onurdongel

(This article was in the newsletter August 23, 2022, and has been updated as needed.)

Epsilon Energy (NASDAQ:NASDAQ:EPSN) overcomes the small company risk that is typical of a lot of companies in the industry by managing to avoid the things that cause a lot of stock price volatility. This is combined with a rock-solid balance sheet to minimize financial risk. The whole strategic package is a smaller company with an unusual amount of safety not often seen even in the larger upstream operators of the industry.

The company reported a second quarter cash balance of $30 million. The cash balance is large enough to pay off all liabilities while still having more cash left in the true Graham and Dodd fashion. Companies in the industry with debt-free balance sheets are not all that common. A large cash balance, as is the case for a company of this size, protects the stock from too much downward pressure because cash is considered a fluid source of funds.

Secondly, the company has an interest in a midstream operation. Midstream operations traditionally do not vary anywhere near as much as upstream. So, there is a steady cash flow available from the midstream operations that many upstream operators lack.

Not An Operator

This company does not operate any of its leases. Instead, management usually has well-established operators that operate the leases. This frees up a considerable amount of personnel expense. However, it also introduces less control over the development pace of the leases where the company has an interest. This fact does necessitate a decent cash balance and low debt so the company can maximize the participation choices once an operator proposes a development pace.

To some extent, the perceived lack of control over the pace of lease development can be offset by contractual agreements. But other factors, like commodity prices are beyond control of the operator. Yet a lot of those factors will control the pace of lease development. In the current environment, any and all parties are likely to develop the company leases at a decent pace.

Investors need to remember that this is a small company. So, production growth can be lumpy. With larger companies that are constantly drilling and completing wells, relatively smooth and predictable production growth results. Here, one project can have a material result on the company-reported production until the next project completes. There is also the factor that the company interest varies by leases developed. So, some projects have considerably more effects upon future reporting than others.

Operating Areas Of Interest

This company operates principally in two basins: the Scoop and Stack area in Oklahoma and the Marcellus in Susquehanna County, Pennsylvania.

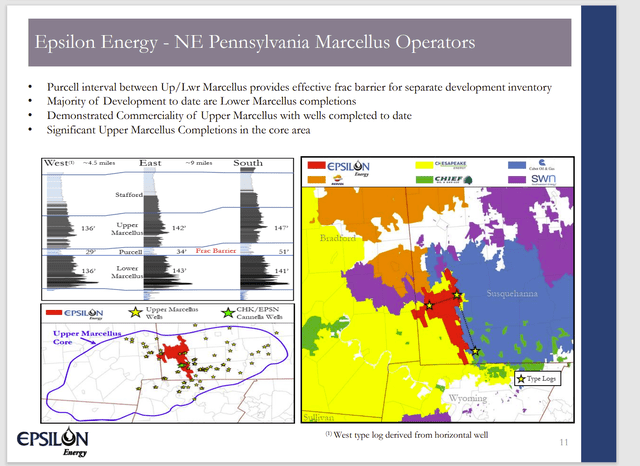

Epsilon Energy Marcellus Lease Holdings (Epslon Energy November 2021, Corporate Presentation)

The established operator of these leases is Chesapeake Energy (CHK). That is a long-standing relationship with the company that goes back about a decade or so.

What is new for the company is the establishment of Upper Marcellus production. Previously all the production came from the Lower Marcellus. That opens up an avenue for some future production growth in a situation that was perceived to be maturing in the past (with of course future production declines expected).

The other possible area of growth from continuing technology improvements is the ability to recover more natural gas. The unconventional business is fairly young. Therefore, recovery estimates are relatively low when compared to a lot of conventional opportunities. That is likely to change in the future as technology continues its forward march.

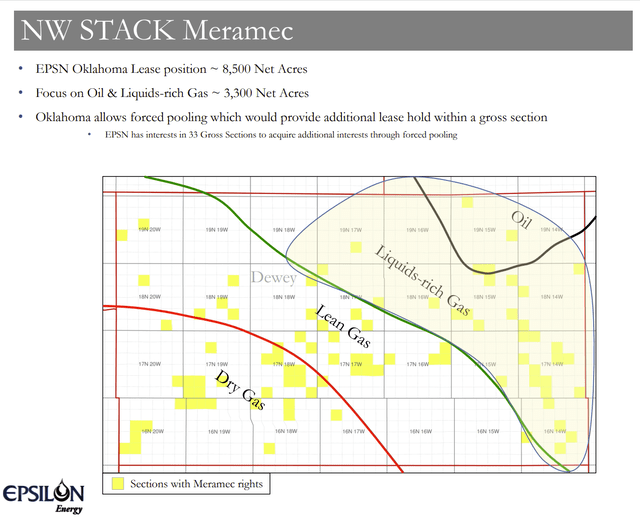

Epsilon Energy Oklahoma Lease Holdings (Epsilon Energy November 2021, Corporate Presentation)

The emphasis on growth will lead to a fair amount of development of the relatively recent acquisition of the Oklahoma leases. The total holdings of leases are far larger than is the case for the Marcellus. The current pricing of various commodities has probably made all the lease areas a potential target for development.

The emphasis on liquids-rich areas as noted by management should give the company a profit flexibility that it never had with the Marcellus leases. Generally, liquids-rich development projects have higher costs. But they also offer a more valuable mix of end products. So, it will be interesting to see how the future strategy unfolds as commodity prices vary over time. That mix of end products can make these leases very profitable under potentially more industry conditions than simply dry gas alone. A lot will depend upon relative production costs in both sets of leases.

Already, these leases have led to an increase in reported oil sales. The dry gas produced in Pennsylvania has an insignificant amount of liquids. The quantity was so small that there really was no overall effect on the average selling price. That is slowly beginning to change as the Oklahoma production begins to grow.

Cash Flow

Management reported about $15 million in cash flow at the six-month benchmark. That is easily the highest cash flow in some time (if not ever). Share repurchases are underway to also support the price of the stock.

There is a new CEO here that the outgoing CEO helped to choose. That means that the transition to the new management will likely be smooth. There is not a lot of operational risk here to begin with because the company relies upon established operators.

The major future risk would be that the remaining lease inventory would not be productive or competitive in future environments. So far that appears to be unlikely.

The Future

This management has navigated a lot of industry challenges over the years and comes through with a pristine balance sheet that protects against a lot of downside risk. Not many competitors can say that.

The reliance on established operators for the leases does take away some control of the pace of the development of the leases. But it also lowers the operational risk that many small companies have.

The current industry pricing environment allows for a fair amount of production growth whereas much of the industry is concentrating upon balance sheet repair. The upside potential of the company is considerable while a rock-solid balance sheet protects the downside to give an asymmetric return.

The presence of the midstream interest also protects downside cash flow risk. This stock is also less risky because management tends to not do “road shows” that entice known industry traders into the stock. The emphasis ends up being on a lot of long-term holders which hold down stock price volatility.

In the past, this was demonstrated by a lower stock price decline during the depths of the fiscal year 2020 challenges followed by a less-than-average appreciation when the industry recovered. A stock like this is best bought and allowed to continue to grow until at some point the size will encourage other institutions to invest in the company stock. That often results in a re-evaluation of the enterprise value of the company in a positive direction.

Companies like this one often make good acquisition candidates in the future because acquirers like to buy something that has “no trouble” and is financially sound. This company easily meets those requirements. In the meantime, this stock is best situation for long-term patient investors.

Be the first to comment