Evgeny Gromov/iStock via Getty Images

Introduction

Thanks to Methanex (NASDAQ:NASDAQ:MEOH) seeing a strong recovery during 2021, it seemed a new era of shareholder returns was afoot upon entering 2022, as my previous article discussed. Despite subsequently boosting their dividends significantly, their share price suffered during the recent months, primarily on the back of recession fears. If a brave investor can ignore the short-term noise, they have the potential to grab a long-term bargain with there being far more to enjoy apart from their otherwise low dividend yield of 2.20%, as discussed within this follow-up analysis.

Executive Summary & Ratings

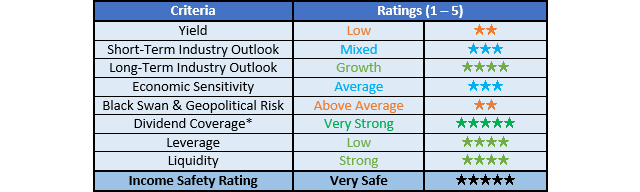

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

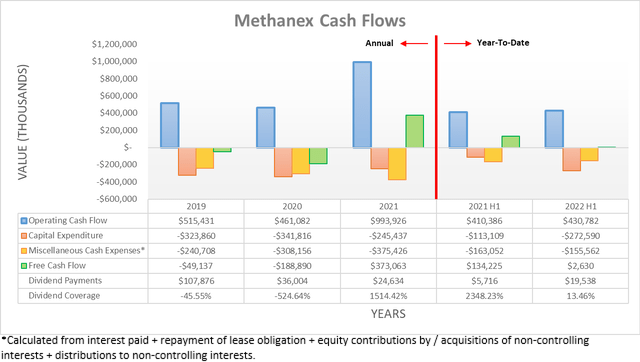

It was positive to see their strong cash flow performance from 2021 continued during the first half of 2022 with their operating cash flow landing at $430.8m and thus a modest 4.97% higher year-on-year versus their previous result of $410.4m during the first half of 2021. Due to their Geismar 3 project capital expenditure increasing, it suppressed their free cash flow to only a mere $2.6m once also accounting for their routine miscellaneous cash expenses, as detailed beneath the graph included above. Since this was insufficient to fund their $19.5m of dividend payments and further $190.4m of share buybacks, it technically caused a cash burn, despite their otherwise continued strong cash flow performance.

Whilst this may sound reckless, they reached their funding goal for their Geismar 3 project by the end of 2021 and thus intended to ramp up their shareholder returns to equal the entirety of their free cash flow excluding capital expenditure relating to this project, as per my previously linked article. If stripping out their capital expenditure attributable to their Geismar 3 project, it boosts their free cash flow by $226.3m to $228.9m during the first half of 2022. Obviously, exact dollar-for-dollar matching is not realistic, but practically speaking, their management kept their word as this adjusted free cash flow roughly matches their combined dividend payments and share buybacks of $209.9m.

If not for a sizeable working capital build of $106.3m during the first half of 2022 also unfavorably skewing their results, they would have generated significantly more free cash flow, even counting their capital expenditure for the Geismar 3 project. By extension, their dividend coverage would have also been very strong with their underlying free cash flow north of $100m and thus many magnitudes above their dividend payments of $19.6m.

As for their shareholder returns, they are heavily weighted towards share buybacks with their new program seeing another 3,500,000 of their shares being repurchased, which amounts to around 5% of their outstanding count. Since these would only cost circa $112m to complete at their current share price of circa $32, I expect these will be completed by the time 2022 ends or, if not, very close to being completed. When combined with the circa $210m already returned via dividends and share buybacks during the first half of 2022, this should make for an impressive year for shareholder returns with a very high double-digit yield against their current market capitalization of only approximately $2.2b, as my previous analysis expected.

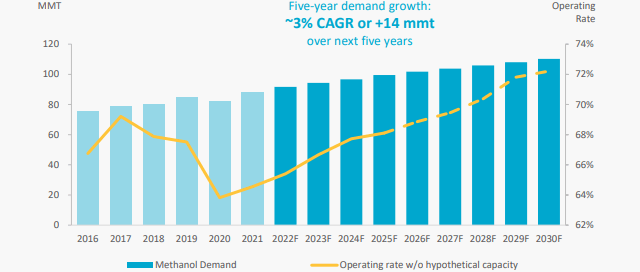

When looking ahead, the seemingly ever-growing risks of a recession on the horizon creates a headwind that leaves their short-term outlook mixed and appears to be the primary issue weighing down their share price, despite methanol prices actually holding up quite well. Even if the global economy is pushed into a recession that hurts their financial performance, thankfully the medium to long-term sees growth for methanol demand, as the graph included below displays.

Methanex August 2022 Investor Presentation

According to the company themselves, they expect methanol demand to grow at circa 3% per annum over the next five years with further growth continuing until at least 2030. If looking elsewhere, this positive medium to long-term outlook is shared by other sources and in fact, others actually see demand growth of circa 5% per annum across this same period of time. Whilst this may not help avoid the short-term pain in the event a recession strikes, it nevertheless means they should see a strong and swift recovery on the other side, as was the case during 2021 coming out of the severe Covid-19 economic downturn of 2020. Once their Geismar 3 project ramps up in 2024 following its completion in the fourth quarter of 2023 and thus fundamentally growing their company, it will further help boost their medium to long-term trajectory.

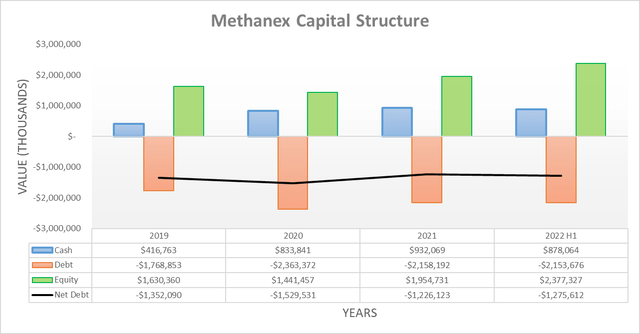

After seeing their cash burn during the first half of 2022, it would be expected higher net debt to follow but interestingly, it only increased by a relatively modest $49.5m to $1.276b and thus far less than the circa $200m directed towards shareholder returns in excess of their free cash flow. The difference stems from a $145m divestiture of a partial stake in a subsidiary, which bridged the gap but is relatively minor in magnitude and thus does not materially alter their outlook.

When looking ahead into the second half of 2022, their net debt appears more likely to slide lower than climb higher, assuming their $106.3m working capital build during the first half reverses and thus broadly funds their circa $112m of upcoming share buybacks, thereby retaining most of their newly generated free cash flow. Or if not, it seems reasonable to expect their net debt to broadly track sideways, unless the methanol market crashes unexpectedly.

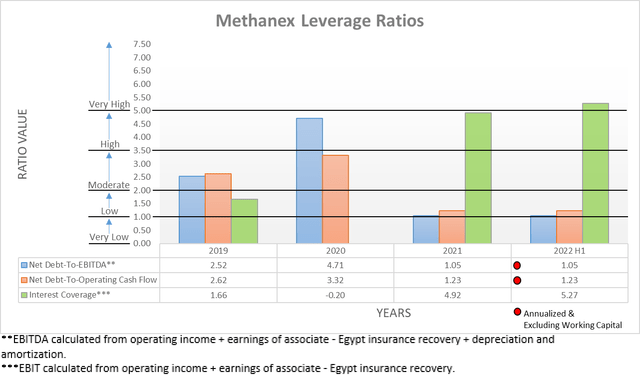

Since their net debt only saw a modest increase during the first half of 2022, their continued strong financial performance kept their leverage unchanged. In fact, oddly both their net debt-to-EBITDA and net debt-to-operating cash flow are identical to their previous results of 1.05 and 1.23, thereby once again residing within the low territory of between 1.01 and 2.00. Whilst the possibility of a recession could derail their financial performance and thus send their leverage higher, their strong financial position means they are very well positioned to ride out this turbulence. Even if this unsavory outcome comes to fruition, thankfully it should only be a short-term bump in the road given their solid medium to long-term outlook.

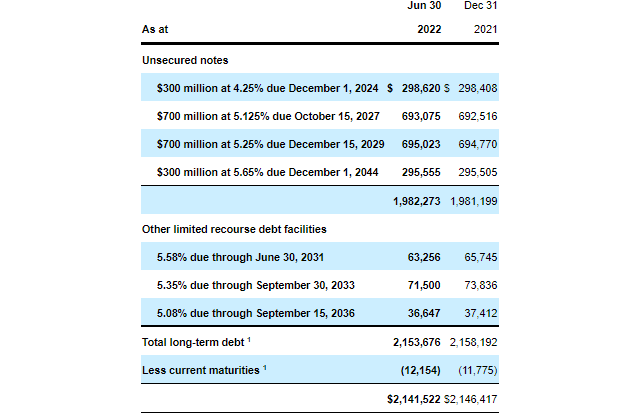

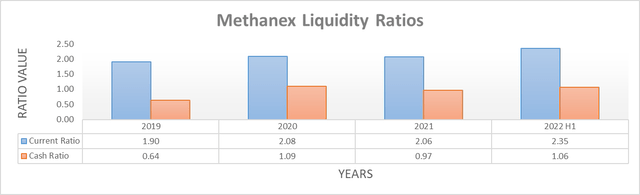

Despite the hindrance of their sizeable working capital build during the first half of 2022, their liquidity remains strong with respective current and cash ratios of 2.35 and 1.06 slightly better than their previous respective results of 2.06 and 0.97 at the end of 2021. This further supports their ability to not only reward shareholders right now but equally importantly, it ensures they can traverse any short-term turbulence due to a recession. Whilst not necessarily required, they also retain a further $600m available under their two credit facilities and despite being less than the $900m they retained at the end of 2021, it remains sizeable and thus does not pose any issues as they have zero debt maturities until December 2024 at the earliest, as the table included below displays.

Methanex Q2 2022 6-K

Conclusion

Ignoring the noise of the market in the short-term can be difficult, especially with seemingly constant news about recessions, high inflation, energy shortages and sadly, a war in Europe. If looking past these short-term issues, the medium to long-term sees growth for methanol demand unpins their ability to return vast sums of cash to shareholders, whilst also supporting a strong and swift recovery from any possible economic downturn. When combined with their strong financial position and ability to provide a very high double-digit shareholder yield on current cost, I now believe that upgrading my rating to a strong buy is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Methanex’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment