JHVEPhoto

Teva Pharmaceutical’s (NYSE:TEVA) management continues to expand its product portfolio, gaining approval for Roche Holding’s (OTCQX:RHHBY) (OTCQX:RHHBF) Lucentis biosimilar in Europe and expanding the database of efficacy and safety of the company’s key brand drugs, driving interest from the scientific community and patients. Increased spending on R&D is beginning to pay off, gradually boosting the company’s cash flow and a potential New York opioid litigation settlement before the end of 2022 will boost investment interest from long-term investors and potentially return dividend payouts from 2025.

The impact of the Zantac lawsuit on Teva Pharmaceutical’s financial position

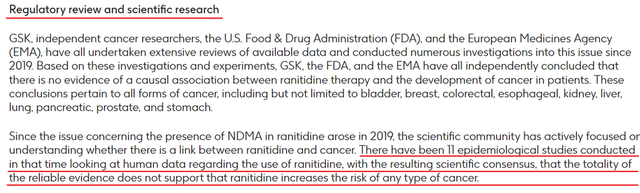

The Zantac lawsuit is litigation from people taking generic and/or branded versions of Zantac that first received FDA approval in 1983, gradually increasing the number of indications for use. According to this lawsuit, this medicinal product, as a result of long storage, may contain an increased content of N-nitrosodimethylamine (NDMA), which is a probable carcinogen and, as a result, can cause cancer. In the lawsuit, the plaintiffs allege that manufacturers of both the brand and generic versions of Zantac put on the market a product that could cause serious harm to health and did not warn consumers of these serious risks. On August 16, 2022, in response to thousands of lawsuits, GSK (NYSE:GSK) (OTCPK:GLAXF) issued a press release reminding investors once again that numerous studies by independent cancer researchers, the FDA, and the EMA have not found evidence of a causal relationship between ranitidine therapy and the development cancer in patients.

Source: Author’s elaboration, based on GSK press release

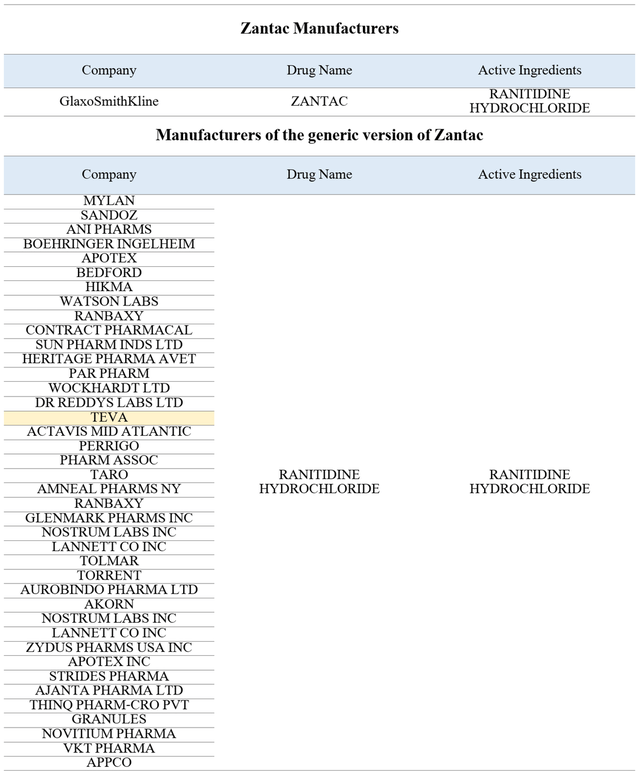

And although Teva Pharmaceutical does not disclose in its financial statements the number of prescriptions that were written for the generic version of Zantac, medicines that include ranitidine hydrochloride as the active ingredient were produced by dozens of other pharmaceutical companies. As a result, the proportion of people who could theoretically be harmed by Teva Pharmaceutical’s medicine is relatively small.

Source: Author’s elaboration, based on FDA

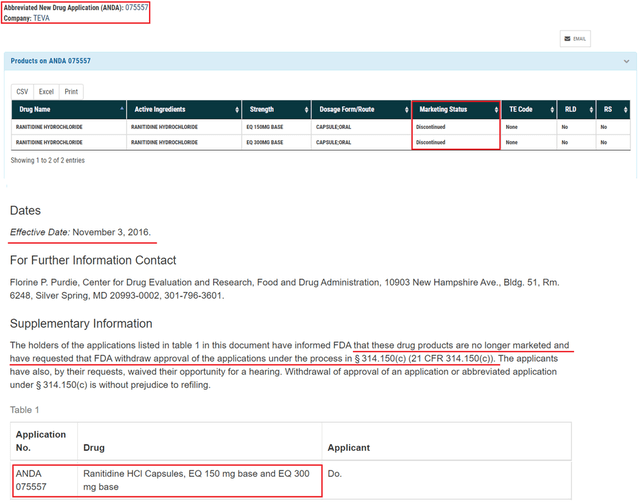

Moreover, Teva withdrew the abbreviated new drug application number 075557 for the generic version of Zantac back in 2016.

Source: Author’s elaboration, based on FDA

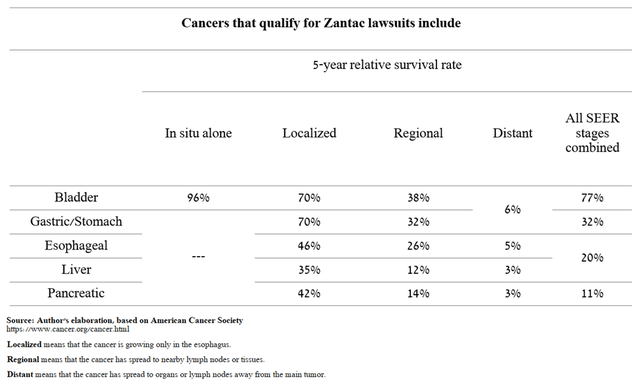

Thus, it has been about six years since the recall of Teva’s generic version of Zantac. Although it is regrettable to say, even if there was a relationship between taking the drug and developing cancer, then most people have already died from the development of the disease and, as a result, the number of potential lawsuits against Teva is small. For example, the 5-year relative survival rate for patients with advanced pancreatic cancer is only 3%, which means that, on average, these people have a 3% chance of living five years from diagnosis compared to the average chance of a healthy person living the same period of time.

Source: Author’s elaboration, based on American Cancer Society

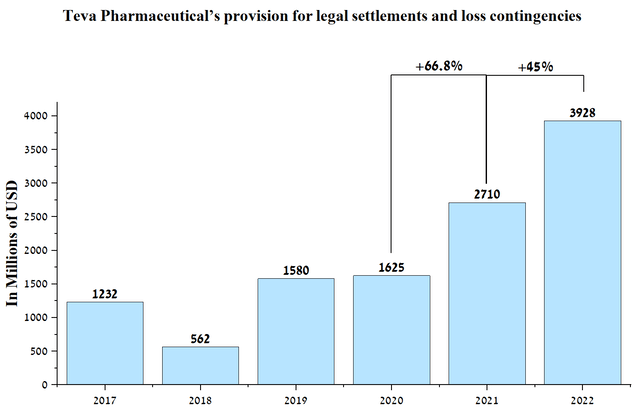

In my estimation, it is unlikely that plaintiffs’ lawyers will be able to prove that it was the impurities in the generic Zantac that harmed the health of their clients after such a long time since the drug was taken. As a consequence, I do not see these lawsuits against the company hurting Teva Pharmaceutical’s financial position. In addition, according to Forbes, which cites Drugwatch, lawyers are no longer willing to represent people who have taken the generic version of Zantac. Thus, this further narrows the potential damage in this case, not only against Teva but also against generic companies in general. If the plaintiffs win, the manufacturers of the branded version of the drug will bear the brunt of the blow. In addition, the company has multi-billion dollar legal reserves that could be used to pay for the Zantac lawsuit. At the end of the 2nd quarter of 2022, these reserves are about $3.93 billion, which is 45% more than in 2021.

Source: Author’s elaboration, based on quarterly securities reports

Conclusion

In Q3 2022, Teva Pharmaceutical continues to expand its product portfolio by gaining approval from Ranivisio, Roche Holding’s Lucentis biosimilar in Europe, becoming the second company after Biogen to achieve this. The absence of tough competition in Europe and the gradual geographic expansion of Ranivisio will allow the Israeli company to capture a large chunk of Roche Holding’s multibillion-dollar brand drug sales and thereby increase Teva’s operating income. Moreover, key drug Ajovy (fremanezumab), with sales of $88 million in Q2 2022, up 25.7% year-over-year, continues to gather clinical data fueling increased interest from clinicians and patients. At the Migraine Trust International Symposium, the company presented data demonstrating the ability of fremanezumab to significantly reduce both the number of monthly migraine days and the number of monthly days of headache and other depressive symptoms compared with placebo. In my estimation, the recent drop in the company’s stock price due to the Zantac lawsuit against pharmaceutical companies will have a negligible impact on the financial position of Teva Pharmaceutical. The gradual increase in the number of biosimilars and generics in the company’s portfolio will help Teva Pharmaceutical’s shares recover more quickly against the S&P 500 (NYSEARCA:SPY) during times of Fed interest rate hikes, thereby attracting investment interest from long-term investors.

Be the first to comment