Darren415

This article was first released to Systematic Income subscribers and free trials on Oct. 22.

Welcome to another installment of our CEF Market Weekly Review where we discuss closed-end fund (“CEF”) market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the third week of October. Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

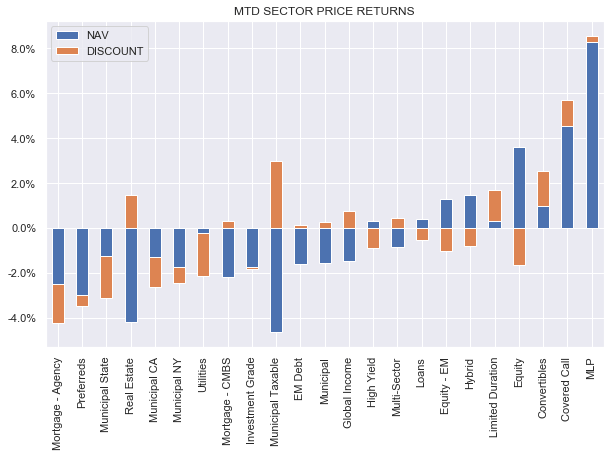

The CEF market was roughly flat for the week, however, the range of returns across sectors was large. Municipal sectors underperformed on the back of rising Treasury yields while many equity-linked sectors delivered positive results. This is also true of the Month-to-date picture as shown below.

Systematic Income

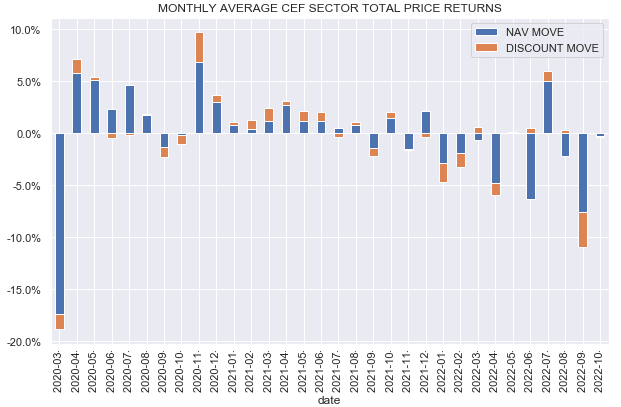

In aggregate, October is running pretty flat so far – a welcome respite after a double-digit drop in September.

Systematic Income

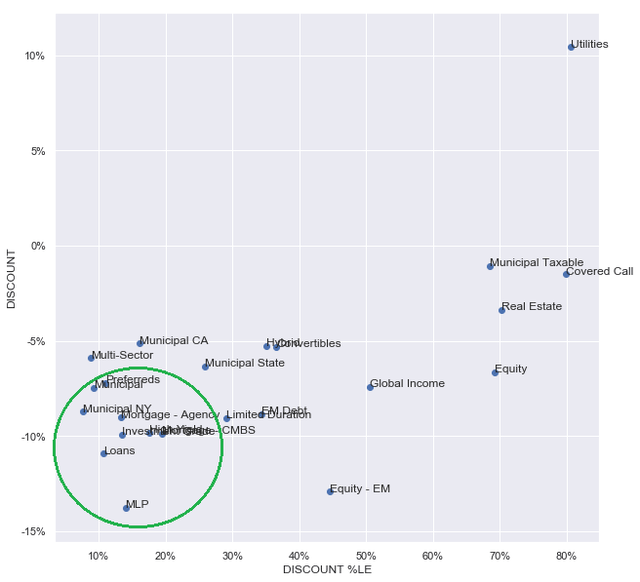

Taking a closer look at CEF sector valuations, there are a number of sectors that are trading at fairly depressed levels. The chart below shows both sector discounts (y-axis) and discount percentiles (x-axis). Sectors like Munis, Preferreds, Loans, Investment-Grade, Agencies and others are trading at discount percentiles of 10-15%, meaning they have only been wider of current levels 10-15% of the time this century i.e. about a year out of the last nearly 23 years of trading. And within those sectors it is easy enough to find securities that have more unusual valuations. In short, investors with conviction are enjoying one of those rare times, allowing them to sustainably grow the income profile of their portfolios for the long term.

Market Themes

On the service, there was a discussion about ROC distributions by the High Yield CEF (CIK) and whether that was a concern. The short answer is no – quite the opposite. The longer answer is that investors shouldn’t pay a ton of attention to net income figures of fixed-income CEFs. That’s because most of the time they give you the wrong picture of their actual underlying portfolio yield. When bonds trade well above par (as they did in 2021) their net income overstates their yield generation capacity and vice-versa.

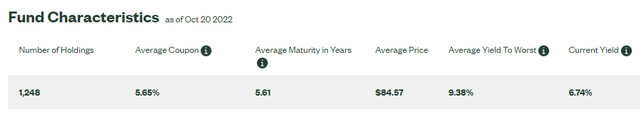

A very good quick way to check what is going on with corporate bonds these days is to open up the website for the benchmark fund (JNK) and just look at its yield numbers.

For the sake of simplicity let’s assume JNK were an unleveraged CEF with no fees. It would show a 6.74% net income yield. In other words, if it distributed something like 9% it would show a terrible distribution coverage of 75% and would also show a chunk of ROC in its distributions if there were no capital gains to distribute.

That would look bad but it’s just optics – the distribution coverage is not “real” in any important sense. That’s all because it ignores pull-to-par. The fund actually earns a yield of 9.38% rather than the 6.74% that it generates in income. That’s because the difference is in pull-to-par which is just as real a yield as coupons – it’s just delayed because the principal repayment doesn’t happen on a semi-annual basis like bond coupons do.

In short, right now is not a great time to stress about low coverage of fixed-income funds because it’s more or less meaningless. The more bond prices diverge from par the more meaningless distribution coverage numbers are for bond CEFs. And right now bond prices are unusually low due to the combination of both high Treasury yields and fairly wide credit spreads.

Market Commentary

The Nuveen Intermediate Duration Municipal Term Fund (NID) and the Nuveen Intermediate Duration Quality Municipal Term Fund (NIQ) have announced the usual restructuring offer that you see with Nuveen term funds. First, there will be a tender offer to buy back the shares at 100% of NAV. If there will be less than $70m of assets remaining in the fund after the tender offer is completed then the fund will instead terminate, otherwise it will convert to a perpetual fund after the tender offer.

With the funds trading at 2-3% discounts versus the sector average of 8% it makes a lot of sense to tender the shares. This is because doing so guarantees an exit at the NAV. Failing to tender could result in the fund having sufficient assets to avoid termination at which point it will convert to a perpetual fund and its discount will very likely widen out to around the sector average i.e. resulting in a loss of around 5% or so. The funds have performed pretty much as expected in a difficult market with their discounts avoiding much of the widening in the sector. Our Muni Income Portfolio holds a 3% position in NID and this will be rotated to other funds during the tender offer.

Stance and Takeaways

We continue to favor decent-quality funds with moderate duration exposure. This is because High Yield corporate bond credit spreads are still trading sub-5%, well below recessionary levels and also because the Treasury yield curve is likely to get increasingly inverted as short-term rates continue to rise. In other words, shorter-maturity or floating-rate securities are rewarded with higher risk-free rates, all else equal. Funds such as DMO, PTA, FINS, among others, remain attractive for new capital allocations.

Be the first to comment