RomoloTavani

This story was originally published for subscribers of Reading The Markets, an SA marketplace service, on August 10. The technical chart was updated on the morning of August 12 for this story.

Zoom Video Communications, Inc. (NASDAQ:ZM) will report fiscal third-quarter results on August 22, and despite the stock’s big move higher over the past several weeks, analysts forecast terrible earnings from the company.

Analysts estimate third-quarter revenue to drop 33% y/y to $0.91, while revenue growth slows to just 9.4%, bringing total revenue to $1.1 billion. Meanwhile, analysts estimate that net addition will be around 211,500 in the quarter, as total customers increase by 0.6% y/y to 508 million.

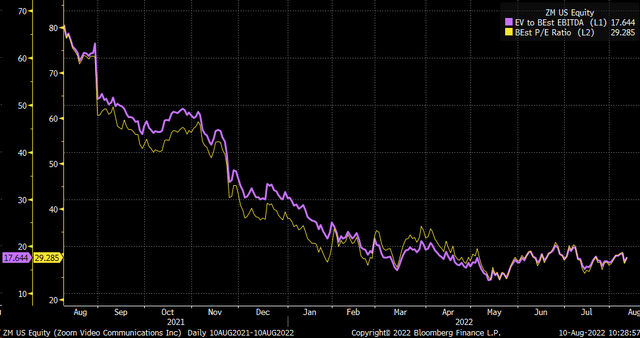

Additionally, the stock’s valuation has fallen dramatically in recent months and now finds itself trading for 17.6 times EV/EBITDA and 29.3 times this year’s earnings estimates. Which isn’t nearly at the insane valuations this stock once saw at the peak of the Covid-19 bubble phase.

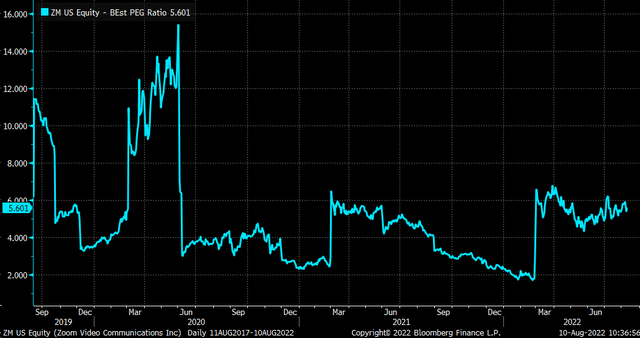

However, the drop in the valuation has been due to the slowing growth rate, and as a result, the PEG ratio has soared. Zoom’s PEG ratio is now at 5.7, which suggests that when adjusted for earnings growth, Zoom’s P/E multiple is very high, and despite the P/E being cheaper than prior points in time, Zoom’s stock is no bargain. Typically, a stock is considered fairly valued from a growth-adjusted basis when the PEG ratio is trading between 1 and 1.5.

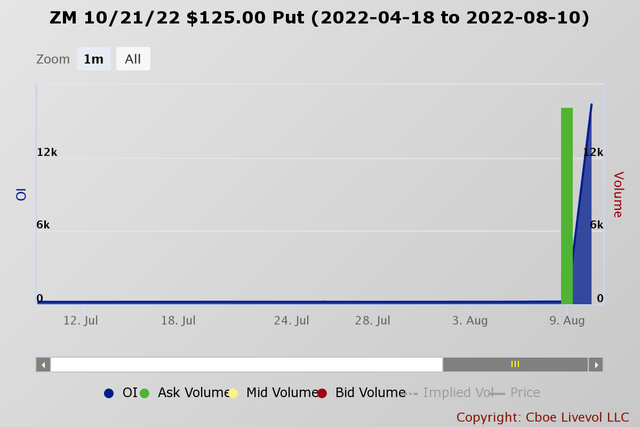

Options Bet

This high growth-adjusted valuation and big rally are causing someone to bet that Zoom’s stock will come hurtling back to earth very soon. On August 10, the open interest for the Zoom $125 October 21 puts rose by around 16,100 contracts. The data shows the puts were bought on the ASK for $25.25 per contract. It is a massive wager, with nearly $40.6 million in premiums paid. This could be a hedge, but that seems like a lot of money to be paid in premiums for a hedge. It may very well be a way for someone to make a massive bet that Zoom is trading sharply lower by the middle of October without having to short the actual stock, which in nominal terms would have been even more expensive, and the equivalent of around 1,600,000 shares. The bearish bet would imply that the stock will be trading below $100 by the middle of October if the trader holds the options until expiration.

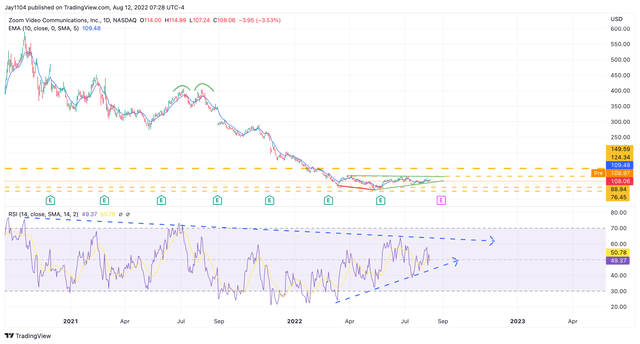

ZM Technical Chart

The Zoom chart shows that the stock has been consolidating with a downward bias. The RSI has been trending higher short term but has a much longer-term downtrend. Should the longer-term downtrend continue to play out and the stock falls below the uptrend that was established in mid-May, then the shares can fall back to support at $89.

Zoom has undoubtedly increased sharply in recent weeks, and it could push even higher heading into the quarterly results, perhaps even as high as $125, should market conditions remain favorable. However, after that, fundamentals may again significantly matter for Zoom, which could usher in lower prices.

Join Reading The Markets Risk-Free With A Two-Week Trial!

(*The Free Trial offer is not available in the App store)

Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, and looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

Be the first to comment