jax10289

By Padhraic Garvey, CFA, Benjamin Schroeder, Antoine Bouvet

Rises in core US inflation can only pressure market rates higher

When the Federal Reserve delivered its first 25bp hike in March, core consumer price inflation (CPI) was running at 6.5%. That, in fact, proved to be a peak, as it wandered to below below 6% in subsequent months. But it rose last month, and the market is expecting it to have risen again for September (today’s report), back up to 6.5%.

That’s discouraging against a backdrop where the Federal Open Market Committee minutes paint a clear picture of an intention to keep rate hike pressure elevated until inflation has been tamed. A wider problem for the Treasury market has been the tendency for core measures of inflation to edge higher again in the past couple of months. We saw that from the US PPI report yesterday, with similar expected from the US CPI report today.

The Fed’s target of 2% inflation remains quite deviant from the 6% handle that core inflation continues to cling to. And even though we expect inflation to fall in a precipitous manner in the quarters ahead on base effects, a recent tendency for core to remain quite elevated and sticky does not help. This maintains upward pressure on Treasury yields.

The 10yr yield has popped above 4% twice in the past few weeks (for the second time yesterday), and seems reluctant to push on above. But in all probability, should we see a 6.5% core CPI inflation reading confirmed today, it should provide enough ammunition for it to make the break above. Yes, it’s what is discounted. But confirmation still has real meaning.

It’s these inflation numbers that continue to drive market rates, and even though real rates have moved solidly positive and breakeven inflation resolutely lower, the fact remains that market rates remain well below printed inflation rates, as does the funds rate (and the Fed knows it).

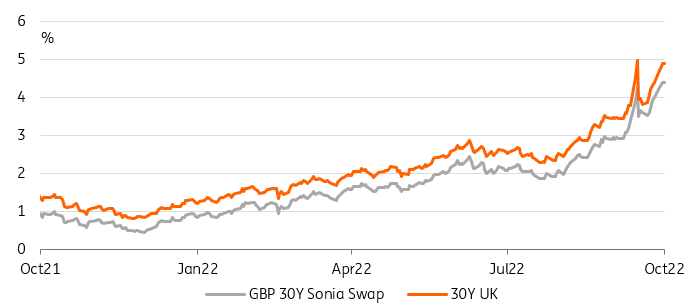

30Y GBP Swap Indicates Gilt Yields Will Soon Rise Above Their Pre-Intervention Peak Again (Refinitiv, ING)

The BoE is trying to hold the line

In the wake of the Fed pressing ahead on its aggressive tightening trajectory, tensions in other markets become more apparent. The UK rates market continues to be a large contributor to volatility as the Bank of England tackles the ongoing fallout from monetary and fiscal policy working at cross-purposes. The BoE’s chief economist had signalled the need to raise rates significantly in November, also citing the likely inflationary impact of the government’s budget plans as they currently stand. But the announcement of the medium-term fiscal strategy has been brought forward to October 31, just days before the BoE is set decide on interest rates.

Until then the BoE may well continue to play hard ball, at least to the extent that financial stability allows. For now, the intervention in the long-end sector of gilts is set to expire by the end of this week, as much was confirmed by a Bank statement after mixed signals in the press. On that prospect, the 30Y gilt yield had indeed briefly climbed above 5%, the level reached before the BoE first started long-end gilt purchases, and only dropped back after the BoE accepted all bids in its daily buying operation. The question remains whether two more days of BoE purchases will be enough to calm markets.

ECB quantitative tightening talk is becoming more concrete

The European Central Bank is watching the BoE’s struggles closely. It is also seeing the potential risk of fiscal policies pushing it towards more aggressive tightening than otherwise. ECB President Lagarde urged cooperation between central banks and their governments. The remarks of the Dutch Central Bank’s Klaas Knot reflected some unease when he said that he was not sure whether all fiscal measures were targeted enough. Against that backdrop, the pricing of rate hikes had already become more aggressive, with the market pricing more than 125bp of hikes still this year and the 1y1y ESTR OIS forward close to 3%.

And looking beyond rate hikes, the talk of quantitative tightening is already becoming more concrete. President Lagarde confirmed yesterday that the Council had started deliberations on the topic. Other members have already been more specific about the ECB’s plans for its balance sheet. France’s Villeroy reiterated that the balance sheet reduction should commence after the normalisation of rates, first with the repayments of the targeted longer-term refinancing operations, where a good part expires in the middle of next year, and then by a gradual reduction of the asset purchase programme portfolio as reinvestments are phased out. This could start before 2024.

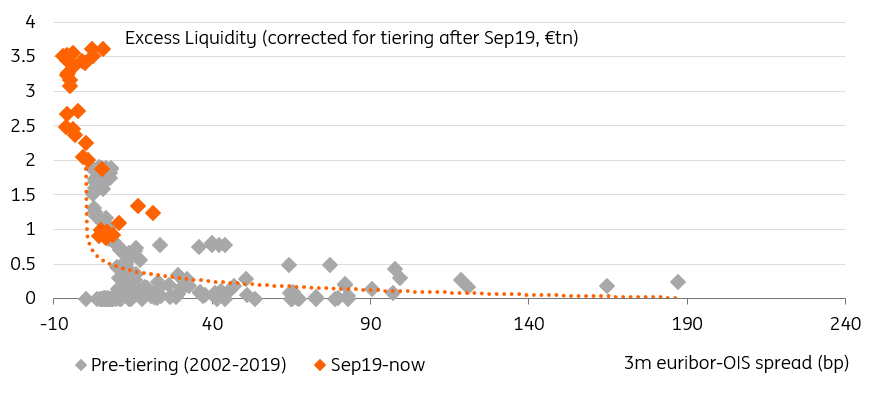

ECB QT Will Widen Money Market Spreads, Starting In 2023 (ECB, ING)

Wary of the impact that already the communication surrounding quantitative tightening may have on markets, the ECB’s current messaging does appear more streamlined than we have experienced in the past. It was also Klaas Knot who remarked that bond markets had become more sensitive to debt sustainability issues, and thus “a process like QT – it should be predictable, it should be gradual, it should be even a little bit boring”.

The key risk gauge is the 10Y spread between Italian and German government bonds, which temporarily rose some 8bp yesterday, though also amid greater market volatility spilling over from the UK. For eurozone bond markets, the ECB’s bond purchases have been instrumental in bringing down bond spreads, and with the excess liquidity injected also in the compression of money market. A reversal of the purchases is therefore all but boring. While the emerging outlines of the ECB’s quantitative tightening plans are consistent with the assumptions we have made so far, we think there could still be a considerable effect on sovereign and money market spreads.

Today’s events and market view

Markets will continue to have one eye on the UK’s and the BoE’s buying operations – and any hint that the intervention could be prolonged. Gilt markets remain a major source of volatility, though today should also see US data taking the spotlight with the CPI data for September. It is the one release where a large surprise could potentially still swing the Fed away from another 75bp jumbo hike, which markets by now are fully discounting. The consensus is looking for the headline rate to be 8.1% year-on-year. In the core rate, the focus should be on the anticipated decline in the monthly rate from 0.6% to 0.4%.

In the eurozone primary market, Italy will sell a new 3-year bond alongside reopenings of 7-, 15- and 30-year bonds for a total of up to €8.75bn. The US Treasury will reopen the 30Y for US$18bn.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Be the first to comment