DNY59

About a month ago, I talked about the crash in shares of artificial intelligence lending marketplace Upstart Holdings (NASDAQ:UPST). The stock dropped after the company announced preliminary Q2 revenue results that were quite horrible, sending shares close to their 52-week low. After the bell on Monday, the company announced its full quarterly results, and it turns out things are even worse than many thought just a few weeks ago.

For the second quarter of 2022, revenues came in as management previously guided to with its warning at $228 million. This was 18% growth over the prior year period, ending a four-quarter streak of more than 150% growth. Q2 2021 was the peak in revenue growth at more than 1,000%, so on one hand it’s actually impressive that the company was still able to grow after that huge increase. Of course, when management guided to around $300 million in Q2, analysts were looking for $335 million, so the end result was rather poor.

With revenues suddenly falling short of expectations, management was unable to cut expenses in a timely manner. Thus, the company swung from a profit of nearly $37.3 million in the year ago period to an almost $29.9 million loss in the June 2022 period. Even on an adjusted basis, the company only managed a one cent profit per share, well short of the street’s expectation for $0.08. I will admit here that not all analysts had adjusted their numbers since the July warning. The average revenue estimate was still about $7 million above what the company gave for its warning, but the bottom line result still likely would have missed anyway.

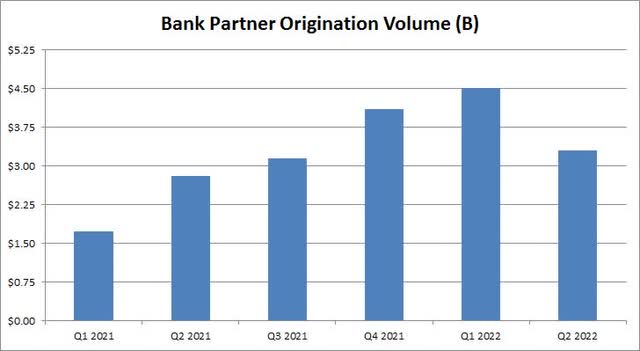

As I mentioned in my previous article, the company stated that its lending marketplace has become funding constrained recently, with participants concerned about macroeconomic factors. Rising interest rates have pressured consumers a bit, and thus the company also had to sell some loans in the period to raise cash. As the graphic below shows, bank partner origination volume fell sequentially in Q2 by more than a billion dollars, almost erasing the prior two quarters of meaningful growth.

Bank Partner Origination Volume (Company Filings)

I previously stated that management would need to take its yearly guidance down, but we didn’t get a full year forecast in the Q2 release. Management did, however, guide to revenues of $170 million for the current quarter. That figure was much worse than the more than $246 million the street was looking for. Analysts were expecting things to improve sequentially on the top line in fiscal Q3, but Upstart is guiding for things to get much worse.

Adjusted EBITDA guidance is calling for the company to break even in the September quarter, while expectations were calling for a nearly $30 million profit for this key metric. Management is also guiding for sequential declines in both net income and adjusted net income, which is primarily a result of the massive revenue drop. I’ll be curious to see if share repurchases continue, after the company spent over $125 million in Q2 to buy back shares at an average price of more than $35 a share.

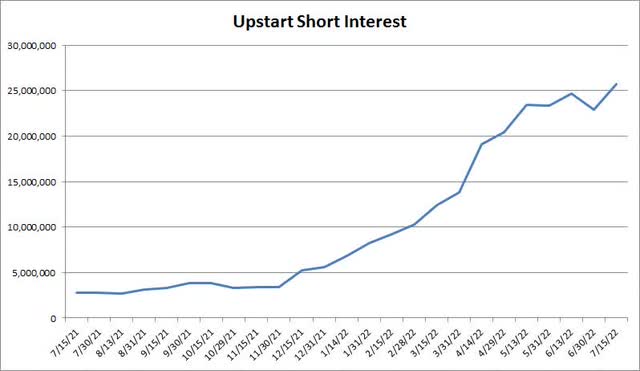

One of the key hopes of the bull camp was that good results could lead to a massive short squeeze. As I mentioned back in early July, this is a heavily shorted stock, with more than 24.7 million of the company’s roughly 85 million shares outstanding being short. It turns out that over the past month, bears added another million shares plus to their negative bet total, meaning total short interest is up over 837% in the past year as seen below.

Upstart Short Interest (NASDAQ)

As one might expect, analysts have been slashing their price targets over time as the stock has plunged and results have fallen short of expectations. What once was an average target over $300 was down to just $45 when I wrote my previous article. That number came down to $31.29 as of Monday thanks to the massive Q2 warning, but I expect we’ll see further target cuts with this very weak guidance for the current period. Upstart shares had been rallying a bit lately, but a 10% fall in the after-hours session put them back at $29. As a reminder, the 52-week range goes from just $22.42 to over $401 a share, so it will be interesting to see if we see a new low in the coming weeks.

In the end, Upstart announced its full second quarter results, and things are even worse than previously expected. The company swung to a large Q2 loss, and origination volumes dipped significantly on a sequential basis. While there were hopes for a revenue rebound in Q3, management guided to a dramatic drop to just $170 million, more than $76 million below analyst estimates. The stock is already more than 90% off its 52-week high, but more losses wouldn’t be surprising until this business can get on some solid footing.

Be the first to comment