todamo

All the way back in late 2019, which feels like some time ago, Cineworld (OTCPK:CNNWF) agreed to purchase Cineplex (OTCPK:CPXGF) in a deal worth $2.1B or $34 a share. At the time, this deal was going to make Cineworld the world’s largest Theatre chain. With Cineplex now trading around $8, those who haven’t followed the story will be able to infer that the deal didn’t close. Cineworld pulled out with the onset of the pandemic, and since then, the pair have been embroiled in legal battles. Cineplex has had success in this regard as the Canadian courts awarded them $1.24B in lost synergies, this will now move to the appeals court.

These on-goings have overshadowed the progress Cineworld has made over the last few quarters and the fundamental strength of the chain in comparison to peers. The stats show the recovery is underway, and I believe Cineworld is one of the best ways to capture the upside in a recovery.

Cineplex is Bouncing Back

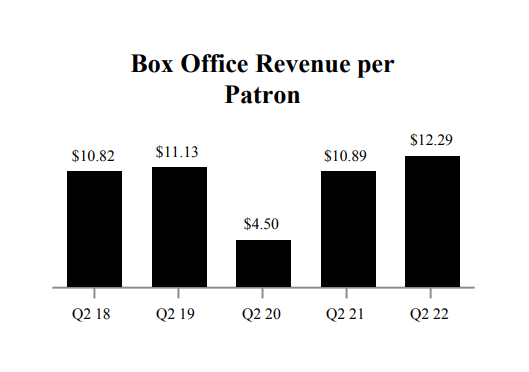

In the second quarter, Cineplex reported revenues of CAD$350 million, significantly higher than the measly CAD$64.9 million from the year prior as theatres start to recover without restrictions. 11.1 million patrons walked through its doors over the quarter, this is still down 35% from pre-pandemic Q2 2019. However, the revenue figure is only down 20% over that period. The stark difference in revenue per patron was driven by a marked increase in both box office and concession spend. Box office spend per patron was 10% higher than Q2 of 2019:

Cineplex Box Office (Cineplex PR)

Concession spend per patron was CAD$8.84, 34% higher than Q2 ’19. This doesn’t include food sales related to its non-theatre segments (the Rec Room). Below, I have tabled Cineplex’s box office and concession spend per patron against comps (converted all into USD).

| Chain | Concession | Box Office | Total |

| Everyman | $10.83 | $13.82 | $24.21 |

| Cineworld | $5.52 | $10.09 | $15.64 |

| AMC (AMC) | $7.52 | $11.52 | $19.04 |

| Cinemark (CNK) | $7.34 | $5.50 | $12.84 |

| Cineplex | $8.84 | $12.29 | $21.13 |

Cineplex is exceeding larger peers on its Key Performance Indicators (KPIs). The only Theatre chain that is achieving higher spend per patron is small UK-based Theatre chain Everyman. I have written a long deep dive on Everyman in another Seeking Alpha article and own a large position in the company. However, as a near micro-cap, it may not be a suitable investment for many and comes with its own risks. It is also hard to buy for US investors (no OTC ticker).

This is massively beneficial for Cineplex and this was evidenced in the last results. It underpins the thesis that the customers who are returning are higher value and spells well for the company if a full recovery is achieved.

The company saw an even stronger recovery in its Amusement segment, where revenues were 12% higher than Q2 2019 – hitting $65M. This increase was primarily driven by LBE amusement hitting a quarterly revenue record at $17.4M. This caused Adjusted EBITDA to soar to $8.3B, nearly double 2019 comparison.

Valuation Comparison

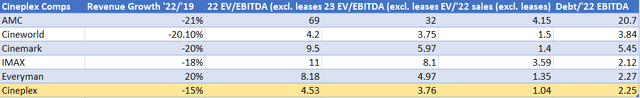

The primary issue when comparing US Theatre valuations with UK and Canadian counterparts is the difference in how leases have been booked on the balance sheet. US companies have nearly all leases booked as operating leases, which means they aren’t in the long-term debt figure. UK and Canadian have nearly all their leases as capitalized leases – booked under long-term debt. Therefore, I have removed leases from the debt figure in order to draw a fairer comparison between companies operating in different jurisdictions. I have only used forward metrics due to the large disruption over the last two years, where different jurisdictions have experienced different levels of disruption at certain times.

Cineplex valuation comparison to comps (Compiled by author from Refinitiv estimates)

Cineplex had $793M in capitalized leases, which more than doubled the long-term debt figure. In contrast, AMC had $4.43B in operating leases, not included in the long-term debt figure.

In comparison to its peers, Cineplex trades at the cheapest forward valuation, yet revenues are expected to also recover quickest. By 2023, apart from Everyman – Cineplex is the only Theatre expected to see its revenues reach 2019 levels. The only large peer that is close in comparison is Cineworld, but that is truly in its own ballpark. Cineworld’s debt pile is incomprehensible and has become a binary bet of whether there is any value left for shareholders (which is highly unlikely too with debt at over $4.8B, but that’s an article in itself for another time).

The Bottom Line

Cineplex is the forgotten chain when it comes to North American Theatre stocks. The chain has started 2022 well and is achieving superior concession spend than its peers, which bodes well for a recovery. The stock is also trading at discounts to peers, even with a more healthy balance sheet and better recovery prospect. And who knows, they may even scrape some money from nearly bust Cineworld. Cineplex is a ‘buy’ at these depressed levels.

Be the first to comment