gorodenkoff/iStock via Getty Images

Iovance Biotherapeutics (NASDAQ:IOVA) is a startup biopharmaceutical company located in San Carlos, California. The company is in the business of developing cutting-edge and innovative treatments for various types of cancer. Founded in 2007, Iovance Biotherapeutics was initially known as Genesis Biopharma. After that, the company transitioned to Lion Biopharma before settling on Iovance Biotherapeutics in 2017.

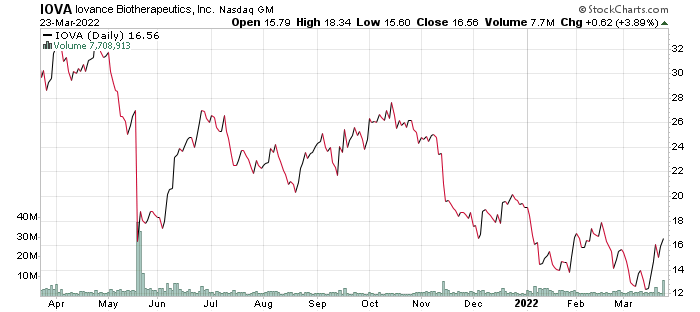

stockcharts.com

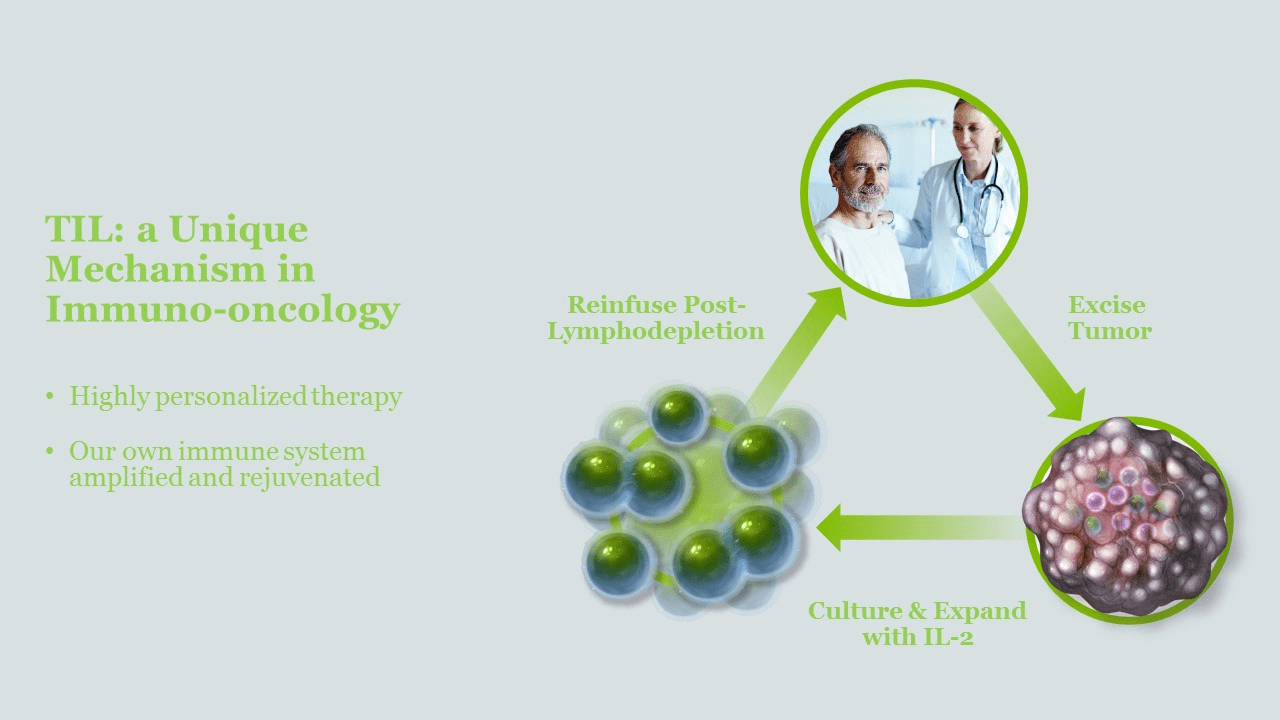

The company has one primary drug in development right now known as Lifileucel. The drug is a tumor-infiltrating lymphocyte (TIL) and is undergoing testing as a viable treatment for metastatic melanomas such as cervical and neck cancers. As of 2022, the company has received approval for its investigational new drug application from the U.S. FDA. This will allow them to move forward with the research, development, and trials of this new treatment method.

iovance.com

In this article, I will show that despite not having a viable product on the market and despite not having anything that generates revenue, Iovance Biopharmaceuticals is a company worth taking a gamble on. Research and Development is an expensive process, and because of that, any time investment in a company with no revenue stream is considered, there is always a significant risk. However, given the demand for oncology drugs, the lack of supply, and the projected market growth of the market overall, there is a tremendous opportunity for a major windfall. This makes the risk level more palatable. Given the progress of targeted oncology drugs in general, I believe a breakthrough will come soon, making Iovance a speculative buy. As a result, I believe investors looking for exposure in the oncology drug market should be bullish on the future of Iovance Biotherapeutics.

Oncology Drug Market

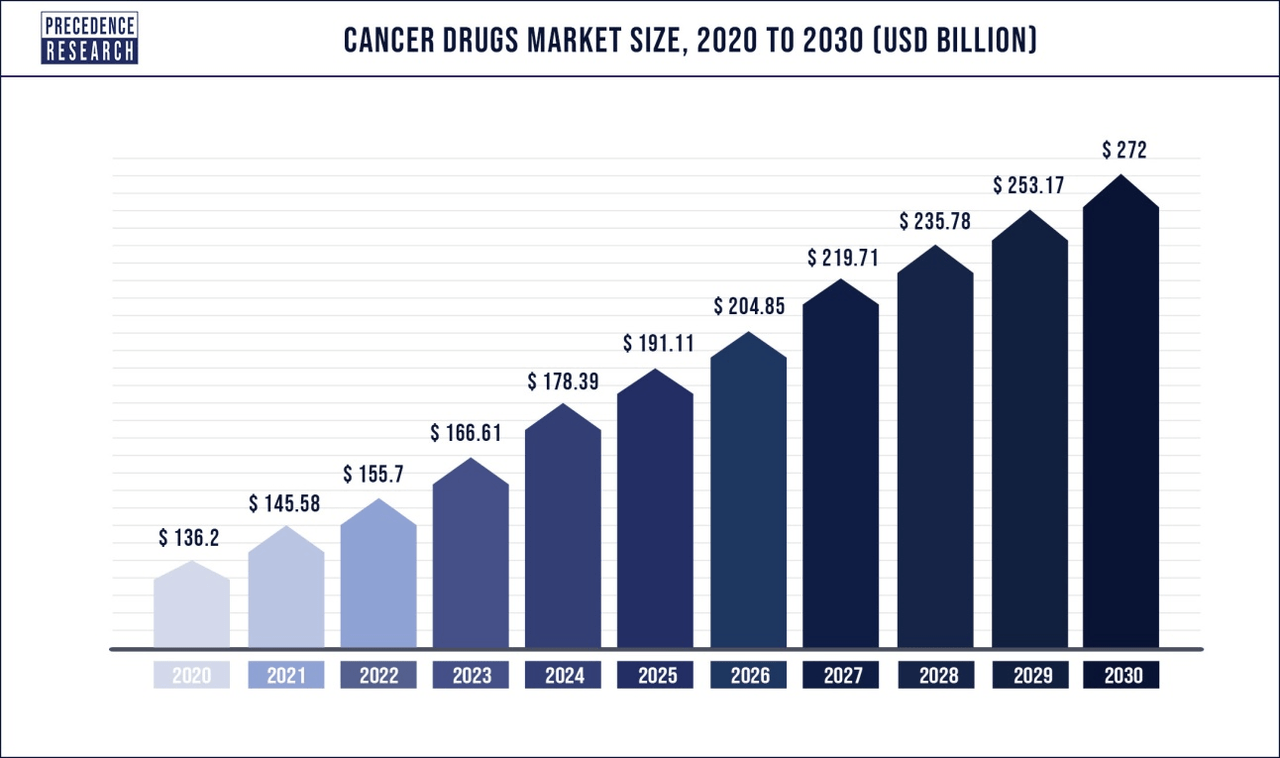

globenewswire.com

One of the biggest drug markets in the biopharmaceutical industry is the market for cancer-related drugs and treatments. The global market for oncology drugs reached $136 billion in 2020. That number is projected to reach $272 billion by 2030 at a CAGR of 7.2%. This healthy CAGR sheds insight into what looks to be a very lucrative future for the market in general. This is because cancer is considered the third most lethal disease globally. Thus, the treatments for the top diseases have high demand and low supply, which makes them rare and valuable.

In North America, where Iovance operates, cancer drugs are at a premium in terms of revenue generation. North America accounted for the largest share of generated revenue out of every other continent in the global oncology drug market. This is only projected to continue, as globally it is expected to see a market CAGR of 6.8% over the next two years. This means that the greatest opportunity for revenue and growth lies in the North American sector of the market, which favors companies like Iovance Biotherapeutics.

The treatments that Iovance offers for cancer fall under targeted cancer therapies. Once a speculative market, targeted cancer therapies have seen a surge in demand and popularity as of late, thanks in part to new scientific breakthroughs. Additionally, as specific types of tumor-causing cancers spike (such as lung cancer, lymphoma, etc.), it has prompted several insurance companies to extend their coverage to targeted therapies. This also serves as a significant market driver within the North American market. All of these factors add up to provide a very favorable outlook for Iovance Biotherapeutics’ future.

Risk Factors

One of the most prominent elements of risk when it comes to investing in a biopharmaceutical company is that the market is primarily based on untapped potential. Many of the smaller companies on the list, like Iovance, do not have a viable product on the market to date. This means that the company generates no revenues and, thus, no profits. As research and development for these treatments takes time, it can be years before a company like Iovance can turn a profit. Additionally, debt can become an issue because R&D is expensive. These are always concerns when looking at investment in these companies.

Furthermore, just because a drug shows promise in its early stages does not guarantee future success. New treatments for oncology-related diseases only have success rates of around 50%. This means that the other 50% of drug developments will fail to make it to the market. The high cost of R&D in terms of both time and money, combined with the high rate of failure, makes investment somewhat risky.

Financial Overview

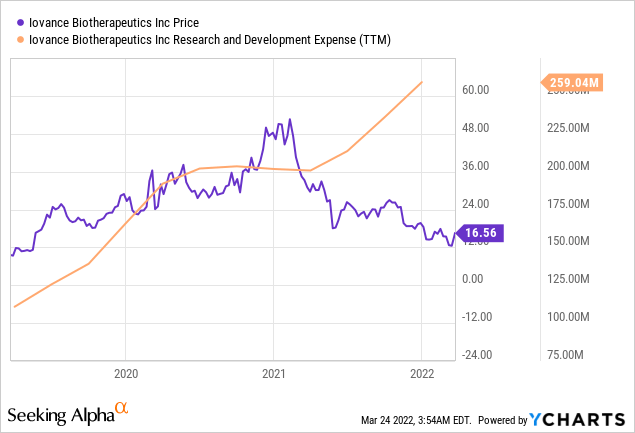

ycharts.com

The company’s research and development costs have more than doubled over the last four years. Starting in 2018, the company posted R&D costs of just under $100 million. In 2019 those costs rose to $166 million. In 2020, costs increased to the tune of $201 million. 2021 saw yet another spike in costs closing the year out at $259 million. While this is not uncommon in the industry, it is somewhat concerning given that a viable market product has not been formed within those four years. Although these could be considered signs of middling failure, it could also signal that the company is nearing its emergence. This means that the company is poised for a big payoff.

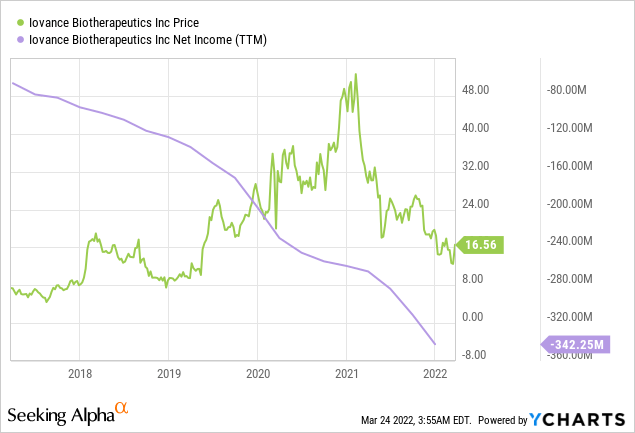

ycharts.com

Due to the firm’s low revenue and rising research and development costs, it has had a 4-year loss of net income. In 2018 those losses stood at $123.5 million. 2019 saw those losses grow again to $197.5 million. 2020 was no better, closing out the year with just under $260 million in net income losses. 2021 was perhaps the worst of them all, with that year ending with net income losses of a staggering $342 million. While not surprising, seeing negatives on the income statement never gives investors a positive feeling.

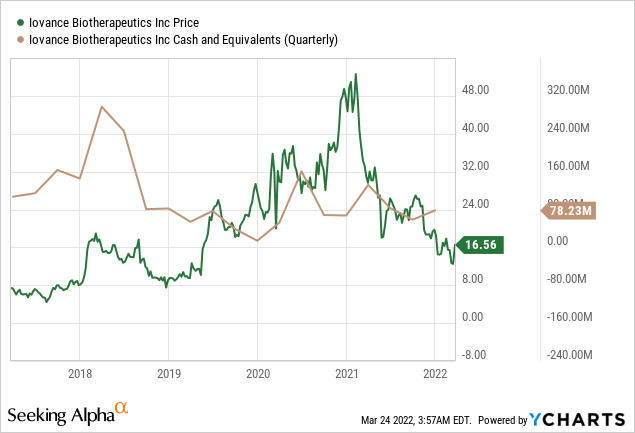

ycharts.com

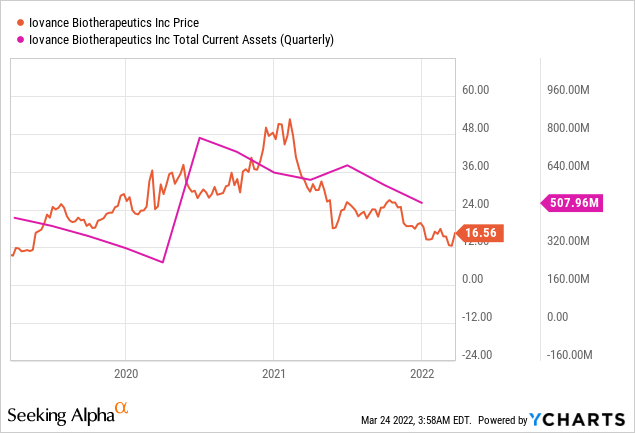

What Iovance has done well is to keep themselves flush with a stable amount of cash on hand. In 2018 the company closed the year with $82 million. In 2019, those cash reserves took a massive hit, decreasing to just $13 million. The company turned the tide a bit in 2020, however, boosting their cash totals back up to $67 million. 2021 saw that trend continue on the balance sheet, closing out the year with $78 million in cash reserves. Assets have been another strong suit for Iovance, as their total current asset totals have risen from $475 million in 2018 to just under $508 million in 2021.

ycharts.com

When you compare the combined assets and cash with the company debt, you can begin to see the upside with Iovance Biotherapeutics’ financials. Despite having zero revenue with zero profits, constantly posting negatives in net income, and dealing with rising R&D costs, the company possesses an extremely reasonable amount of debt. In fact, from 2018 to 2020, the company had no long-term debt to speak of. In 2021, Iovance held only $1 million in long-term debt. Given that the company holds cash in excess of $78 million and assets that total around $508 million, the company can clearly pay its debts. This is a sign of strong financial management.

Conclusion

Iovance Biotherapeutics is most certainly a company that carries some significant risk in investment. They have no products on the market, no source of revenue. Research and development costs have continued to rise. This has dragged on for several years. However, despite all of that, the company is stable, has cash on hand, a healthy number of assets, and a minute amount of debt. Add that to robust growth in an already lucrative oncology market, and you have the makings for a high-risk-high reward stock. Iovance has just received investigational approval from the FDA and could very well be on the path to a cancer breakthrough. If that happens, the company could soar. For these reasons, I view Iovance as a buy for any biopharma investor looking to expand their portfolio.

Be the first to comment