Love Employee/iStock via Getty Images

Shares of budding ADC player Mersana Therapeutics (NASDAQ:MRSN) have risen by 168% over the past 3 years. So far in 2022, they have posted a gain of +21%.

I’ve been quite skeptical of this one over the past year, especially given possible safety signal for their lead ADC program (NaPi2b target) in the form of pneumonitis in 9 out of 145 patients including one Grade 5 event (death). This rate was much higher than predecessor lifastuzumab vedotin, which makes me wonder whether this specific issue is target related or rather specific to this particular ADC (thanks to JQ on Twitter).

Also, while the company has been operating since 2001, they have yet to approach pivotal or regulatory finish line for any product candidate in development.

On the pro side, much like my recent write-up on Sutro Biopharma, I’m a fan of management’s partnership & business development savvy including the decision to discontinue NaPi2b ADC in NSCLC (bar was too high) and partner HER2-targeting ADC with GlaxoSmithKline for $100M upfront (saves the company from burning cash in an area of high competition).

With market capitalization of $735M and $400M enterprise valuation, my initial take is that risk/reward profile remains attractive as lead ADC UpRi moves forward in 3 mid-to-late stage studies and phase 1 trial for B7-H4 Dolasynthen ADC gets underway (particular utility in breast, endometrial and ovarian cancers).

Let’s take a closer look to see what we uncover here.

Chart

Figure 1: MRSN weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares hit a high in the mid-twenties back in 2020. From there, they’ve steadily fallen to lows below $4 level before recently rebounding back above $7. My initial take is that share price appears to be extended and I would encourage readers to wait for a pullback below 50 day moving average before considering a pilot position.

Overview

My prior notes on the JP Morgan Healthcare Conference Webcast were helpful in getting sense of the bigger picture at Mersana:

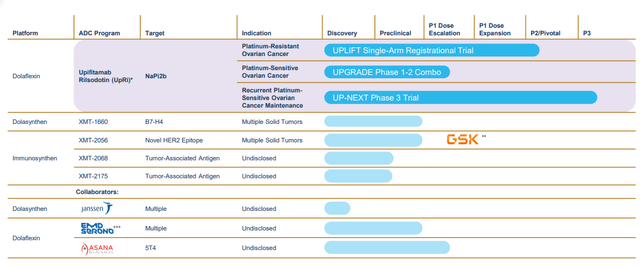

- CEO states that their lofty goal is to become a leading player in the ADC field. A key pillar to the strategy is advancing lead drug candidate upifitamab rilsodotin (UpRi) in multiple clinical studies across various indications within ovarian cancer (building it into a foundational therapy). The company has additional, highly intriguing shots on goal including HER utilizing the Immunosynthen platform and first-in-class B7-H4 ADC using the Dolaynthen platform technology. Management’s opinion is that the ADC field has not realized its full potential due to limited platform innovation and they seek to address limitations of Gen1 approaches, thereby advancing the field.

Figure 2: Pipeline (Source: corporate presentation)

- For example, both the Dolaflexin and Dolasynthen platforms achieve a controlled bystander effect (former allows for high drug to antibody ration, latter allows for precise, customized ratio). They aim to overcome longstanding issues in ADC development by increasing the therapeutic index (limiting cases of severe neutropenia, neuropathy and ocular toxicity). The Immunosynthen platform delivers targeted stimulation of innate immune system and STING agonist payload, with preclinical data showing a wide therapeutic index and strong efficacy signal.

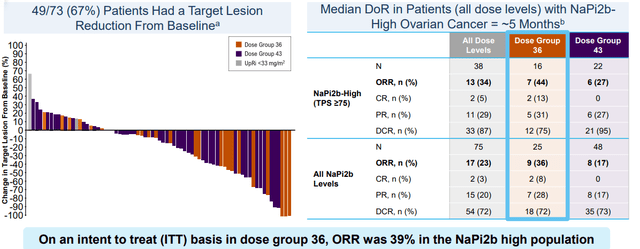

- Going back to lead ADC UpRi (targeting Napi2b), the target has limited expression in healthy tissue which makes it an ideal one for the ADC modality. Management’s excitement is based on data in over 200 patients, almost 100 of which came from the ovarian expansion cohort. Objective response rate of 34% in the 2/3rds of patients with sufficient expression including complete responses in late-stage platinum-resistant patients who exhausted both PARP inhibitors and bevacizumab was promising.

Figure 3: Promising activity for UpRi in heavily pretreated population (Source: corporate presentation)

- Consider that for context, current treatment for these patients is single agent chemo with 12% response rate and highly significant toxicities. UpRi has a differentiated safety profile with no neutropenia, neuropathy or ocular toxicity along with a diagnostic to select patients most likely to respond to treatment. They’ve selected the optimal, “go-forward” dose and we’re reminded that in terms of competition from PARP inhibitors, efficacy is limited to just the BRCA mutation patients and HRD+ (leaves substantial gap in platinum sensitive maintenance setting as well). Again, the ultimate goal is for UpRi to address both platinum-resistant and sensitive disease.

- For the UPLIFT registrational study in platinum-resistant patients, in terms of market opportunity consider that there are 14,000 deaths in the US annually. For these essentially terminal-stage patients, single agent chemo yields ORR of less than 12%, duration of response for less than 4 months and median overall survival less than 1 year, all with significant toxicities. Given the activity observed here with UpRi, they can enrich for NaPi2b high-expressors and management remains confident that a differentiated tolerability profile will translate into a successful readout and robust launch (I remain skeptical, however). They are enrolling the broadest group of platinum-resistant patients, much more so than predecessor studies in this area (more flexibility with prior lines of therapy, prior therapies and comorbidities). The pivotal study gives them 2 shots on goal with primary endpoint of confirmed overall response rate in NaPi2b high expressors or ORR in the overall population. Management stated that enrollment would complete in Q3.

- As for the platinum sensitive setting, 3 PARP inhibitors are approved for maintenance with $1 billion in combined US revenues and $2 billion worldwide. There is still significant unmet need as “watch and wait” is the recommended approach according to NCCN guidelines. The first group to pursue is patients who progress on PARP + bevacizumab (no standard of care here, as these agents are moving to earlier lines of therapy and this group of patients is becoming larger). The second group of patients is those who are poorly served by current maintenance agents (just do “watch and wait”). Third group of interest is patients achieving only stable disease (these are often excluded from PARP studies)- this growing group has emerging evidence showing platinum responsiveness decreases with prior PARP treatment (whereas UpRi is seeing complete responses in heavily pretreated patients). UPNEXT trial could serve as post approval confirmatory study in the US and global registration study. They will enroll patients who achieved CR, PR or stable disease immediately following platinum treatment whether its 2nd, 3rd or even 4th platinum treatment received. They are requiring all patients enrolled to be NaPi2b high. Prior PARP therapy is only required for BRCA patients. The trial (n=300) will be randomized 2:1 to placebo with PFS as primary endpoint, ORR and OS as secondary endpoint. UPGRADE study is evaluating platinum combination with paclitaxel which remains standard of care in ovarian cancer (patients receive it multiple times in disease until they become platinum resistant). It would be interesting if they can replace paclitaxel with UpRi to eliminate burdensome toxicities and this could also allow for longer treatment and better outcomes. Other agents cannot combine with platinum because of overlapping toxicities (particularly neutropenia and neuropathy). UPGRADE phase 1/2 study is combining UpRi with carboplatin for 6 cycles followed by UpRi single agent until progression (data could help chart the path forward to eventual frontline therapy). As for next generation Dolasynthen-derived NaPi2b ADC XMT-1592, I correctly predicted that this shot on goal for the crowded indication of lung cancer would be discontinued (a “data driven decision”, per management).

- Moving on to XMT-1660, this is a first-in-class ADC targeting B7-H4 which is broadly expressed and has limited healthy tissue expression. Indications of high expression include breast cancer, TNBC, HR+2 HER2- breast, endometrial and ovarian cancer. ImmunoSynthen pipeline focuses on XMT-2056 targeting HER2 with STING agonist payload. I’m glad they partnered this one given HER2 is such a crowded space and Daiichi’s Enhertu data in HER2 low patients is making it even more competitive. An ADC approach to STING activation allows for targeted stimulation in tumor and in the tumor microenvironment, which could be superior to previous approaches such as systemic delivery or intra-tumoral injection. It’s differentiated from toll like receptor-based ADCs, as STING expressed and can be activated in both tumor cells and tumor resident immune cells providing a one-two punch with better efficacy. They evaluated multiple targets and chose 2056 first. It’s shown robust, target-dependent anti-tumor responses in vivo and ex vivo models. It’s well tolerated in non-human primates at doses and exposures well above those resulting in complete regression in vivo models. Thus, there’s potential for a wide therapeutic index. While it is targeting HER2, they deliberately selected a proprietary antibody targeting a novel epitope of HER2 with differentiated binding versus pertuzumab or trastuzumab. This allows for single agent activity and broad combinability. Excellent in vivo efficacy was observed in combination with trastuzumab, and it’s also highly combinable with all standard of care agents.

Select Recent Developments

On February 3rd the company announced a research collaboration and license agreement inked with Janssen Biotech (part of Johnson & Johnson). Mersana received $40M upfront and remains eligible for over $1 billion in total milestones plus mid-single-digit to low double-digit royalties on net sales. The collaboration leverages the Dolasynthen platform (enables precise control of drug-to-antibody ratio as well as ability to vary DAR across a broad range). According to deal terms, Janssen will provide proprietary antibodies for three targets.

In August, the company announced global collaboration with GlaxoSmithKline for XMT-2056 (targeting novel epitope of HER2 via the Immunosynthen platform). Mersana received $100M upfront option purchase fee and management wisely retained options for US profit-sharing and co-promotion. Phase 1 study will investigate potential in a range of HER2-expressing tumors including breast, gastric and non-small cell lung cancer. Mersana is also eligible for up to $1.36 billion in milestone payments and tiered double-digit royalties on global net sales.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $225M which does not include $100M upfront payment from GSK. Operational runway is 1.5 years or so considering net cash used in operating activities of $44M. Research and development expenses increased by 50% to $41M, while G&A nearly doubled to $14.8M.

As for the conference call, for the UPLIFT study of UpRi in platinum-resistant ovarian cancer, they are on track to announce enrollment completion by the end of Q3 positioning them for topline readout and BLA filing in 2023.

As for institutional investors of note, BB Biotech owns a 5.8% stake and Bain Capital owns a 4.2% stake. CEO Anna Protopapas owns over 300,000 shares.

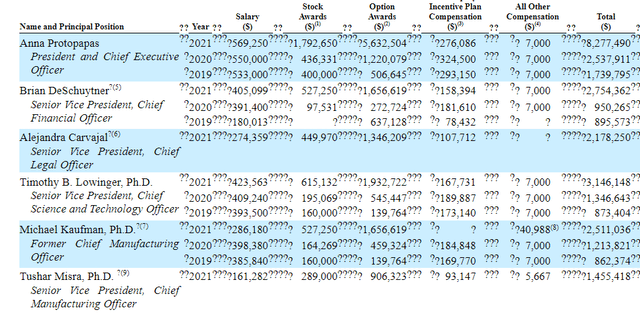

As for executive compensation, cash component (and equity awards for that matter) seem quite reasonable for a company this size. The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

Figure 4: Executive compensation table (Source: proxy filing)

As for prior financings, May 2020 equity offering was priced at $19 per share (more than a double from current levels).

Accumulated deficit is $450M, which seems reasonable considering this company was founded all the way back in 2001.

As for IP, patent portfolio consists of 22 issued US patents, 13 pending non-provisional US applications, five pending provisional US applications, 102 issued foreign patents and other associated pending PCT patent applications. Patents covering Fleximer ADC platform are projected to expire in 2032, while those covering Dolaflexin platform expire 2034 to 2038.

Final Thoughts

To conclude, it’s clear that partnership progress here is providing Mersana Therapeutics multiple shots on goal with increasingly attractive economic terms via upfront payments as well as co-development options and higher share of royalties. On the other hand, I remain highly skeptical of lead candidate UpRi’s potential to establish a beachhead and become broadly used in ovarian cancer given competition from other companies such as Immunogen and potential adverse events of concern. Enterprise value of $400M appears to have gotten ahead of itself, and the right decision for me as an investor is to wait patiently on the sidelines for the story to progress to gain greater clarity and potentially a better entry point. B7-H4 ADC is perhaps the most attractive shot on goal to my eyes given broad expression across solid tumors, but again I need to see initial data before I can take further action.

For readers who are interested in the story and have done their due diligence, MRSN is a Buy below the $5 level as partnerships make the story more attractive, offering multiple shots on goal. Again, at the current valuation I cannot justify chasing the stock, even for a pilot position.

From an ROTY perspective (focus on next 12 months), I will keep an eye on clinical progress particularly for the B7-H4 program and also for UpRi across various ovarian cancer studies (close eye on safety and durability).

Key risks include disappointing pivotal data for UpRi in 2023, clinical setbacks including for trials seeking to expand use to additional indications, setbacks with partnerships, further dilution in 2023 (secondary offering is likely) and substantial competition in certain cancers such as ovarian and lung cancer.

For our purposes in ROTY again, I cannot justify entry at the current valuation and will keep an eye on the story from the sidelines. The ADC space on the whole is increasingly attractive given consolidation of larger players and the potential for next-generation technologies to unlock new targets and broad indications. However, that’s not excuse to throw caution to the wind with these more speculative players until a clear path to market is unveiled and valuation presents an attractive risk/reward profile.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. I look forward to your thoughts in the Comments section below. Lastly, be aware that most of my articles appear first to members of the ROTY community.

Be the first to comment