Douglas Rissing

Transcript

After the European Central Bank’s (ECB) big rate hike last week, this week the Fed is set to hike by at least 75 basis points to try to rein in inflation.

Volatility ahead after rate hikes

Market views on rates have been volatile – surging on prospects central banks will fight inflation at all costs, and then retreating on recession fears.

We expect more volatility until central banks acknowledge they’ll have to live with higher inflation.

1) Communication at odds with reality

The Fed and ECB are hostages to the politics of inflation, responding to calls to rapidly bring it down. But inflation is caused by production constraints – and rate rises don’t fix those.

Getting inflation to 2% would mean a recession. Until central banks accept this, they’ll keep being surprised by incoming data that just doesn’t fit their outlook.

As the impact of rate rises becomes clear, we expect the Fed and the ECB to change course – and even cut rates.

2) More persistent inflation and volatility ahead

A policy pivot means persistent inflation, in our view.

Market expectations of inflation aren’t consistent with this: they have dropped briskly in the past month. So, more persistent inflation could surprise to the upside – and again cause markets to rapidly price a higher rate path.

We focus on nimble, tactical portfolio positioning. We are underweight developed market stocks and overweight credit.

____________

Bumpy ride

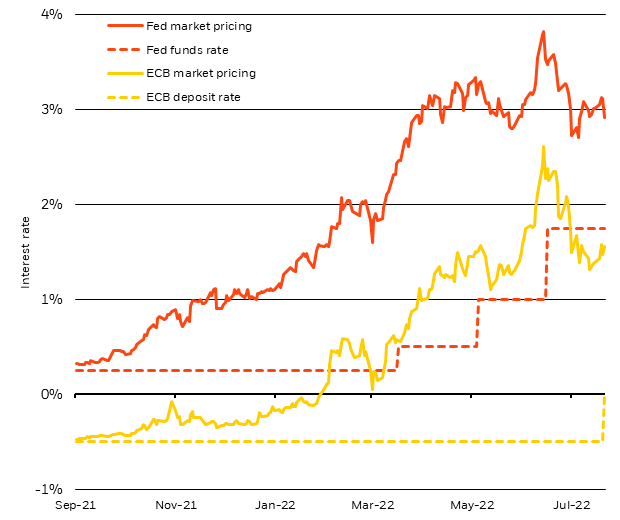

Central Bank Policy Rate Pricing In Rate Forwards, September 2021-July 2022 (BlackRock Investment Institute with data from Refinitiv Datastream, July 2022)

Notes: The chart shows expectations for three-month interest rates as implied by futures pricing for the U.S. and euro area. Solid lines show market expectations for 1-year rates in one year’s time based on interest rate swaps. Dotted lines show central bank rates.

Market expectations for Fed and European Central Bank (ECB) policy rates have swung up and down in the past year, futures pricing of Refinitiv data show. First, market pricing for the Fed funds rate jumped from near zero to almost 4% in June. See the red line in the chart. That epic move was followed by a one percentage point drop in just a month’s time. The biggest monthly changes in rate projections have been more than double the average in the two decades before the pandemic, we find. The reason: Central banks have been ignoring the sharp trade-off they are facing; crush growth or live with some inflation. This has caused rate projections to surge higher on expectations central banks will fight inflation at all costs and then retreat on recession fears. The Fed’s forecasts, in particular, suggest it believes it can bring inflation back to its 2% target without damaging growth.

The Fed and ECB are hostage to the “politics of inflation,” in our view, responding to a chorus of voices demanding they bring down inflation. The problem? Today’s inflation is caused by production constraints, from labor shortages to supply chain kinks, not because of excessively high demand. Rate hikes can cool the latter but don’t really fix the former, we think. Reducing inflation to 2% would mean slamming spending down so hard, it would stall the economic restart. Yet, the Fed and ECB still suggest they can engineer a “soft landing,” where higher rates decrease inflation and cause only a mild slowdown. Case in point: the ECB explicitly said it doesn’t foresee a recession when it raised rates by 0.5% last week.

Can they stick a soft landing?

We think a soft landing is unlikely. Central banks today face sharp trade-offs between growth and inflation, as detailed in our mid-year outlook, and many have yet to acknowledge this. The ECB limited its maneuvering room by stressing it’s only focused on inflation. This will make it harder to change course. We see a pivot later this year when a recession we flagged in early March comes knocking. We expect the Fed to change course only next year, when the economic effects of rate rises become clear. The market agrees. Rate projections now show the Fed cutting rates in 2023. That’s consistent with our view.

The ECB and Fed will eventually choose growth over inflation, we believe. That means they won’t have slammed demand all the way down to meet the low level of productive capacity. Production constraints are likely to keep fueling inflation as a result. That’s why we think inflation will persistently run above central bank targets, even as it declines from current 40-year highs. Market expectations are not consistent with this. Breakeven inflation rates – a measure of expected inflation derived from bond yields – have fallen sharply in the past month. Markets appear to expect a typical slowdown, where both growth and inflation weaken. This means inflation data could surprise to the upside – and cause markets to rapidly price a higher rate path once again. Result: another equities sell-off. That’s why we further reduced equities to a tactical underweight.

Our bottom line

We expect more volatility, so we focus on nimble, tactical positioning. We are underweight developed market equities on a tactical horizon because central banks appear set to overtighten policy. We are ready to switch back to overweight once central banks pivot to a more moderate rate path. We’re overweight credit amid higher yields and low default risks. We steer away from U.S. Treasuries as we expect further rate rises and a higher term premium, or the compensation investors demand for holding long-term bonds. We like inflation-linked bonds amid persistent inflation.

Market backdrop

The ECB raised rates by 0.5% last week. European bond yields spiked briefly on the news before settling lower on recession fears. We see a euro area recession even if rates rise very little. Why? We think the energy shock from Russia’s invasion of Ukraine will drag down economic activity. We’re already seeing weakness in PMI data, especially in Europe. The ECB’s new bond buying instrument to limit market stress may make it more inclined to overtighten policy into a recession, in our view.

This week’s Fed meeting is front and center. The market is pricing a hike of at least 0.75%. We think the Fed has boxed itself in by responding to political pressures to tame inflation. We see the Fed ultimately living with higher inflation, but only once the cost to growth from rising rates becomes clear. Second-quarter U.S. and euro area GDP data will help gauge momentum.

Be the first to comment