solarseven

Introduction

Imperial Brands PLC (OTCQX:IMBBY) (referred here as “IMB”) released FY22 (ending September 2022) results on Tuesday. (November 11). IMB shares finished the day in London down 0.8% (in U.K. pounds).

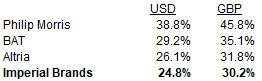

We initiated our Hold rating on Imperial Brands in July 2019 with the article title “Worst of the Big 4 Tobacco Stocks”. Since then IMB shares have indeed been the worst performer among the Big 4, with a return of just 24.8% in U.S. dollars (mostly in dividends), nearly 15 ppt behind our consistently Buy-rated Philip Morris (PM):

|

IMB Total Gain vs. Tobacco Peers (Since Initiation)  Source: Refinitiv (15-Nov-22). |

IMB’s FY22 results provided little evidence of operational improvement. Adjusted EPS rose 6.8% year-on-year, but mostly due to lower debt and currency. Adjusted EBIT rose 1.8% excluding currency, but mostly due to prior-year litigation charges. Across IMB, Tobacco Adjusted EBIT fell as larger “strategic investments” more than offset “underlying tobacco” EBIT growth, but Next Generation Products (“NGP”) losses were lower after IMB exited key markets. EBIT fell in Europe for the third time in four years, potentially signalling what IMB will eventually face globally. NGP revenues in the key US market have continued to fall, not helped by an FDA ban on IMB Vapor products.

For FY23, management has promised mid-single-digit Adjusted EBIT growth, albeit H2-weighted. However, competition is intensifying, especially with Philip Morris set to make a strong entrance into the U.S. IMB is increasing investments across all three NGP categories and expects to push overall NGP losses upwards back to FY21 levels.

IMB shares have a superficially “cheap” 7.7x P/E and a 7.0% Dividend Yield, but the chances of substantial profit declines in future years are too real. We reiterate our Hold rating, meaning the stock should be avoided.

Why We Avoid Imperial Brands Stock

We have been cautious on IMB due to its fundamental business problems:

- IMB is mostly in markets with unfavorable demographics or regulations; profit growth was weak, even before the threat from NGPs

- IMB has under-invested, including in NGPs, instead prioritizing an unsustainable dividend growth, until a dividend reset in May 2020

- IMB’s NGPs are far behind peers and have little hope of catching up

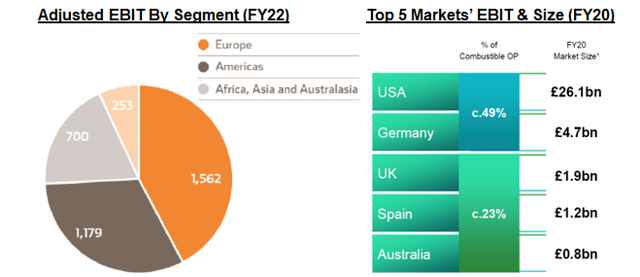

IMB’s largest region is Europe (45% of EBIT), followed by the U.S. (approx. 30%). The U.S. and Germany together were 49% of its Combustible EBIT; the U.K., Spain and Australia together were another 23%. Other top-10 markets were France, Italy, Japan, Russia, and Saudi Arabia:

|

IMB EBIT By Segment & Top 5 Markets  Source: IMB company filings. NB. U.S. not reported separately since FY19. |

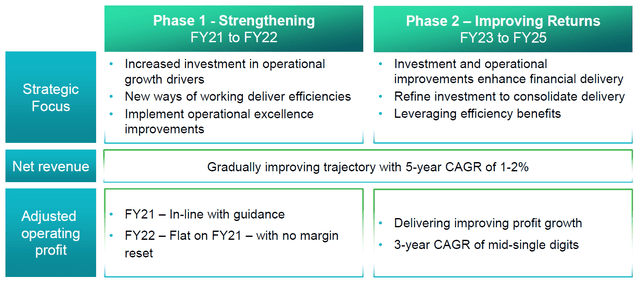

Since 2021 IMB has been executing a 5-year strategic plan, which specifies an Adjusted EBIT trajectory that is relatively flat in FY21-22 but accelerates to a mid-single-digit 3-year CAGR in FY23-25; management have clarified that “mid-single-digit” means 3.5-6.5% in this case:

|

IMB FY21-25 Outlook  Source: IMB investor day presentation (Jan-21). |

IMB’s FY22 results indeed showed a flattish Adjusted EBIT but provided little evidence of operational improvement.

Imperial Brands FY22 Results Headlines

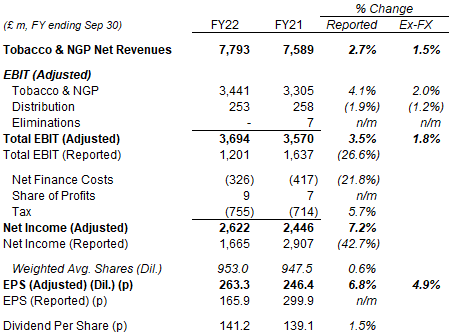

Key P&L headlines on IMB’s FY22 results were as follows:

|

IMB Results Headlines (FY22 vs. Prior Year)  Source: IMB results release (FY22). |

Adjusted EPS rose 6.8% in U.K. pounds year-on-year, but mostly due to deleveraging and currency. (At the time of writing, the U.K. pound has fallen 11.5% against the U.S. dollar in the past 12 months.) At constant currency, Adjusted EPS only grew 4.9%, and there was an approximately 3.5 ppt gap between Adjusted EBIT growth and Adjusted Net Income growth that was largely due to lower Net Finance Costs after IMB reduced its debt.

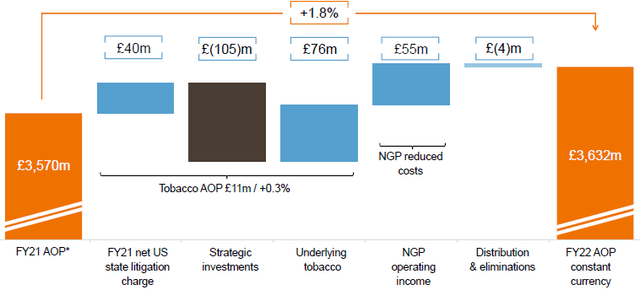

Excluding currency, Adjusted EBIT rose just 1.8% (or £62m), with most (£40m) of this being due to prior-year U.S. state litigation charges (related to settlements with Texas and Minnesota):

|

IMB Adjusted EBIT Bridge (FY21 to FY22, Ex-Currency)  Source: IMB results presentation (FY22). |

Excluding litigation, IMB’s Tobacco Adjusted EBIT fell, with larger “strategic investments” (£105m) more than offset “underlying tobacco” EBIT growth (£76m). NGP Operating Loss improved by £55m, but management acknowledged that this “reflects our decision to exit certain triple-A (Africa, Asia & Australasia) markets last year”.

Exit the business in Russia was worth approximately 3.5% of Tobacco volume and 0.8 ppt of net revenue growth (at constant currency) in FY22. It was not material to Adjusted EBIT.

IMB’s FY22 results look no better on a regional level.

Imperial Brands FY22 Results By Region

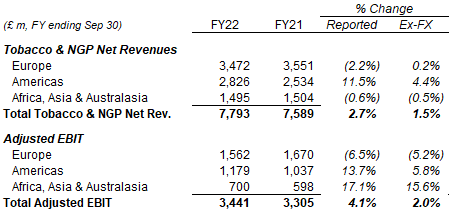

IMB’s Tobacco & NGP revenues and Adjusted EBIT figures by region are as follows:

|

IMB Tobacco & NGP Results By Region (FY22 vs. Prior Year)  Source: IMB results release (FY22). NB. Russia is reported as part of Africa, Asia & Australasia. |

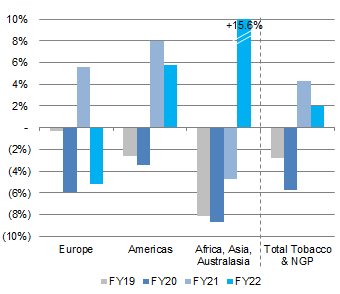

For context, we have shown IMB’s constant-currency Adjusted EBIT growth rates by region for the past 4 years below:

|

IMB Adjusted EBIT Growth By Region (Ex-Currency) (FY19-22)  Source: IMB company filings. |

Europe saw Adjusted EBIT fell for the third time in four years, excluding currency. Including currency, Adjusted EBIT in Europe has fallen by 8% in U.K. pounds in 4 years. (The U.K. pound has fallen by 8% since the end of FY18, as of November 2022.) Tobacco volume fell 4.1% in Europe, and price/mix was just 3.1% for the full year (improving to 6.0% in H2), partly due to a post-COVID mix shift towards lower-value Southern Europe (with more people travelling), so Tobacco revenues fell 1.0% ex-currency. Adjusted EBIT was also reduced by higher “strategic investments” in both combustibles and NGPs.

NGP competition is intensifying in Europe. Excluding currency, Philip Morris grew revenues by 10.8% and Adjusted EBIT by 6.9% year-on-year in its European Union region in Q3, helped by a 44.7% jump in its Heated Tobacco volume. PM’s Heated Tobacco Products has reached a 7%+ share of the E.U. nicotine market. IMB’s continuing decline in Europe may signal what it will eventually face globally.

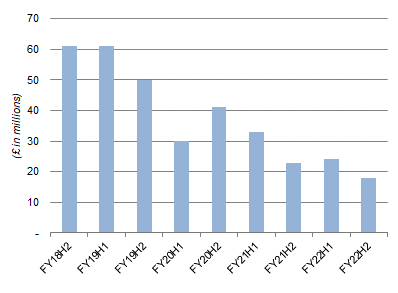

Americas saw IMB’s Adjusted EBIT grew 5.8% (or approximately £60m) in constant currency. However, prior-year state litigation charges explain most (£40m) of this “growth”. “A stronger tobacco performance and lower NGP losses” were cited as factors, but the latter came with a 29.7% ex-currency decline in NGP revenues in the region. Management attributed its NGP revenue decline in Americas to “continued competitive environment with greater discounting” as well as uncertainty created by the FDA’s ban on IMB’s myblu Vapour products (which IMB is appealing). IMB’s NGP revenues in Americas have been falling (in U.K. pounds) close to continuously since H2 FY18:

|

IMB Americas NGP Revenues (Since H2 FY18)  Source: IMB company filings. |

Americas Tobacco revenue grew 4.4% year-on-year excluding currency, on a 2.0% volume growth. However, volume benefited from two one-off factors: There was an 1 ppt benefit from customer inventory increases ahead of Hurricane Ian and expected price increases. KT&G’s (OTCPK:KTCIF) exit from the U.S. earlier this year also allowed IMB to gain share.

Africa, Asia & Australasia (“AAA”) Adjusted EBIT grew 15.6% year-on-year in FY22. However, this came after at least three years of declines; during FY18-21, AAA Adjusted EBIT fell by 27.1% in U.K. pounds. (The “AAA” region was only created in FY19.). Management attributed the EBIT growth to “strong performance in Australia, Africa and the Middle East and lower NGP investment compared to last year, following our decision to exit Japan and Russia”, with the former at least partly helped by a post-COVID rebound and the latter being one-off by nature.

IMB presented market share gains in combustibles as evidence that its business has improved. IMB’s aggregated combustibles market share in its top 5 markets has increased by 35 bps year-on-year, notably by 90 bps in the U.S. and 85 bps in the U.K. However, we believe market share is a poor indicator compared to profits and revenues. IMB’s market share was also down 85 bps in Germany, down 45 bps in Europe and down 5 bps globally.

FY23 Will Be a Year of Change

FY23 will be a year of change for IMB, and we think it may fall short.

IMB is raising investments across all three NGP categories, with launches executed or planned in key markets:

- In Heated Tobacco, IMB has now launched its Pulze and ID products in three more markets (Italy, Portugal, and Hungary), taking its total number of markets to five

- In Vapour, IMB has launched its new Blu 2.0 products in the U.K., following pilots in France; IMB will also be launching a new “blu bar” disposable product in the U.K. later in November

- In Oral Tobacco, IMB has continued to launch new flavors for its Zone X products in Austria, Sweden, and Norway

As a result of higher investments, NGP losses are now expected to return to FY21 levels in FY23, removing one of the drivers of profit growth in FY22. NGPs are only expected to break even by the end of the current 5-year plan in FY25.

Management still expects to achieve low-single-digit revenue growth and mid-single-digit Adjusted EBIT growth at constant currencies from FY23. The gap left by higher NGP losses is expected to be filed by improved Tobacco profits and further cost savings. This will be H2-weighted, with Adjusted EBIT expected to be flat year-on-year in FY23.

Competition will also likely intensify for IMB in FY23.

Competition Intensifying

We have discussed in past articles how far behind IMB is in NGPs. This has not changed.

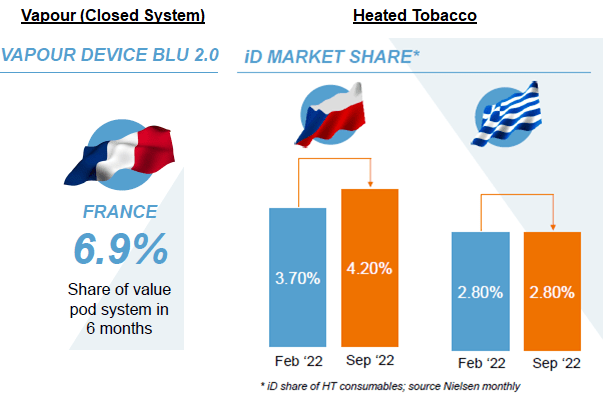

The best NGP market share datapoint IMB could give was a 6.9% value share in closed system Vapour in France. In Heated Tobacco, IMB’s ID had a low-single-digit market share in both its launch markets, including a flat 2.8% share in Greece across the past 6 months. There is no evidence that IMB is close to reaching the same market share it currently has in Tobacco (~14% across the group, ranging from 10% in Americas to 19% in Europe) in any NGP category. That means any significant consumer shift from Tobacco to NGPs is likely to be negative for IMB earnings.

|

Market Share of Selected IMB NGPs  Source: IMB results presentation (FY22). |

Philip Morris is set to make a strong entrance into the U.S. Its acquisition of Swedish Match (OTCPK:SWMAY) is going ahead, as PM has waived its previous 90% acceptance threshold and has already acquired 86% of outstanding Swedish Match shares as of November 10. We believe the deal will close by early 2024. This will give PM a scaled platform in the U.S. with at least 134k stores. PM’s product portfolio already includes VEEV Vapour products and VEEBA Vapour disposables (though not yet with FDA marketing approvals), and it will regain the U.S. rights for its flagship IQOS Heated Tobacco product after April 2024.

We believe PM will threaten IMB U.S. profits, in addition to the pressure it is already exerting on IMB profits in Europe.

Valuation: Is Imperial Brands Stock Cheap?

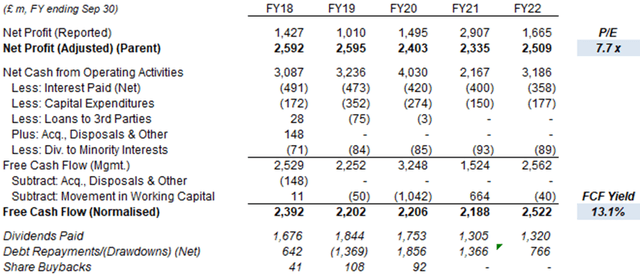

At 2,027.0p, IMB shares have a 7.7x P/E and a 13.1% Free Cash Flow Yield:

|

IMB Net Income, Cashflow & Valuation (FY18-22)  Source: IMB company filings. NB. Cashflows not adjusted for sale of Premium Cigars. |

IMB stock pays a dividend of 141.17p, 1.5% higher than last year, which implies a Dividend Yield of 7.0%.

A new £1bn share buyback program was announced in October and expected to be completed by FY23 year-end. The £1bn amount is equivalent to 5.2% of the current market capitalization.

Net Debt / EBITDA was 2.0x at FY22 year-end, at the low end of management’s 2.0-2.5x target range.

Is Imperial Brands a Buy? Conclusion

IMB shares have a superficially “cheap” valuation.

However, its exposure to mostly mature Europe/U.S. tobacco markets and the deficiencies in its NGP portfolio means that it is vulnerable to any major shift to NGPs. The chances of substantial profit declines in future years are too real.

FY22 results met undemanding expectations but provided little evidence of operational improvement.

FY23 will see IMB making higher NGP losses, with competition likely to intensify. IMB may fail to meet growth targets.

We reiterate our Hold rating on Imperial Brands, meaning the stock should be avoided.

Be the first to comment