brightstars

The iShares MSCI Global Silver Miners ETF (BATS:SLVP) is a bet primarily on silver but also gold exposures, and to general metallic exposures. The declines in silver and general values of metals, including those for industry, have contributed to the YTD declines the portfolio has experienced, but we think there are risks to gold as well which has held up well during this part of the cycle. The fact of the matter is that gold and silver aren’t this cycle’s safe havens, it’s the USD. And all the reasons that further market declines could happen, leading people to search for safe havens, would be the same reasons the dollar becomes more attractive. With more than 50% exposed to silver and gold, be aware of this.

Breaking Down SLVP

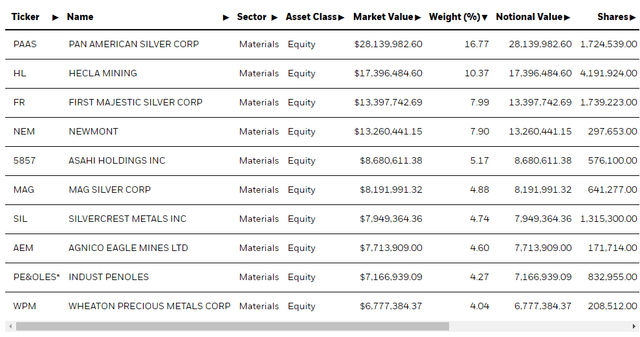

Let’s have a look at what’s inside SLVP.

Pan American Silver Corp (PAAS) is commodity price exposed to silver. Hecla Mining (HL) has major silver exposures as well. First Majestic Silver Corp (AG) likewise is silver price exposed. The list goes own with Newmont (NEM) and MAG Silver Corp (MAG). That’s already 45% primarily silver exposures. The rest are more skewed to gold or general metals through recycling and recovery businesses.

Remarks

Silver has declined about 18% YTD while gold has stayed in line with levels that opened the year. Commodities have similarly seen declines to the tune of 20-40% depending on the metal. It is fair to say that the 30% YTD declines of the fund reflect that, although they do go beyond the average silver and gold price declines we’ve seen so far. Indeed, the ETF does trade below NAV by about 20%. While that might constitute somewhat of a buying opportunity relative to buying the sum of the parts, we invite investors to play devil’s advocate and consider the forces that could further guide a negative direction for the stock.

With employment holding up despite reduced consumer confidence there could be a reckoning there. In any case, the consequent inflation persistence that was seen in the last round of macro figures invites more aggressive rate hiking by the Fed. Both of these factors could create more appetite for safe havens. The issue is that with rising rates, treasuries have for the first time in a while been sound investments for allocators like insurance companies, pension funds etc. Yields now exceed by fair margin things like FX hedging costs, and this wasn’t always the case in this last decade of the proclaimed post-crisis new normal. USD denominated treasuries will be the safe haven. Indeed, the USD has appreciated a lot relative to countries that have had similarly aggressive rate hiking plans like Sweden, but the exorbitant privilege of the dollar will always put it on top. Where silver and gold don’t create any yield, and aren’t industrially very useful, what chance do they stand? Gold still has a lot of room to fall, and the SLVP exposure to gold is not irrelevant. While silver might have already been penalised under this logic, as rates continue to rise, we may see more pain for the SLVP which has established its trading pattern as counter-rate. ETF investors, who probably aren’t looking for all that much risk, should bear all this in mind. We’d pass on this for now, especially when there’s no dividend yield really to speak of.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment