Vlada_Z

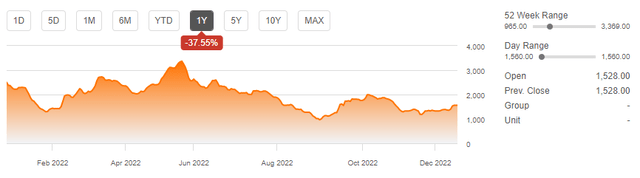

Even though ZIM (NYSE:ZIM) has been generating record returns in recent months, its stock has been constantly depreciating due to the falling freight rates that also negatively affected shares of other container shipping businesses. However, there’s an indication that the situation could improve soon as the leading shipping indices show that the rates for primary trade routes begin to stabilize while the latest weekly decline in prices has been minimal.

If in the next couple of weeks we witness flat growth or an improvement in freight rates, then this would be a game changer for the whole container shipping industry. If that’s the case, then we could safely assume that ZIM’s stock has reached a bottom and has a decent chance of appreciating in the foreseeable future, as in the past its price has been closely correlating with the freight rates.

At the same time, even though ZIM is likely to significantly cut its dividends next year due to the turbulent macro environment in 2023, the company’s solid balance sheet should help the business weather the upcoming challenges with relative ease, which gives reasons to be optimistic about the company’s long-term future.

Is This The Bottom?

A couple of weeks ago, I’ve already published an article on ZIM, which noted that despite generating record returns in recent quarters, the company’s share price highly correlates with freight rates that have been in a decline for a while due to various geopolitical and macroeconomic reasons. At the same time, in that article, I’ve highlighted the prevailing view of major shipping analysts, which outlines the uniqueness of the current situation within the shipping industry and how there’s a decent chance that if freight rates begin to rebound then there’s a possibility that shipping stocks would follow them as well.

ZIM’s Stock Performance (Seeking Alpha)

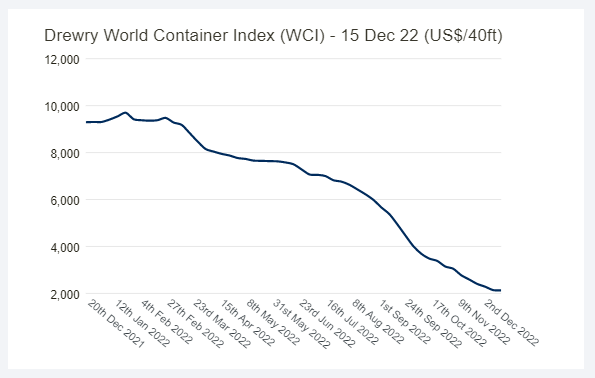

If we take a look at the leading Drewry World Container Index, we’ll see that in recent weeks the decline in freight rates slowed down and there’s a sign that prices could stabilize soon.

Drewry World Containter Index (Drewry)

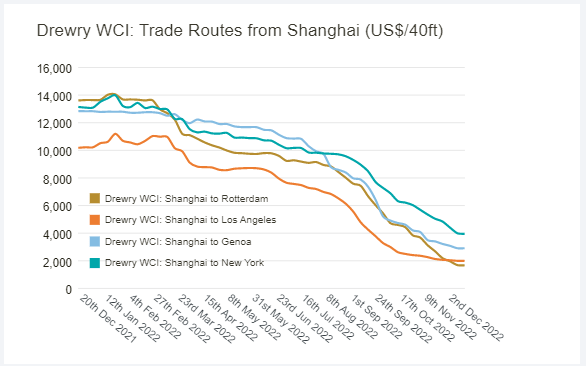

Even though freight rates overall have been in a decline for 42 consecutive weeks, there was a slight improvement in prices for trade routes such as Shanghai – Los Angeles and Shanghai – Genoa. At the same time, the decline in prices for routes such as Shanghai – Rotterdam, and Shanghai – New York has been minimal, which resulted in the overall decline of the index of only 1%. Such a decline rate is significantly lower in comparison to what we’ve witnessed in recent months, which gives investors hope that the rebound is around the corner.

Rates For Trade Routes From Shanghai (Drewry)

On top of that, the Baltic Dry Futures (BDIY:IND), which mirror the Baltic Dry Index, has also stabilized and have been trailing upward in recent days. This could also be a sign that things could improve at least in the short term soon and lift ZIM’s stock as well.

Baltic Dry Futures Performance (Seeking Alpha)

Drewry gives a consolidated update on freight rates each Thursday and if we do see an improvement in prices in the next week or two in its reports, then there’s a decent probability that ZIM’s shares would be able to appreciate and at least become a strong momentum play for a while.

The Future Is Not As Grim As Some Might Think

The prevailing argument of bears is that due to the hawkish monetary policy of central banks we’ll enter a global recession that would put a halt to trading activity and push freight rates lower even more. While it’s a valid argument and it would be stupid to say that the monetary policy hasn’t played a role in the recent market rout, there’s still one major flaw in such thinking.

First of all, Russia’s invasion of Ukraine has served as a major catalyst for the rise in energy prices this year, which subsequently led to a decrease in global trade activity that hurt the freight rates. Secondly, due to China’s zero-Covid policy, the country’s manufacturing output decreased, which has also negatively affected the global economy and the shipping industry in particular.

However, the potential reopening of China, a decline in oil prices from the summer peaks, and a decline in natural gas prices that peaked in August and have been mostly going down recently indicate that it’s unlikely that the shipping industry will experience a hard landing as the overall situation improves. As a result, the positives from those developments could outweigh the demand destruction argument, as geopolitics had a greater impact on the industry than monetary policy tools in the first place.

At the same time, let’s not forget that despite all of those challenges, we saw that the shipping industry managed to adapt to the changing environment and be able to generate record returns, which could’ve been considered unimaginable in the past. That’s why shipping executives begin to sound more optimistic and expect a normalization of the situation, as some of the rates start to stabilize as they return to the pre-Covid levels.

What’s also important to note is that contrary to the doomsday forecasts the overall global economy nevertheless is expected to grow by 2.2% and 2.7% in 2023 and 2024, respectively. For comparison, the global economy grew by 2.61% in 2019 when it did not face the same challenges as we do today.

On top of that, while globalization unravels amidst the worsening of Sino-American relations, the cross-border trade itself is not going anywhere away. What we currently see is that supply chains are simply being relocated to other more safe places to mitigate the geopolitical risks. ZIM itself in its latest earnings report showed that its business has witnessed an increase in activity in the Cross-Suez and Latin American trade routes despite the relatively high freight rates. At the same time, the Drewry index shows that as China closed, the trade routes such as New York – Rotterdam and Rotterdam – New York experienced growth as their rates are up Y/Y.

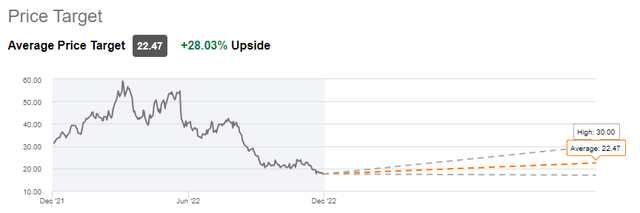

Another important thing to mention is that as the shipping industry is going through structural changes, ZIM is likely to continue to generate decent returns as during its investors’ conference earlier this year, the company showed that it can generate higher average revenue per TEU in comparison to major peers. At the same time, in my latest article on the company I’ve highlighted how the business has invested in various big data startups to be able to successfully generate higher returns during challenging times. That’s why a near 30% upside to its share price is likely to be justified given the latest developments.

ZIM’s Consensus Price Target (Seeking Alpha)

The Bottom Line

A likely normalization of freight rates would be a real game changer for ZIM and its peers, as it would give a signal to the market that we’ve reached a bottom of an almost year-long decline. This could also help ZIM’s shares to finally appreciate and reward its shareholders.

At the same time, even though there are significant risks that could undermine the bullish thesis, the company is likely to weather the upcoming challenges and thrive in the long run thanks to its strong fundamentals and a number of significant long-term catalysts.

Be the first to comment