Ian Tuttle

Introduction

Since the beginning of 2022, Roblox Corporation (NASDAQ: RBLX) has declined 51.46% as a result of the economy worsening and investors overreacting to decreased growth in bookings value. However, I believe the company still has excellent fundamentals but needs to go down further to constitute a sound investment.

Company Overview

Roblox is an online gaming platform where anyone can create games for others to play. Its leading source of revenue is from Robux, their in-game currency, making up 49% of its revenue, with most of the remaining revenue coming from advertisements and licensing deals. Its video game offerings are attractive as it’s free of charge and appeal especially to children. In fact, it’s reported that over half of children in the US play Roblox.

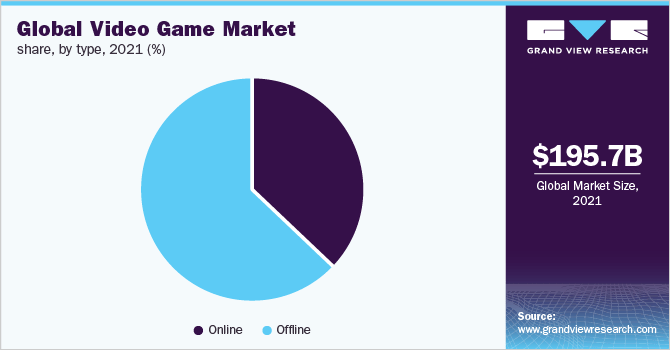

According to Grandview Research, the Video Game market is valued at around $195 billion with an attractive 12.9% 8-year CAGR. Roblox holds a market cap of $28.81 billion, representing a 15% market share.

Grandview Research

Q1 2022

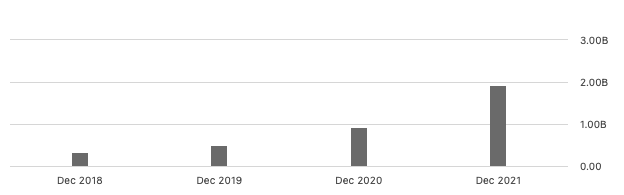

Even though some investors are disappointed with the recent results, Roblox’s Q1 2022 results still reflect the company’s status as a high-growth company. Revenue has increased 29% YoY to $537.1 million with forecasts in the 30%-32% range for the remainder of 2022.

Seeking Alpha

Sound Fundamentals

The gaming industry has recently experienced a decline in both sales and active players. A report from NPD Group found that video game spending has dropped 13% YoY and gaming giants like Activision Blizzard saw their monthly active users drop by over 14.5%. Roblox was not immune to this slowdown, as booking fell 3% YoY.

However, in the same period, Roblox grew its daily active users (DAU) by 28% YoY which broke company records. Furthermore, management still expects an 18% increase in engagement for the rest of the year. Roblox’s resilience in the face of changing behavioral trends by gamers makes a strong case for the value of the platform and the loyalty of its users.

Although some investors are jumping off the metaverse hype train, there is no doubt that Roblox will be an important player in the gaming industry. Traditional gaming conglomerates have been slow in developing their metaverses, while Roblox holds a large edge in the gaming metaverse because of their well-developed platform-which has integrated digital avatars and in-game currencies. Furthermore, Roblox continuously provides players with new experiences and has over 9.5 million users who also serve as developers of new Roblox worlds.

Risk

Going into Q2 earnings, Roblox could see a further decline in growth as post-pandemic behavioral shifts materialize on their income statement. On a broader scope, Roblox experiences regulatory risks because its platform is marketed toward children. There have been controversies recently related to the lack of moderation on the platform, with concerns regarding mature content on the platform as well as child safety.

Valuation

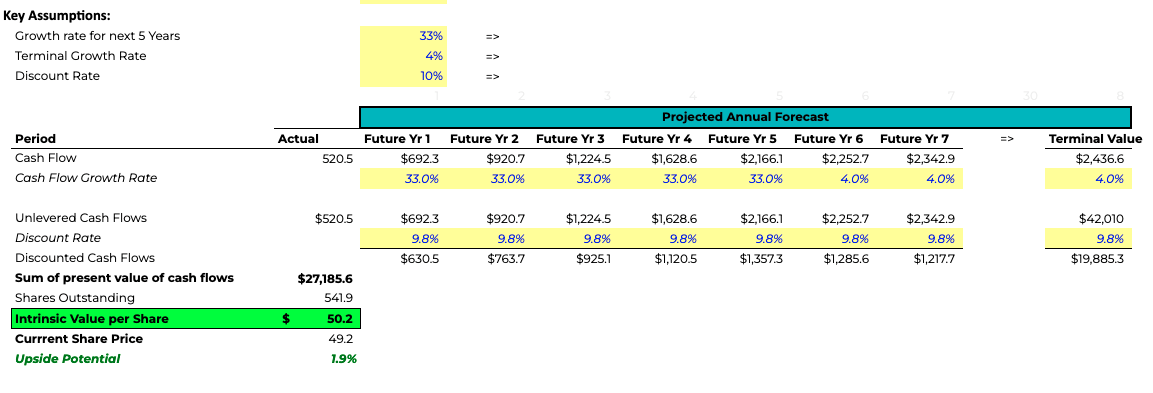

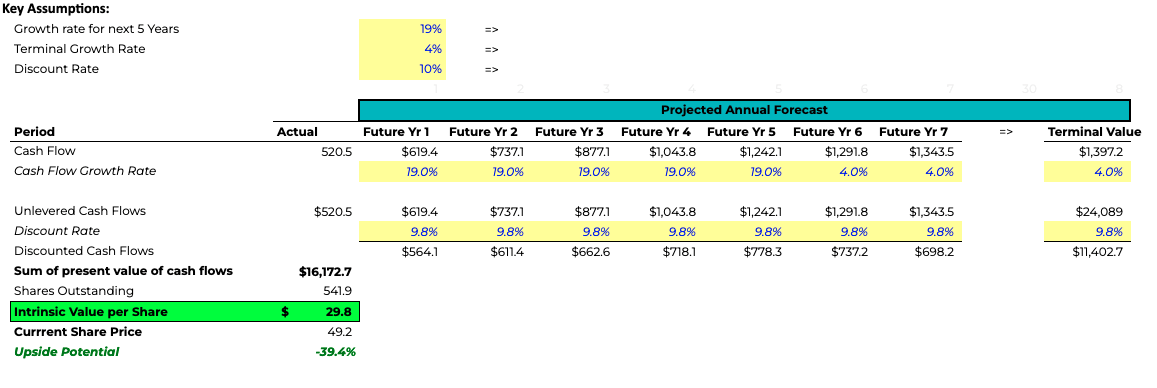

Though the company’s fundamentals are strong, Roblox’s valuation has become too high to justify a buy recommendation. On the high end of my valuation (with a discount rate of 9.8% and terminal growth rate of 4%), Roblox needs to grow at a CAGR of 33% to justify its current share price.

Google Sheets

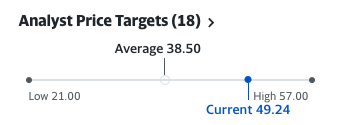

Furthermore, my valuation is supported by 18 analysts from Yahoo Finance, with average ratings at $38.50 and upside limited to $57.00 (which is just 15% from its current prices).

Yahoo Finance

Even if I believe in Roblox’s growth prospects, it lacks a sufficient margin of safety. As recession fears and fed interest hikes stir the opinions of investors back and forth, we might find Roblox at a much more attractive price later in the year.

Google Sheets

It should be noted that Roblox becomes a much more attractive investment in the $30s range with CAGRs in the ~20% range. At those price points, a margin of safety begins to build for investors to safely bet on Roblox’s future success.

Recommendation

Roblox’s fundamentals are very strong, with a sticky user base and platform structure that guarantees continuous new experiences for players. However, I believe there will be more attractive opportunities to purchase Roblox’s stock because of the uncertainties facing the economy.

Be the first to comment