bunhill

Thesis

Dow’s (NYSE:DOW) Q3 earnings release showed that operating deleverage is now coming for the leading diversified chemicals company through FY23. Europe’s high inflation and macro weakness have impacted its operating performance due to record energy costs.

Also, China’s stringent zero COVID restrictions have continued to hamper consumer demand and infrastructure investment. Management was optimistic about a progressive easing of COVID restrictions as the CPC 20th National Congress drew to a close. However, Xi Jinping’s keynote suggests that any thoughts about ending its COVID restrictions are premature.

Despite that, we are optimistic that the 40% battering in DOW from its April highs to its recent September lows has reflected these near-term challenges. We also gleaned that analysts’ estimates for Dow’s industry peers and the materials sector have been revised markedly through September. Coupled with the market’s positioning, we are confident that Dow’s valuations reflect a mild-to-moderate recession (our base case).

DOW’s price action is also constructive, as a robust bullish reversal help deny further downside pressure, stanching the pressure from the pessimistic sentiments of bearish investors at its September lows.

Accordingly, we rate DOW as a Buy and urge investors to capitalize on its recent bullish reversal and add more positions.

Dow’s Estimates Have Been Cut

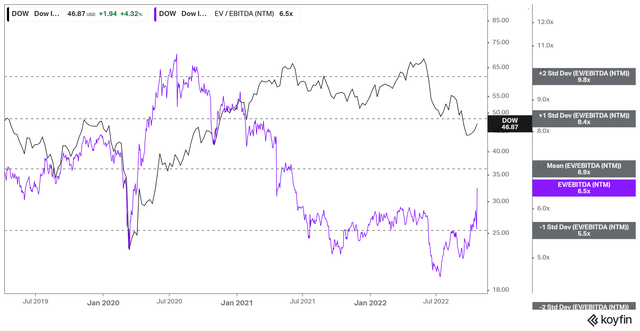

DOW NTM EBITDA multiples valuation trend (koyfin)

DOW last traded at an NTM EBITDA multiple of 6.6x, well above its July lows of 4.6x. So, DOW’s valuation is more “expensive” than in July, but its value is down nearly 10% from its July lows.

For investors less experienced with cyclical stocks, it’s critical to understand that such estimates cuts would lead to sharp spikes in its EBITDA multiples, as seen above.

Therefore, it makes sense why the market did not re-rate DOW even as it was well below its EBITDA multiples mean in July. While the market had undoubtedly battered DOW toward its July lows, DOW analysts were still overly-optimistic about their prospects through the coming recession.

As such, it needed a Q3 earnings wake-up call to convince them they needed to cut their estimates further. So, Street analysts cutting earnings estimates markedly, checked.

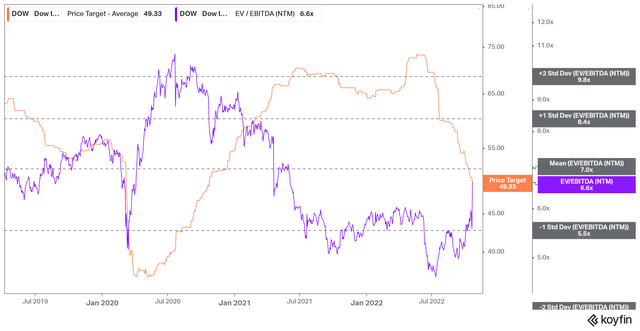

DOW Average price target trend (koyfin)

Also, investors need to be wary about ascribing too much importance to the Street’s average price targets (PTs). As seen above, they were obviously too optimistic through its highs in April to June 2022 and even raised their PTs.

However, the steep selldown in July led them to cut their PTs substantially. Then they went into panic “PT cutting mode,” as the market forced DOW down further toward its September lows (pre-Q3 earnings release). Hence, the market forced the Street to “abandon” their overly-optimistic earnings estimates and PTs in rapid succession.

But this is precisely what patient investors should be waiting for in cyclical stocks: Street analysts going into panic mode.

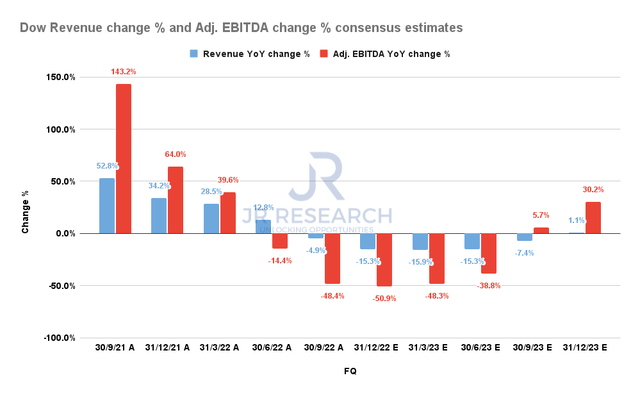

Dow Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

We also noted that the consensus estimates (neutral) project that Dow could be impacted by significant operating deleverage through H2’22, as seen above.

Therefore, investors should expect the company to continue facing near-term challenges as the global economy heads into a recession. In addition, our assessment of its Q3 release suggests that the company faced broad-based weakness across its three revenue segments. In particular, the company highlighted significant energy cost challenges in Europe, coupled with record inflation rates. Moving ahead, the focus will be on recessionary themes as the rapid pace of interest hikes is expected to slow its operating performance further. Hence, we are confident that the consensus estimates are credible.

Furthermore, the company expects its energy costs to stay volatile in the near term, impacting its cost structure. However, the company highlighted that it anticipates $1B of cost savings, which should help mitigate its OpEx base in 2023.

Notwithstanding, given Dow’s exposure to global markets, we believe it’s pretty clear that the world is heading for a broad slowdown, with a recession over the horizon. Furthermore, the boost management expected from China’s easing of its COVID restriction is unlikely to transpire soon.

Chinese President Xi Jinping (who just secured his third term in office) seems to be committed to his COVID strategy. However, we believe that Dow has likely factored in China’s structural challenges, given its property market malaise. Hence, we don’t expect the market to inflict more damage on DOW due to Xi’s insistence.

Is DOW Stock A Buy, Sell, Or Hold?

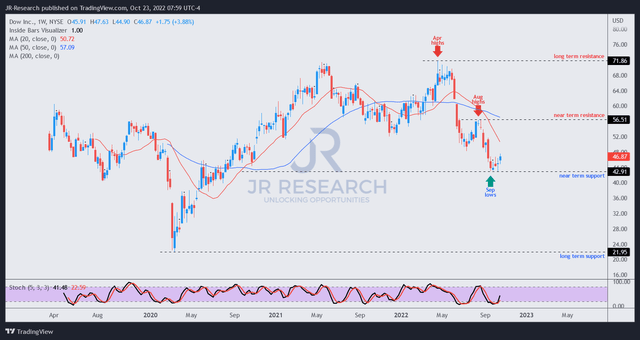

DOW price chart (weekly) (TradingView)

The market has anticipated these challenges since staging its highs in DOW in April 2022. We noted a validated bull trap (indicating the market rejected further buying upside decisively) at its April highs while using a distribution phase to draw in buyers through June. Therefore, we found it strange for Wall Street to lift its PTs higher before its steep collapse through its July lows.

Despite a brief recovery toward its August highs, the market had correctly anticipated further weakness in its Q3 release. As such, it sent DOW nearly 25% below its August highs, taking out the buyers who picked its July lows.

With the significant battering in DOW and panic from the Street analysts, we believe DOW’s near- and medium-term downside has been reflected.

Notwithstanding, our analysis is predicated on our assessment of a mild-to-moderate recession. However, if a worse-than-expected downturn were to occur, it should lead to further value compression, which could cause more analysts to throw in the towel, cutting DOW estimates further.

Our assessment indicates that investors need to watch the gap between its near- and long-term support as a potential zone for its eventual bottom. For now, it’s still too early to determine where DOW could land if the market anticipates a deeper recession.

As such, we believe it’s appropriate for investors to start layering in their positions, and we rate DOW as a Buy.

Be the first to comment