Evgenii Mitroshin

Driven by higher oil and natural gas prices, Texas Pacific Land Corporation’s (NYSE:TPL) stock price has increased by more than 30% in the last six months. However, it is important to know that oil prices dropped below $90 per barrel. Moreover, TPL’s debt and cash situation indicate that the company can remain financially stable with lower oil and gas prices. The company’s revenues are linked to oil and natural gas productions in the Permian Basin, which are expected to increase in the following months. My stock valuation shows that the stock is worth $1849 per share. The stock is a hold.

TPL 2Q 2022 highlights

In its 2Q 2022 financial results, TPL reported total revenues of $176 million, compares with 2Q 2021 total revenues of $96 million. The company’s oil and gas royalties and water sales increased by 109% and 79%, respectively. Compared with 2Q 2021, TPL’s total operating expenses in the second quarter of 2022 remained the same. The company reported a 2Q 2022 net income of $119 million, or $15.37 per diluted share, compared with a 2Q 2021 net income of $57 million, or $7.36 per diluted share.

In the second quarter of 2022, TPL produced 813 thousand barrels ((MBbls)) of crude oil, 2912 million cubic feet (MMcf)) of natural gas, and 507 thousand barrels of NGL. In the second quarter of 2021, the oil, natural gas, and NGL production of the company were 683 MBbls, 2807 MMcf, and 342 MBbls, respectively. TPL 2Q 2022 total production volume increased by 21% YoY to 1805 thousand barrels of oil equivalent (MBOE). The company’s equivalents per day production increased from 16.4 MBoe in 2Q 2021 to 19.8 MBoe in 2Q 2022. Oil, natural gas, and NGL realized price of the company increased from $65.30/Bbl, $2.89/Mcf, and $25.64/Bbl in 2Q 2021, to $108.16/Bbl, $6.55/Mcf/ and $41.93/Bbl in 2Q 2022, respectively.

In the second quarter of 2022, TPL repurchased $25.5 million of its common stock. “TPL continues to reap the rewards of strong oil and gas prices and supportive Permian Basin activity, with record quarter revenues from oil and gas royalties,” the CEO commented.

The market outlook

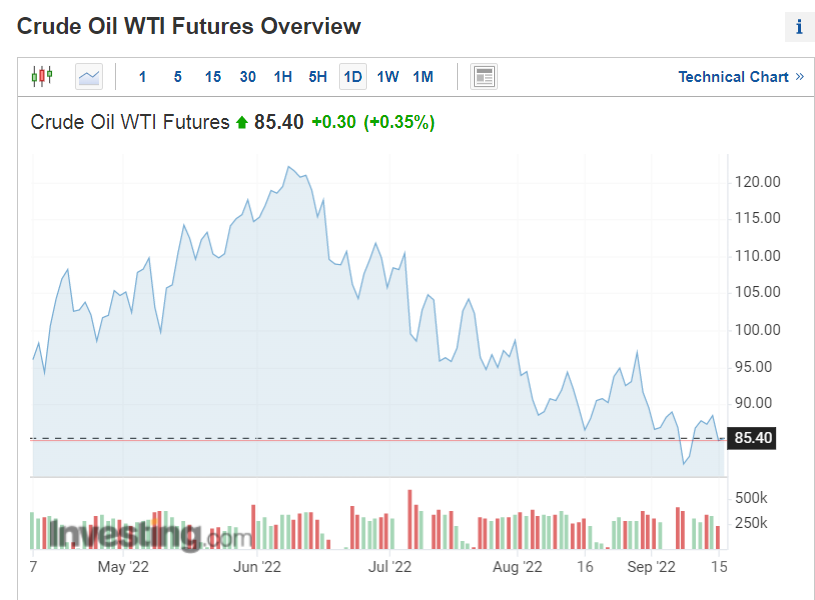

Due to higher oil and natural gas prices, driven by the invasion of Russia to Ukraine which caused an energy crisis in Europe, TPL’s realized prices in 2Q 2022 were significantly higher than in 2Q 2021. Figure 1 shows that in the second quarter of 2022, WTI crude oil prices were between $93 per barrel to $120 per barrel.

However, during the last months, WTI crude oil prices dropped to $85 per barrel. EIA forecasts WTI crude oil price of $91 per barrel for 2023, compared with WTI crude oil price of $98 per barrel in 2022. Crude oil prices decreased in August 2022 due to higher global petroleum inventories and ongoing growth in the global production of crude oil. Recently, OPEC announced that the upward adjustment of 0.1 mb/d to the production level was temporary. Thus, the OPEC crude oil production level in the following months will be lower than in September. Also, the geopolitical tensions in Europe continue, and there is no serious sign of the end of the war in Ukraine. Thus, I don’t expect EU leaders’ agreement to ban Russian oil imports by 90% to change. Moreover, I do not expect sanctions against Iranian oil to be lifted (at least until the United States House of Representatives elections and the Israeli legislative election in November 2022). Thus, I don’t expect oil prices to fall below their current levels.

Figure 1 – WTI crude oil price

investing.com

Figure 2 shows that natural gas prices in the United States increased from $5.4/MMBtu on 30 June 20222 to $9.7/MMBtu on 22 August 2022, up 80%. Due to increased natural gas demand for U.S. LNG exports driven by the Russia-Ukraine war, combined with high temperatures in the United States, which increased demand for air conditioners, U.S. natural gas futures jumped to these levels for the first time since July 2008. Natural gas prices in the United States decreased to $7.8/MMBtu in the past three weeks. However, I expect TPL’s natural gas realized price in 3Q 2022 to be at least 10% more than in 2Q 2022. Thus, I expect that in the third quarter of 2022, the effect of high natural gas prices on TPL’s revenue, EBITDA, and net income to be more significant than in 2Q 2022.

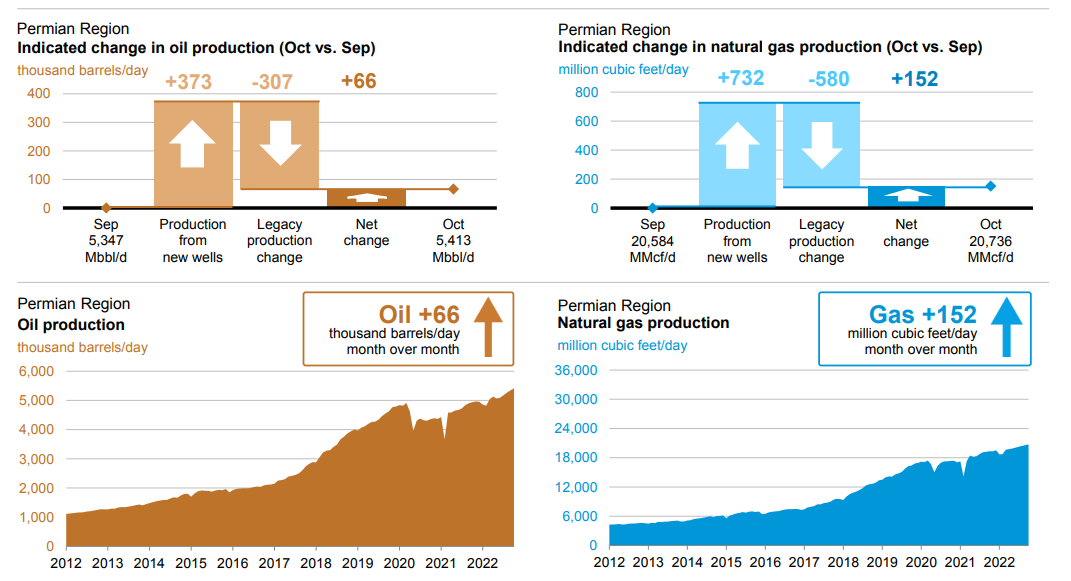

According to U.S. Energy Information Administration (EIA), the Permian Basin is the second-largest shale gas-producing region in the United States, which produced, on average, 34.8 Bcf/d of marketed natural gas in 2021. TPL owns an average 4.4% revenue interest across more than 533000 gross royalty acres in the Permian Basin. Thus, with a unique exposure to the Permian development chain, TPL’s profitability is strongly linked to the operations in the Permian Basin. According to Figure 3, oil production in Permian Basin is expected to increase from 5347 thousand barrels per day in September 2022 to 5413 thousand barrels per day in October 2022. It is worth noting that in June 2022, production in Permian Basin was 5232 thousand barrels per day. Also, in October 2022, gas production in Permian is expected to increase by 152 MMcf per day. According to the oil and natural gas market conditions and the production levels in the Permian Basins, I expect TPL’s adjusted EBITDA to be $547 million in 2022.

Figure 2 – Natural gas price in U.S.

tradingeconomics.com

Figure 3 – Oil and gas production in the Permian Basin

EIA

TPL performance outlook

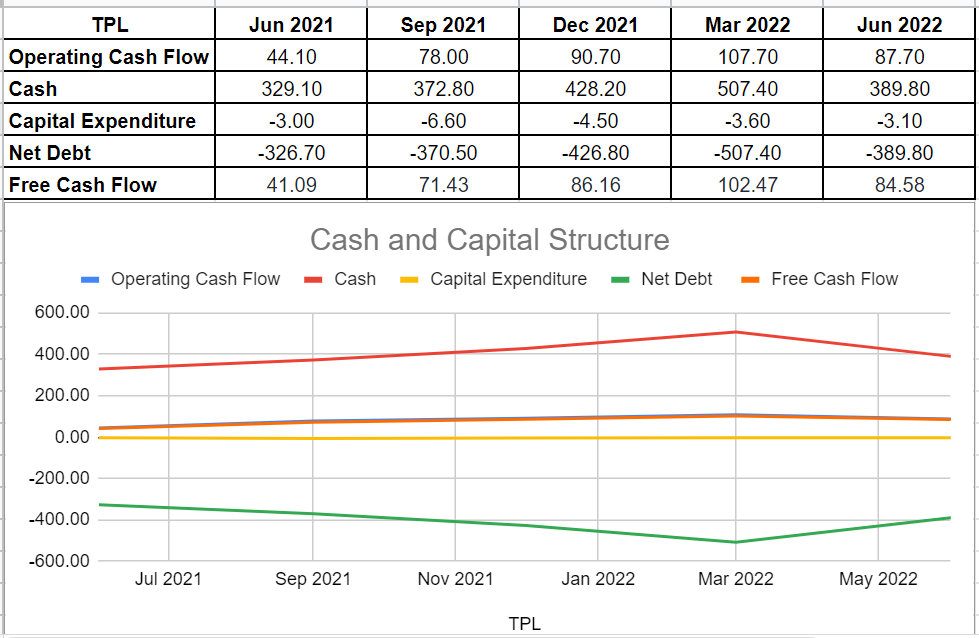

As can be seen from TPL’s cash and capital structure, for the sake of the surge in the oil price during the first quarter of 2022, the company generated a good amount of operating cash balance. In Q2 2022, the company’s operating cash flow of $87.7 million is twofold year-on-year compared with its level of $44 million during the second quarter of 2021. Hence, following their up-to-now performance and financial results, we can expect stronger cash and capital structure outlook for the rest of 2022. The company’s operating cash flow, combined with $3 million in capital expenditures, led to $84.5 million in free cash flow in Q2 2022 compared with its previous level of $41 million at the same time in 2021, up over 100%.

Texas Pacific Land’s zero debt and a cash balance of $360 million at the end of Q2 2022 indicate the company’s capability for more profit and distributions between shareholders in the case of any plunges in the oil and gas prices in the future (see Figure 4).

Figure 4 – TPL’s cash and capital structure

Author (based on SA data)

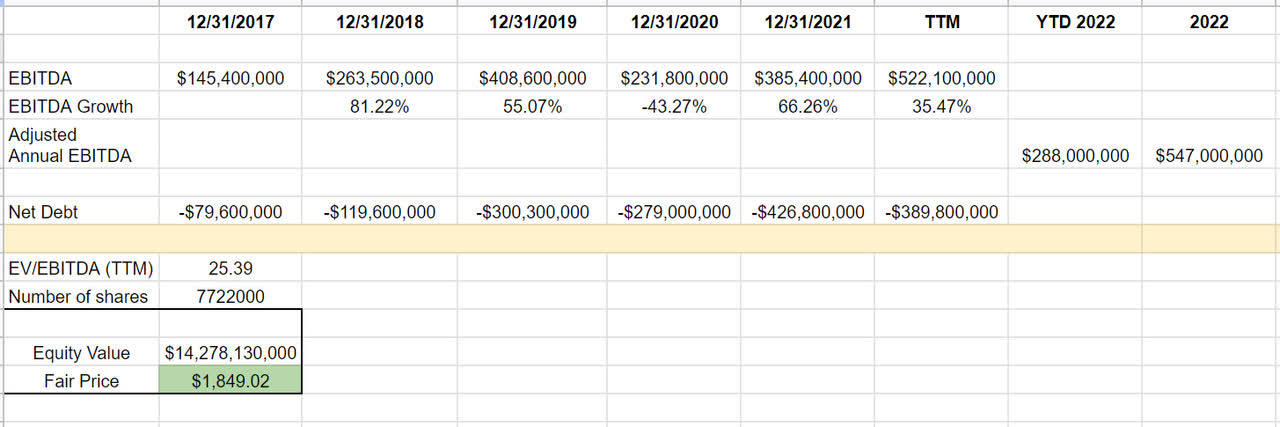

TPL stock valuation

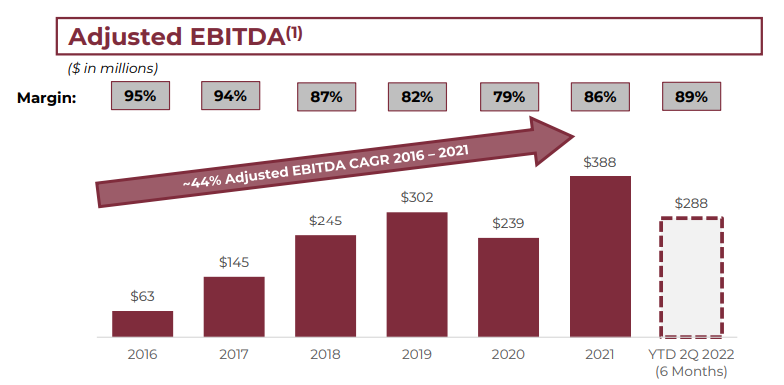

After watching Texas Pacific Land’s well-performed cash and capital structure, we observed that the company has been able to generate a good amount of free cash flow so far. Also, as the company illustrated in its presentation, its adjusted EBITDA has boosted by 44% since 2016 and sat at $288 million YTD in 2022 (see Figure 5). TPL generated 20% of its adjusted EBITDA from its water services and operations and the rest of it from land and resource management. Following its up-to-now performance, I estimate the adjusted EBITDA will reach about %547 million at the end of 2022. All was said and done, their zero-debt amount combined with the cash balance should lead to higher shareholders’ distributions, and thereby, according to such inputs, I evaluate the stock as undervalued, and its fair value would be around $1850 (see Table 1).

Figure 5 – TPL’s adjusted EBITDA

2Q 2022 presentation

Table 1 – TPL stock valuation

Author (based on SA data)

Summary

According to SA ratings (Wall Street’s price target), TPL has an average price target of $1769 per share. My valuation shows that the stock is worth $1849 per share. Oil and natural gas prices in the second half of 2022 are not as high as in 1H 2022. However, even with oil prices of between $80 to $90 per barrel, and the increasing production volume in the Permian Basin, TPL will do fine. The stock is a hold.

Be the first to comment