baona/iStock via Getty Images

Pair trades are not something that I perform often as I am not a natural short seller, though I have used them in the past. When I do enter into a pair trade, they tend to jump off the page and scream at me due to their obviousness.

In today’s article, I will be discussing why I believe a long Unilever (NYSE:UL), short Procter & Gamble (NYSE:PG) pair trade makes perfect sense given recent developments regarding legendary activist investor Nelson Peltz, along with the significant valuation gap that exists between the two.

Overview

Unilever and Procter & Gamble can be thought of as the Coca-Cola (KO) and Pepsi (PEP) of the broader diversified consumer staples sector. Both companies have a long and storied operating history, along with a plethora of billion-dollar brands worldwide.

Unilever is headquartered in London, England and Procter & Gamble is headquartered in Cincinnati, Ohio, which leads to the natural impression that Unilever is European focused. This is certainly not the case looking under the hood at the two companies, although major geographic sales differences do exist.

| Sales by Geography Comparison as of year-end 2021 |

| Company | North America | Europe | Asia | ROW |

| Proctor & Gamble | 47% | 22% | 19% | 12% |

| Unilever | 21% | 21% | 46% | 12% |

As we can see from the above, Unilever is highly levered to Asia, while Procter & Gamble is primarily a North American focused company. It is important to explain that Unilever’s Asian exposure is only reliant on the Chinese market for roughly 5.5% of total sales and that India is the crown jewel of this region, accounting for roughly 11% of total sales via Unilever Hindustan.

While geographical differences do exist, along with product mix differences, these two company’s present remarkably similar offerings.

Research Gate

Research Gate

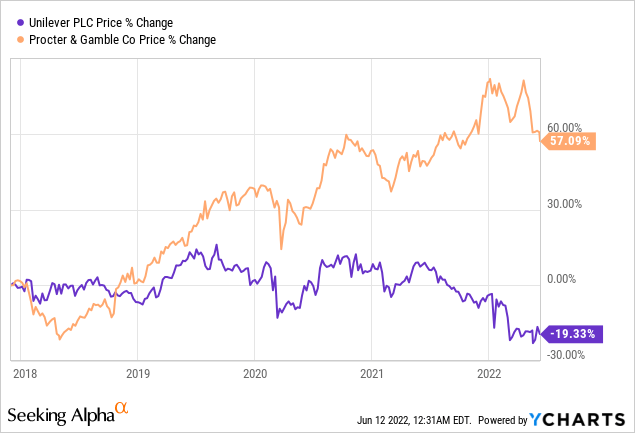

One glaring difference between the two behemoths is the recent performance of the respective stocks. Procter & Gamble, from 2018 onwards, has been on a tear that is seldom seen in the slow and steady consumer staples sector. Conversely, Unilever has dropped to price levels not seen since 2017.

So, what happened during this time frame? One major contributor to P&G’s success that cannot be ignored has been the involvement of Mr. Nelson Peltz.

Mr. Peltz initially build his stake in P&G during 2017 and was nominated to the board in December of 2017. Below is a chart showing the performance of the two company’s during this time frame.

Seeking Alpha

This stark 76% difference in price returns is highly impressive given the similarities that exist between P&G and Unilever and lends further credibility to Mr. Peltz’s ability to transform stagnant consumer staples companies.

Thankfully, for Unilever shareholders, Mr. Peltz has decided as of May 2022, to take his talents from Cincinnati, across the pond to London.

Trian Partners, Mr. Peltz’s investment management firm, recently announced a full liquidation of his long-held P&G stake and the initiation of a 1.5% ownership stake in Unilever along with the May 31st appointment to serve on Unilever’s board.

From Trian Partners website:

Nelson Peltz served on the P&G Board of Directors from March 2018 until October 2021, when he decided not to stand for re-election.

In May 2022, Trian announced it had exited its position in P&G.

On May 31, 2022, Unilever announced that it has appointed Nelson Peltz as a Non-Executive Director of the company and as a member of its Compensation Committee. It is expected that the appointments will be effective as of July 20, 2022, subject to receipt of any required regulatory approvals.

Trian believes Unilever has significant potential, through leveraging its portfolio of strong consumer brands and its geographical footprint. Trian looks forward to working collaboratively with management and the Board to help drive Unilever’s strategy, operations, sustainability, and shareholder value for the benefit of all stakeholders.

Mr. Peltz, throughout his career, is known for reorganizing and reinvigorating stagnant brand portfolios. He generally attempts to realign bloated cost and compensation structures and to focus on top line revenue growth through brand divestments and acquisitions. Clearly, Mr. Peltz believes that Unilever has the potential to transform in a similar way to P&G and feels that his work at P&G has now concluded.

Unilever, of late, has struggled mightily with revenue growth and has reverted to an assumption among the investment community of only 3% organic sales growth, from the more historic 5% levels. Unilever has also stumbled recently by involving itself in political issues, the most notable being the Ben & Jerry’s Israeli ice cream boycott, which continues to ruffle feathers in the United States.

Mr. Peltz clearly believes that while the company may be bruised from self-inflicted wounds, it is certainly not broken and beyond repair.

Valuation Gap

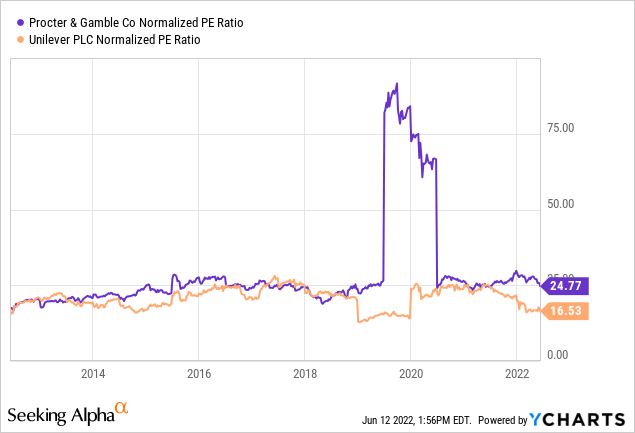

One of the major factors that likely caught Mr. Peltz’s eye is the rather stark valuation gap that currently exists between Procter & Gamble and Unilever. Currently, P&G, on a PE basis, is valued nearly 33% higher than Unilever.

This valuation gap is now at a historically high level and appears to be driven primarily by the revenue growth and margin differences that currently exist between the two companies.

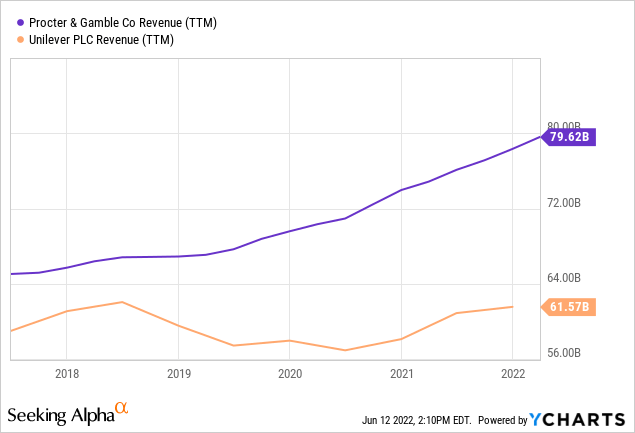

Procter & Gamble, thanks in part to Mr. Peltz’s intervention, has grown revenues consistently over the last 5 years while Unilever has shown choppy and uneven progress during this time period.

In addition, Procter & Gamble has been able to maintain greater profit margins to go along with this revenue outperformance. P&G consistently boasts margins in the 48% range, while Unilever has been stuck in the 42% level.

Some of this margin difference comes from the fact that Unilever has a larger food offering, which has historically lower margin levels, however, P&G’s ability to maintain very high gross margins, while growing revenues at impressive levels is something I am sure he will look to emulate during his tenure on Unilever’s board.

What is clear is that Mr. Peltz has turned Procter & Gamble into a refocused, finely tuned machine, capable of growing revenues at a healthy clip whilst maintaining industry leading profit margins. This fact, and his long history of success, points to the potential of the pair trade and of the thesis to go long Unilever.

Bottom Line

Unilever is clearly in need of precisely the kind of changes that an activist such as Nelson Peltz can provide, a reinvigorated focus, back to the basics of cost structure, brand optimization, along with compensation and cultural reform. Unilever certainly has all of the pieces to become a truly great company once again and it appears that thankfully, the company has welcomed Mr. Peltz with open arms.

The valuation difference between P&G and Unilever is stark and a reversion to the mean of similar valuation levels is highly achievable over time, leading to potentially 33% returns.

The downside risk of this trade, in my opinion, is somewhat limited due to the historically low valuation level that Unilever currently resides; however, given investors tend to view Unilever as a European focused company, continued escalation of the war in Ukraine has the potential to continue to erode the valuation gap between the two companies. In addition, Mr. Peltz may not be able to execute a turnaround of a similar nature or in the time frame that he did with Procter & Gamble.

Given the potential for margin interest and the long-term nature of this trade, personally, I have chosen to sell my remaining shares in Procter & Gamble and purchased additional Unilever shares with the proceeds, which is precisely what Mr. Peltz did.

One benefit to this trade, if you do decide to short P&G is that the Unilever dividend is currently a healthy 4.31% compared to P&G’s 2.57% which helps to partially offset the potential 4 to 8% yearly margin interest hit to the trade.

The ink is now dry on Mr. Peltz’s plans to reinvigorate Unilever and his board tenure is officially set to begin on July 20th, 2022. I look forward to seeing a new and improved Unilever in years to come.

Let me know your thoughts in the comments section below. Thank you for reading and good luck to all!

Be the first to comment