Justin Sullivan

The biggest investment mistakes of the last couple of years have been to over extrapolate on short term covid boosts or macro headwinds. Roku (NASDAQ:ROKU) remains a prime example of this scenario where short-term scatter market ad issues don’t impact the long-term investment story. My investment thesis remains ultra Bullish on the irrational dip to the $50s, even with the rally back above $60 in short order.

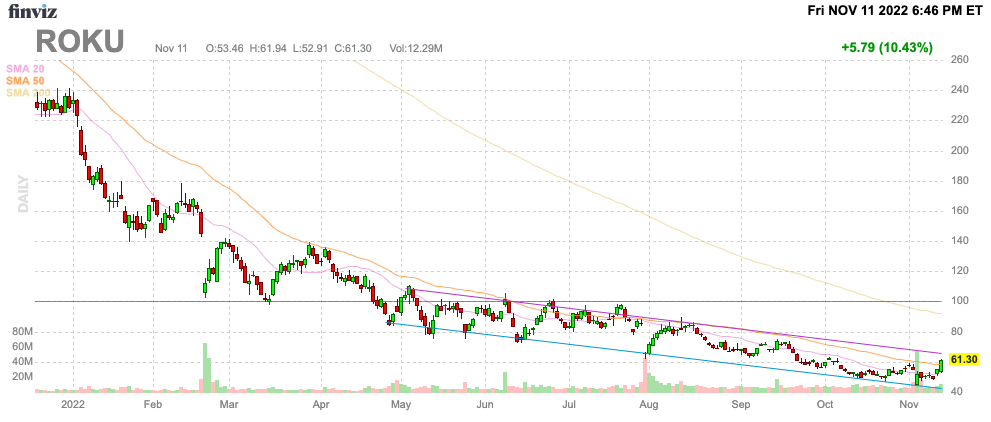

Source: FinViz

Ad Issue Will Pass

A couple of weeks back, Roku reported a solid quarter, but the video streaming platform guided to weak Q4 revenues. The company cut Q4’22 quarterly revenue estimates to only $800 million, down from analyst targets at nearly $895 million and original expectations topping $1 billion.

The stock initially sold off to $44.50 before rebounding on the date of earnings to $51.84. Roku has now rebounded to close last week at $61.30. Amazingly, the stock has already rallied nearly $7 from the pre-earnings price.

This price action is a perfect example of what occurs at bottoms. Roku reported weak guidance due to the tough ad scatter market. The video streaming company is building a video ad platform to serve ads to their growing Roku Channel to feed a 90% boost YoY in streaming hours.

The increased engagement is what ultimately drives value for a platform like Roku. The company will make money over time based on upfront ad sales and a more normal ad scatter market.

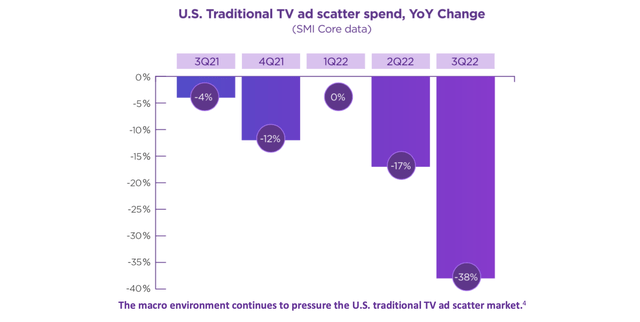

According to Roku, the ad scatter spend on traditional TV plummeted 38% in Q3’22 with losses accelerating from the 17% loss in the prior quarter. The company already has $1 billion in upfront ad deals for the next cycle reducing the reliance on this ad market in the future.

Source: Roku Q3’22 shareholder letter

While the ad market will normalize and the company will benefit from upfront ad sales to reduce the reliance on the scatter market, Roku is still growing active accounts and streaming hours. The company now has 65.4 million active accounts for 16% growth in a tough economic environment.

Streaming hours continue to grow as well with viewers streaming 21.9 billion hours, up from 20.7 billion hours in the prior quarter. The combination of active accounts and higher engagement is very positive for the video streaming platform. Even the ARPU rose slightly to $44.25 in Q3’22, up 10% over the $40.10 earned per user last Q3.

The biggest issue is the ongoing losses now with the ad market weakening. Roku reported an EBITDA loss of $34.4 million in Q3 and the amount will surge to $135 million in Q4.

The company is absorbing some losses in Player profits by not hiking prices in the face of inflationary pressures. Again, Roku is more focused on getting viewers of the platform to stream video to ultimately collect ad revenues for internal content.

Ark’s Plan

ARK Investment Management led by Cathie Wood has been crushed over the last year with stocks like Roku not living up to expectations. The manager of the ARK Innovation ETF (ARKK) placed a remarkable $605 price target on the stock in a call that appears ridiculous now.

The biggest question is whether Roku is a broken company with covid boosts hiding fundamental flaws in the business model or a broken stock hitting bottom with the bump following the big cut to Q4’22 expectations. The ARK Invest base case was for revenues to surge to $14.4 billion in 2026 based almost entirely on growth in video advertising followed by a distant boost in content distribution revenues.

Based on the growing active accounts, hours watched and ARPU, Roku just appears a broken stock. As the company shifts to video ads, the Cathie Wood research firm’s analysis is likely to play out to a certain extent.

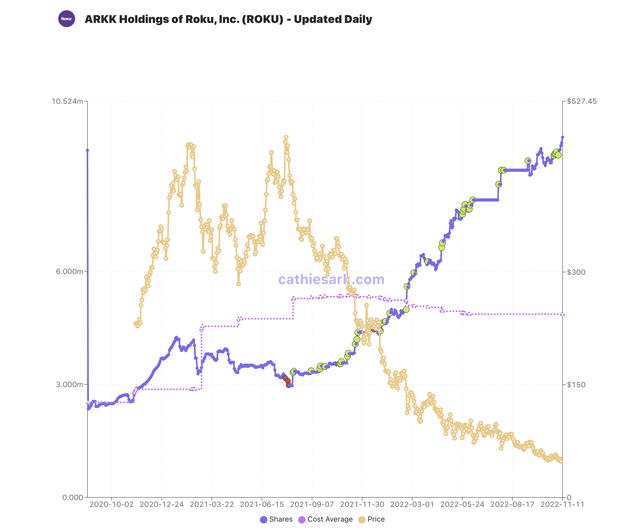

The firm famously placed a bull case price target of $1,493 on the stock. The good news for investors is that ARK Invest apparently agrees that Roku is a broken stock with continued purchases at these cheap prices. The ARK Innovation ETF has purchased over 200K shares since the start of November and now owns over 9.3 million shares of Roku.

Source: CathiesArk.com

Roku is the third largest holding in the fund, just below Tesla (TSLA) now.

Takeaway

The key investor takeaway is that Roku remains on track for strong results in the future. The company will shift business to the upfront market in the future driving stronger and more consistent video ad revenues.

Investors should use the weakness to build a position in Roku similar to ARK Invest.

Be the first to comment