Spencer Platt/Getty Images News

Shale focused independent E&P company EOG Resources (NYSE:EOG) adopted a strategy to prioritize and develop the company’s self-described “premium” wells. That strategy has certainly led to premium shareholder dividends for EOG investors. I say that because, YTD, EOG has declared $8.80/share in (base+variable) dividends. That’s good enough for a 6% yield based on Friday’s close of $147.11. Meantime, note the stock is up 100% since my Seeking Alpha Buy-rated article in May 2021 (see EOG: Shares Pop Higher On $1/Share Special Dividend). That being the case, investors underweight in the energy sector and looking to add exposure to O&G prices should consider EOG as a wonderful mix of excellent income and capital appreciation.

Investment Thesis

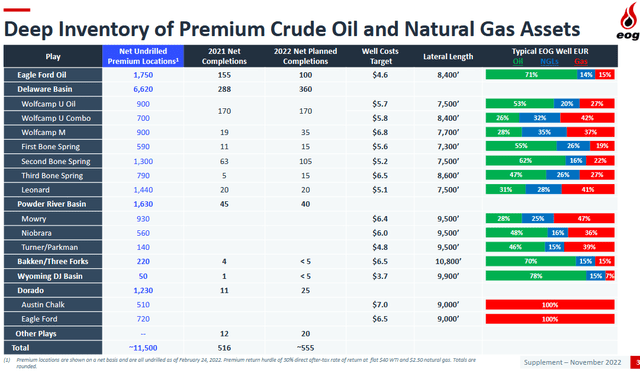

As many of you already know, EOG was an early mover in the domestic shale O&G revolution, entering many plays and drilling shale wells before most other companies had yet to fully recognize the potential of American shale to completely change the dynamics of the global O&G market. That being the case, EOG has strong acreage positions in the Eagle Ford, Bakken, and Permian plays. As a result, and the fact that EOG has continued to explore for economical shale acreage in the U.S., the company has a very impressive, deep, and diverse resource inventory:

The slide above (taken from the company’s recent November Supplemental Presentation, which I advise all current and prospective investors to read) shows EOG has ~11,500 “premium” wells. If you cannot read the (1) footnote small print, EOG says these wells will deliver a 30% internal rate of return (“IRR”) at $40/bbl WTI and $2.50 MMcf nat gas. Note that WTI closed Friday at $89.53/bbl and NYMEX gas at $6.05/MMBtu.

More recently, EOG management is marketing a 6,000+ subset of these wells as “double-premium”, or wells that can deliver a 60% IRR given the same pricing noted above.

During the last few years, EOG has actually added more “premium” wells to its inventory than it has drilled. That means continued sustainability of its business model and more sustained dividends directly into the pockets of shareholders.

Shareholder Returns

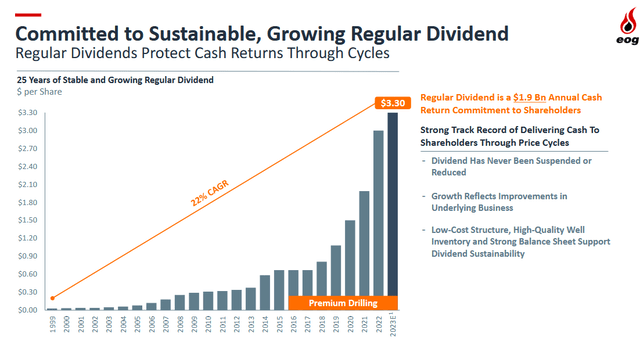

EOG’s regular dividend growth trajectory is shown below in a slide taken from the Q3 Presentation:

The company raised its base dividend 10% in its Q3 EPS report and now pays an annual base (or “regular”) dividend of $3.30/share. Indeed, EOG has not only caught but jumped way over its much bigger peer ConocoPhillips (COP) – a company whose management team has chosen to greatly over-emphasize share buybacks over its dividend – when it comes to the base dividend. EOG is now paying $1.26/share more than COP shareholders receive through its base dividend.

Meantime, EOG has also paid more “variable” dividends as well. So far this year, EOG has declared variable dividends of $5.80/share. That is more than COP’s (base+variable) dividends combined ($4.99/share). Even taking into account the differences in outstanding share counts, revenue, and FCF between the two, EOG is the clear winner when it comes to allocating dividends directly to shareholders.

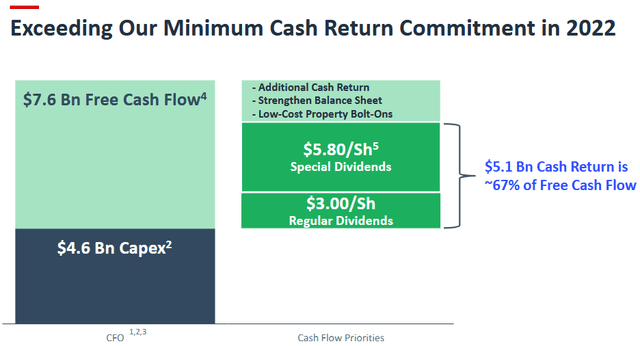

Bottom line: EOG has committed to returning 60% of annual free cash flow to shareholders. So far in 2022, the company has exceeded that (67%):

As you can see, out of $7.6 billion in FCF, EOG has returned $5.1 billion of that in (base+variable) dividends.

Sustainability

While the sustainability of the current high oil & gas price environment is certainly not guaranteed, the strength of EOG’s portfolio does appear to have a long runway. I say that because EOG expects to complete ~520 premium wells this year. All things being equal, that means EOG’s ~11,500 premium well inventory has a lifespan of 22+ years at current drilling rates.

In addition, EOG has – somewhat under the radar – established a 395,000-acre position in what is being called the “Utica Combo” play. EOG plans to step-up activity to 20 wells next year and says there is “significant double premium” potential across its Utica Combo leasehold. EOG’s EVP of E&P, Ken Boedeker, discussed the play on the Q3 conference call:

In addition to the well performance, we also want to highlight our embedded mineral interest in the southern portion of the acreage. We’ve acquired 100% of the mineral rights across 135,000 acres of our leasehold for about $1,800 per acre, which is in addition to the $600 per net acre for the leases. This mineral interest significantly enhances the value of this play by adding 25% to our production and reserve strain from no additional well cost or operating expense.

This area is also where we’ve drilled our most prolific well, which has initially produced over 2,500 barrels of oil per day and 3,500 barrels of oil equivalent per day from a 12,000-foot lateral. The total value of this mineral interest across our southern development area is significant, especially since EOG will dictate the pace of development as operator.

In addition to the Utica Combo position, EOG has also been expanding its holdings in the Powder River Basin in Wyoming, and that is in addition to its Dorado natural gas discovery in South, TX that I reported on in a previous Seeking Alpha article (see EOG: Pumping Income From Oil With A Natural Gas Kicker).

The bottom line: EOG is drilling premium wells, but its inventory of premium wells continues to expand, and the company has a long run-way of premium drilling locations. And that means investors have a clear line of sight into strong dividends well into the future.

Valuation

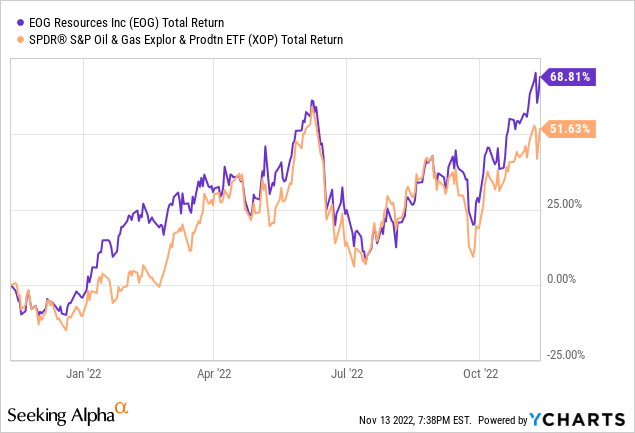

As the chart below shows, over the past year EOG has significantly out-performed the SPDR S&P E&P ETF (XOP) by 17%+:

This is rational given EOG’s shareholder-friendly management and the excellent FCF generation and income delivered for investors. However, the stock may have gotten a bit ahead of itself. Consider the following chart:

| P/E | Forward P/E | |

| EOG | 11.6x | 10.2x |

| COP | 9.6x | 9.4x |

| PXD | 9.1x | 8.1x |

As can be seen, EOG is trading at a significant premium as compared to peers Conoco and Pioneer Natural Resources (PXD). However, the premium is arguably rational given that, in Q3, EOG converted 30% of its $7.59 billion in revenue into FCF ($2.27 billion). That compares to an FCF/Revenue ratio of 22% for COP, and 28% for Pioneer. I think the ~20% premium valuation the market gives EOG over Pioneer is likely not due to the only 2% FCF/Revenue ratio advantage, but more likely because of the quality and breadth of its acreage and well inventory in its more diverse and larger overall footprint across 7 shale plays.

Summary & Conclusion

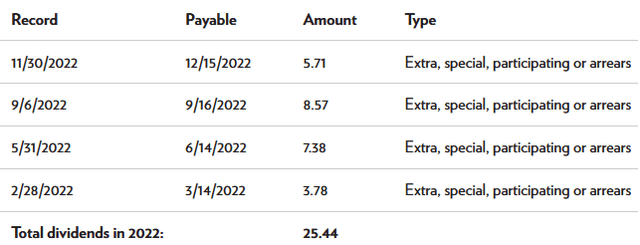

I still like EOG, and I am bullish on the near- and mid-term outlook for oil & gas. However, the stock has run-up quite a bit of late. If I already owned EOG, I certainly would not sell it here. However, if I was an investor looking to buy into an O&G company, I would wait for a better entry point for EOG, and perhaps consider COP as a lower-valued high-quality name. However, if your prime motivation is income, COP’s dividend flow is much less than either EOG or PXD. From that standpoint, and considering the valuation metrics shown in the table above, PXD might be the better buy right now for income. Note that PXD has declared $25.44/share in dividends this year:

Some people thought I was crazy back in April when I wrote on Seeking Alpha, PXD Could Pay $20/Share In FY22 Dividends. Well, there it is, in spades.

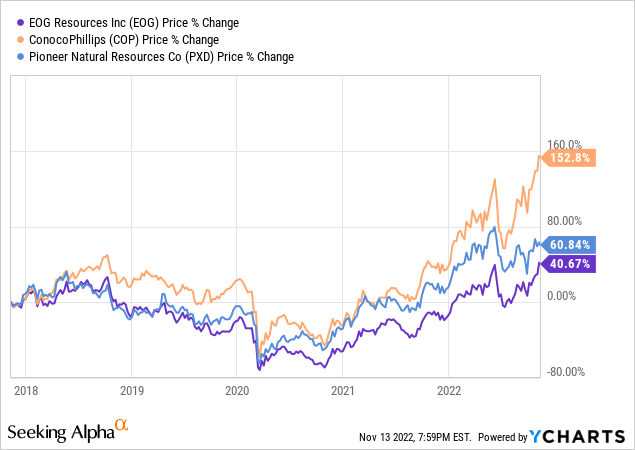

I’ll end with a 5-year price comparison of EOG as compared to COP and PXD:

Be the first to comment