guvendemir/E+ via Getty Images

Introduction

I’m guilty of using the words “bear market” a lot in my article titles recently. However, I cannot help myself. Whenever the market tanks, we get new buying opportunities. Over the past few weeks, I have discussed railroads, high-yielding utility companies, consumer stocks, and related. One stock that was missing is L3Harris Technologies (NYSE:NYSE:LHX), a stock that undeservingly flies under the radar as people mainly focus on the “big guys” in the industry. In this article, I will walk you through my thoughts as we look into one of the most advanced defense contractors in the world with a decent dividend yield and the potential to maintain sky-high long-term shareholder distribution growth. We’ll also look into political issues like the war in Ukraine and the defense budget, which are just two of many factors providing the industry with the outlook of accelerating tailwinds.

So, without further ado, let’s dive into this dividend beauty!

What’s L3Harris?

As L3Harris isn’t as well-known as its big brother Lockheed Martin (LMT) or defense/commercial hybrid Raytheon Technologies (RTX), let’s start with a quick look into the company’s business.

As I wrote in my last article,

[…] I believe that L3Harris is one of the best ways to buy defense exposure thanks to its diversified exposure. For example, while Lockheed Martin is highly dependent on the F-35 program, L3Harris does not have any major projects.

The company has three business segments:

- Integrated Mission Systems

[…] including multi-mission intelligence, surveillance, and reconnaissance (“ISR”) and communication systems; integrated electrical and electronic systems for maritime platforms; and advanced electro-optical and infrared (“EO/IR”) solutions.

[…] including space payloads, sensors, and full-mission solutions; classified intelligence and cyber defense; avionics; and electronic warfare.

[…] including tactical communications; broadband communications; integrated vision solutions; and public safety radios; global communications solutions.

Moreover, this year, it went from four to three business segments, which means the company also still includes commercial aviation products, commercial pilot training equipment, and mission networks for air traffic management. These were formerly part of its Aviation Systems segment.

Adding to that, and this is important if you’re new to L3Harris, the reason I’m not backtesting the stock in this article or showing you financial data prior to 2019 is that L3Harris is the result of a 2019 merger between L3 and Harris.

With that said, even if the only thing you take away from the information above is that L3Harris is a (1st-tier) supplier of major defense contractors with incredible diversification and exposure to all major defense “niches”, you know enough.

2022 Isn’t *That* Bad For LHX Investors

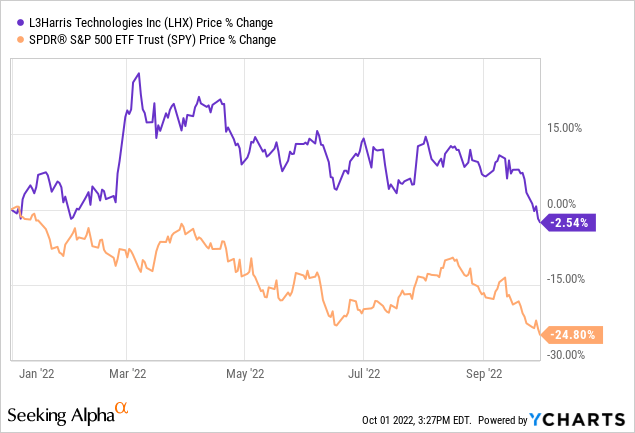

Since the close on December 31, 2021, L3Harris has lost 2.5% of its value, excluding dividends. That’s down from a gain of roughly 20% after Russia set foot in Ukraine earlier this year.

Meanwhile, the S&P 500 has lost a quarter of its value in what has become the second-worst drawdown since the Great Financial Crisis.

Essentially, we’re dealing with an environment of slowing economic growth, persistently high inflation, and aggressive Fed that is trying to fight the latter, making the first issue worse. I discussed this in great detail in this macro/market-focused article.

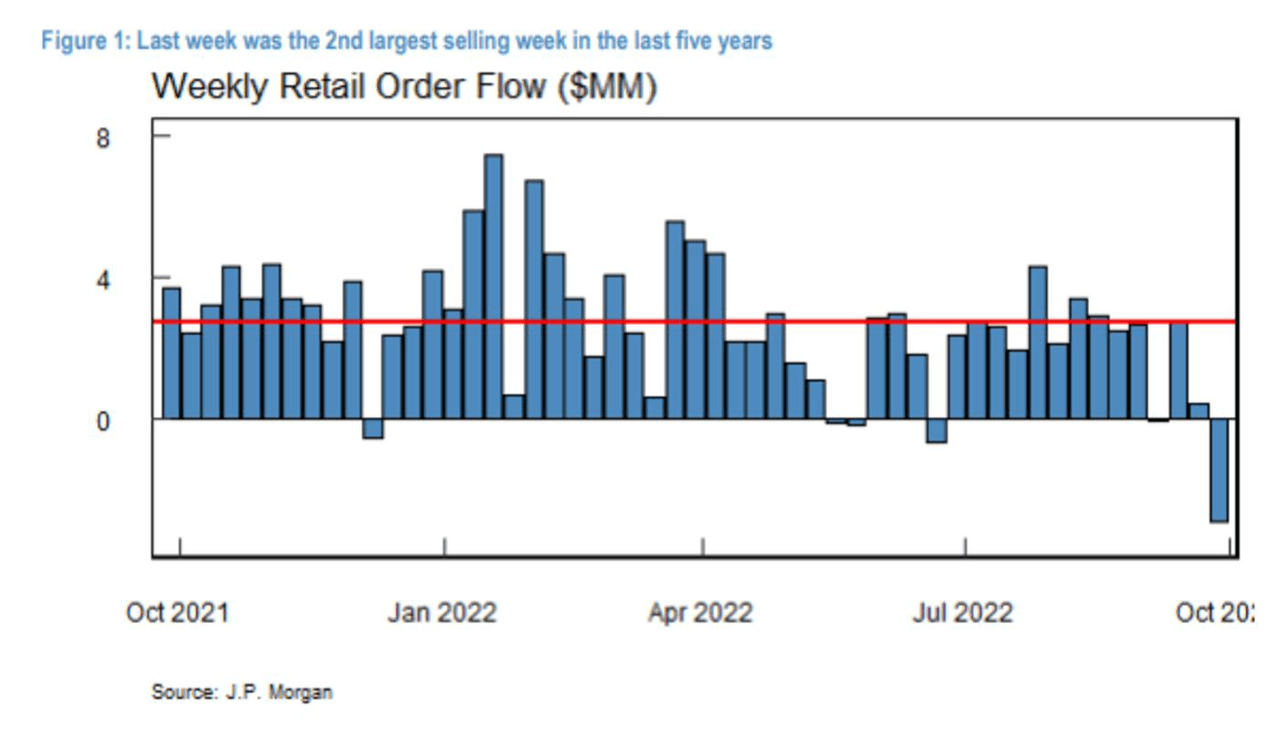

As the Fed is sticking to its plan despite an imploding stock market, retail investors are now starting to panic. According to Bloomberg:

Fed officials Thursday again hammered home their intention to keep tightening until inflation comes down, markets be damned — more or less. Retail investors, who bought almost every dip since the Covid crash, are exiting stocks at a rate not seen at any time since the pandemic lows while spending a record to lock in protective options.

As visualization trumps everything, the chart below shows retail outflows, making last week the 2nd-largest selling week in the past five years. That’s quite something.

JP Morgan

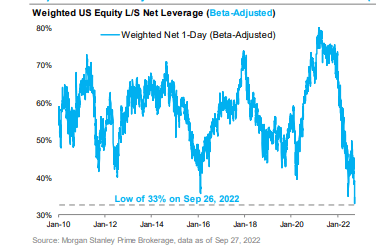

The same goes for professionals as hedge funds have hit the lowest net leverage levels since Morgan Stanley started tracking the data.

Morgan Stanley

All of this is bad for the market. However, it isn’t bad news for L3Harris. Like its peers with close to 100% defense exposure, its largest risks are supply risks, not demand risks.

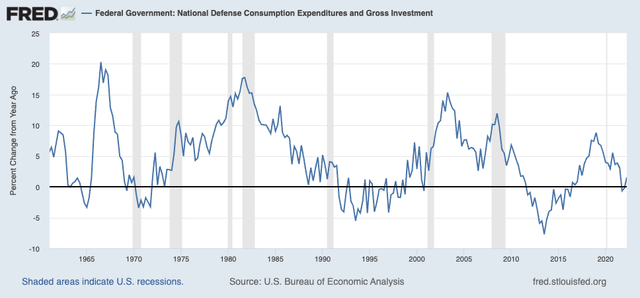

The Defense Bull Case

If anything, demand could increase for a number of reasons. Reason number one is that defense spending isn’t just anti-cyclical, it is also often used as a tool to support the economy. As the chart below shows, defense spending often increases during recessions. The shaded areas display recessions. This makes sense as spending billions on large defense projects not only benefits the largest contractors but also thousands of companies further up the supply chain. It is an easy way to maintain employment in manufacturing industries.

Reason number two is the war in Ukraine and tensions in Taiwan. While I do not expect China to make a move on Taiwan due to the insane (I’m not using this word lightly) impact it would have on its own economy, we’re in a situation where global tensions are sky-high. Europeans are boosting defense spending, as NATO made clear that the 2% (of GDP) spending target is now considered to be a floor as accelerated spending is needed. Moreover, Ukraine is getting “old(er)” equipment from partners, meaning these older technologies need to be replaced.

It’s also looking like the war in Ukraine won’t be over soon. Ukraine is making good progress pushing back the Russian forces, which is now leading to a (partial) mobilization in Russia. Russia made clear it has targets in Ukraine, and being pushed out anytime soon doesn’t look like the likely outcome.

Reason number three is inflation. Government defense spending needs to increase to offset high materials, labor, and related inflation. As Defense One reported last month: defense firms sound inflation alarms as Congress mulls the 2023 budget.

High inflation is estimated to cost the Pentagon roughly $110 billion in buying power between 2021 and 2023.

According to the article:

“To protect readiness, maintain critical acquisition and [research-and-development] schedules, and avoid waste, we request that Congress consider inflation when setting the topline for a continuing resolution,” the associations wrote in a Monday letter to Senate and House appropriations leaders.

NDIA said the Pentagon needs $815 billion, a $42 billion increase, to keep pace with inflation in 2023.

Moreover, the following quote is important as a lot of defense companies have more than 50% of contracts with a fixed-cost structure:

In its white paper, NDIA took that a step further, arguing that Congress should order the Pentagon to adjust contracts, even fixed ones, for inflation.

“Congress should direct that contract prices are adjusted for inflation,” the white paper states. “Programs that are currently being executed and that were priced prior to the onset of inflation should be adjusted to correct for unexpected inflation. Future contracts should include an automatic inflation adjustment clause.”

Note that I’m not just bringing this up to make the case that defense spending needs to rise due to inflation, but that a lot of people and trade groups are employed to make sure that the government provides efficient funding for the defense supply chain. This helps the long-term bull case for defense companies. Especially when it comes to beating both the market and long-term inflation.

Even if the market sell-off continues to pressure defense stocks, I continue to believe that buying opportunities should be used as the industry is not encountering economic risks like cyclical companies.

It also helps that L3Harris has become much, much more attractive from a dividend point of view.

L3Harris Dividend

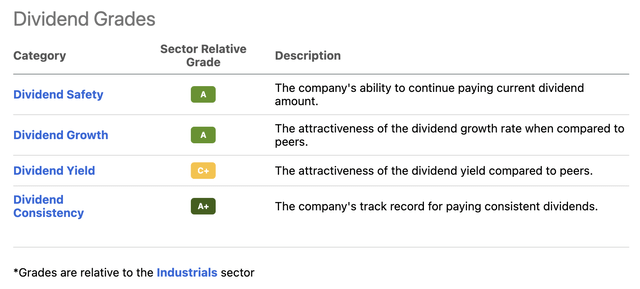

Besides its fantastic business model, the Seeking Alpha dividend scorecard below is the reason why I cannot stop talking about L3Harris. The only thing that somewhat disappoints some investors is its yield. The company scores a C+ when comparing its yield to its industrial peers. All other segments are in the A range.

However, thanks to the sell-off, yields are rising. The company is currently paying a $1.12 dividend per quarter. That’s $4.48 per year, implying a 2.2% dividend yield.

Income-seeking investors will probably still dislike the stock. However, the company has a history of high dividend growth. If we go back 10 years, prior to the merger, we get a 10-year average annual dividend growth rate of 14.1%.

These are the most recent hikes (all post-merger):

- February 25, 2022: 9.8%

- February 26, 2021: 20.0%

- February 28, 2020: 13.3%

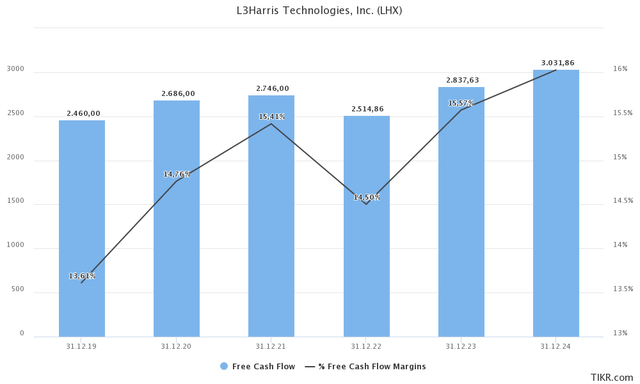

These numbers are backed by very strong free cash flow. Free cash flow is basically operating income minus capital expenditures. It’s cash a company can distribute at will as it is not necessarily needed to run its business.

As L3Harris is expected to end this year with less than $6.2 billion in net debt (or 1.7x EBITDA), it does not need to prioritize its balance sheet.

Looking at the graph below, we see that free cash flow is expected to gradually grow to more than $3.0 billion in 2024. Moreover, the free cash flow margin is consistently rising, meaning the company is increasingly efficient. In 2024, $0.16 of every revenue dollar is expected to end up as free cash flow. That’s up from less than $0.14 after the merger.

If the company does indeed end up with $2.8 billion in free cash flow next year, we’re dealing with an FCF yield of 7.0%.

That’s one of the highest (expected) free cash flow yields I have encountered – even after the recent sell-off.

What this means is that the company can technically distribute a 7% yield to shareholders every year. This consists of a dividend (currently 2.2% yield) and buybacks. It also means that dividends not only have a lot of room to grow but also that there is plenty of long-term growth as free cash flow isn’t done growing.

Moreover, the dividend payout ratio is just 31% using the next twelve months’ EPS estimates of $14.4. That’s extremely low, and good news for dividend growth investors.

Using 2Q22 as an example, the company distributed $217 million in dividends. It also bought back $421 million worth of stock. Since early 2020, the company bought back 15% of its shares outstanding. That’s a remarkable number as it covers more than $7 billion from free cash flow and post-merger divestitures. The company still has $1.8 billion remaining under its authorized buyback program. That alone is 4.5% of its market cap.

Related, it also helps that the valuation has come down a lot.

LHX Stock Valuation

The sell-off is hitting sectors and industries across the board. Investors are de-risking their portfolios causing even high-quality stocks to sell off. It also doesn’t help that Wells Fargo downgraded defense companies as it sees budgetary difficulties and easing global tensions.

Lockheed was cut to Underweight from Equal Weight, while its price target was raised to $415 from $406 a share. L3Harris was downgraded to Equal Weight from Overweight with a price target lowered to $238 from $272 a share.

The bank foresees a difficult year ahead with U.S. budgetary constraints and the possibility that global political tensions will ease.

“The bull case for defense seems clear — geopolitical tensions are high and politicians have discussed higher defense spending,” Matthew Akers, analyst at Wells Fargo, said in the Sept. 28 report. “On the other hand, we think 2023 sets up as a difficult U.S. budget environment, with significant downside potential if tensions ease.”

Investors may think that defense stocks act as a hedge against stock-market declines, but their record is mixed in the past 20 years, the bank’s research indicates. Consumer staples and utilities stocks are less likely to underperform during market corrections, or declines of at least 10% from a peak.

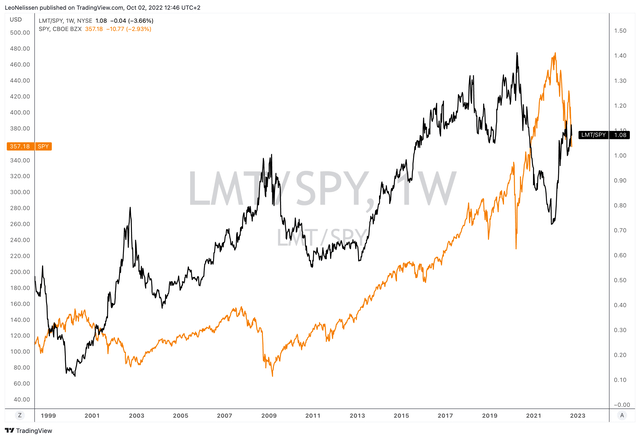

I respectfully disagree with the bank. First of all, global tensions are not easing. While the big headlines have faded, we are now dealing with lasting conflicts where a lot of parties are throwing money at the conflict without hopes of a quick resolution. The chart below shows the Lockheed Martin/S&P 500 ratio compared to the S&P 500. I didn’t use LHX because of the company’s “recent” merger. What we see is that LMT shares, which basically stand for “defense” outperformed the market during the Great Financial Crisis, the 2011 debt crisis, the 2015 manufacturing recession, the pandemic, and the current bear market. It underperformed in times when “growth” stocks were the place to be.

TradingView (Black = LMT/SPY, Orange = SPY)

Moreover, while budgetary talks are indeed not very bullish, I don’t see a way around accelerated spending as I explained in the first part of this article.

I also disagree that defense companies are a hedge against stock market declines. So far, LHX and peers have outperformed the market by a wide margin. And even if stock prices decline, we do not encounter demand risks.

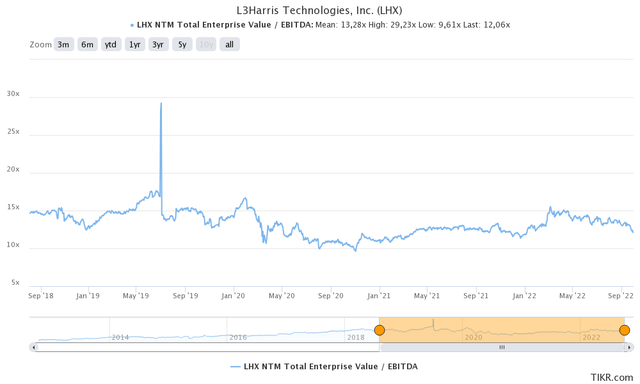

That said, the company is trading at 11.5x 2023E EBITDA of $4.0 billion. This is based on a $46.0 billion enterprise value consisting of its $39.8 billion market cap, $5.7 billion in 2023E net debt, $440 million in pension-related liabilities, and $100 million in minority interest.

This valuation is close to the 2020 lows and highly attractive for people looking to either initiate a position or add to an existing position.

Takeaway

Times are tough, the bear market is destroying value and now causing retail traders to panic. As panic often leads to very bad financial decisions, I have always based my research on finding high-quality dividend stocks that, even though they tend to fall during bear markets, protect investors against vicious recessions.

L3Harris is one of these companies. This Florida-based defense contractor is a highly-diversified supplier of high-tech equipment in all areas imaginable. Its business model protects investors against recession-induced demand risks. However, its stock price is still suffering as investors are selling everything to de-risk. It also doesn’t help that inflation is putting tremendous pressure on the defense budget.

However, I remain very bullish for a number of reasons. The company remains in a good spot as it is able to generate high free cash flow used to not only support and grow its dividend but also to aggressively repurchase shares. The company is on track to see a 7.0% free cash flow yield next year, which makes the current valuation so much better.

Moreover, I expect the defense budget to increase by “a lot” as high inflation is turning into a supply chain risk, impacting smaller (lower tier) suppliers.

On top of that, global tensions are not easing. If anything, we’re now in a situation where tensions seem to remain elevated on a prolonged basis, making it necessary for NATO defense budgets to be adjusted as modernization will be key.

So, while it’s hard to call for a bottom, I’m buying good stocks at good valuations whenever I encounter them. Right now, LHX is extremely attractively valued, offering opportunities for dividend growth investors looking to buy high-quality yields.

The only reason I’m not buying is that I have close to 25% defense exposure already.

(Dis)agree? Let me know in the comments!

Be the first to comment