bernie_photo/iStock via Getty Images

Earnings of Capital Bancorp (NASDAQ: NASDAQ:CBNK) will likely dip this year relative to last year mostly because of a decline in mortgage refinancing activity. On the other hand, economic factors will likely ensure that loan growth remains at double-digit levels this year, which will support the bottom line. Further, the margin will likely expand in a rising interest-rate environment partly thanks to sticky deposit costs. Overall, I’m expecting Capital Bancorp to report earnings of $2.52 per share in 2022, down 11% year-over-year. The year-end target price suggests a decent upside from the current market price. Based on the total expected return, I’m adopting a buy rating on Capital Bancorp.

Refinancing Activity to be the Main Contributor to an Earnings Decline

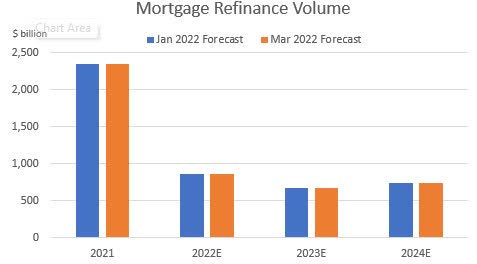

Earnings of Capital Bancorp were elevated in the last two years partly because of the heightened mortgage banking income. The increase in interest rates this year will hurt refinancing activity, which will result in a much lower gain on sales of mortgage loans this year. The Mortgage Bankers Association expects the refinance volume to more than halve this year, according to its March forecast.

Mortgage Bankers Association

Theoretically, rising interest rates should also hurt mortgage purchase volume. However, Mortgage Bankers Association has increased its mortgage purchase volume forecast for 2022 following the Fed’s revised projections showing a greater rise in interest rates in 2022 than previously expected. The anticipated increase is attributable to economic factors other than interest rates. The following chart shows Mortgage Bankers Association’s latest forecast for mortgage purchase volume compared with the January forecast.

Mortgage Bankers Association

Apart from mortgage banking income, fee income will likely grow normally this year. As a result, I’m expecting the non-interest income to decline by 11% year-over-year in 2022.

Loan Growth to be at the Lower End of the Historical Trend

Excluding Paycheck Protection Program (“PPP”) loans, the loan portfolio surged by a sizable 16% during 2022. The growth momentum continued in the last quarter of 2021, as the portfolio increased by 22% (annualized) by the end of December 2021 from the end of September 2021. The strong loan growth in the fourth quarter was partly attributable to several strategic hires in the commercial bank subsidiary, as mentioned in the earnings release. Given the early success, it seems very likely that the new talent will continue to drive the loan portfolio in 2022.

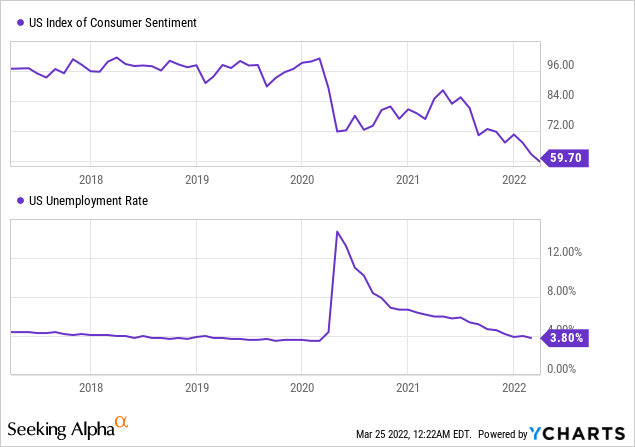

Capital Bancorp offers commercial and consumer banking services in Washington D.C. metropolitan area, mortgage banking services in all 50 states, and credit card services all over the country. As a result, the nationwide unemployment rate and the U.S. consumer sentiment index are appropriate gauges of product demand. The charts below show the recent trends in these two economic metrics.

While the unemployment trend bodes well for credit demand, consumer sentiment does not. Overall, I believe the economic environment will be conducive to loan growth this year.

Capital Bancorp has experienced strong double-digit loan growth in the past, excluding PPP loans. Considering the factors mentioned above, I’m expecting loan growth, excluding PPP, to be at the lower end of the historical trend.

Meanwhile, the upcoming forgiveness of PPP loans will have a significant impact on total earning assets. PPP loans outstanding totaled $108.3 million at the end of December 2021, representing 5.5% of total earning assets. I’m expecting most of these loans to get forgiven this year, which is likely to increase the excess cash on books as re-deployment may take some time. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Financial Position | |||||||

| Net Loans, Ex-PPP | 877 | 989 | 1,158 | 1,292 | 1,499 | 1,671 | |

| Growth of Net Loans | NA | 12.7% | 17.1% | 11.6% | 16.0% | 11.5% | |

| Other Earning Assets | 127 | 92 | 240 | 540 | 453 | 435 | |

| Deposits | 905 | 955 | 1,225 | 1,652 | 1,797 | 2,003 | |

| Borrowings and Sub-Debt | 31 | 23 | 48 | 36 | 34 | 35 | |

| Common equity | 80 | 115 | 133 | 159 | 198 | 231 | |

| Tangible BVPS ($) | 7.0 | 9.2 | 9.5 | 11.5 | 14.1 | 16.4 | |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

Sticky Deposit Costs to Help the Margin Expand

The liability side of Capital Bancorp’s balance sheet is well-positioned for a rate hike. Non-interest-bearing deposits made up around 43.8% of total deposits at the end of December 2021. As a result, the average deposit cost will likely remain upward sticky amid a rising interest-rate environment.

Unfortunately, the asset side is not as well-positioned for a rate hike as the liability side. This is because of mortgage loans that normally have fixed rates. The management’s interest-rate sensitivity analysis given in the 10-K filing shows that a 200-basis points increase in interest rates can boost the net interest income by 7.2% over twelve months. This analysis assumes a parallel interest rate shock. As the interest rate hike this year will be gradual, the impact on net interest income will be lower than 7.2%.

Further, the analysis given above considers a static balance sheet. Capital Bancorp has excess cash on its books that provides the company the flexibility to shift its asset mix once yields are high enough. Cash and cash equivalents made up a sizable 8.9% of total assets at the end of December 2021. The PPP forgiveness mentioned above may also increase the excess cash on hand.

Considering these factors, I’m expecting the margin to increase by six basis points in the second half of 2022.

Expecting Earnings to Decline by 11% Year-Over-Year

The dip in mortgage banking income will likely drag earnings this year. On the other hand, double-digit loan growth and slight margin expansion will likely support the bottom line. Meanwhile, I’m expecting the provision expense to remain at a normal level for 2022.

Overall, I’m expecting Capital Bancorp to report earnings of $2.52 per share in 2022, down 11% year-over-year. Despite the dip, earnings for 2022 will likely remain much higher than the pre-pandemic level. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Income Statement | |||||||

| Net interest income | 49 | 58 | 68 | 84 | 117 | 126 | |

| Provision for loan losses | 3 | 2 | 3 | 11 | 3 | 4 | |

| Non-interest income | 15 | 16 | 25 | 50 | 51 | 45 | |

| Non-interest expense | 47 | 54 | 67 | 88 | 110 | 118 | |

| Net income – Common Sh. | 7 | 13 | 17 | 26 | 40 | 35 | |

| EPS – Diluted ($) | 0.62 | 1.02 | 1.21 | 1.87 | 2.84 | 2.52 | |

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to the COVID-19 pandemic and the timing and magnitude of interest rate hikes.

Adopting Buy Rating Due to a Decent Total Expected Return

Capital Bancorp is offering a dividend yield of 0.9% at the current quarterly dividend rate of $0.05 per share. The earnings and dividend estimates suggest a payout ratio of just 8% for 2022. Therefore, there is no threat of a dividend cut despite the prospects of an earnings decline. Capital Bancorp has only recently started paying dividends, so it is difficult to predict if the company will increase its dividend this year.

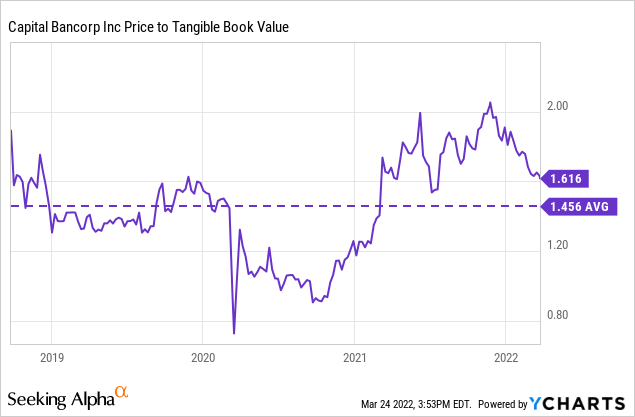

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Capital Bancorp. The stock has traded at an average P/TB ratio of 1.456 in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $16.4 gives a target price of $23.8 for the end of 2022. This price target implies a 4.0% upside from the March 24 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.26x | 1.36x | 1.46x | 1.56x | 1.66x |

| TBVPS – Dec 2022 ($) | 16.4 | 16.4 | 16.4 | 16.4 | 16.4 |

| Target Price ($) | 20.6 | 22.2 | 23.8 | 25.5 | 27.1 |

| Market Price ($) | 22.9 | 22.9 | 22.9 | 22.9 | 22.9 |

| Upside/(Downside) | (10.3)% | (3.2)% | 4.0% | 11.1% | 18.3% |

| Source: Author’s Estimates |

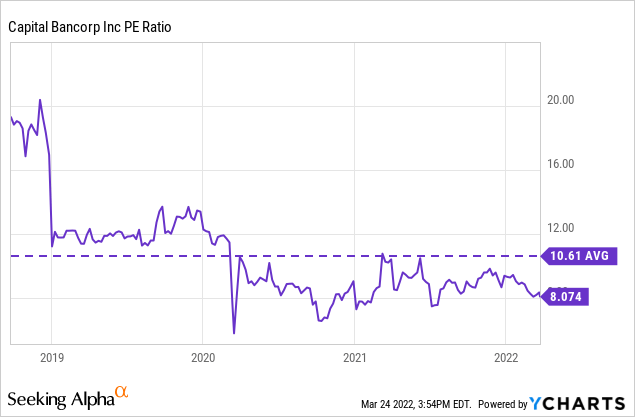

The stock has traded at an average P/E ratio of around 10.61x in the past, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $2.52 gives a target price of $26.7 for the end of 2022. This price target implies a 16.4% upside from the March 24 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.6x | 9.6x | 10.6x | 11.6x | 12.6x |

| EPS 2022 ($) | 2.52 | 2.52 | 2.52 | 2.52 | 2.52 |

| Target Price ($) | 21.7 | 24.2 | 26.7 | 29.2 | 31.7 |

| Market Price ($) | 22.9 | 22.9 | 22.9 | 22.9 | 22.9 |

| Upside/(Downside) | (5.5)% | 5.5% | 16.4% | 27.4% | 38.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $25.3, which implies a 10.2% upside from the current market price. Adding the forward dividend yield gives a total expected return of 11.1%. Hence, I’m adopting a buy rating on Capital Bancorp.

Be the first to comment