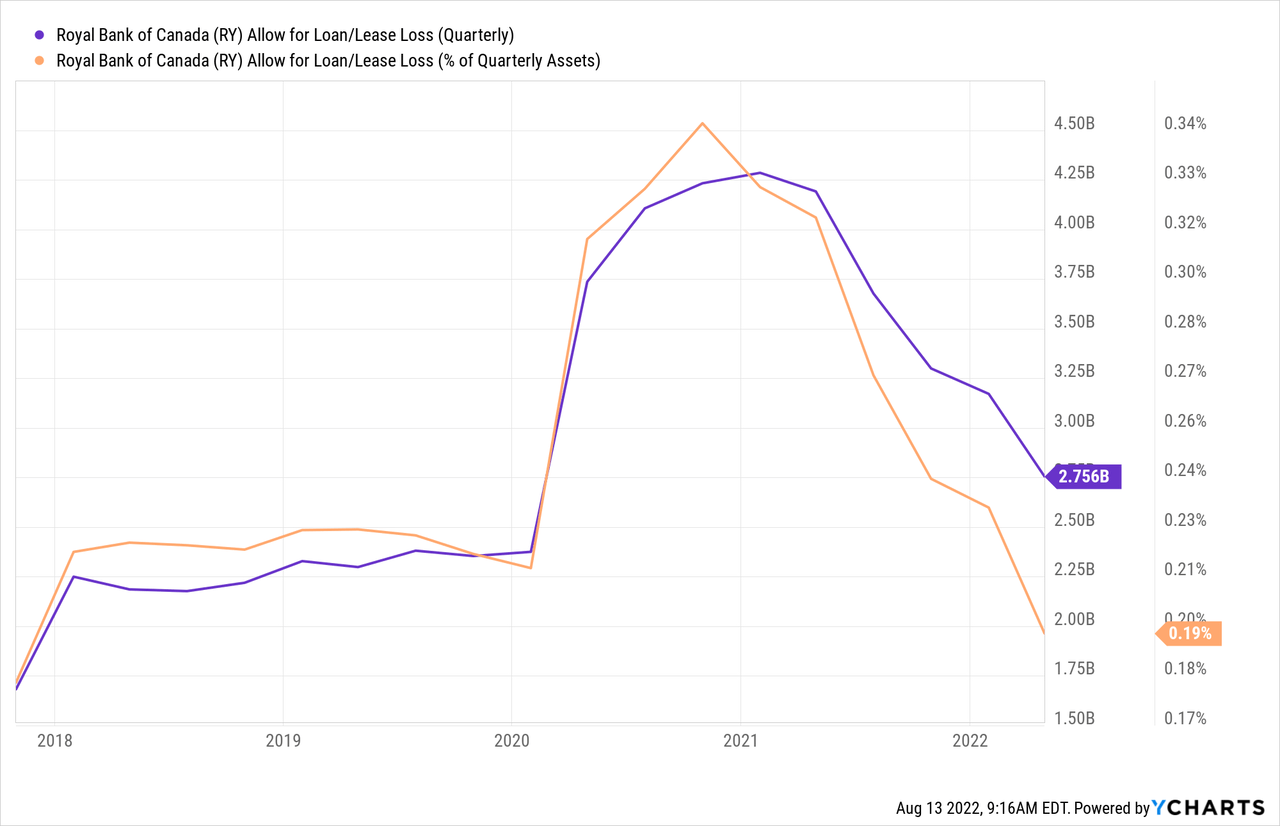

Royal Bank of Canada’s Credit Quality

RBC’s strong credit quality should help it to avoid a sharp rise in loan loss provisions as the correction in the housing market continues.

Although Canadian residential mortgage lending represents nearly half of its loan book, credit risks are mitigated by its conservative underwriting and strict mortgage affordability (B-20) stress tests, which were made mandatory by the country’s banking regulator in 2018.

RBC, in particular, takes a disciplined approach by targeting lending to borrowers with a higher credit score and modest loan-to-value ratios; new mortgage customers have an average FICO score of 761, an average LTV ratio of 71% and an amortization period of 25 years. Meanwhile, the average FICO score in the residential mortgage portfolio is 803, with a low average LTV ratio of 47%.

Nevertheless, the bank set aside a further C$233 million (~$180 million) in provisions during Q2 to cover emerging risks, including rising inflation, tighter monetary policy and heightened geopolitical uncertainty. This was, however, more than offset by a release of the majority of its remaining COVID-related loan reserves on performing loans, which gave it a net provision release of C$342 million (~$260 million) for the quarter.

If things do indeed turn out to be worse than expected, RBC’s healthy capital generation and its excess capital position should help it to absorb an unanticipated rise in credit costs. The bank has a 5-year average return on equity of above 16% and a common equity Tier 1 (CET1) capital ratio of 13.2% – both putting it at the top end of its peer group.

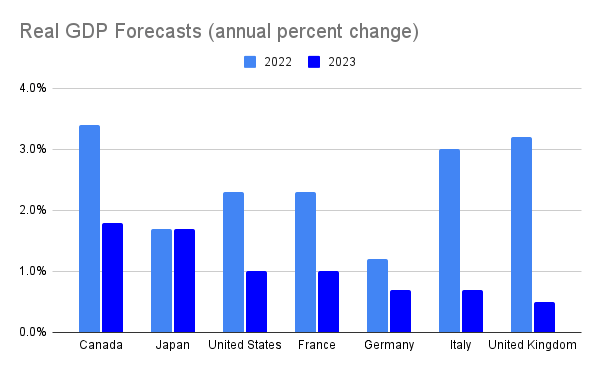

GDP Growth Forecasts

Importantly, housing market pressures will be partly offset by Canada’s resilient economy. The latest IMF estimates show Canada is expected to be the fastest growing G7 country over the next two years, with real GDP growth of 3.4% and 1.8% in 2022 and 2023, respectively.

Forecasts from the IMF World Economic Outlook, July 2022 Update

Against this backdrop, low unemployment and steady wage growth should maintain continued high levels of mortgage affordability and keep default rates low.

A strong economy also means that the slowdown in mortgage lending will be partly offset by ongoing strength in other categories of lending, as well as healthy client activity levels in investment banking.

RBC, which has more diversified sources of revenues than its smaller Canadian peers, with greater exposure to commercial banking, capital markets and wealth management, is particularly well-placed to benefit as tailwinds shift away from the mortgage market.

Fee income accounts for roughly 60% of its total revenues, with much of that coming from wealth management, insurance and investment banking.

Credit card utilization and revolve rates continue to show good momentum. There is room for more improvement too, as credit card balances remain below pre-pandemic levels, due to high levels of savings that had been built up during lockdowns.

“Recovery to pre-pandemic commercial utilization and card payment rates from current levels will not only add to Canadian Banking loan balances but also drive further margin expansion, potentially adding nearly $200 million of additional revenue over time.”

Chief Executive Officer David McKay, RBC Q2 Earnings Call

Rising Rates

Rising interest rates is another key driver for earnings growth. “A 100 basis point parallel shift is expected to provide a C$1.1 billion (~$860 million) benefit to net interest income in the first year, rising to approximately C$1.8 billion (~$1.4 billion) in year 2,” said CFO Nadine Ahr in the earnings conference call. Furthermore, the flattening of the yield curve could also add another C$260 million (~$200 million) to its bottom line, as that would help margins in the repo business and in wealth management.

Combined, these factors should deliver a decent boost to revenues from Q3 onwards, and likely more than offset the negative impacts of monetary tightening on activity levels in capital markets and the mortgage market.

The revenue uplift will also ease the impact of headwinds on the cost front, which are being driven by inflationary pressures, higher wages and increases in technology and marketing spending. RBC has so far maintained good cost discipline – expenses in Q2 were up just 1% year-over-year. However, as market-sensitive revenues decreased, the bank did benefit from lower variable and share-based compensation, which if excluded would have seen controllable costs up 7% in the quarter.

Things could get tougher in the future, as inflationary pressures, particularly wage growth, do not appear to have peaked. The bank expects to see annual controllable costs to grow at the higher end of the low single-digit range for the full 2022 fiscal year.

RBC Dividend Growth

Demonstrating management’s confidence in its earnings outlook, RBC announced a bigger than expected increase in its dividends. The quarterly dividend per share from July onwards will be C$1.28 (~$0.99), following an C$0.08 increase, representing dividend growth of 7%.

Looking ahead, there’s more room for the dividend to grow. The payout ratio sat at just 40% in Q2 – placing it at the bottom of its 40-50% medium-term target. RBC also bought back C$1.9 billion (~$1.5 billion) worth of its shares, which combined with the dividends, brought its total payout ratio to 86%.

Even as RBC returns an overwhelming majority of its capital generation to shareholders via buyback and dividends, RBC remains on the lookout for inorganic opportunities. Earlier this year, it announced plans to buy Brewin Dolphin for £1.6 billion (~$1.9 billion) in an effort to grow its wealth business and expand its footprint in the UK.

Final Thoughts

Royal Bank of Canada has demonstrated its resilience through a number of difficult challenges – including the 2007/8 financial crisis, COVID-19 and the ultra-low interest rate environment. The bank has bounced back stronger each time, although a tougher test could yet lie ahead of it – namely a housing market correction.

Luckily then, there are a few tailwinds to help it through this uncertain future, including rising net interest margins, a flattening yield curve and a buoyant Canadian economy. The benefits of the bank’s wide moat, robust credit quality and diverse revenues sources are also still very much intact – and differentiate RBC from the crowd.

Put together and it means Royal Bank of Canada has the potential to outperform against banking peers in and outside of Canada.

Be the first to comment