Cunaplus_M.Faba/iStock via Getty Images

Introduction

Zoetis Inc. (NYSE:ZTS) released their Q2 2022 results last Thursday (August 4), and its stock has fallen 4% since then.

We upgraded our rating on Zoetis to Buy in February, after shares had already fallen 22% from its December 2021 peak. They have fallen by another 9% in the six months since, underperforming the S&P 500 by approximately 6%:

|

Librarian Capital’s Zoetis Rating History vs. Share Price (Last 1 Year)  Source: Seeking Alpha (11-Aug-22). |

Net Income was flat year-on-year in Q2, but primarily due to currency. Underlying growth was strong, with revenues up 8% and Net Income up 9% operationally, despite specific headwinds in macro and one legacy product. Zoetis has continued to make strong progress on new products, though there was bad news in some businesses. 2022 guidance was tightened slightly on an operational basis. ZTS shares are now at less than 35x 2022 EPS. Our forecasts show a total return of 53% (13.6% annualized) by 2025 year-end. Buy.

Zoetis Buy Case Recap

Zoetis is the global leader in animal health, with a high-quality business that we believe to be capable of growing EPS at a 10%+ CAGR:

- The global animal health market is growing structurally, historically at 5-6% per year. Petcare is the main driver, benefiting from growing pet numbers and new products serving previously unmet needs

- Zoetis can grow its revenues faster than the market, at a high-single-digit revenue CAGR, thanks to its leading portfolio, brands, product innovations, scale, sales and marketing infrastructure

- Zoetis’ margin will continue to expand, from a combination of mix shift, pricing power, manufacturing efficiencies and natural operational leverage

COVID-19 was a net positive for Zoetis, boosting the number of pets and their demand for medical products, though this was partly offset by a reduction in protein demand and lower livestock prices.

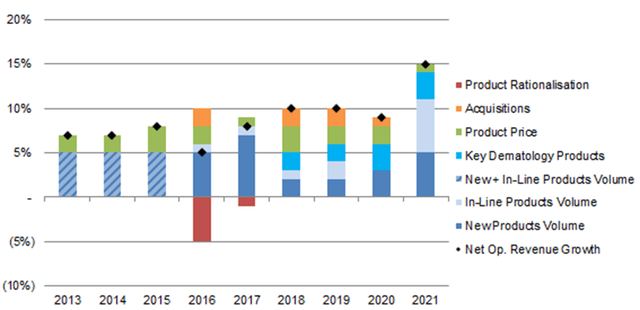

Zoetis’ operational revenue growth (excluding acquisitions) was 15% in 2021, and averaged 8% in the years before:

|

Zoetis Components of Op. Revenue Growth (2013-21)  Source: Zoetis company filings. |

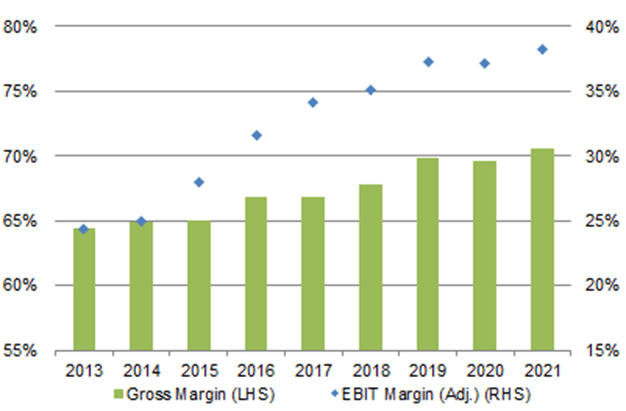

In 2021, Zoetis’ margins rose by another 1% in both Gross Margin (to 70.6%) and EBIT Margin (to 38.2%):

|

ZTS Gross Margin & EBIT Margin (2013-21)  Source: Zoetis company filings. |

Zoetis P/E was at 51.8x (relative to 2020 EPS) at our downgrade in July 2021, and subsequently rose to more than 58x (based on 2021 EPS) in late 2021. We had been assuming a 38.5x exit P/E until May 2022, when we moved to 37.0x

Q2 2022 results showed that Zoetis’ growth is on track operationally, but currency headwinds have increased further.

Zoetis Q2 Results Headlines

Q2 2022 headlines looked disappointing, primarily due to currency, but underlying growth was strong.

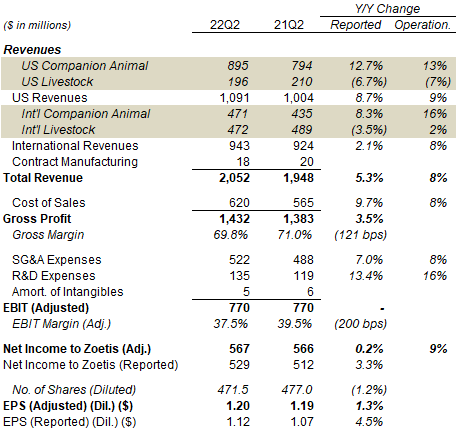

On an operational basis, total revenues grew 8%, while Cost of Sales and SG&A also grew 8%. R&D Expenses grew 16%. These helped Adjusted Net Income grow 9% operationally – in line with our investment case.

However, including currency, revenue growth was lower at 5.3% while Cost of Sales growth was higher at 9.7%, reducing Gross Profit Growth to just 3.5%. This was exceeded by SG&A and R&D expense growth rates in USD, which meant USD Adjusted Net Income was flattish (up 0.2%) year-on-year and EPS was up just 1.3% after buybacks.

|

Zoetis P&L (Non-GAAP) (Q2 2022 vs. Prior Year)  Source: Zoetis results releases. |

In addition to currency, there were other specific macro headwinds in Q2, including the Russia/Ukraine conflict (which reduced international revenue growth by 1% across H1), COVID restrictions and low pork prices in China, and supply chain issues with some products. We believe most of these to be temporary or one-off in nature.

Zoetis revenue growth continued to be driven by Companion Animal sales, which grew by 13% year-on-year operationally in the U.S. and by 16% in International in Q2. Livestock sales were down 7% in the U.S., but up 2% in International. The decline in U.S. Livestock sales was due to generic competition to DRAXXIN (in cattle) and Zoamix (in poultry), as well as cheaper alternatives in other poultry products. Management continues to expect Livestock sales growth to normalize upwards in 2023/24. (Historically, Livestock sales growth had averaged mid-single-digits annually.)

Revenue growth in Q2 included 3% from price/mix in existing products; price/mix grew 5% in Companion Animal and a lower figure in Livestock. New products contributed 5% of growth and key Dermatology products contributed 2%.

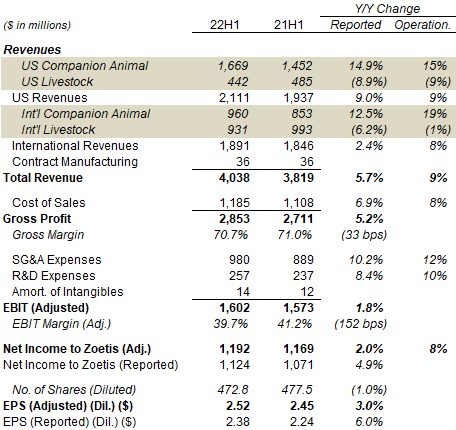

The picture is similar across H1 2022 as a whole. Operationally, total revenues grew 9% year-on-year, again led by Companion Animal sales. Cost of Sales grew a bit less, while SG&A and R&D expenses grew a bit more, in part due to items like travel returning to normal. Adjusted Net Income grew 8% operationally year-on-year in H1.

|

Zoetis P&L (Non-GAAP) (H1 2022 vs. Prior Year)  Source: Zoetis results releases. |

Update on New & Existing Products

Zoetis has continued to make strong progress on new products, though there was bad news in some businesses.

- Simparica Trio (a parasiticide against heartworms, fleas and ticks in dogs) sales grew 72% operationally in Q2 (to $237m globally, including $30m outside the U.S.). Management now expects a competing triple-combination product to be approved in the U.S. in H2 2022 and to be launched there in 2023, but believes Simparica Trio sales will continue to grow thereafter thanks to its brand, track record and marketing

- Key Dermatology products sales grew 16% operationally in Q2 (to $315m). Zoetis now expects new competition for APOQUEL and Cytopoint to emerge in H2 2023 at the earliest (was 2023 before)

- Diagnostics sales declined year-on-year in Q2, after growing 12% operationally in Q1, and were “about flat” for H1. The Q2 decline was concentrated in the U.S., and attributed to disruption from Zoetis’ establishment of a new dedicated field salesforce. Diagnostics sales still grew in International. Management expects the effectiveness of its new field salesforce “to improve gradually over the remainder of the year”.

- Librela (monoclonal antibodies for osteoarthritic pain in dogs) generated $26m of sales in Q2 (from $21m in Q1), and sale are expected to “exceed $100m” this year. Librela remains the #1 pain product in the E.U. and is still expected to be approved by the FDA for the U.S. later this year.

- Solensia (monoclonal antibodies for osteoarthritic pain in cats) had $5m of sales in Q2 (from $3m Q1). Early experience trials have already begun in the U.S., with a full launch there planned in H2.

- DRAXXIN – generic competition for DRAXXIN has continued to be a drag on Zoetis sales in U.S. cattle. However, its revenue impact should decline as Zoetis laps the expiry of its U.S. exclusivity in Q1 2021

Are Generics a Threat to Zoetis?

The overall threat of generics to Zoetis is small, as DRAXXIN was an unusual situation and Zoetis has a strong pipeline.

DRAXXIN has had an outsized impact because it was by far Zoetis’ largest Livestock product, and was its #2 product overall with approximately $375m of revenues as recently as in 2019. It is also old, originally launched in 2004.

Zoetis’ top two products in 2021 were APOQUEL and Simparica Trio, each with approximately 10% of group revenues. The rest of its revenues are diversified, with the next three products at just 13% of group revenues in total, and the next five products at just 14%. APOQUEL expects to face generic competition in H2 2023 at the earliest, but this date has been repeatedly delayed, and APOQUEL is also a relatively old product that was originally approved in the U.S. in 2013. Simparica is a much newer product, approved in the U.S. only in 2020, which means its patent has many years to run

In general, patent expiries and generic competition are an inherent part of the pharmaceutical industry, and companies have had reasonable success in both marketing and product extensions that extend revenue lifecycles.

Zoetis’ Updated 2022 Guidance

Zoetis tightened its full-year 2022 guidance slightly on an operational basis, but cut its USD Adjusted EPS somewhat due to currency. Management now expects operational growth of 9.5-10.5% (was 9-11%) in revenues and 11-13% (was 10-13%) in Adjusted Net Income. Adjusted EPS is now expected to be $4.97-$5.05, within the previous range of $4.99-$5.09, but with a mid-point that is $0.03 lower.

|

Zoetis 2022 Earnings Guidance  Source: Zoetis results presentation (Q2 2022). |

Valuation: Is Zoetis Stock Overvalued?

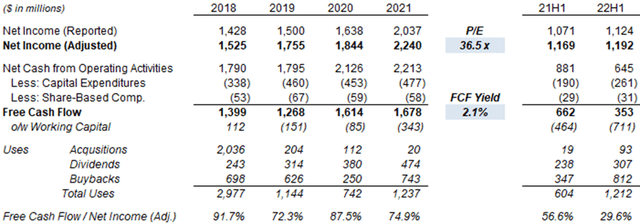

At $173.18, relative to 2021 financials, Zoetis shares are trading at a 36.5x P/E and an 2.1% Free Cash Flow Yield:

|

Zoetis Earnings, Cashflows & Valuation (2018to H1 2022)  Source: Zoetis company filings. NB. 2018 figures not pro forma Abaxis acquisition (completed Jul-18). |

Relative to the new 2022 EPS guidance, Zoetis shares are trading at a P/E of 34.3-34.8x.

Zoetis pays a dividend of $1.30 ($0.325 per quarter), representing a Dividend Yield of 0.8%. The dividend was raised by 30% in December 2021.

Zoetis repurchased $452m of its stock (at an average price of $170.65) in Q2, its largest amount ever, taking the H1 2022 total to $812m (compared to $743m for the entire 2021). $3.37bn remains in its authorized buyback program, equivalent to 4.1% of the current market capitalization.

FCF was significantly lower year-on-year in H1 2022, despite a slightly higher Net Income, due to working capital. Management attributed this to “the timing of receipts and payments in the ordinary course of business and the inventory build-up of certain products for increased demand”.

Zoetis Stock Forecast

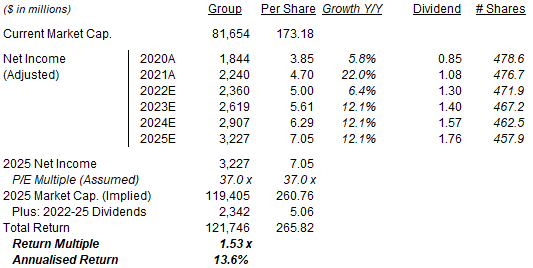

We reduce our 2022 EPS forecast slightly, but keep growth rates in subsequent years unchanged, in effect assuming that recent currency movements to be permanent. We also raise our buyback assumptions slightly.

Our key assumptions now include:

- 2022 EPS of $5.00 (was $5.04)

- From 2023, Net Income growth of 11% a year (unchanged)

- From 2022, share count reduction of 1.0% a year (was 0.8%)

- 2022 dividend of $1.30 (unchanged)

- From 2023, dividend to grow on a Payout Ratio of 25.0% (unchanged)

- P/E of 37.0x at 2025 year-end (unchanged)

Our 2025 EPS forecast is roughly unchanged from before ($7.05 vs. $7.06):

|

Illustrative Zoetis Return Forecasts  Source: Librarian Capital estimates. |

With shares at $173.18, we expect a total return of 53% (13.6% annualized) by 2025 year-end.

Is Zoetis Stock A Buy? Conclusion

We reiterate our Buy rating on Zoetis Inc. stock.

Be the first to comment