Mike Coppola

(Note: This article was in the newsletter Friday September 30, 2022.)

The market was not really happy with the second quarter results of Warner Bros. Discovery (NASDAQ:NASDAQ:WBD). But as management noted, with an acquisition of this size, results do not happen in a quarter.

And as I said on our earnings call, a lot of what’s happening in our financials right now is really still the impact of decisions that were made 12, 18 months ago.

This statement comes from Gunnar Wiedenfels, Chief Financial Officer answering interview questions at the Goldman Sachs Communacopia + Technology Conference 2022 Call September 13, 2022.

Managements often give a preliminary budget and results data. But, oftentimes, the detail really needed for that first year is just not available before the acquisition. Therefore, managements often have a range of outcomes that include the “worst possible” even if that is not disclosed to the public.

Many times, the first quarter or two is not at all relevant to the potential outcome of an acquisition. The next few quarters begin to show the effects of management decision making. It really takes at least a year (sometimes two) for an acquisition to report earnings in the fashion designed by the acquiring management strategy.

But you would never know that from the reaction of the market to the report. Generally, the bad news comes first. Just as generally, the market overreacts to that first news as if those results would persist. Yet managements that acquired acquisitions like this one planned on the preliminary results not persisting.

The Difference

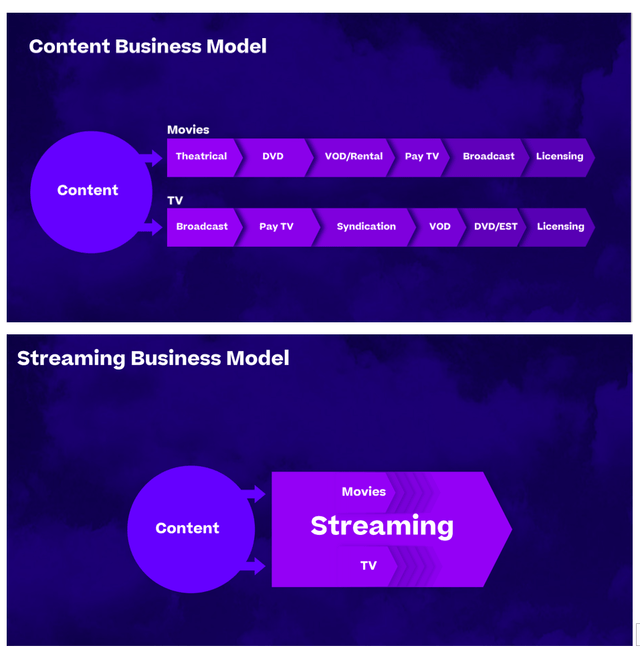

This management does not see streaming or “D2C” as the only way to go. The future market is not a “one horse play” for this management.

But we’ve also been very clear that we’re not optimizing for subscribers. We’re optimizing for a long-term sustainable business for one additional distribution platform that’s going to drive a better monetization of our content and as such, better shareholder value.

Source: Gunnar Wiedenfels, Chief Financial Officer answering interview questions at the Goldman Sachs Communacopia + Technology Conference 2022 Call September 13, 2022.

In addition to keeping options for future business growth, management has long stated that spending will be disciplined within budgets. This management does not agree with the idea of outspending revenue in streaming (for example) to grow the subscriber base because that is not a sustainable model.

So, no matter the headwinds, this management is finding a viable long-term strategy that will produce sufficient profitability or management will not be in that particular part of the industry in the current format.

Competition

It would appear that Netflix (NFLX) has in particular acknowledged that it cannot continue to either outspend cash flow from operating activities or not generate free cash flow. This is a part of the industry known for generating free cash flow (and a lot of it too from the leaders). Netflix as a pioneer cannot be classified as a disrupter until it generates sufficient cash flow.

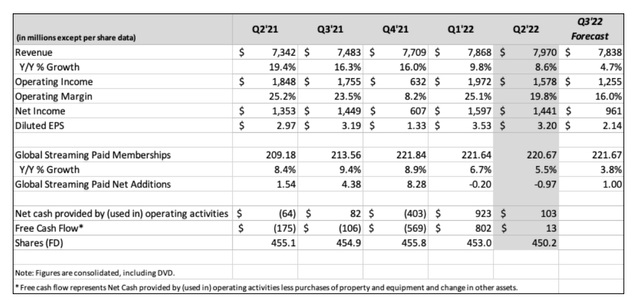

Netflix Second Quarter 2022, Operating Results Summary (Netflix Second Quarter 2022, Earnings Press Release)

As shown above, Netflix continues to have trouble generating sufficient cash flow to support the astronomical valuation of the company. For the company valuation, the cash flow from operating activities should probably be in the $20 billion annual rate territory. It is nothing close to that. This can be compared to a true disrupter like Apple (AAPL) when Steve Jobs brought out new products. Hardly anyone would dispute that Apple made a lot of money and generated a lot of cash while growing tremendously his second time around.

Now it appears management is finally ready to reign in costs. Comedy specials are the first part of the budget to feel the cost cutting knife. Secondly, management appears to be racing to boost revenue with an ad-supported tier. That is a tacit admission that the traditional revenue generator is unlikely to ever produce the growth it has in the past.

Warner Bros. Discovery Advantage

The problem with the market assumptions is that the fairly significant amount of competition is likely to limit overall growth of the company (Netflix) revenue in the future. Netflix does not have the Warner Bros. Discovery options available as the main business is streaming.

Warner Bros. Discovery has the advantage of making money in several different ways. Streaming is just one part of the company.

Warner Bros. Discovery Business Organization And Strategy Chart (Warner Bros. Discovery August 2022, Corporate Presentation)

Netflix is largely confined to the lower slide. Even in that slide the streaming part is really the option whereas Warner Bros. Discovery has television channels that may be able to handle a streaming presentation and they have a movie business as well.

Both companies can do DVD sales and licensing. But the more times something is shown to viewers either through streaming or through other channels, then the more significant DVD sales and independent licensing agreements are likely to be because each showing as an advertising edge to it.

That means that Warner Bros. Discovery can offset losses in streaming to the point where the overall profitability of the company will increase just from entering the streaming business. That is real bad news for a specialist like Netflix as it affects their main source of funding hits.

The Future

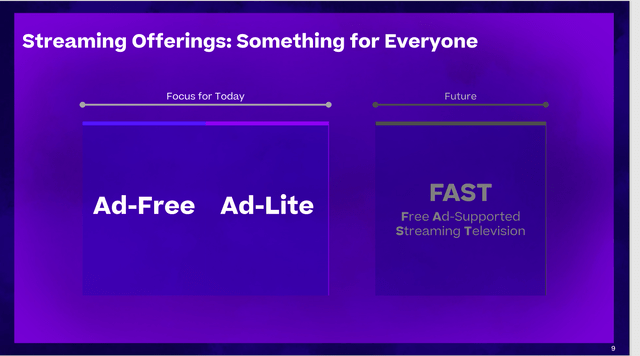

I have long stated my belief that the whole industry is likely to move to the internet in the future. But that is likely to include cable as well because cable has an advantage of large packages for a reasonable price.

Warner Bros. Discovery Management Vision Of The Industry Future Entirely On The Internet (Warner Bros. Discovery August 2022, Investor Presentation)

That means that Netflix will become in essence one television channel of many available on the internet as the whole industry heads towards streaming and downloads. I already can watch whatever I miss by going to channel website and catching up with a specific program (many times up to four weeks of missed episodes). It may not be too long before everything heads there.

Netflix is way overpriced as a television station of any type and it fails to generate the cash flow typical of more traditional stations.

Warner Bros. Discovery already has television stations both on cable and through the streaming route. The valuation of the company is very reasonable (or underpriced) for the potential of the newly combined company.

One of the things shown by the combined company is that Warner Bros. Discovery is coming into streaming with an already significant free cash flow advantage. Management has made it a priority to increase that advantage as fast as possible. In the coming streaming wars, free cash flow will be a huge advantage.

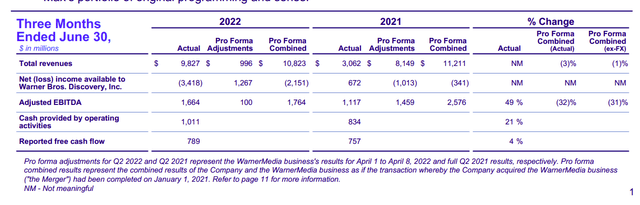

Warner Bros. Discovery Second Quarter Operating Results Summary Comparison (Warner Bros. Discovery Second Quarter 2022, Earnings Press Release)

Management is moving very quickly to “right the ship” because of the very clear implication that free cash flow did not gain materially from the combination as shown above. Still that free cash flow shown equates to at least a $3 billion annual rate. That is three times the size of the Netflix stated goal of cash flow and it is a far higher rate than the company ran in the second quarter annualized. Netflix cash flow and free cash flow is going in the opposite direction of the goal stated by management and the goal stated by Warner Bros. management. It will be interesting to see the cash flow “race” unfold throughout the streaming business as the future unfolds.

Even considering the fact that free cash flow was likely impacted by non-recurring combination charges, the annual free cash flow of the combined Warner Bros. Discovery company was pitiful. The situation therefore needed the immediate attention it got. As nonrecurring expenses decline, cash flow should rise dramatically because management has taken steps to cut costs immediately.

But the market was concerned with the impairments and other charges needed to bring about the changes that would unlock the potential of the merger. That likely continues to make an investing opportunity in the stock because the market (as usual) underestimates the ability of management to bring about the original value contemplated. The focus of the market is on the original charges as being the problem rather than part of the solution is bringing about a bargain for potential investors.

Because of the 12 to 18 months lag that management discusses above, there will be a mixture in the results reported for the next year or so. The old parent company results will have a steadily declining impact over results while the new management decisions will have an increasing impact over results reported.

Therefore, probably by yearend, quarterly results will improve with a small chance that some of the management actions will be visible to shareholders in the third quarter. I would expect some fairly dramatic quarterly improvements just to get to average returns posted by this industry. This management is likely to keep posting improved results for a superior return. That means the investor has a good chance to recover the stock price decline as well as post a decent return above that decline.

Be the first to comment