All_About_Najmi

Sometime around the 4th of July weekend, I attended a get together for fireworks and a cookout – a fun summer weekend combination of late nights, loud noises and grilled food. Several days later, I found out that two of the people there – a husband and wife – had come down with COVID-19, and given their respective ages at over 65, could be at greater risk. Thankfully they received some treatment and seem to be on the mend from what I know, but it had me thinking about their access to healthcare in the United States courtesy of Medicare. The options for choosing Medicare coverage could be a rather overwhelming set of choices. First you have to decide between traditional Medicare or Medicare Advantage, in which your benefits are administered through private insurance. If you choose traditional Medicare, then you also have to decide whether to go with or without Medigap coverage. These are also known as supplemental plans, of which there are more than a dozen options to choose from, and offered by a vast array of insurers. If you choose Medicare Advantage, selecting the most appropriate private insurer to suit your preferences is then another set of choices before getting your final coverage all in place. And then, to top it all off, you can change you can change mind from one year to the next, if you want to, and potentially start the whole decision making process over again.

Working your way through it alone could definitely be daunting, which is part of the reason that businesses like eHealth (NASDAQ:EHTH), SelectQuote (SLQT), and GoHealth (GOCO) have customers. These nationwide insurance brokers can assist people in getting signed up for the coverage they want or need, not just with Medicare related insurance, although that is a major portion of their business. eHealth makes it revenues in the forms getting paid a commission by the insurers whose plans are made available through eHealth’s platform. So when hypothetical customer “Jane Doe” uses eHealth to help her enroll in a Medicare Advantage plan with Cigna (CI), for example, Cigna is paying eHealth a commission (I just pulled an insurer at random; in fact I don’t know if Cigna is one of eHealth’s partner carriers). Jane Doe can use eHealth’s web portal to enroll, or can call into the eHealth call center and get live assistance. If the customer keeps her same plan the following year, then Cigna continues to pay eHealth a commission.

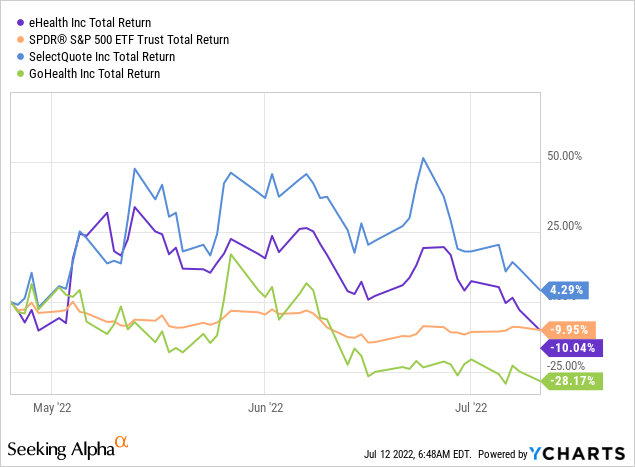

I first considered the investment case for eHealth in late April, just a few days before the company released its first quarter results. I considered it a hold or speculative buy at the time, and the market responded favorably to the reaffirmation of guidance, making a 25% jump. However, the shares are now back to 52-week lows, under the value where they were 2 months ago, essentially matching the S&P index now, after having outperformed up until very recently, and in the last few trading sessions eHealth has continued to lose ground.

Updates from Q1

The actual results for the quarter were not good. Revenues for Q1 of 2022 were $105 million, a year over year decline of $29 million (21.5%). A decline in revenue was fully expected, as management guided to expect full year 2022 results to be down 10%. As management explicitly kept full year guidance the same, the remaining quarters are expected to have narrower declines relative to 2021. For Q1, in addition to lower revenue, operating expenses were higher by $10 million, especially driven by advertising and customer enrollment costs. The bottom line was a tough quarter, with a loss per share of $1.46.

There were a bright spots to point to, suggesting some of the turnaround efforts are making things better. Specifically, the persistency of Medicare Advantage customers – the percentage of members renewing their plan from year to year – saw improvement in the cohort that just had the first option to renew, although overall customer retention (measured on a three-year rolling basis) did fall, suggesting that more recent customers were hopefully more likely to continue renewing their plans in the years ahead and the churn rate might start to decrease. CEO Fran Soistman noted this in his prepared remarks for the quarter:

we’re seeing a positive traction in . . . retention characteristics from the new enrollments that we added during the 2022 annual enrollment period, relative to the comparable enrollment cohorts from the 2021 and 2020 annual enrollment periods. This is based on the preliminary data we have received to the end of April. The data suggests that although we have a comparatively lower telephonic conversion rate in Q1 resulting in lower volume, the enrollments we brought in are of higher quality that will lead to higher customer satisfaction, increased plan longevity, and over time, higher lifetime values.

If that increased lifetime value [LTV] is going to be realized, it will take some time to start showing up in the results according to ASC 606 accounting rules, but the gist is that if lower churn is sustainable, then naturally the average value derived from the commissions paid to eHealth of each individual enrollment will go up. In the Medicare Advantage segment, the LTVs for eHealth are reported at $948, down slightly and expected to remain flat for the rest of the year.

One of the more surprising things, in my opinion, was the fairly dramatic change on the balance sheet assigned to the commissions receivable just since the end of 2021; these were the figures I really grappled with the most in my prior assessment, and the values have declined fairly sharply. At year end of 2021, the total value of commissions receivable was $908 million, broken down as $255 million in current receivables and $653 million in long-term. Three months later, those values have dropped off by 8.5%, with $204 million in current receivables and $627 million in long-term, for a total of $831 million. This has wiped off quite a bit of eHealth’s book value in a relatively short time, and that value could continue to decrease in the coming quarters as the growth stalls.

As I attempted to express in my prior article, the LTV calculations and how those are inter-related to the commissions receivable is especially complex accounting, although eHealth had called on a 3rd party actuary to stand behind their figures for 2021. Nevertheless, I should note that the company’s auditor, Ernst & Young, did express its view that these values were based on complicated assumptions. I won’t quote the auditor’s letter in full, but it is worth a read in the 2021 10-K. In part, it states:

Auditing management’s determination of the LTV of commission revenue was . . . highly judgmental due to the complexity of the models used and the subjectivity required by the Company to estimate the amount and timing of future cash flows, calculate the amount of commission revenue that is probable of not being reversed, and determine the timing and amount of any adjustment revenue that results from changes in the estimates of previously recorded LTV. . . Our audit procedures also included, among others, evaluating the methodology used and significant assumptions discussed above, and testing the completeness and accuracy of the underlying data used by the Company.

What is important to know is that management is intentionally attempting to pivot from growth at any cost to profitable growth only. The declines in the top line, while perhaps more pronounced than anticipated, were not entirely unexpected, and investors should start to see the cost containment efforts begin showing up aggressively in the coming quarters. eHealth is still pointing towards a revenue goal of around $460 million, and a GAAP net loss of $95 million. The revenue guidance would imply a definite pick-up in revenue (4th quarter is historically the largest quarter based on the enrollment window for Medicare). On the bottom line, having already booked a nearly $40 million loss in Q1 alone, the company clearly expects the losses to continue for the year, but at a moderated pace.

Getting To Positive Cash Flow

With the base share price back essentially back to where it was in late April, in some ways it makes valuation comparisons simpler. On almost any valuation tied to a price ratio of some sort, intuitively it should now be at best the same and probably worse, given the lackluster results from Q1 and forward guidance. While I focused previously on a price to book ratio and suggested discounting the book value of the long-term commissions receivable, this time I am going to come at it from a slightly different angle, trying to assess the potential for eHealth to generate positive free cash flow. I will not specifically address valuation in terms of setting a price target, but if a long-term investor is essentially buying access to a share of the company’s future cash flows, then I want to know if there is a viable path to real cash flows materializing.

Looking at the last couple of years, eHealth has been dependent on cash from financing for support, raising $260 million in common equity financing over 2019 – 2020, an additional $225 million in convertible preferred stock in private placement in 2021, and $65 million in debt financing during Q1 of 2022. The total comes to $550 million of cash taken in over the last 40 months or so, against a cash balance at the end of Q1 of $231 million. Over the same period (Q1 of 2019 through Q1 of 2022, 13 quarters), the cash from operations has been -$71.5 million [2019], -$107.9 million [2020], -$162.6 million [2021], and +47.1 million [Q1 2022], for a cumulative use of cash in operations of $294.9 million.

To reverse course, eHealth is going to need to accomplish three things, based on their current strategy:

- Cut the major expenses for customer acquisition at a rate greater than the rate of decline in sales.

- Stabilize the sales at a point from which even modest growth can be expected going forward, based on overall favorable demographic trends.

- Successfully convert long-term commissions receivable into cash.

The problem is simple to identify – getting customers is too expensive, and the plans start with getting expenses down, especially the acquisition spend, to the tune of $60 million in savings. Against a total combined spend in advertising and customer enrollment for 2021 of $450.6 million, $60 million is a good start, if actually achieved, but not enough given the G & A expenses. Mentally setting aside all other costs than advertising and enrollment support for a moment, assume the $60 million in savings comes exclusively out of those line items.

The cost savings would leave eHealth in the area of $70 million remaining by the following logic: $460 million of revenues [management guidance] less $390 million in reduced advertising and enrollment costs. Historic CapEx needs have run $20 million per year, and there will start to be payments due on the $65 million in debt, so there could be in the range of $45 million pre-tax, but that will not come close to covering the technology and remaining G & A costs (combined for ~$150 million on average in recent years). The announced plans on cost savings are a necessary step in the right direction, but with revenues declining in 2022 by perhaps $80 million, saving $60 million will not be nearly enough.

There are additional initiatives which involve guiding more enrollments to be fully completed online without requiring a telephone interaction, therefore being more profitable and efficient. Management has not directly answered questions about the overall staffing levels or possible downsizing in the number of agents. As of the Q1 investor call, CEO Fran Soistman indicated that details on a financial plan would presented to the board in June and shared with investors in the second half of the year. All in all, I expect to see a plan on where management thinks the cost savings will come from, and a sense of how big a reduction they think will be necessary. In my view, targeting $100 million in total cost reductions will be needed at a minimum, which still will come up short of being break-even on operating profit without also achieving some sales growth.

On the question of sales growth, there is a steadily closing window in terms of adding the new Medicare enrollments from Baby Boomers. The Centers for Medicare and Medicaid expects the Baby Boomer driven growth in enrollment to fall off by 2030. That leaves a long tail for many people to continue using Medicare each and every year for decades (setting aside the question of Medicare’s long-term solvency), even if new enrollment growth diminishes, but the chance for eHealth to get the benefit of the initial sign-ups is going to start to fade over the next 5 to 7 years. This puts a sort of natural demographic support in place for eHealth to work from, but sales can easily slip year to year regardless, as 2021 already showed, and as 2022 is fully expected to show again.

It is actually on the growth side that I think eHealth has a chance. The company clearly has attracted a core of users, and continues signing up brand new customers. At guided revenue for 2022 of $460 million, sales would be some 21% less than the high point in 2020 of $583 million. However, modest 5% enrollment growth for 2023 and 2024 could put the revenues back up over $500 million, and be near a break-even point on operating profits (assuming for now $350 million in customer acquisition / advertising costs and $150 million in technology and G & A costs), although this would not yet cover capex and interest payments, with taxes likely to be negligible. Given the demographic trends on Medicare, I don’t think 5% growth is a far stretch, although if they don’t get there soon, as in the next 2 or 3 years, it could quickly become out of reach.

The benefits of return to growth should be obvious, as long as the growth can be supported with lower costs, but the top line and bottom line are not the only trends to pay attention to with eHealth. The other key advantage of a return to sales growth is the long-tail of revenue represented in each member’s LTV, and contribution to the long-term commissions receivable. In this industry, this particular balance sheet item is particularly significant, as it represents the value of future revenue that, in theory, should be converted into cash flows after more than a year.

As mentioned earlier, this expected cash is a bit of a slippery notion, as it depends on the variable of human behavior. People must consistently re-enroll through the same platform from year to year for those commissions to actually be paid, when in reality each and every year people are completely free to choose new plans, go through a different platform, or even potentially purchase the plan directly from the carrier without using a broker at all. So the commissions receivable is eHealth’s best estimate, based on the past trends of customer behavior regarding switching, but are not receivables in the traditional sense of being backed by a purchase order. It is something like accounting for cell phone customers who have a post-paid cell phone subscription and signed a two-year contract, except in this case the customers are only actually committed to a year, while eHealth assumes that they will stick around longer.

Conclusion

I respect eHealth’s capacity to help consumers find their way through the labyrinth of health insurance options, especially Medicare-related plans. However, the path to value creation is apparently even more difficult to figure out, and eHealth hasn’t gotten their yet, and it isn’t clear if they are fully committed in the right direction. I have attempted to lay out one possible way for the company to come closer to generating cash internally under what I think are relatively fair and modest assumptions about the future. Nevertheless, any number of combinations of cost savings, time, and growth could get it there. Of those, time is the most limiting factor, at least as far as the best opportunities in Medicare on account of demographic tailwinds.

Achieving growth while simultaneously cutting expenditures is a narrow needle to thread. With management indicating that it plans to reveal more details of its cost containment measures later this year, I personally prefer to sit on the sideline to wait and see what they have say. I continue to rate eHealth as a hold.

Be the first to comment