Artur/iStock via Getty Images

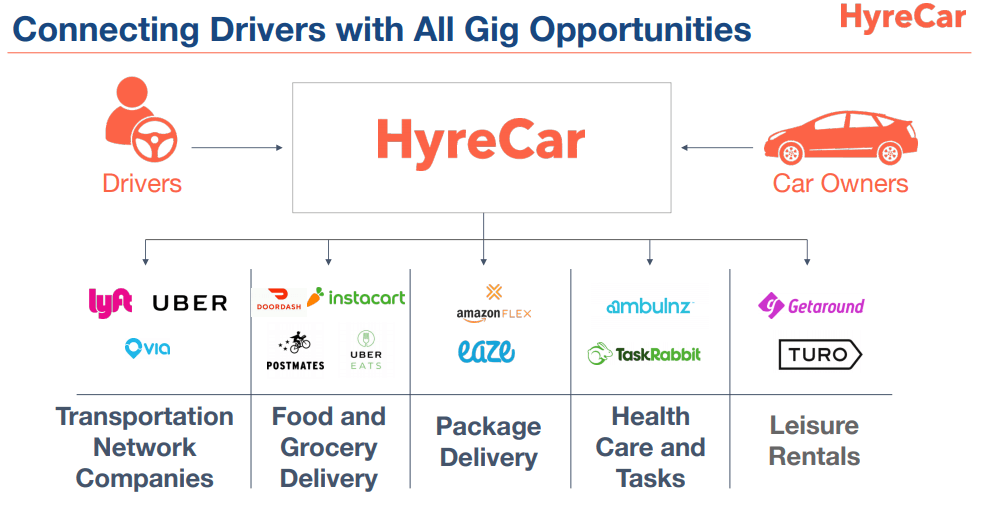

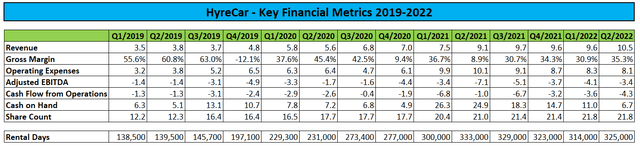

Last month, niche carsharing services provider HyreCar (NASDAQ:HYRE) reported another set of uninspiring quarterly results as the business continued to struggle with an undersupply of cars on its platform.

As a result, rental days have remained range-bound for several quarters in a row now.

Company Presentation

Particularly the much-touted strategic partnership with AmeriDrive Holdings (“AmeriDrive”) and Cogent Bank hasn’t played out as expected so far.

In recent quarters, the company was required to restrict an aggregate $3 million in cash as collateral for increases to AmeriDrive’s revolving credit facility with Cogent Bank thus reducing HyreCar’s unrestricted cash and cash equivalents to a measly $3.7 million at the end of Q2.

That said, the company made additional progress towards its stated 40% gross margin target for the end of this year and reduced operating expenses further from 2021 highs.

Management has frequently pointed to the requirement of doubling the number of cars available on its platform to up to 7,000 to achieve cash flow break-even with annual revenues between $65 and $70 million.

For the past couple of quarters, HyreCar had been working on securing a warehouse credit facility for capital-constrained strategic partner AmeriDrive and finally succeeded in its efforts earlier this month (emphasis added by author):

HyreCar Inc. (…) announced today an agreement with a premier global investment bank and Medalist Partners for a $100 million warehousing line of credit. The global investment bank will provide primary financing with Medalist Partners providing $20 million of additional financing. Under the agreement, HyreCar’s fleet operator partner, AmeriDrive Holdings, LLC, will use this facility to purchase vehicles for exclusive listing on the HyreCar platform through a bankruptcy-remote joint venture.

Through this initial warehousing line, HyreCar expects AmeriDrive to add an additional 6,000 to 7,000 vehicles over the next 12 to 18 months to the HyreCar platform. These vehicle assets will serve as collateral under the facility. As previously indicated, the company expects this line to begin a broader facility expansion into white-labeling vehicle financing for HyreCar’s fleet operators.

“While the HyreCar platform has consistently generated upwards of 30,000 driver leads every month, our bottleneck to growth has always been constrained by car supply. This partnership with Medalist, in conjunction with a premier investment bank, is the start of the next chapter for HyreCar’s growth as we seek to address the chronic shortage of drivers and cars for rideshare and delivery companies in North America,” said Joe Furnari, CEO of HyreCar. “We continue to expect to be profitable at the 6,500 to 7,000 daily car rental threshold, and we believe this deal will allow us to exceed that number. As a reminder, every 10,000 active rented cars on the HyreCar platform represents approximately $100 million in run rate revenue.”

Please note that HyreCar will be required to provide up to $10 million in financing for the new “HyreDrive” joint venture while Credit Suisse (CS) has committed $70 million and Medalist Partners the remaining $20 million.

Suffice to say, the likely resumption of growth is a major positive but expectations for adding up to 7,000 cars within just four to six quarters look aggressive, particularly given recent changes in the macroeconomic environment.

Initially, the company expects to add 1,500 vehicles over the next six months which would result in the obligation to inject approximately $2.3 million into HyreDrive.

Moreover, entering a new growth phase will almost certainly result in rising claims costs due to the requirement of onboarding a host of new drivers with unproven track records as witnessed in the past already.

In addition, the company’s ongoing liquidity issues have resulted in substantial dilution in recent weeks as evidenced by the recent $5 million emergency financing:

On September 7, 2022, we sold 5,789,716 shares of our Common Stock pursuant to that certain Common Stock Purchase Agreement, dated August 11, 2022 (the “PIPE Agreement”), by and among the Company and certain accredited investors named therein (the “Purchasers”). The shares sold pursuant to the PIPE Agreement were sold at a purchase price of $0.8636, which was the average closing price of our Common Stock as reported on the Nasdaq Capital Market (“Nasdaq”) for the five trading days immediately prior to the signing of the PIPE Agreement, for total proceeds to us of approximately $5 million.

HyreCar also started to utilize its recently downsized $7.9 million at-the-market offering program (“ATM program”). As of September 13, the company had sold 1.0 million shares for total net proceeds of $1.3 million.

The company also issued 0.5 million new common shares to Lincoln Park Capital Fund LLC (“Lincoln Park”) in exchange for providing an up to $15 million equity line of credit.

Warehouse facility lenders also managed to extract an aggregate 3.2 million warrants with an exercise price of $1.02.

Lastly, the company issued an aggregate $0.5 million in 7% short-term promissory notes to senior management.

As a result, outstanding shares have increased by more than 35% since the end of Q2 to approximately 29.7 million as of September 12.

Bottom Line

While the long-awaited warehousing credit facility recently secured for strategic partner AmeriDrive should reinvigorate growth on HyreCar’s platform, the company’s vehicle deployment projections look aggressive, particularly in light of the current macroeconomic environment.

Moreover, increasing revenues by 150% within just 18 months will almost certainly cause some growing pains as already witnessed in the past.

On the respective conference call, analysts almost desperately tried to get some insights into the company’s deployment strategy but were largely rebuffed by management.

For my part, I remain skeptical on HyreCar’s near-term outlook due to a number of issues:

- Growing macroeconomic pressures

- Overly aggressive vehicle deployment projections

- Potential, substantial increases in claims costs and operating expenses

- Likely requirement to raise additional capital in the near-term

- Management’s history of over-promising and under-delivering

Investors would be well-served to remain on the sidelines until management has proven its ability to handle the company’s next growth phase and near-term capital needs have been successfully addressed.

Be the first to comment