PonyWang

Introduction

These are the longer-term trends and semiconductors are everywhere and it’s also obvious that big societal challenges need big solutions and semiconductors go to the heart of those. So I say yes, semiconductors will grow, the semiconductor industry will grow, and lithography intensity will increase. And as a matter of fact, if we look at that, we are going to just repeat what we said a quarter ago. That we do need structurally more capacity.

Peter Wennink (ASML CEO) during Q2 earnings release video

ASML Holding (NASDAQ:ASML) reported its Q2 earnings this week. Many tech investors were awaiting these earnings because, being the leader in lithography equipment, the company has a pretty good view of what’s happening in the space. The focus for investors was definitely the demand landscape. It has increased in relevance over the last few months as the market discounts an upcoming semiconductor bust, but it came out pretty strong for ASML, as we anticipated. The main problem continues to be the supply, which is weighing on the company’s short-term growth.

We’ll cover all these topics in the article, so let’s get started!

The numbers

The headline results

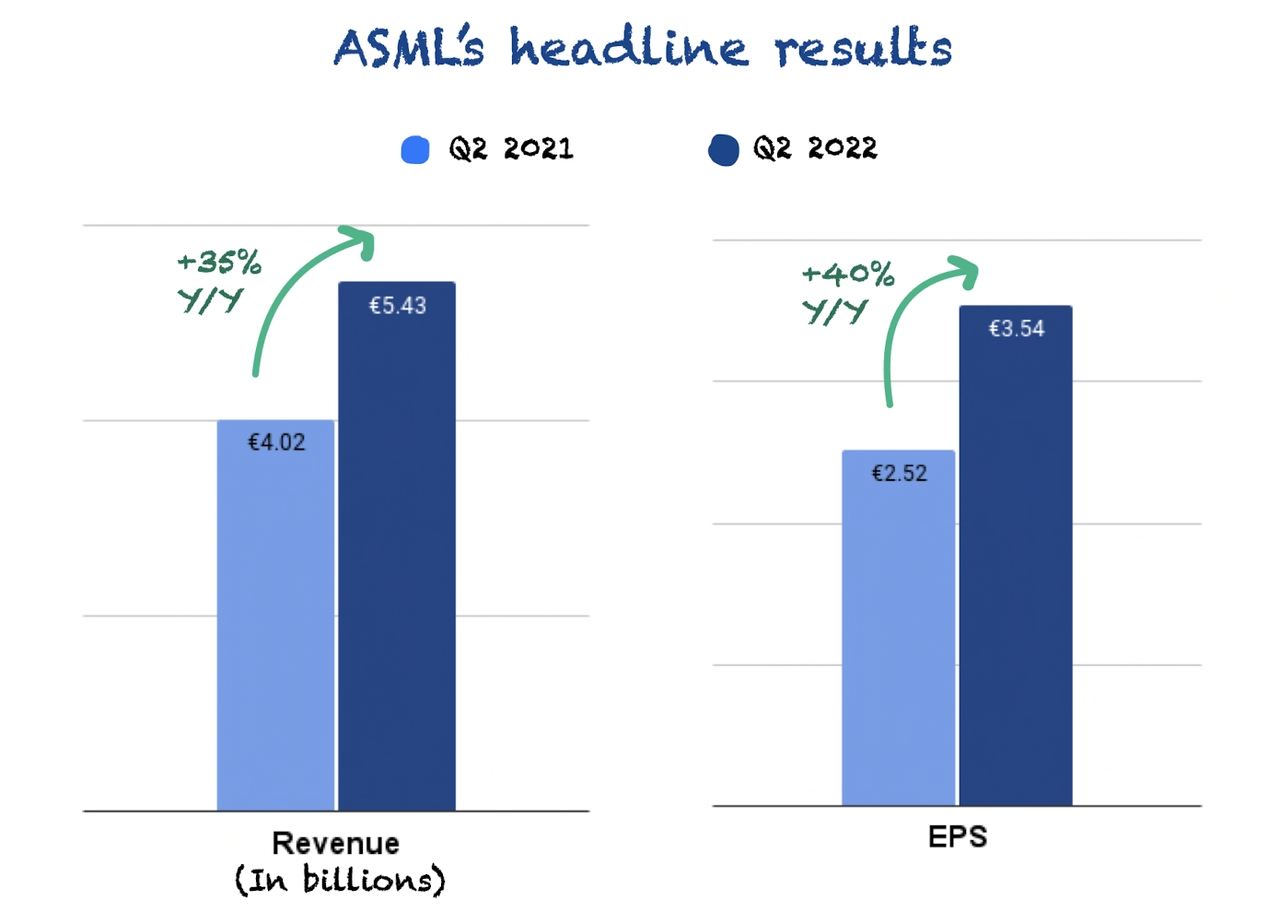

ASML slightly beat analysts’ top and bottom line estimates, and revenue came slightly above management’s guidance.

Revenue came in at €5.43 billion (+35% Y/Y), and EPS came out at €3.54 (+40% Y/Y):

Made by Best Anchor Stocks

These are impressive growth rates, but it’s important to remember that ASML saw sales and EPS decline last quarter. This quarterly volatility should make us shy away from quarterly data for ASML right now. Until the supply problems subside, it will be challenging for the company to grow smoothly because shipments won’t match revenue.

Breaking down net sales

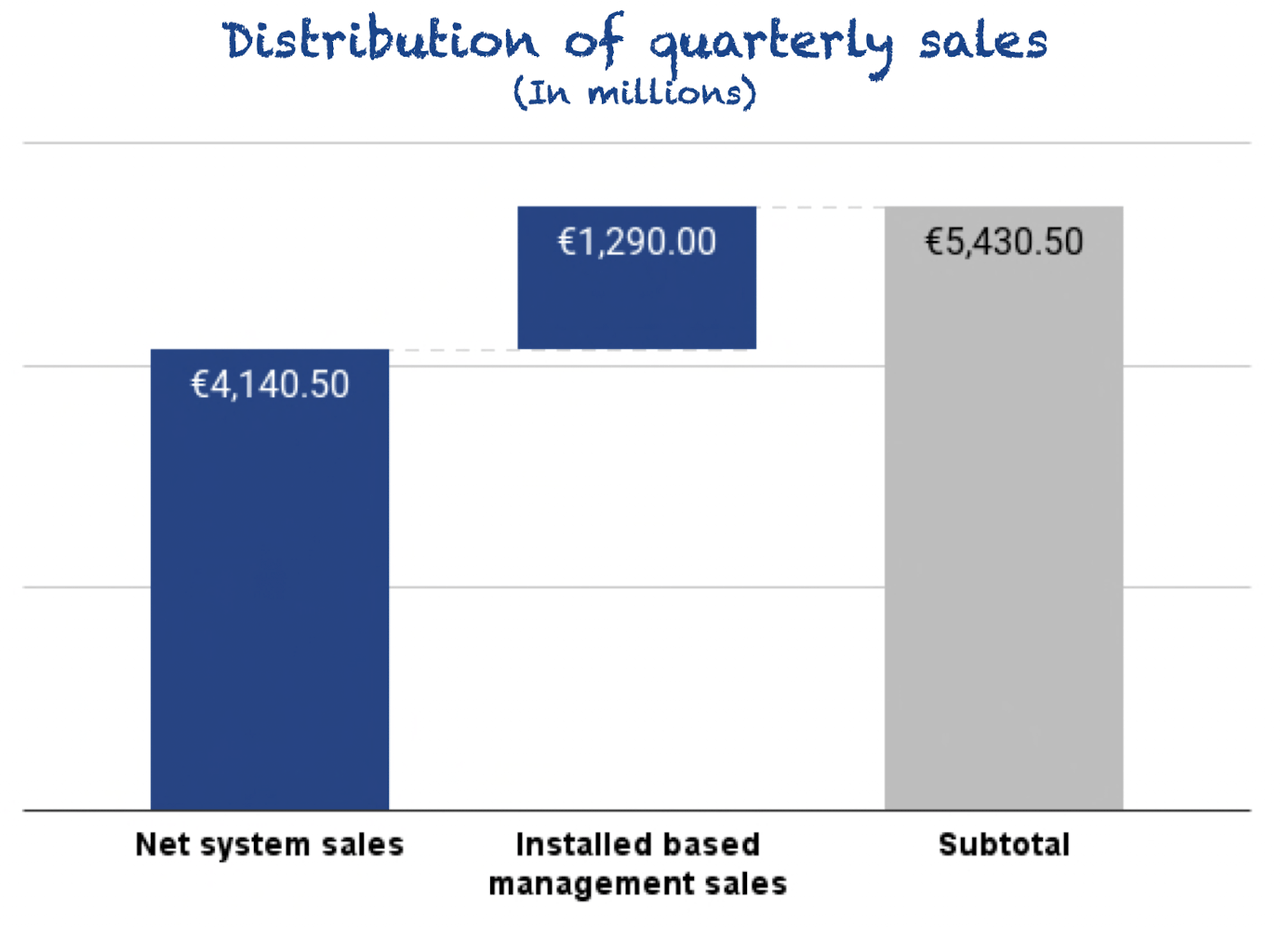

Net sales were distributed as follows between net system sales and net service and field option sales:

Made by Best Anchor Stocks

Net system sales were responsible for carrying growth this quarter (+40.4% Y/Y), whereas service and field option sales fell short of overall growth (+20.5% Y/Y). Again, there’s little we can do with this data because it’s very volatile. However, we must understand that service and field option sales should lag net system sales as the former are a direct function of the latter. Installed based management sales are also more recurring in nature, while net system sales are product-based and thus more volatile.

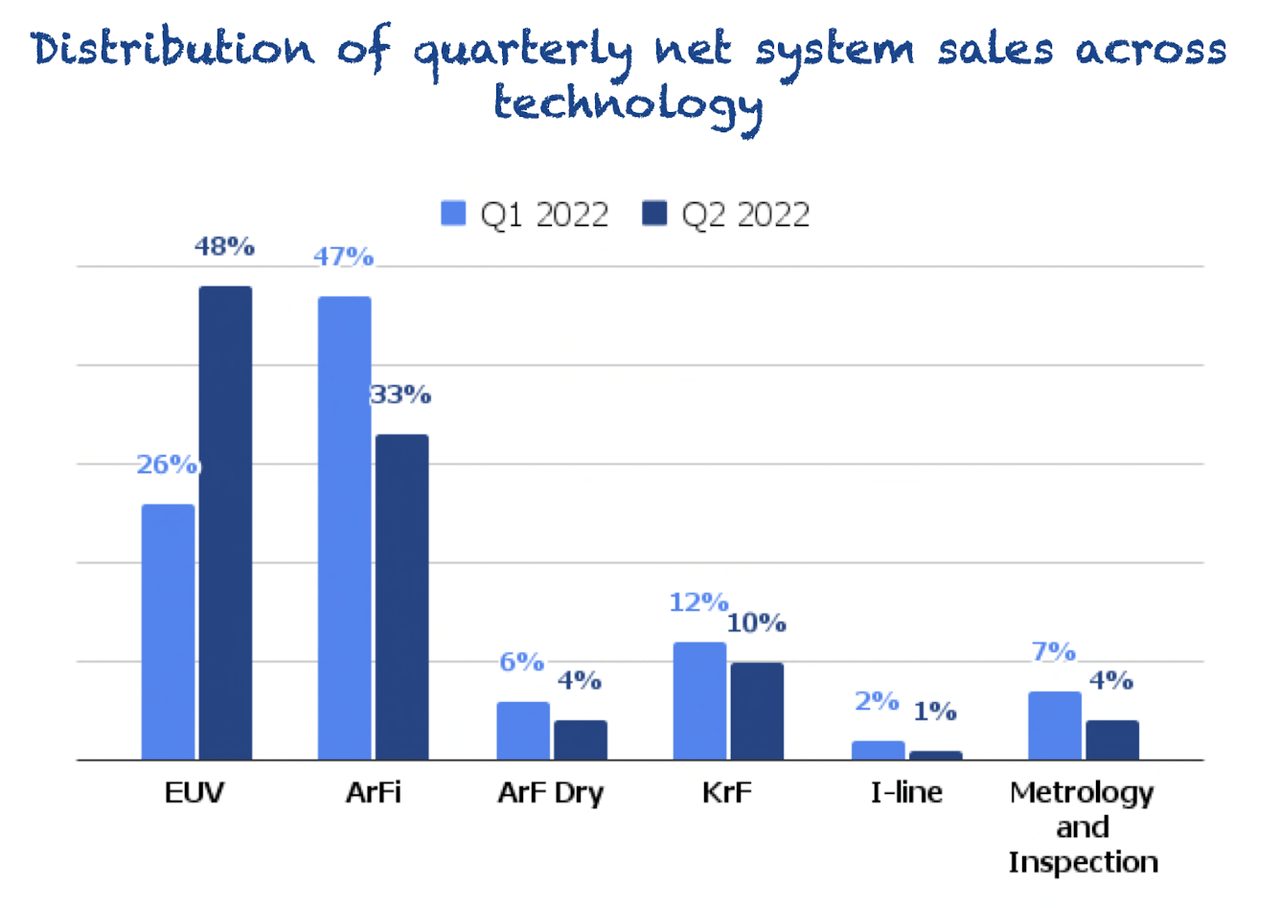

If we double-click on net system sales, we can see how leading-edge systems continue to dominate the scene:

Made by Best Anchor Stocks

Remember that leading-edge systems are ASML’s bread and butter, especially EUV, where there’s no competition. So the industry’s shift to leading-edge nodes has important implications for ASML, as its moat should widen.

Again, we should carefully interpret these numbers because they are very volatile. For example, ASML sold 3 EUV systems last quarter, whereas it sold 12 this quarter. We don’t think there was such volatility in shipments, but as the company has to wait to recognize shipments in revenue, it creates accounting volatility.

We would love to say we can just look at quarterly numbers and rush to conclusions, but in ASML’s case, we have to be a bit more patient and wait until we can zoom out. The timing of revenue recognition is playing its role, and there’s not much management can do to control it amidst the current supply-constrained environment.

All in all, sales were strong, and they seem to be shifting to the leading-edge, which is obviously great for the company’s future.

Bookings: the focus amidst the downturn

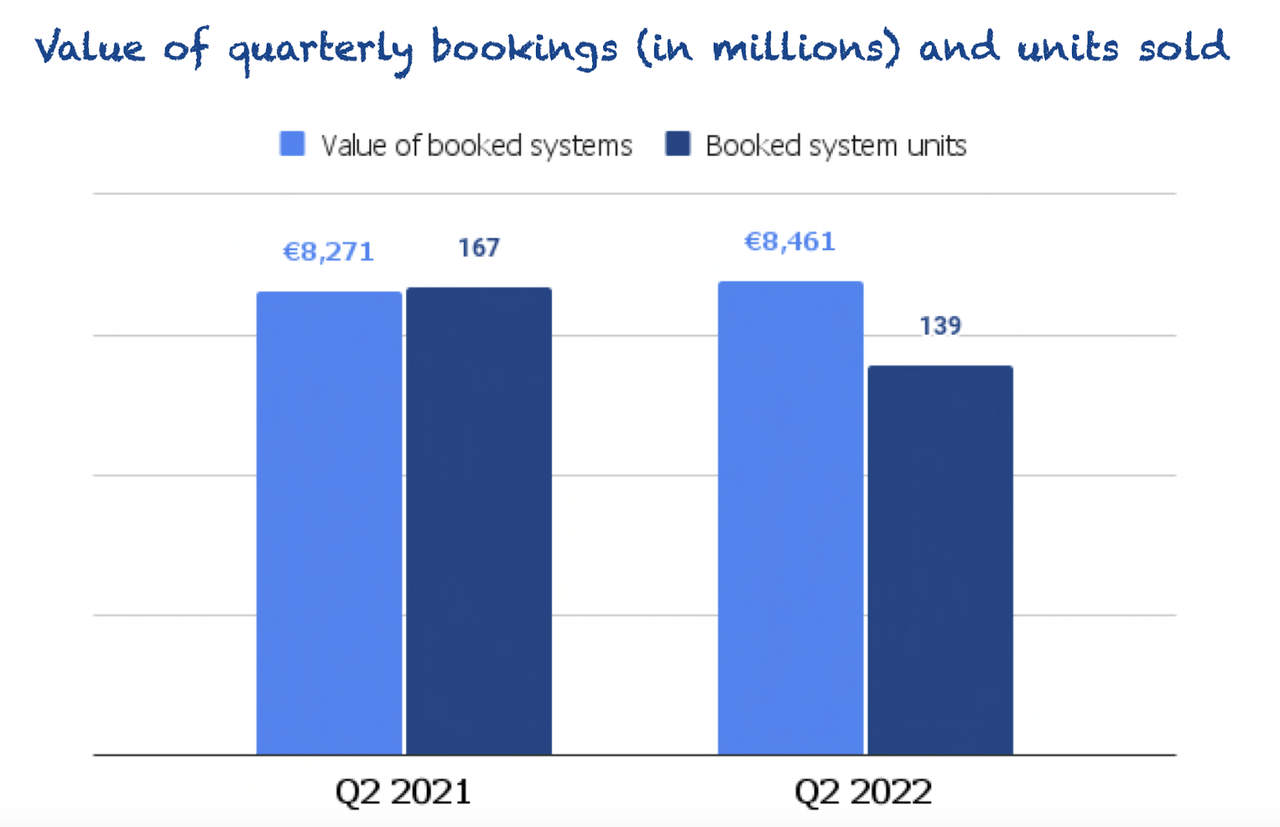

Despite the sales mix pointing in the right direction, the leading indicator of the top line is bookings. Recall that bookings measure orders that customers have placed but ASML has yet to fulfill. This means they should eventually flow into revenue.

In our opinion, this was the true focus of the release for investors (at least those that know the company well). It was pretty evident that short-term results would not be impacted by lower demand because it’s a matter of when (not “if”) ASML will recognize revenue it has already shipped (fast shipments). However, net booking does give us a look-through into future demand and the most feared by semiconductor investors: double ordering.

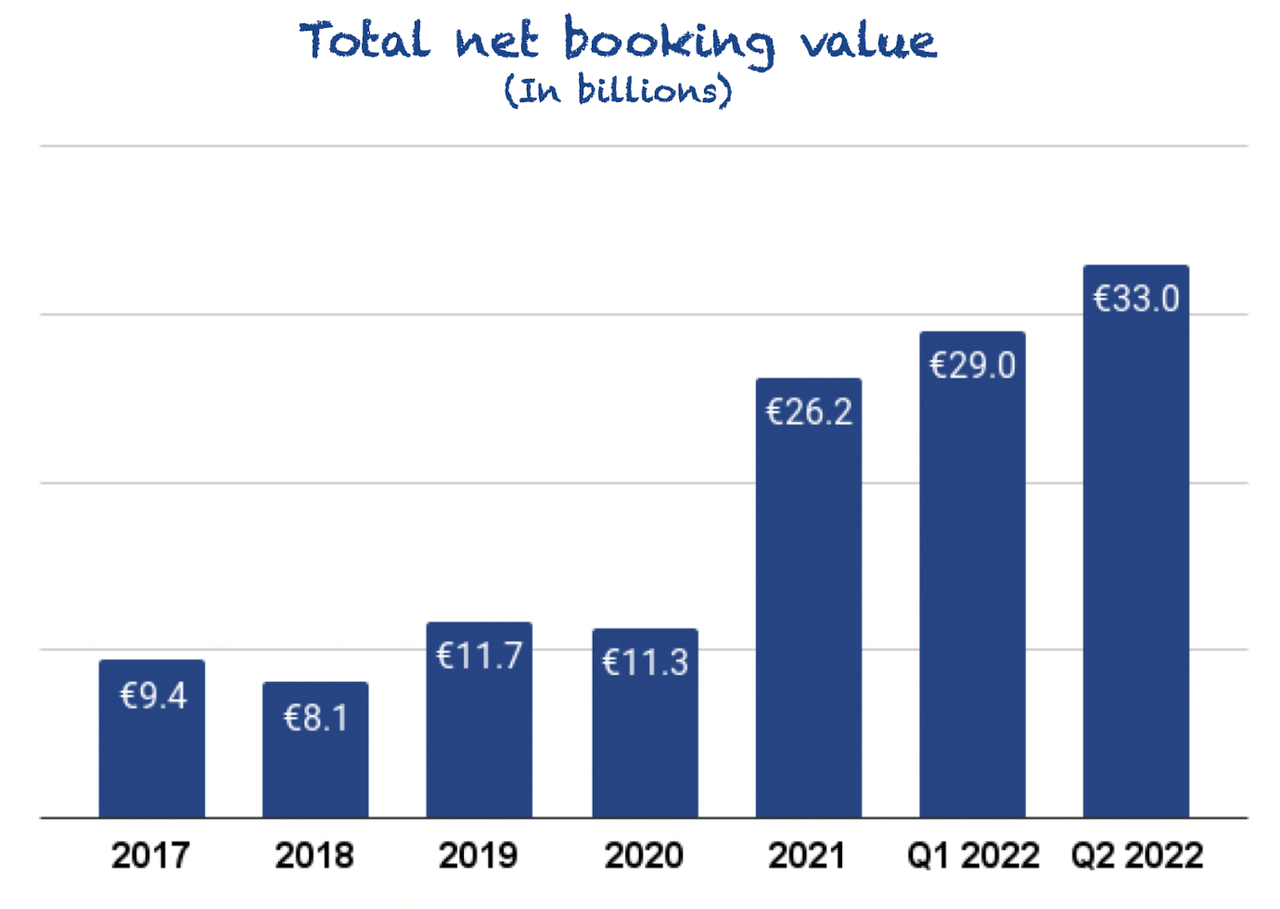

Despite all the worries created by a potential semiconductor downturn, ASML posted net bookings in the quarter of €8.5 billion, which is an all-time quarterly record.

Fewer systems are generating these bookings, so they are being driven by leading-edge technology, which commands higher ASPs (Average Selling Price):

Made by Best Anchor Stocks

Strong quarterly bookings lifted total net booking value to an ATH (All-time high) of €33 billion:

Made by Best Anchor Stocks

The interpretation of this metric is relatively straightforward, although it has two possible variations because it’s a “net” metric:

-

Customers are ordering more and not canceling orders

-

Some customers are ordering more while others are withdrawing orders, and new orders are outweighing cancellations by a wide margin

Management doesn’t share which one of the two it is, but the essential thing is that demand remains strong. However, they gave us a clue because they implied that customers are only canceling systems to order newer ones…

And on cancellations, as you know, Mehdi, in all the time I’ve been with the company, the only cancellations I can remember was a customer actually canceled orders because they wanted to replace that tool type with a new tool type.

Source: Peter Wennink during Q2 2022 earnings call

The distribution of net booking value across leading and trailing edge technology is also a positive sign for ASML’s resiliency:

And you have to remember that of our backlog 85% is for advanced semiconductor manufacturing. High-end immersion and EUV. Now for the remaining 15% mature technology, they also need that for advanced production.

Source: Peter Wennink (ASML CEO) during Q2 earnings release video

As discussed in our article ‘ASML: Don’t Worry About A Bust‘, we feel that leading edge orders are much more resilient to cancellations because customers need them to remain competitive. The company expects yet another significant order intake in Q3.

Breaking down profitability – Inflation and supply weighing into margins

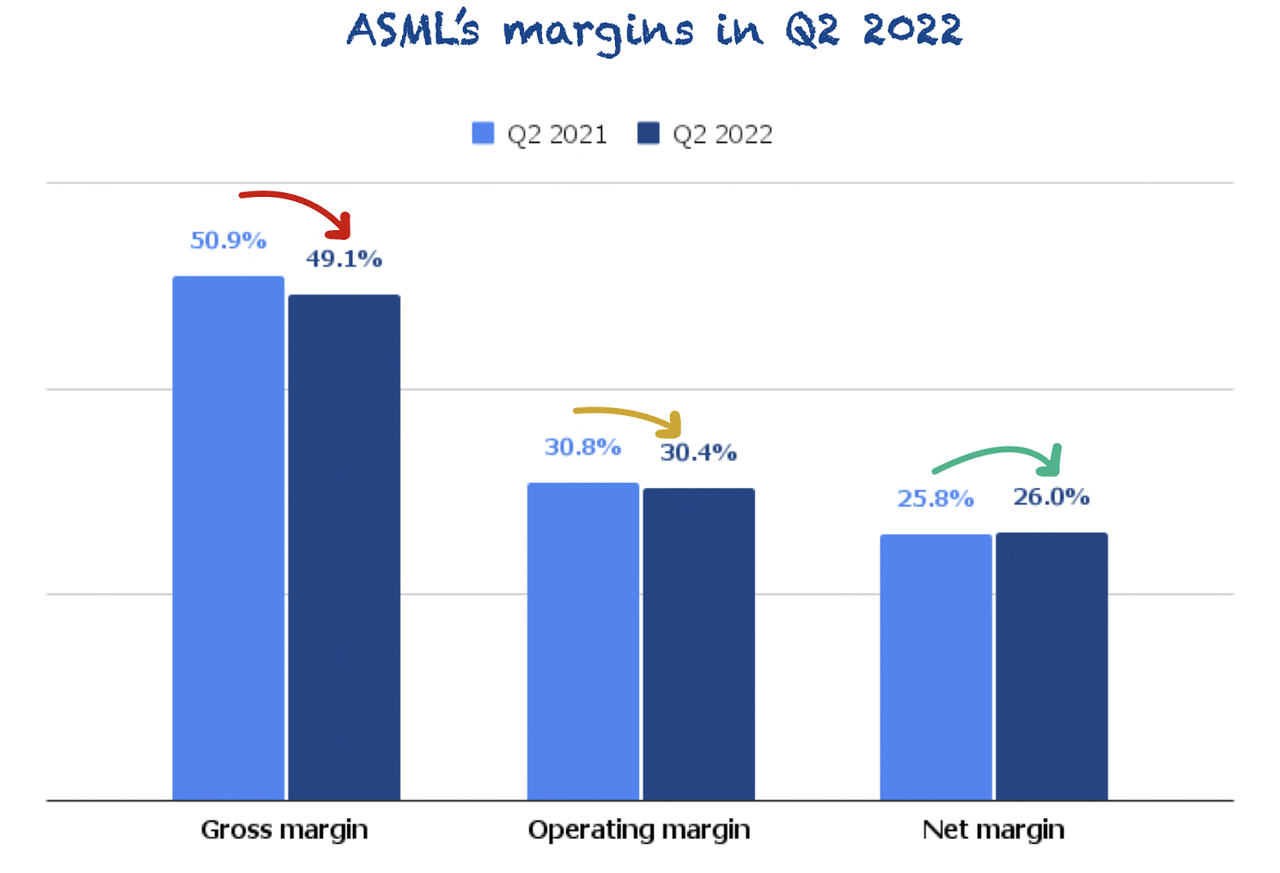

ASML’s gross margins came in at the low end of guidance (49.1%), which management attributed to two things:

-

More fast shipments: as revenue for some systems is being deferred to future quarters, but fixed costs remain unchanged, margins are contracting. Simply put, fixed costs are being spread across a smaller amount of systems.

-

Inflation: obviously, inflation is weighing on ASML’s suppliers, some of which are raising prices. The impact doesn’t feel too high for a manufacturing company, though.

Both seem to be temporary problems, so we are not really worried about them. #1 should be solved once ASML fixes its supply chain shortage. It’s a problem of timing, in our opinion. There will be future periods when more system revenue will be recognized, and revenue will outpace the increase in fixed costs, showing stronger margins.

About #2, we don’t expect inflation to remain this high forever and we don’t think anybody does. It’s also a matter of when (not if) inflation comes down.

The landscape is quite different once we go down the income statement, though. Despite posting a lower gross margin, ASML managed to post a higher net profit margin and a similar operating profit margin than in the comparable period:

Made by Best Anchor Stocks

The impact on operating profit margins was absorbed by some sort of leverage in operating costs, whereas the higher net profit margin resulted from a lower provision for taxes as a percentage of revenue. But, again, if quarterly revenue is volatile (which it is), quarterly margins will also be volatile due to fixed costs.

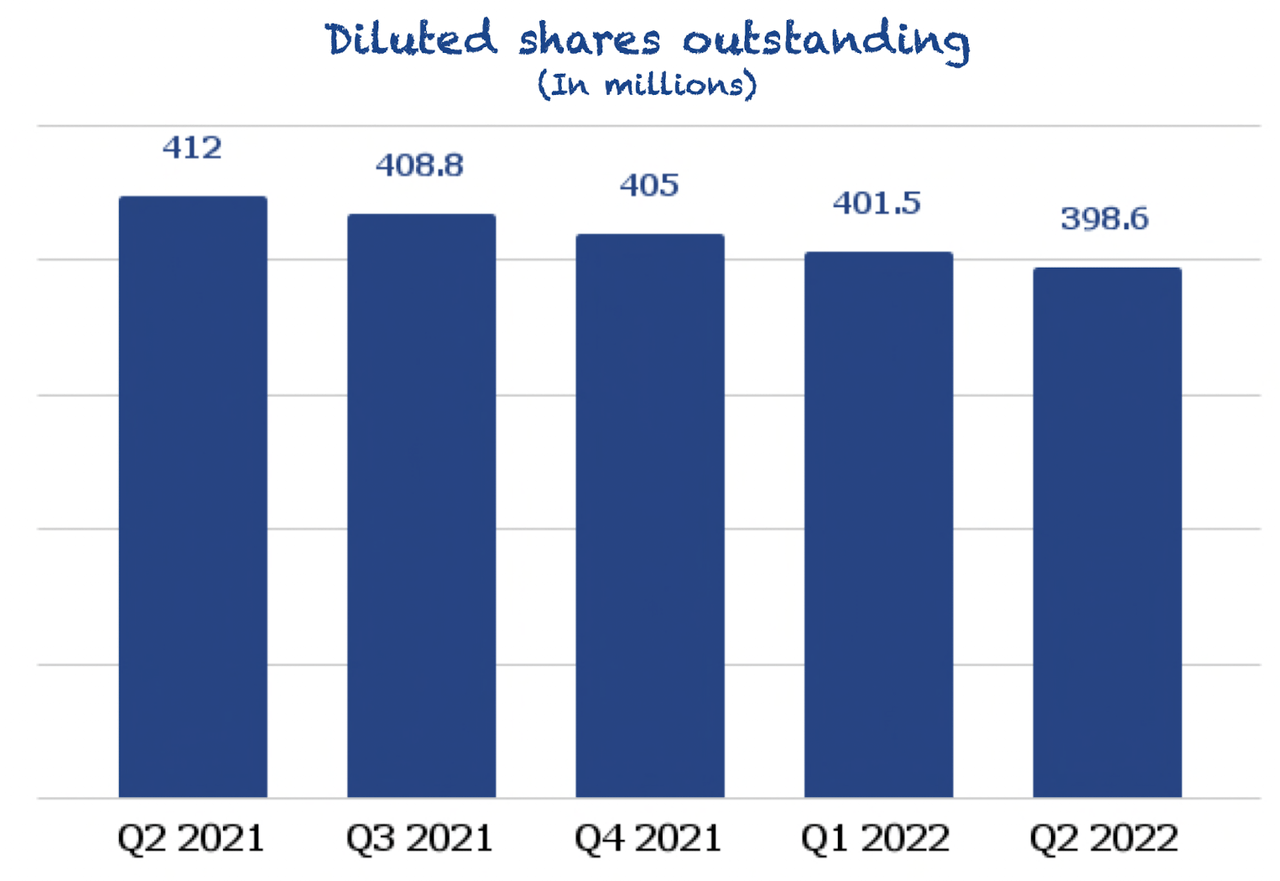

The highlight was EPS (Earnings Per Share) which grew faster (+40% Y/Y) than revenue and net income (+35% Y/Y). This was a result of the company’s buybacks, which reduced the share count by 3.2%:

Made by Best Anchor Stocks

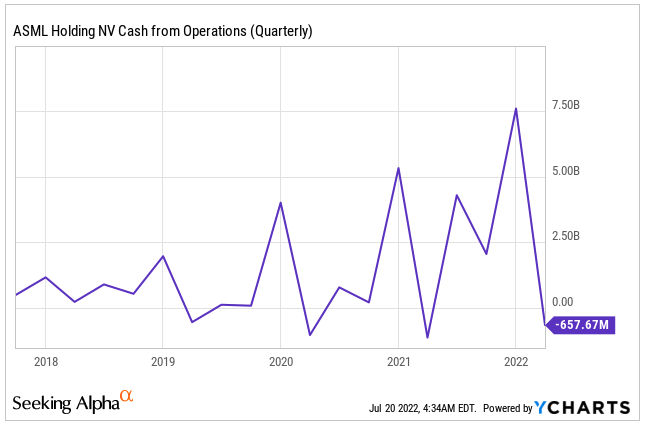

Cash flow is yet another metric to track yearly

We will not spend too much time on cash flow because it’s very volatile, and it doesn’t make sense to look at quarterly figures. Take a look at cash flow volatility:

YCharts

The company ended Q2 with a cash position of €4.4 billion and total debt of €4.7 billion, which is quite healthy. As mentioned, we should expect this cash position to grow towards the end of the year when cash flows are stronger, and we should maybe see the company end the year in net cash territory.

The qualitative highlights

The numbers are essential, but when it comes to ASML, as numbers are supply-constrained and are almost “known” in advance, we should also focus on the story.

The most important day for investors: Investor Day in November

As we’ll see later in guidance, ASML is still operating in a supply-constrained environment which is deferring a significant portion of its revenue to future periods. This is not great because it weighs negatively on growth. Cutting growth is never good, but there are two scenarios under which this can happen which have different interpretations:

-

Demand is coming down

-

Supply can’t meet demand

#1 would be much more worrying than #2 because there’s not much the company can do to fix it. Regarding #2 (ASML’s case), it would be much more worrying if competitors were taking market share due to the company’s inability to supply its demand. This, however, is not happening here, so we should not expect ASML to lose market share despite delays, especially in leading-edge tools.

ASML must fix #2 over the long term, or else the company’s growth will remain permanently impaired. As we saw in our article ‘ASML: Don’t Let The Headlines Fool You‘, management is already working on a capacity expansion plan with its suppliers. We should hear something during Investor Day in November, which in our opinion, is the most relevant event for the company this year without a doubt.

From a semiannual to a quarterly dividend and no plans on cutting buybacks

ASML is shifting from a semiannual to a quarterly dividend. We don’t think this says much besides the fact that shareholders will receive dividends more frequently now, and the company will be able to enjoy a smoother cash position throughout the year.

Management plans to continue its capital allocation strategy of giving almost all FCF back to shareholders through dividends and buybacks:

I think the future is very bright so our cash generation will be quite significant. But first of all, like we’ve always done, we will use the cash first to run our business. Secondly, then we will pay a dividend which is going to be an increasing dividend. And by the way we have decided to move from a semi-annual dividend to a quarterly dividend that we will start in Q3. An interim dividend for the first time this quarter. And any excess cash will be used for share buybacks as we have done in the past. So no change to our policy.

Source: Peter Wennink (ASML CEO) during Q2 earnings release video

The current buyback program is ending as the company has already used €7.9 billion. We expect the company to come up with a new one in the coming months to execute this strategy. We are not huge fans of ASML’s buyback policy because it seems to be done no matter the price, and we would much prefer this money as dividends. It’s true, though, that the buybacks made by the company can prove to be very profitable for shareholders in the coming years. We’ll only know in hindsight.

Fast shipments to become the norm?

During the call, management discussed the normalization of fast shipments, which might be a relevant event for ASML. There are two possibilities to normalize them. The first and obvious one is to learn to live with them and acknowledge that they’ll be recurring. The second, and most discussed option, was to change the revenue recognition account policy. According to management, the data shows that internal tests (those that are bypassed by fast shipments) are not adding much value and installation times vary little between fast and non-fast shipments:

We now have evidence, because we’ve been doing this for 9 months now, that as Roger said earlier, the installation time between a fast shipment and a non-fast shipment is exactly the same. So what we’ve effectively done, we have reduced the cycle time from the start of the system to the installation at the customer side with about a month.

Source: Peter Wennink (ASML CEO) during Q2 2022 earnings call

If this is the case, then changing the revenue recognition policy makes sense (if customers agree, of course), and ASML will see slightly lower costs (as internal tests have no longer to be carried out) and will be able to match shipments with revenue. This should smooth revenue and facilitate the digestion of results for shareholders.

What about a recession?

“Recession” is a word that is in everyone’s mouth nowadays, and this was no exception during ASML’s earnings call. We have discussed several times that we feel ASML is somewhat protected from a potential recession thanks to its supply-constrained nature. ASML’s CEO, Peter Wennink, said something similar during the call:

If we were to go into a significant recession, we would not be immune to this, but we don’t expect our ’22 business to be impacted. And also for 2023, given our backlog, we believe we are well covered.

Source: Peter Wennink (ASML CEO) during Q2 2022 earnings call

The leading edge doesn’t seem to be a place where customers want to cut.

DUV export ban to China

Several weeks ago, there was a rumor that the US was lobbying the Dutch government to ban the exports of ASML’s DUV equipment to China. This topic was briefly covered during the earnings call. CEO Peter Wennink said that it’s a possibility but warned US politicians that it might not be the best idea:

I think we need to realize that China is an important player in the semiconductor industry and especially in the more, let’s say, not mature nodes but in the more mainstream semiconductors. It’s everything that has to do with deep UV, yes? And it ranges from 20-nanometer up to 28, 45, 65. It’s immersion, it is dry. And they’re a very significant supplier of the global markets.

So we just have to be careful what we are doing. We’ve also been saying publicly that we cannot ignore the fact that China has a manufacturing capacity out there on DUV, which the world needs.

Source: Peter Wennink (ASML CEO) during Q2 2022 earnings call

He is basically trying to say that an export ban might backfire by making the shortage worse, which we don’t think anybody wants. We don’t know how this will play out, but there’s a possible chips act to counter its impact.

Guidance

Guidance was once again severely impacted by ASML’s supply-constrained nature. As we’ve already mentioned in the article, we don’t think these problems will be permanent, but we must see some realistic roadmap during Investor Day.

Q3 guidance – Same problems as in Q2

Q3 guidance surfaced the same problems as Q2: revenue being deferred to future periods.

What we saw in the second quarter, which is basically an acceleration of supply chain constraints, is actually also happening in Q3.

Source: Peter Wennink (ASML CEO) during Q2 earnings release video

Both quarters are so similar that Q3 guidance is almost identical to Q2’s guidance. Management expects €5.1 – €5.4 billion in revenue, from which €1.4 billion will be from installed base management. Gross margin is expected to come around 49% to 50%. Here you have a comparison of what was guided in Q1 for Q2 and what has been guided in Q2 for Q3. Similarities stand out:

Made by Best Anchor Stocks

€5.25 billion at the midpoint translates into 0% Y/Y growth, but as we have repeated several times, we shouldn’t focus too much on quarterly growth rates.

The true lowlight of guidance was the full-year guidance.

Full-year guidance – Guide down due to supply constraints

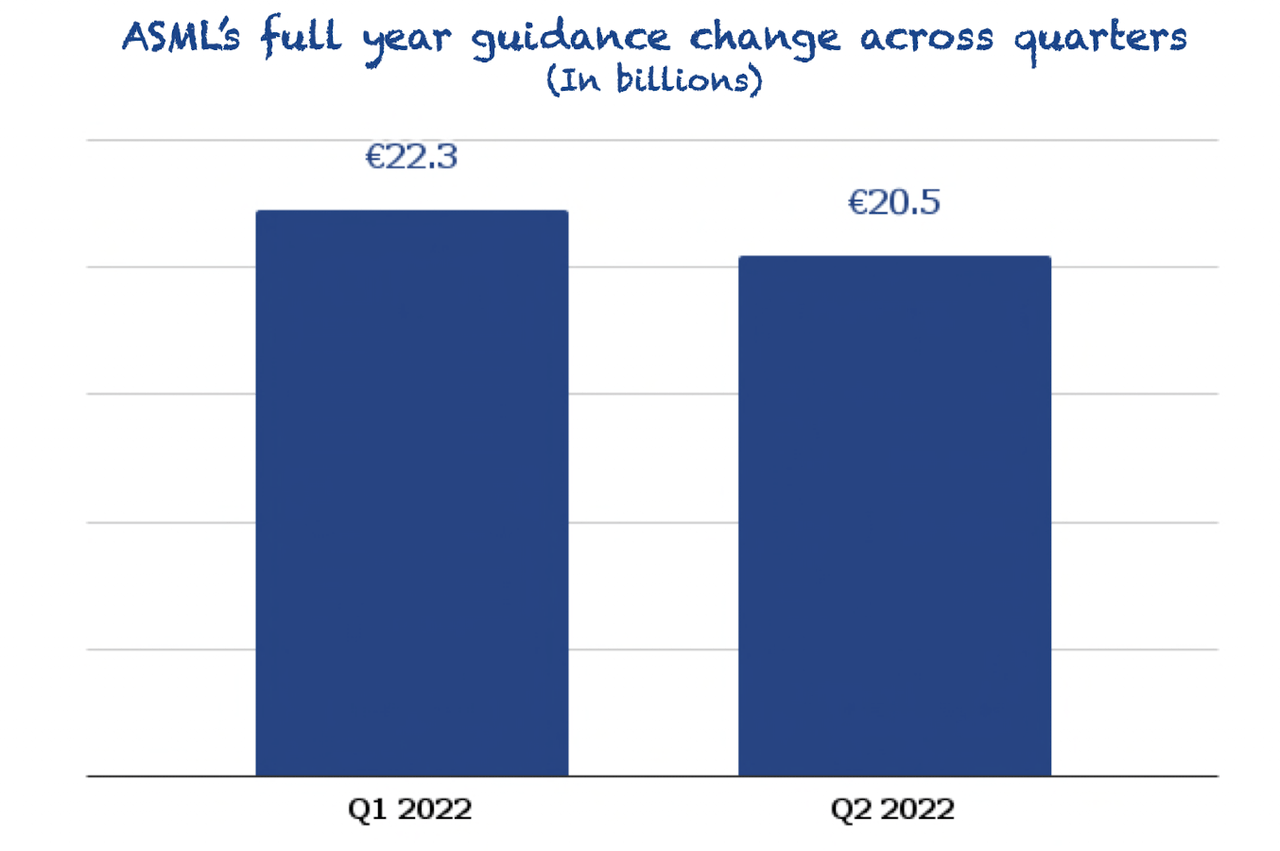

Full-year guidance was the lowlight of the release. While management said in Q1 that they expected 20% Y/Y sales growth in 2022, they have now cut this back to 10%. It needs some context, though.

Many people commented that this guide down showed a reduced demand in the semiconductor industry, but by simply reading the transcript from the release video, these people would’ve understood this is not the case, at least for ASML.

In Q1, management guided for €22.3 billion, and now this number has come down to €20.5 billion:

Made by Best Anchor Stocks

The difference comes entirely from delayed recognition of revenue (i.e., fast shipments). A portion (€1 billion) of this revenue recognition delay was already factored into yearly guidance in Q1, but it has increased quite substantially:

We said a quarter ago that the impact of those fast shipments, this revenue recognition delay, was going to be about €1 billion for this year. Now where we are today, we think it’s going to be €2.8 billion. So we have about €1.8 billion of more revenue recognition delays.

Source: Peter Wennink (ASML CEO) during Q2 earnings release video

Simply put, an additional €1.8 billion in net system sales will be recognized next year once customers have tried the tools at their site. If we double-click on these incremental delays, we can see that most of it have to do with EUV, as the company now expects to recognize revenue for 40 of these systems and not 49 as previously guided.

Management also guided margins down. At the start of the year, they expected 53% gross margins, which has now come down to 49%-50%. The reason for this decrease is twofold. On the one hand, as a great deal of the delayed revenue is the leading edge equipment that commands higher margins, not being able to recognize it in 2022 will negatively weigh on margins. The other thing that’s impacting is inflation, of course. This said, management is talking with the whole ecosystem (customers and suppliers) to share inflationary costs:

We’re currently in discussion with our customers and suppliers to find a fair way to share in these inflationary cost increases. It is important to emphasize that the reasons for the lower margin guidance are a result of short-term shocks in our ecosystem and can be adjusted over time in collaboration with our ecosystem partners.

Source: Peter Wennink (ASML CEO) during Q2 2022 earnings call

As they deem these impacts temporary, the long-term gross margin target remains unchanged at 54% – 56%.

Conclusion

ASML posted strong results but weak guidance. However, ASML is a rather special company in which lower guidance doesn’t come from demand problems but from supply problems. The guide down for FY 2022 is still a guide down in either case, but context is needed to assess how worrying it is. We hope this article helped you with this!

In the meantime, keep growing!

Be the first to comment